- SOL resisted a sharp decline despite large exchange inflows.

- Technical analysis suggested a bearish bias for the token.

According to X’s Whale Alert post, four Solana (SOL) transactions worth approximately $160 million were sent to Coinbase. According to AMBCrypto’s observations, all transactions occurred in the same time period.

Typically in the following cases: whale Sending large amounts of tokens reduces the number of cryptocurrencies affected. Because selling is usually the goal.

SOL has proven to be powerful.

This was not the case with SOL. At press time, Solana’s price was $196.37, similar to the price 24 hours earlier. The value of the cryptocurrency indicates that the participants involved may not have sold their tokens yet.

If the same thing happens, the token price may fall. If selling pressure is strong, the value of SOL could fall below $190.

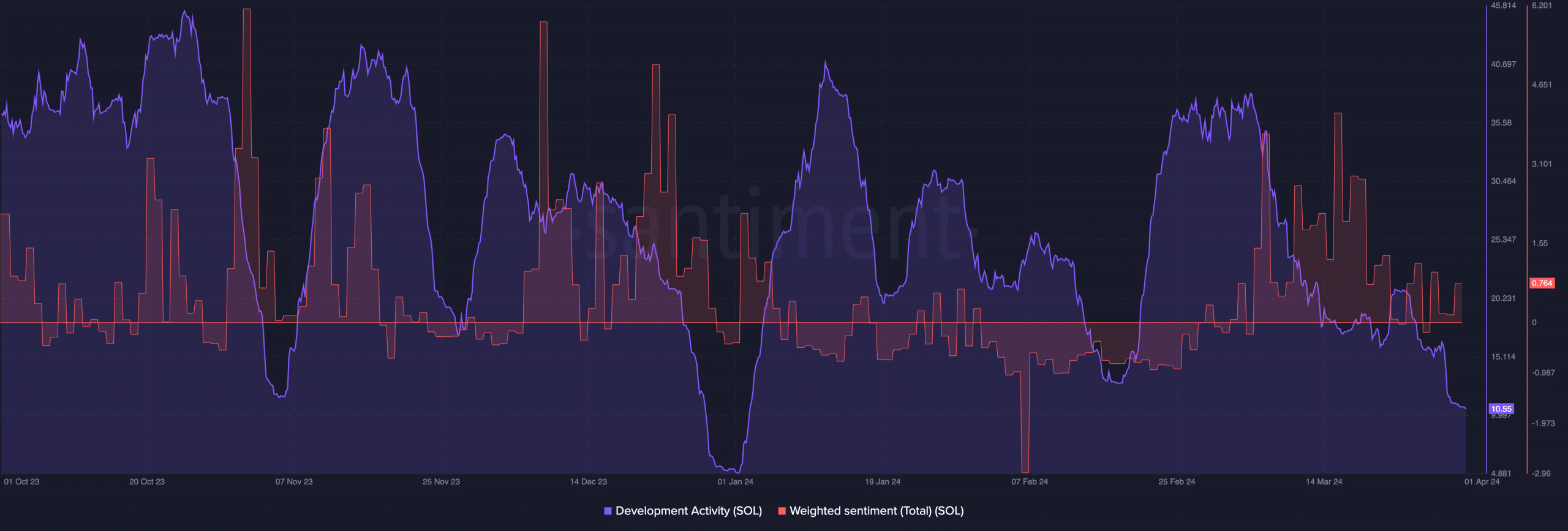

In addition to these speculations, AMBCrypto also investigated Solana’s on-chain status. According to Santiment, the network’s development activity has dropped to 10.55.

Development activity is tracked in a public GitHub repository dedicated to the project. Increasing metrics mean that developers are contributing their code to the proper functioning of the network.

However, a decrease in metrics means a decrease in the capabilities provided to the network. Regarding sentiment toward SOL, this condition means that participants are bearish toward the token.

I also checked Weighted Sentiment. According to on-chain data, Weighted Sentiment rose from negative territory.

Source: Santiment

This reading suggested that opinions about SOL were mostly positive. If this continues, the predicted decline may not last for long. If sentiment continues to rise, SOL may surpass $210.

There may be a drop next time

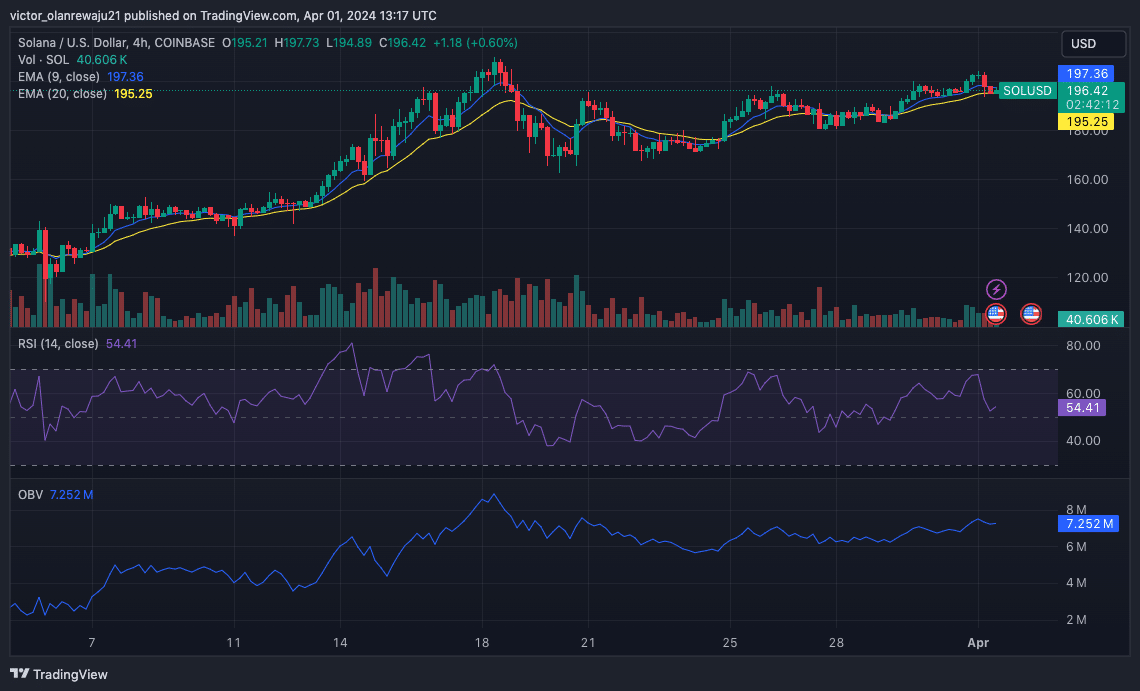

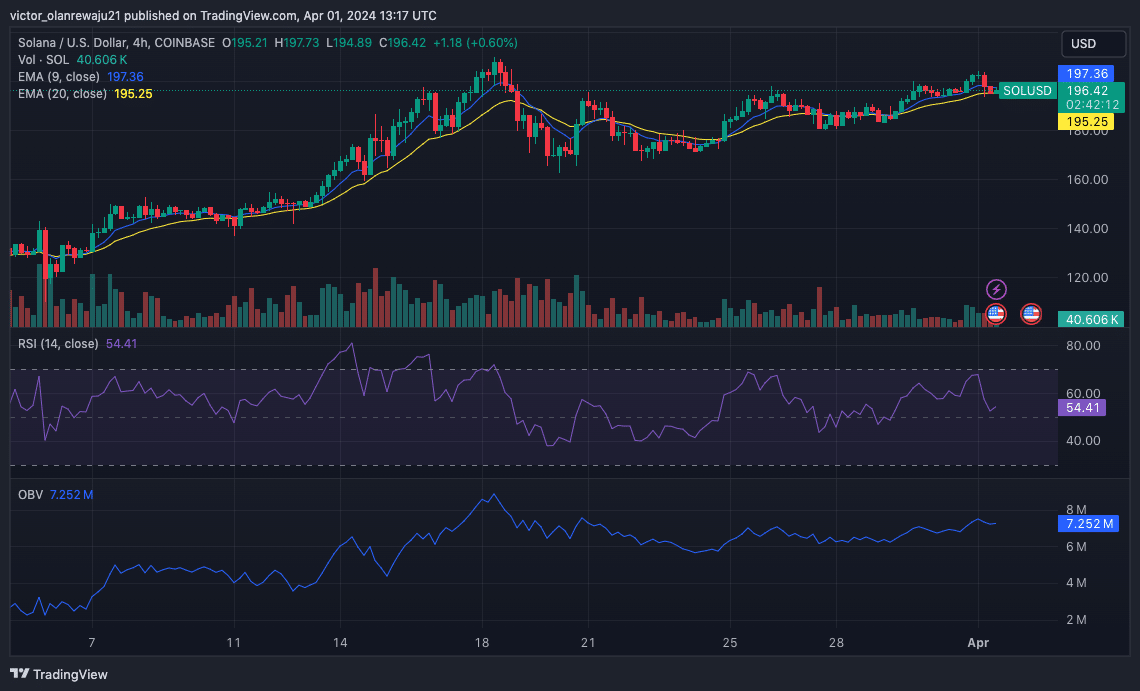

From a technical perspective, AMBCrypto has considered exponential moving averages (EMAs). At the time of writing, the 9 EMA (blue) has crossed the 20 EMA (yellow). Normally this would have implied a bullish bias.

However, at the time of press, the price of SOL was on the verge of falling below the EMA. That would invalidate SOL’s optimistic claims.

Moreover, the Relative Strength Index (RSI) shows that buying momentum has decreased. If the reading continues to decrease, it may be difficult for the SOL to bounce.

Looking at the On Balance Volume (OBV), I noticed that the reading was stuck. This means that there was virtually no buying pressure. However, these numbers also did not support intense selling pressure.

Source: TradingView

Read Solana (SOL) price forecast for 2024-2025

Combining all these indicators, we can assume that Solana may not be ready for an upward trajectory. Instead, the token price may move sideways.

In a very bullish case, SOL price could move towards $210. However, the bearish thesis for SOL sees the cryptocurrency price possibly falling to $171.