- It has been reported that the U.S. SEC is investigating the operations of the Ethereum Foundation.

- Despite regulatory developments, the price of ETH has remained relatively unwavering.

Ethereum (ETH) has been facing tremendous volatility over the past few days, which can be partially attributed to its correlation with Bitcoin (BTC). Recent events may further amplify the volatility that ETH has been facing.

face a problem

According to recent reports, the SEC has begun legal initiatives to potentially classify Ethereum as a security.

The regulator has issued subpoenas to several companies as part of its investigation into Ethereum, focusing in particular on its relationship with the Ethereum Foundation, the organization that oversees blockchain development.

The investigation comes after Ethereum switched from a proof-of-work to a proof-of-stake consensus mechanism, and the SEC will be looking into the implications.

Despite this news, the price of ETH was not affected. In a surprising turnaround, ETH price surged 11.63% in the last 24 hours.

During this period, the price of ETH exceeded $3,500, causing several short positions to be liquidated. Approximately $48.9 million worth of short positions were liquidated in the last 24 hours.

At press time, ETH was trading at $3,492.85.

Source: Coinglass

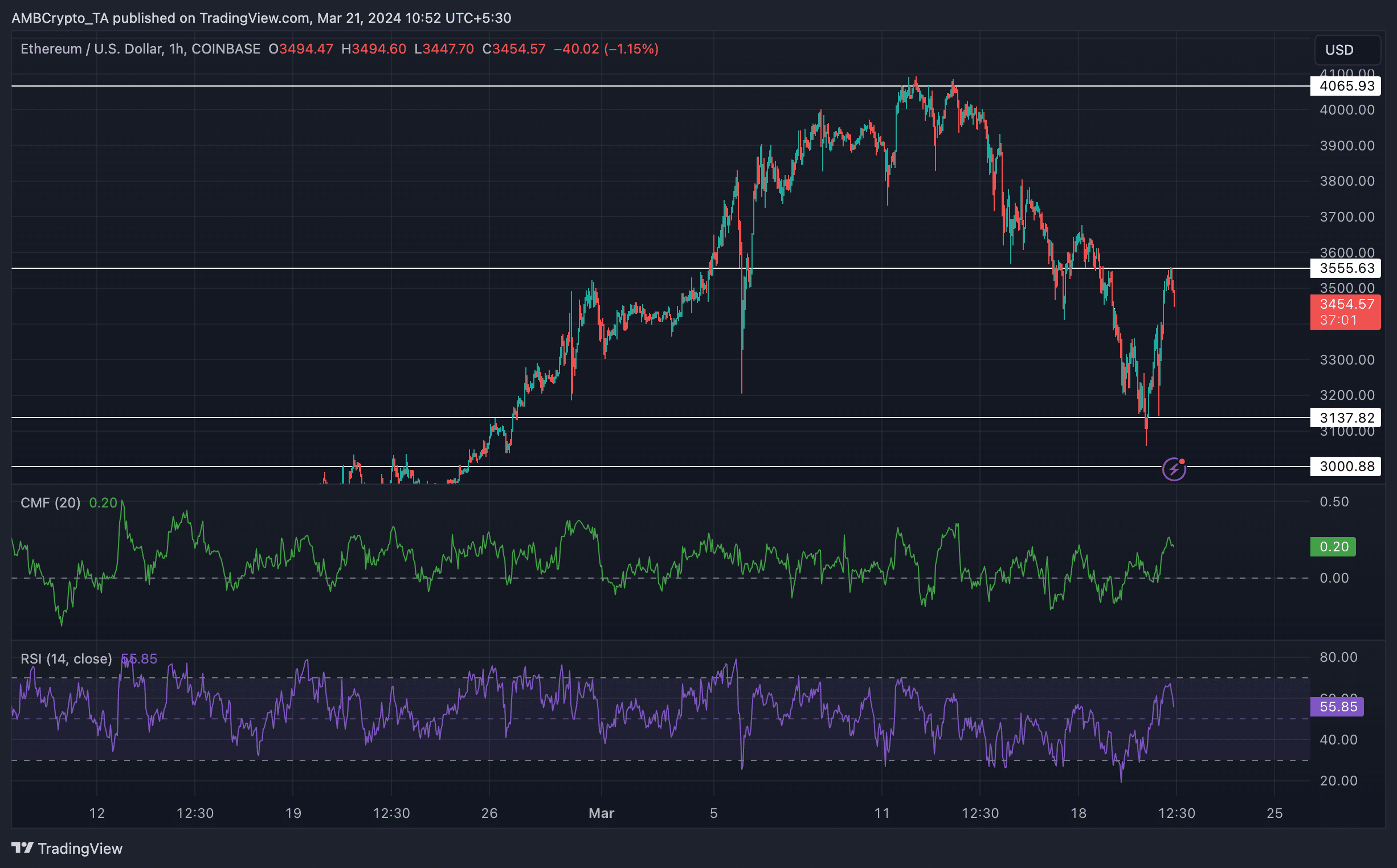

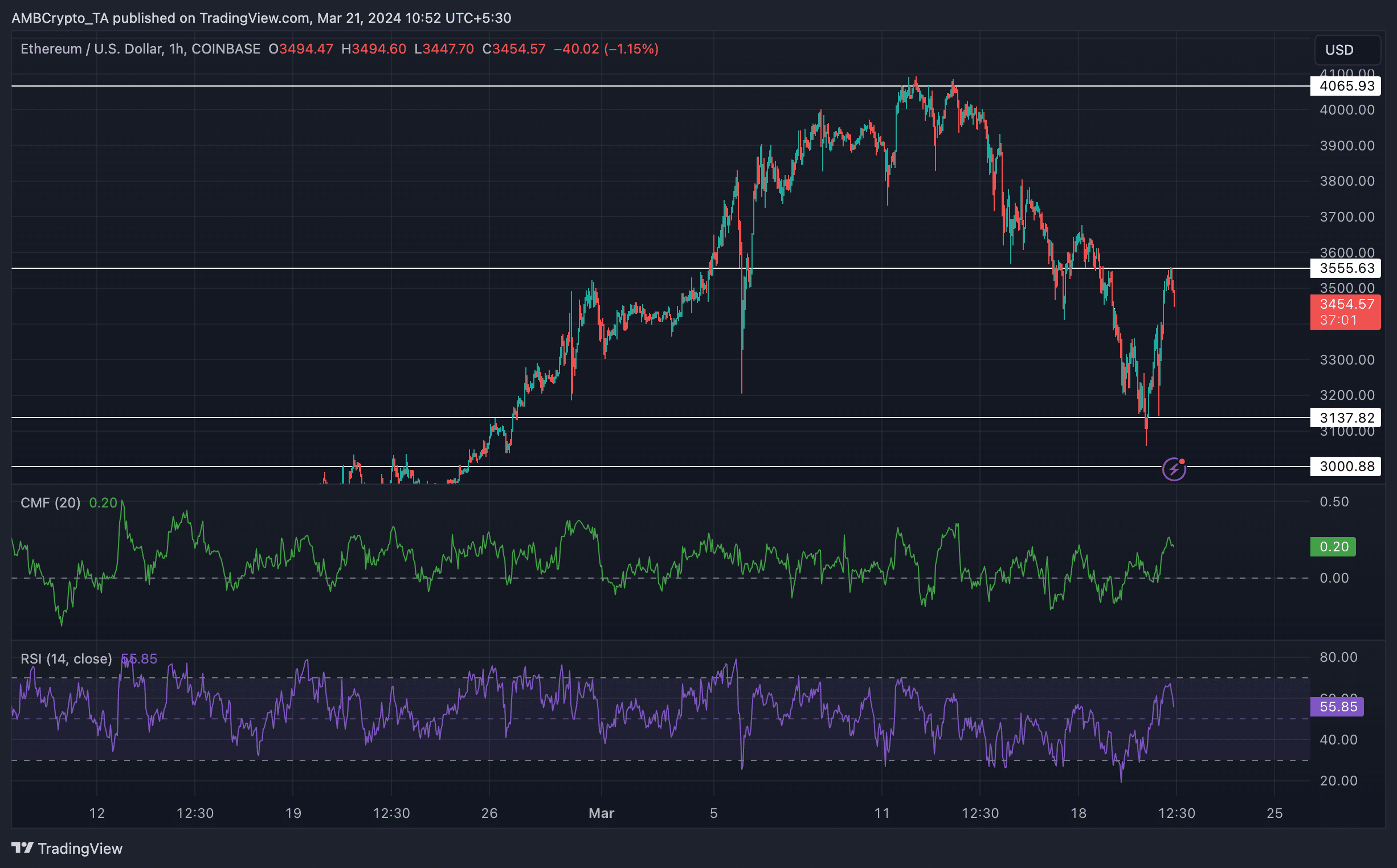

ETH price has tested the $3,555 resistance several times over the past few days. If ETH price regains momentum and retests the $3555 resistance, it could break this level in the future and reach the $4000 level in the future.

However, looking at the larger trends that have emerged over the past few weeks, the price of ETH has made several lows and highs, and the recent price surge has not been large enough to represent a trend reversal.

If the price continues its downward trend, it may fall to the $3.137 support level. ETH price action over the next few days will be pivotal for traders as it will determine the larger trend that ETH will soon follow.

Source: Trading View

How much is 1,10,100 ETH worth today?

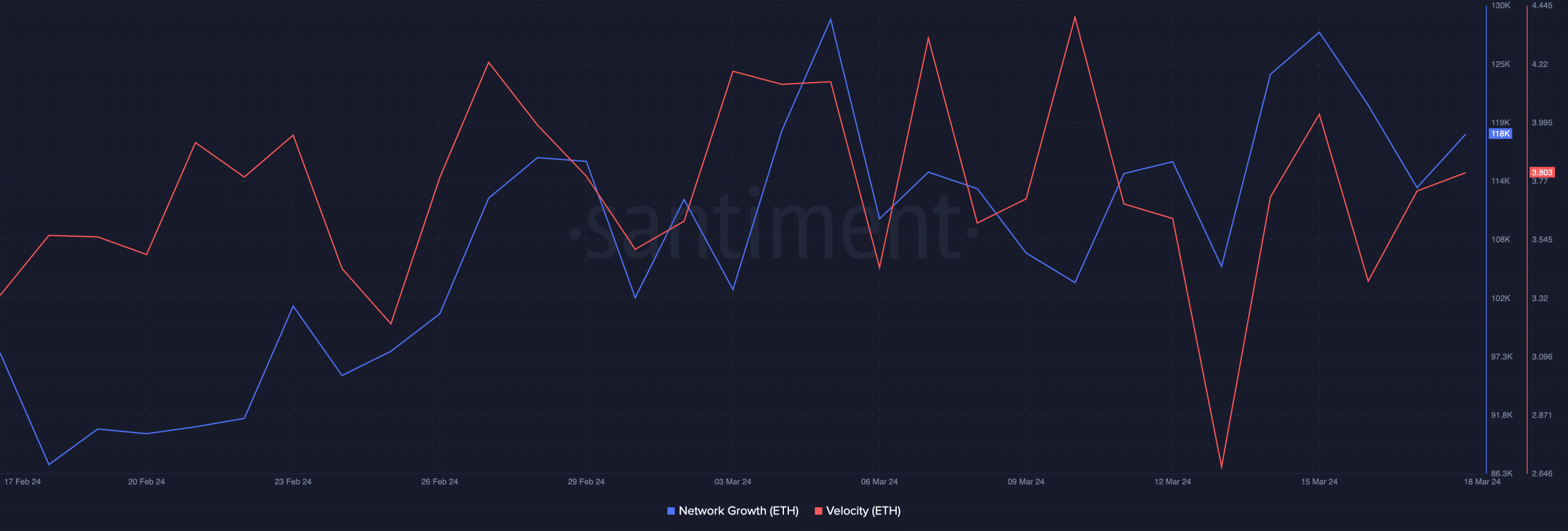

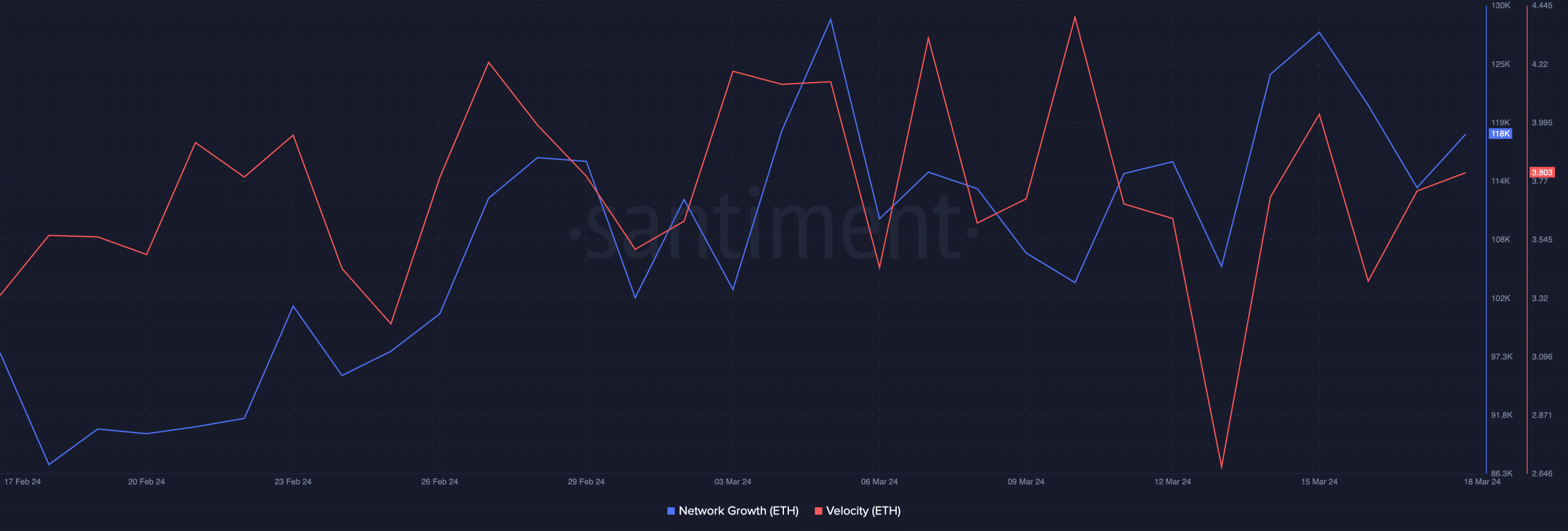

Moreover, ETH has witnessed a significant increase in network growth. This suggested that new addresses were showing interest in ETH. Rising interest in new addresses could give ETH’s bullish momentum a further boost.

Additionally, the speed of ETH has also increased, indicating that ETH transfers are becoming more frequent.

Source: Santiment