Bullish (OP) prices are the best choice as broad market signals and investor actions are sending buy signals.

The question is whether operating profit will still generate more profit than at the beginning of the year, or whether it will stop midway.

Investor optimism is high

The beginning of the month was bleak for price optimism, but altcoins have found their footing over the past few days. This is a result of increased participation by OP holders. This can be seen through the surge in active addresses, which has increased by more than 30% in the last 24 hours.

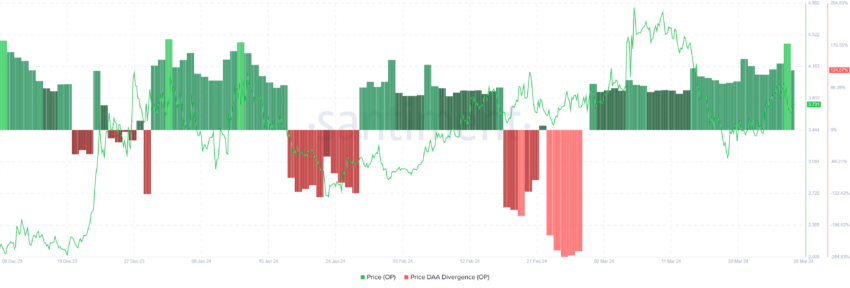

With increased investor activity on the network and falling prices, Optimism is showing buy signals. According to the price daily active address (DAA) differential, operating profit is a good asset to accumulate now.

Read more: What is optimism?

Price-Daily Active Address (DAA) gap occurs when the price of a cryptocurrency and the number of daily active addresses show contrasting trends, indicating a potential discrepancy between market value and actual network usage or adoption. If the price falls and participation rises, the buy signal will flash and vice versa.

Therefore, if bullish holders move to add OP to their wallets, the price may surge.

OP Price Prediction: Profits Are Coming

Optimism’s price is currently trading at $3.72 after failing to break the resistance marked at $3.99. Once this barrier is crossed, OP will reclaim $4.00 as support and rise to $4.69, marking its highest of the year and a 26% rally.

Both the relative strength index (RSI) and moving average convergence divergence (MACD) indicate potential strength. RSI measures price momentum and indicates overbought or oversold conditions. MACD, on the other hand, is a trend-following indicator that shows the relationship between two moving averages, indicating potential buy/sell opportunities.

Both indicators are currently on the verge of a bullish reversal, which would support the expected 26% rally.

Read more: Optimism vs. Arbitrum: Ethereum Layer-2 Rollup Comparison

However, if OP fails to break $4.00, Optimism’s price could fall by $3.42, pushing the altcoin below $3.00, invalidating the bullish argument.

disclaimer

In accordance with Trust Project guidelines, this price analysis article is provided for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate and unbiased reporting, but market conditions may change without notice. Always do your own research and consult with a professional before making any financial decisions. Our Terms of Use, Privacy Policy and Disclaimer have been updated.