- LINK has shown signs that it has no intention of repeating 2020 trends.

- On-chain metrics show that SOL may continue to outperform LINK.

There has been a lot of change in the market since the last bull cycle, and one thing that may have been overlooked is the trend in Chainlink (LINK).

In the past 30 days, the price of LINK has increased by 0.69%. On the other hand, Solana (SOL) soared 66.23% during the same period. But that wasn’t always the case, especially when the Bitcoin (BTC) halving was just a few days away.

For example, the price of Chainlink surged significantly before the May 2020 halving, with LINK rising from $2.07 to $4.07. Three months later, the price doubled again.

Things are no longer as they seem

Current trends demonstrated by the project have shown that such achievements may not be repeated. AMBCrypto’s research suggests that this change may be due to the impact Solana had over the past year.

Last year, LINK’s value increased by 182%, but it was nowhere near SOL’s 819% increase over the same period.

Currently, the Bitcoin halving is estimated to be on April 19th. Unless there is a major change in price action in the coming days, LINK may not move the same way it did in 2020 and 2016.

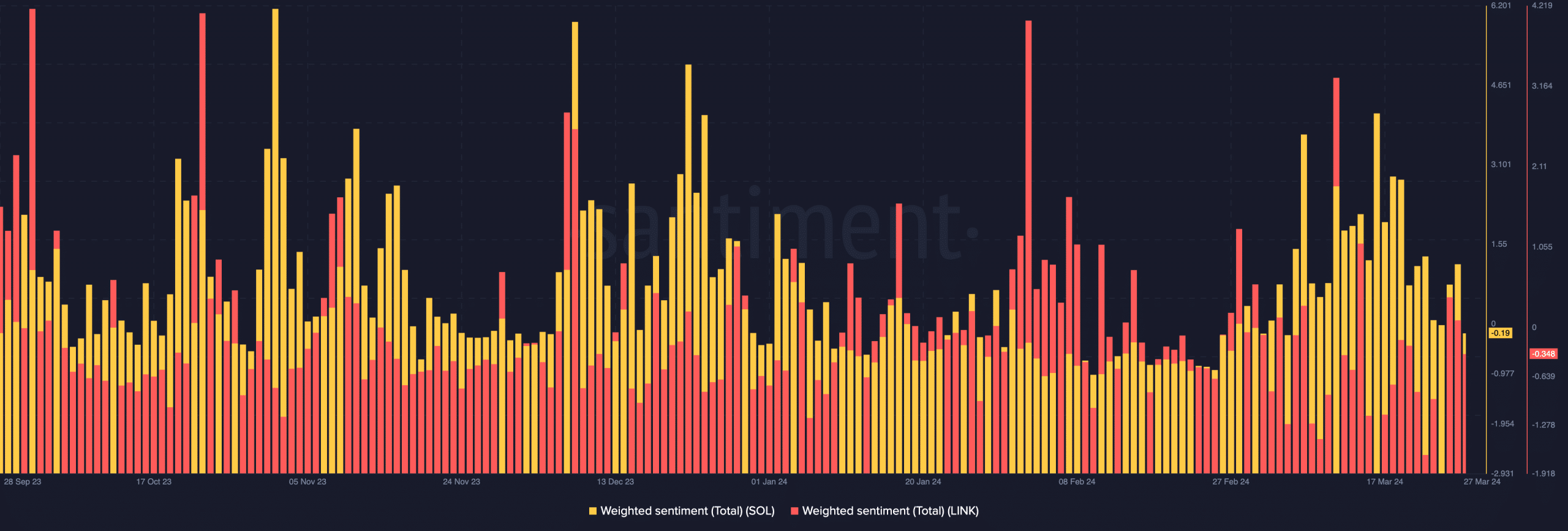

When it comes to sentiment towards both projects, we found them to be similar. At press time, Weighted Sentiment toward SOL was negative. Chainlink’s sentiment was virtually indistinguishable from its opposing numbers.

Source: Santiment

These negative numbers mean that traders expect the prices of both tokens to decline in the near term. Despite Solana’s performance, on-chain data shows that market participants are turning their attention to Chainlink.

Decline may be followed by rest

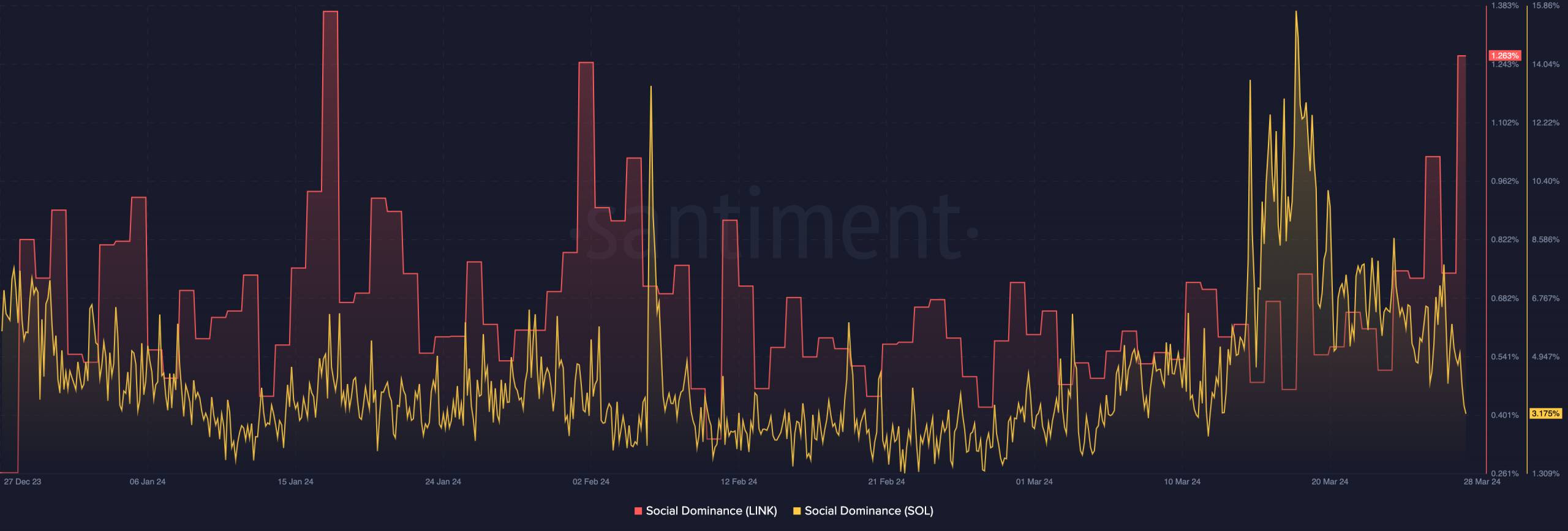

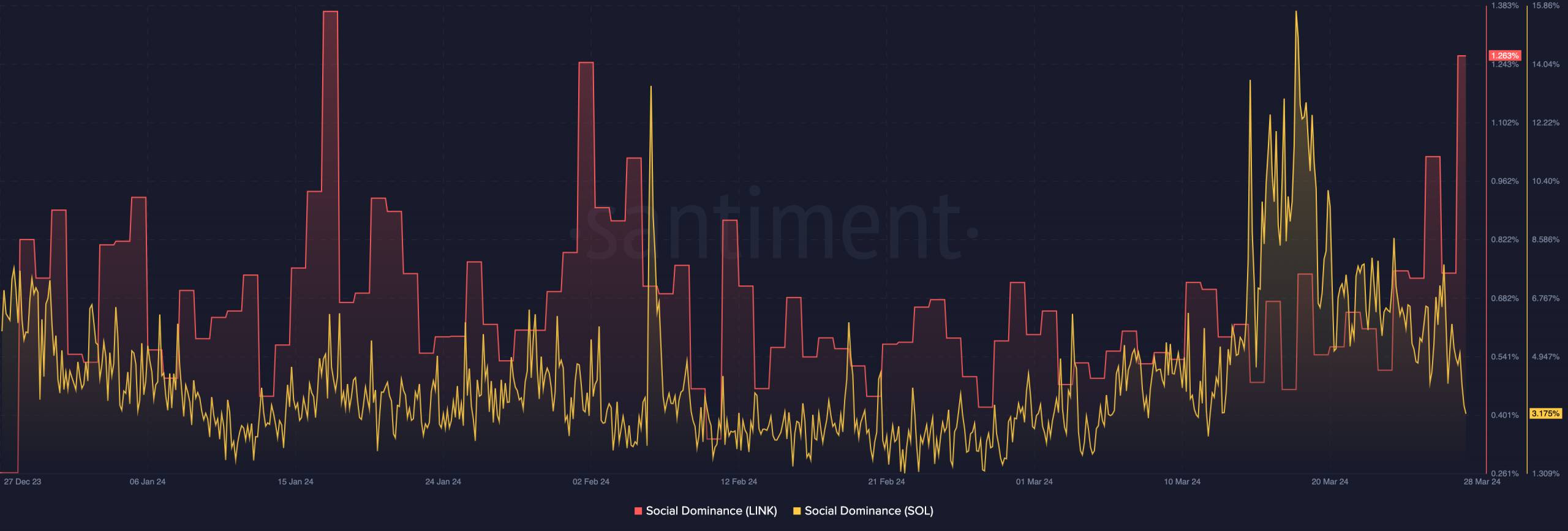

As of this writing, LINK’s social dominance has risen to 1.263%. Solana had a higher figure, but the trend was down to 3.175%.

However, high social dominance is not always a good sign for cryptocurrency prices. Likewise, a lower indicator number means there is a higher likelihood of an increase.

If the trend remains the same in the coming days, the price of SOL may increase. LINK has the potential to do the same, but it may not be as big as Solana predicts.

Source: Santiment

However, the post-halving performance of both cryptocurrencies may be optimistic. Historically, Bitcoin loses dominance days or weeks after an event. This allows altcoins to provide more profits to their holders.

Realistic or not, LINK’s market cap on a SOL basis is:

As things stand, post-event volatility could be extremely high and altcoin prices could fluctuate in high ranges.

However, once things stabilize, things can change. In this case, SOL and LINK could hit new annual highs. Regardless of performance, Solana may have a higher market cap than Chainlink.