- The prices of BOME and PEPE rose by more than 8% and 10%, respectively.

- The metrics looked bearish for both memecoins.

As market sentiment gradually changes, Book of Meme (BOME) and pepe We are optimistic as we record promising growth. Therefore, AMBCrypto planned to closely examine these memecoins to see if this upward trend would continue for longer.

BOME and PEPE bulls are buckling.

CoinMarketCap’s data It has become clear how these two memecoins achieved their rise. The value of BOME has surged more than 8% in the last 24 hours. At the time of writing, Meme Coin was trading at $0.01195, with a market capitalization of over $659 million.

On the other hand, PEPE recorded double-digit growth, rising more than 10% in value. At press time, PEPE was trading at $0.000007226, with a market capitalization of over $3 billion, making it the 40th largest cryptocurrency.

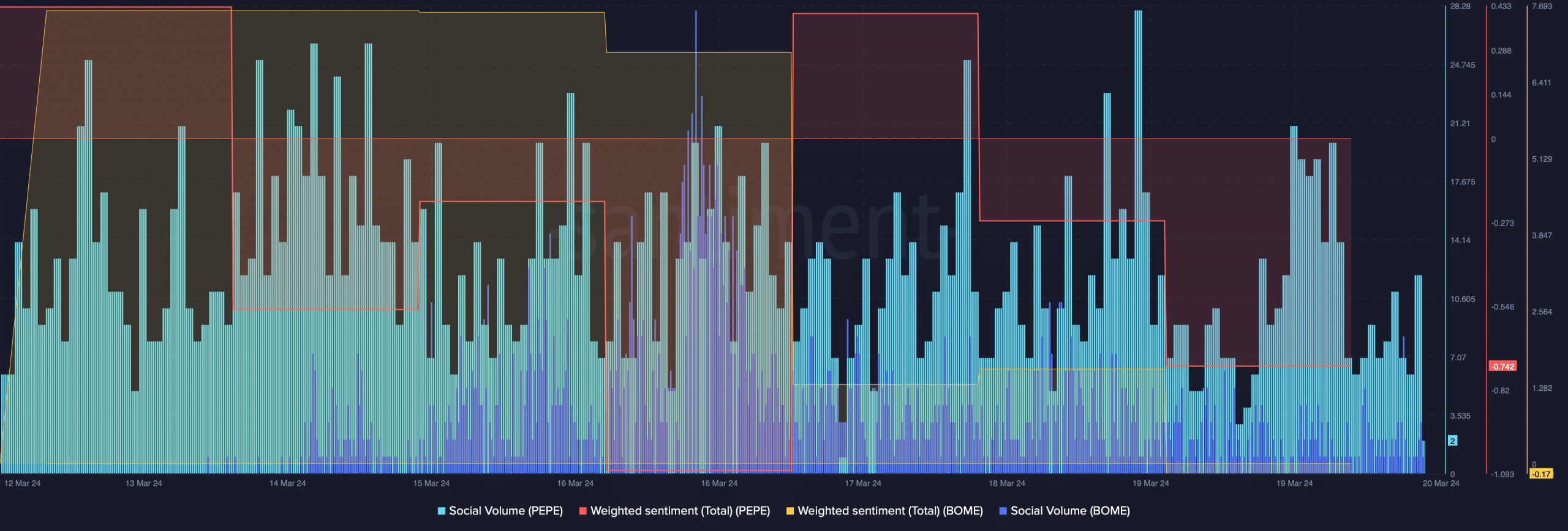

Thanks to the price rise, PEPE’s social volume has increased over the past few days. However, BOME’s metrics moved in the opposite direction as social volume declined.

It is surprising that weighted sentiments for both PEPE and BOME have remained low despite the recent price rise. This means that bearish sentiment towards them dominates the market.

Source: Santiment

What can you expect from BOME and PEPE?

To see if these meme coins will maintain this growth, AMBCrypto analyzed their metrics. We find that BOME faces strong resistance near $0.013.

Once the price reaches that level, a large number of BOME will be liquidated, suggesting a correction is possible at that point.

Source: Hiblock Capital

Liquidation heat maps indicated a brief rally, but derivatives indicators told a different story. Coinglass Analysis by AMBCrypto data It was revealed that BOME’s funding rate had fallen sharply.

This meant that derivatives investors were not buying meme coins. Open interest may also decrease somewhat, putting an end to the Mimcoin bull market.

Source: Coinglass

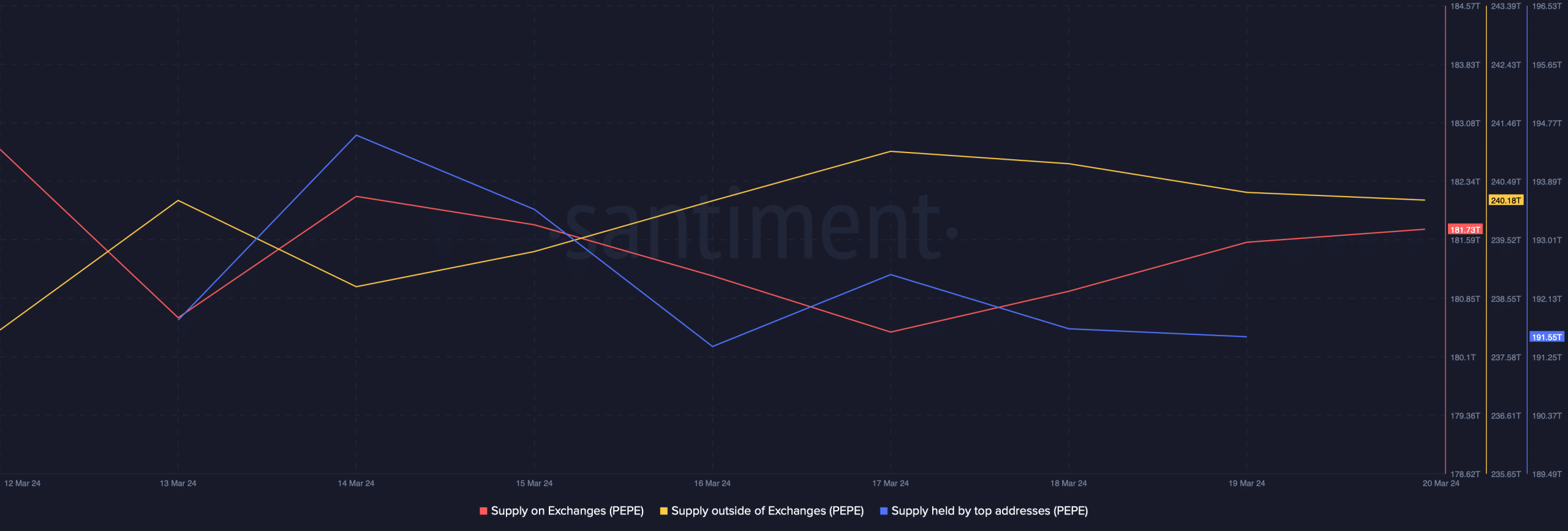

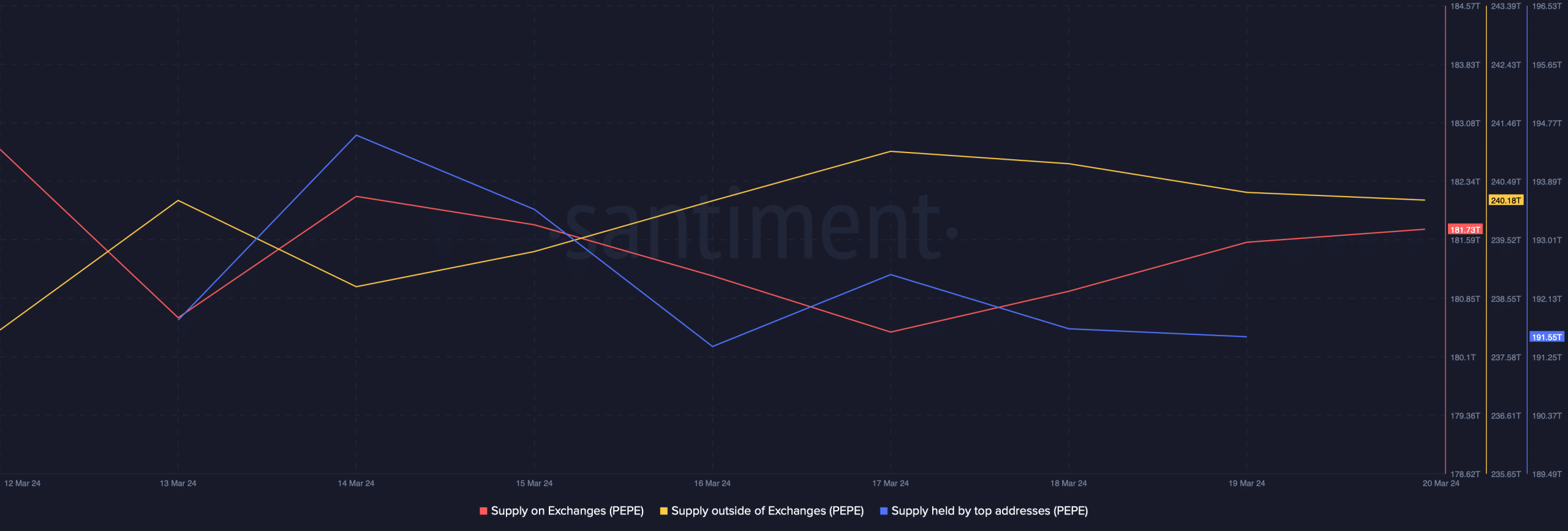

We then looked at the status of PEPE. According to our analysis, selling pressure on Memecoin was increasing. This is clearly evident in the slight decrease in supply outside the exchange and the slight increase in supply within the exchange.

read PEPE price prediction 2024-25

Additionally, whales were actually selling PEPE, which suggests an imminent price correction.

Source: Santiment

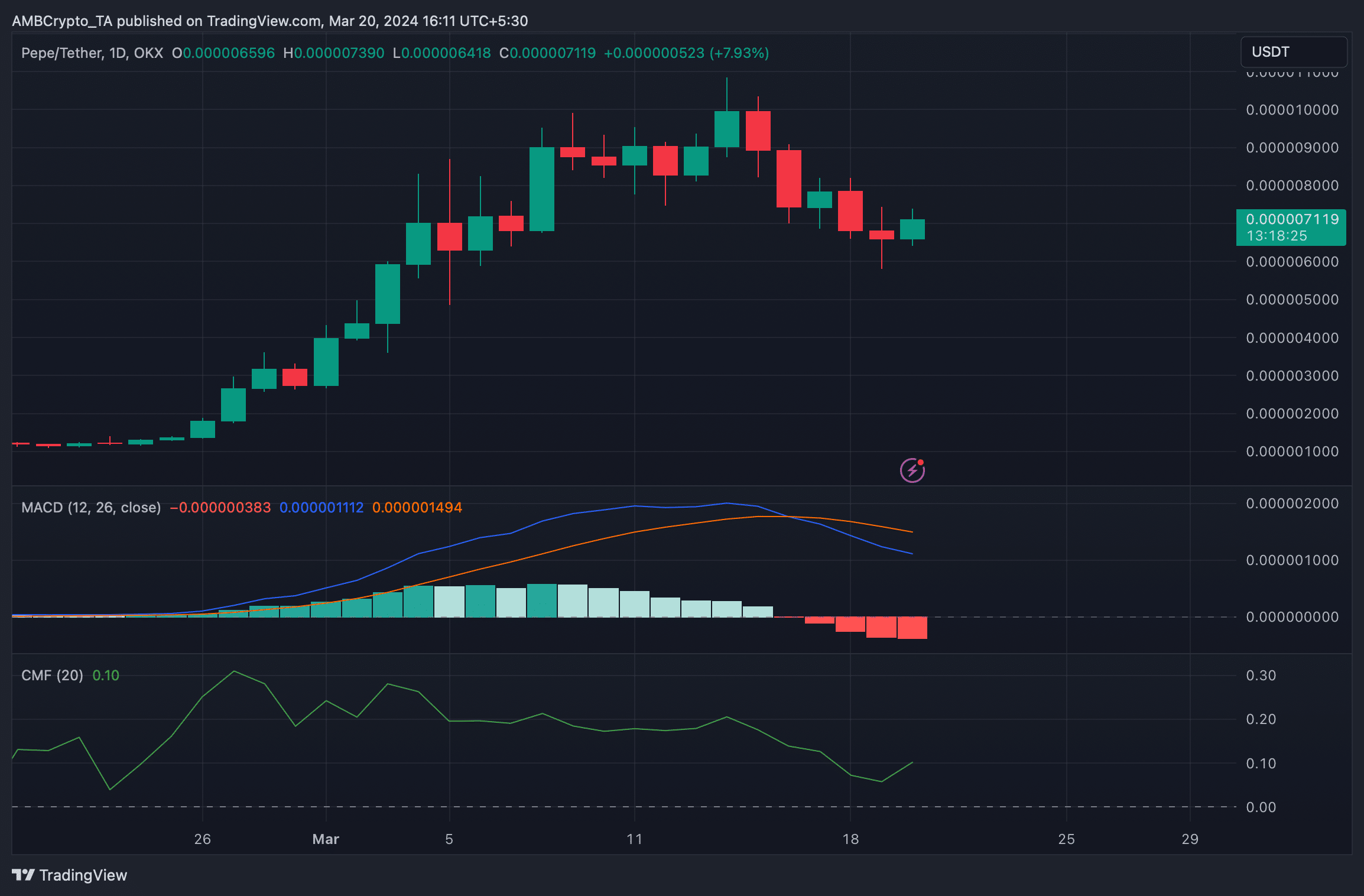

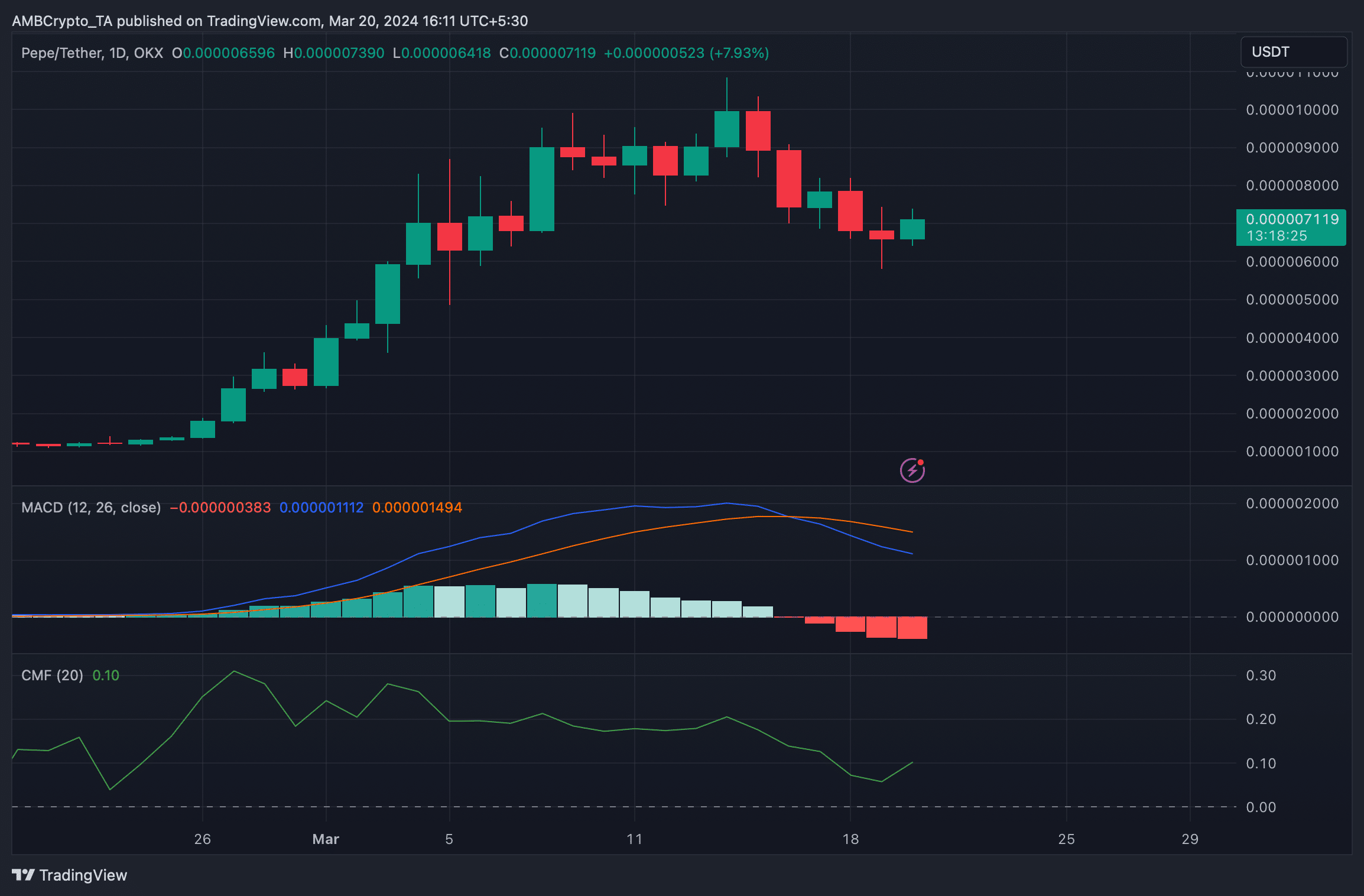

The technical indicator MACD also showed a bearish crossover, supporting the selling trend. Nonetheless, Chaikin Money Flow (CMF) recorded gains, indicating that PEPE is likely to continue its bullish rally.

Source: TradingView