The following is an excerpt from the latest edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be the first to get these insights and other on-chain Bitcoin market analysis delivered to your inbox, Subscribe now.

With Bitcoin’s next halving scheduled for this month, miners are using their record profits to adapt their business models to the disruptive opportunity.

Halving is almost here. As the entire Bitcoin world waits with bated breath for mining rewards to be halved, the potential for new revenue streams has left many wondering how the Bitcoin space will react to new market conditions. Past halvings have generally been associated with Bitcoin’s prosperity, but they have been known to significantly shake up previously held assumptions. We are already seeing some examples of these market changes. To give just one example, large-scale miners have been modernizing their equipment to maximize hardware efficiency. This led to a mass sale of these companies’ outdated equipment, with thousands of mining rigs being delivered to aspiring miners in Africa and Latin America. Ethiopia’s cheap hydropower is already attracting international capital to become a new mining hub, with many of these rigs going there for pennies on the dollar.

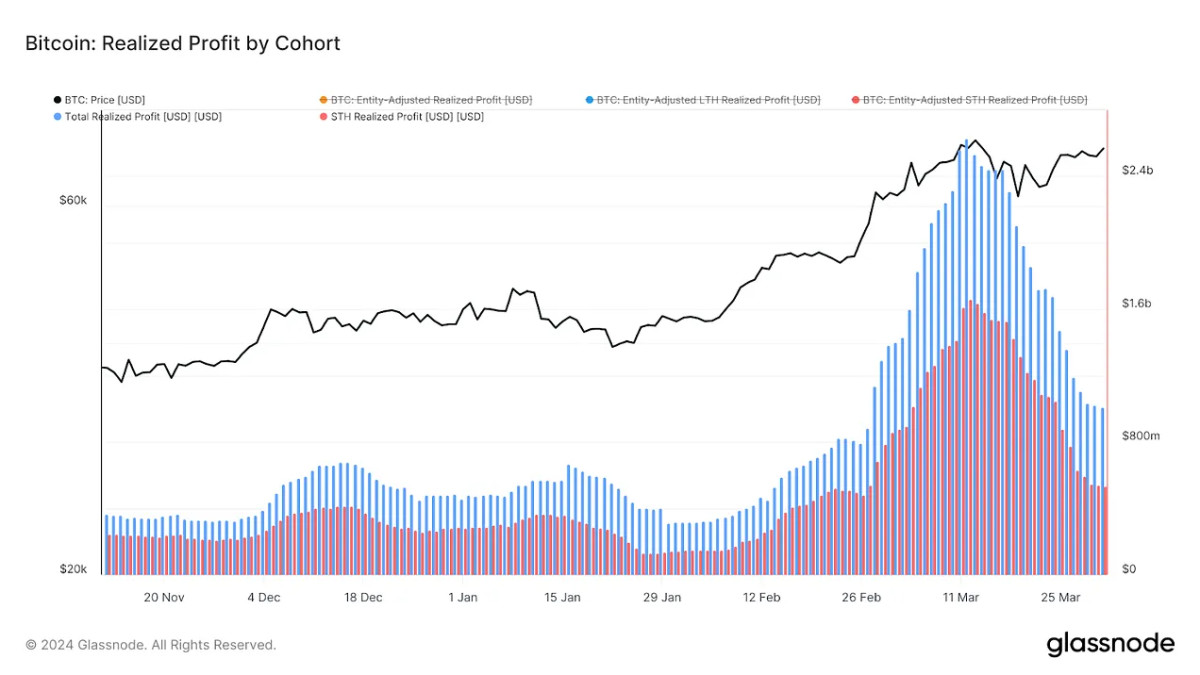

This means that miners expect production to decline in the near future, but this has nonetheless fueled the establishment of new mining companies globally and net growth in the industry. This is just one example of the unexpected opportunity that is about to sweep the digital asset market, and it is up to Bitcoin users to seize it. Overall, there are certainly plenty of opportunities for miners. In March 2024, monthly revenue for the collective mining industry reached an all-time high of over $2 billion. What’s especially notable is that less than half of this revenue came from trading fees. This is a far cry from the situation in December, when transaction fees outpaced mining rewards.

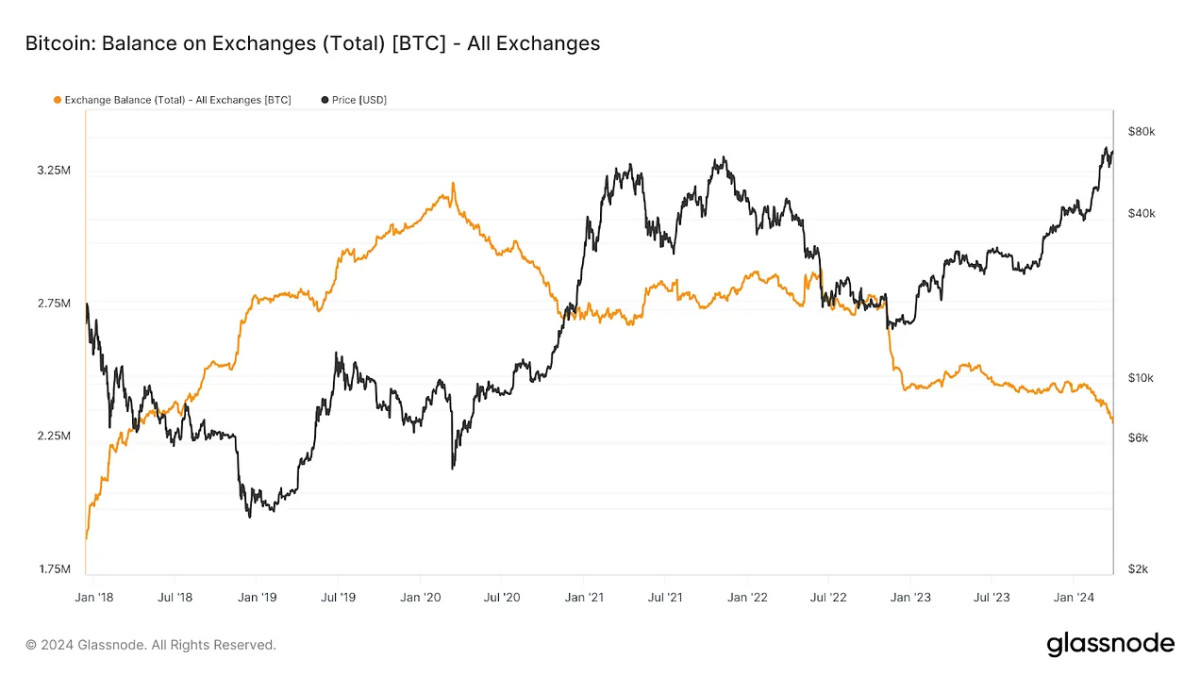

In December, the price of Bitcoin was much lower and the blockchain suffered from congestion. Not only has this congestion suppressed demand to purchase Bitcoin, it has also increased demand for miners willing to process the blockchain. Simply settling transactions for already mined bitcoins was more profitable than mining and selling new bitcoins, making the company a lifeline for many small businesses. But now it seems like money is flowing everywhere. Bitcoin ETFs are gobbling up Bitcoin at an extreme rate, more than six times the actual production of miners. The jackpot even refocused the attention of venture capitalists, further increasing enthusiasm. Bitcoin holdings on major exchanges fell by nearly $10 billion in the first three months of 2024, revealing huge demand for newly mined coins. In these market conditions, it is natural that miners’ profits have reached record highs.

However, while this period of intensive selling has certainly presented opportunities for miners, there are also risks that come with half as much. These companies are in a mad rush to secure as much revenue as possible before the halving, and the competition is extremely desperate for one simple reason. While trend lines can provide encouraging data, there is no real guarantee that the Bitcoin price will rise accordingly after supply ends. Reduce it. Halving expectations and the massive success of ETFs have pushed Bitcoin prices to record highs, but these records have been accompanied by volatility. Bitcoin has hovered around a respectable benchmark since passing it without continuing its explosive surge. If the Bitcoin price continues to behave in unexpected ways, it will ultimately cause significant harm to small businesses and spur industry consolidation.

Additionally, a particularly interesting development has emerged in the secondary Bitcoin market. As widespread demand from financial institutions, including ETF issuers, completely outstrips supply, some long-term holders (LTHs) are fearful of a general liquidity crisis. Whales, who were previously content to hold on to Bitcoin for years at a time, have changed their behavior and seem to have decided that it is finally time to realize massive profits. In March 2024, long-term holders began selling their assets at unprecedented rates, generating disproportionate returns compared to other Bitcoin sellers. Obviously resources like this can’t last forever, but this is an important reminder for some miners. Just because the industry is having trouble making ends meet after the halving doesn’t mean the industry will. If you don’t adapt, space will find new ways to leave you behind.

Nonetheless, miners large and small did not challenge the halving. These runaway profits have forced companies to invest in a variety of preparedness strategies, sometimes dramatically shaking up their business models. For example, the US company Arkon Energy previously operated more as an infrastructure company and was seen as a provider to its customer base of independent miners. By announcing the purchase of a large batch of cutting-edge mining equipment on April 2, we joined the industry-wide trend of preparing for the halving with the most efficient equipment. However, rather than providing this equipment to former customers, Arkon announced its intention to mine and mine Bitcoin itself. This simple change represents a dramatic shift in their overall business model, which they plan to follow “with the goal of making Arkon one of the most efficient miners in the world.”

On the other hand, leading miner Hut 8 has begun its own business model transformation, but in a slightly different direction. During the company’s first-quarter earnings call in late March, CEO Asher Genoot acknowledged that 70% of the company’s revenue came from asset mining, although plans were expected to change somewhat as the halfway mark approaches. Hut 8, like many other mining companies, is still focused on upgrading hardware and exploiting energy resources at new sites, but it is also investing in new directions. This new direction is aimed at developing high-performance computing and AI operations, as mining operations are focused on Bitcoin and not on other assets. Genoot argued that these new businesses are “sub-scale today.” But we are excited about this business because we see it as a foundation for growth. “You’ll see us continue to be creative, maximizing the value of every machine,” he says, emphasizing the need to remain passionate and disciplined about existing mining operations.

These are just a few of the many new strategies miners are taking to anticipate the halving. Companies have been preparing for months now, and there is still time to make additional new plans. As of this writing, halving is less than three weeks away, and the countdown to this event reveals an optimistic and celebratory attitude from Bitcoin investors everywhere. No matter what happens when the long-awaited day finally arrives, a few constants seem very reliable. There will be tremendous demand for the world’s best digital asset, and the Bitcoin community will have the same spirit of innovation as always. Whether Bitcoin surges immediately or behaves unpredictably, it’s certain that someone will win big. For us Bitcoin users, this means we have a lot to look forward to.