- Investors should prepare for a plunge to $33.

- The 78.6% Fibonacci level is likely to halt the current short-term downtrend.

Avalanche (AVAX) price has fallen once again, with Bitcoin (BTC) and the rest of the cryptocurrency markets witnessing heavy selling activity over the past four days. During this period, market dynamics changed.

Traders and investors can embrace a new narrative. Alternatively, utilizing technical analysis and finding narratives can also lead to consistent profits. So what are the pitfalls that AVAX bulls need to watch out for?

One of the breaker blocks is already broken.

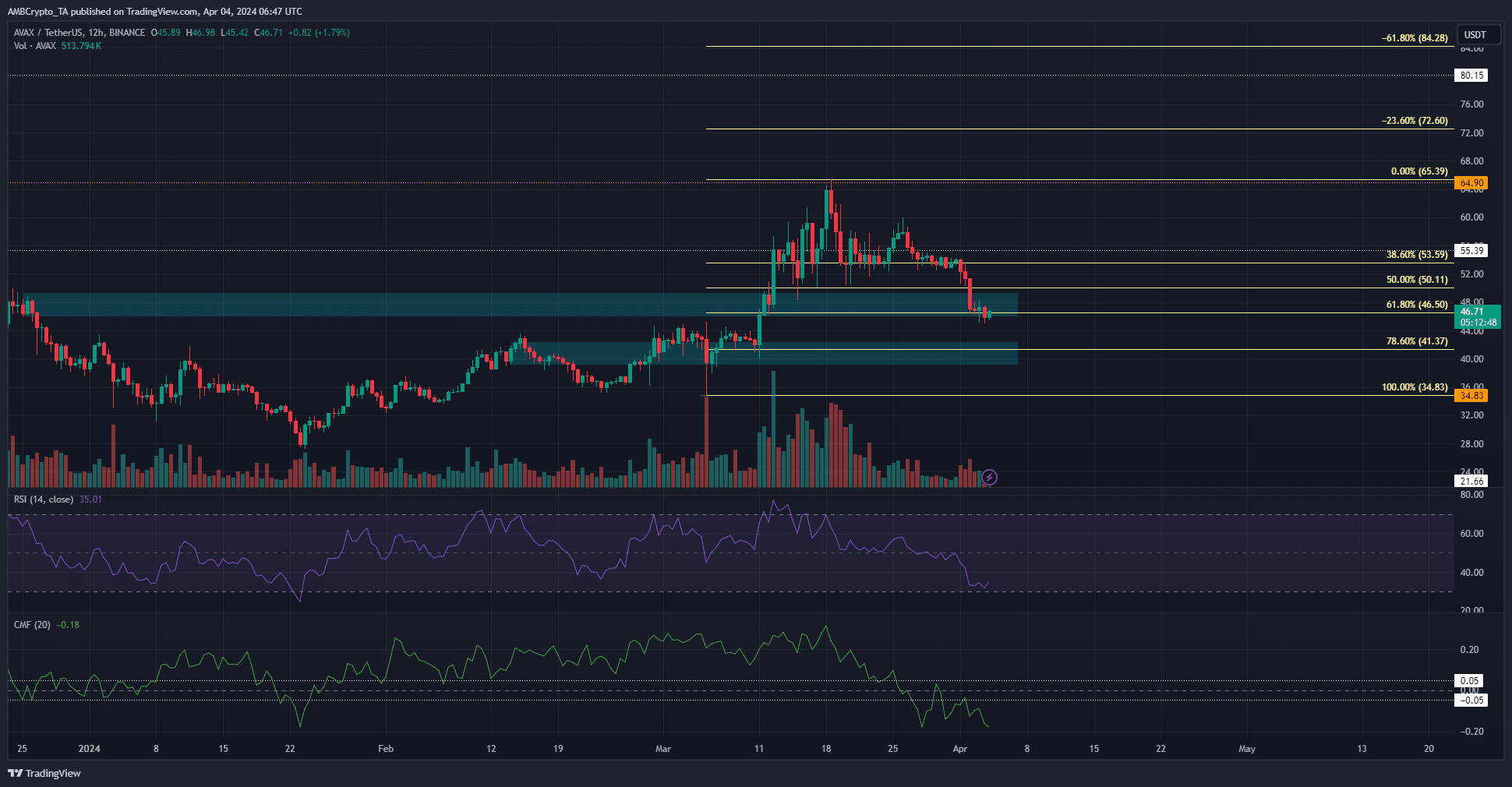

Source: AVAX/USDT on TradingView

Based on one-day price action, AMBCrypto has marked two breaker blocks in turquoise, indicating demand zones.

AVAX was expected to see a bullish reaction at $46.5 as it is at the 61.8% Fibonacci retracement level.

Instead, the price briefly fell below $46.5 on April 3. It has not yet closed a 1-day or 12-hour candle below $46.5.

Further south, the $41.37 level was important as a demand zone for the same reason: the confluence of a breaker block and a fiber retracement level.

Technical indicators showed a serious situation for the bulls. RSI is at 35, reflecting solid bearish momentum. CMF was -0.18, indicating strong capital flows in the market.

Should investors prepare for a revisit to $30?

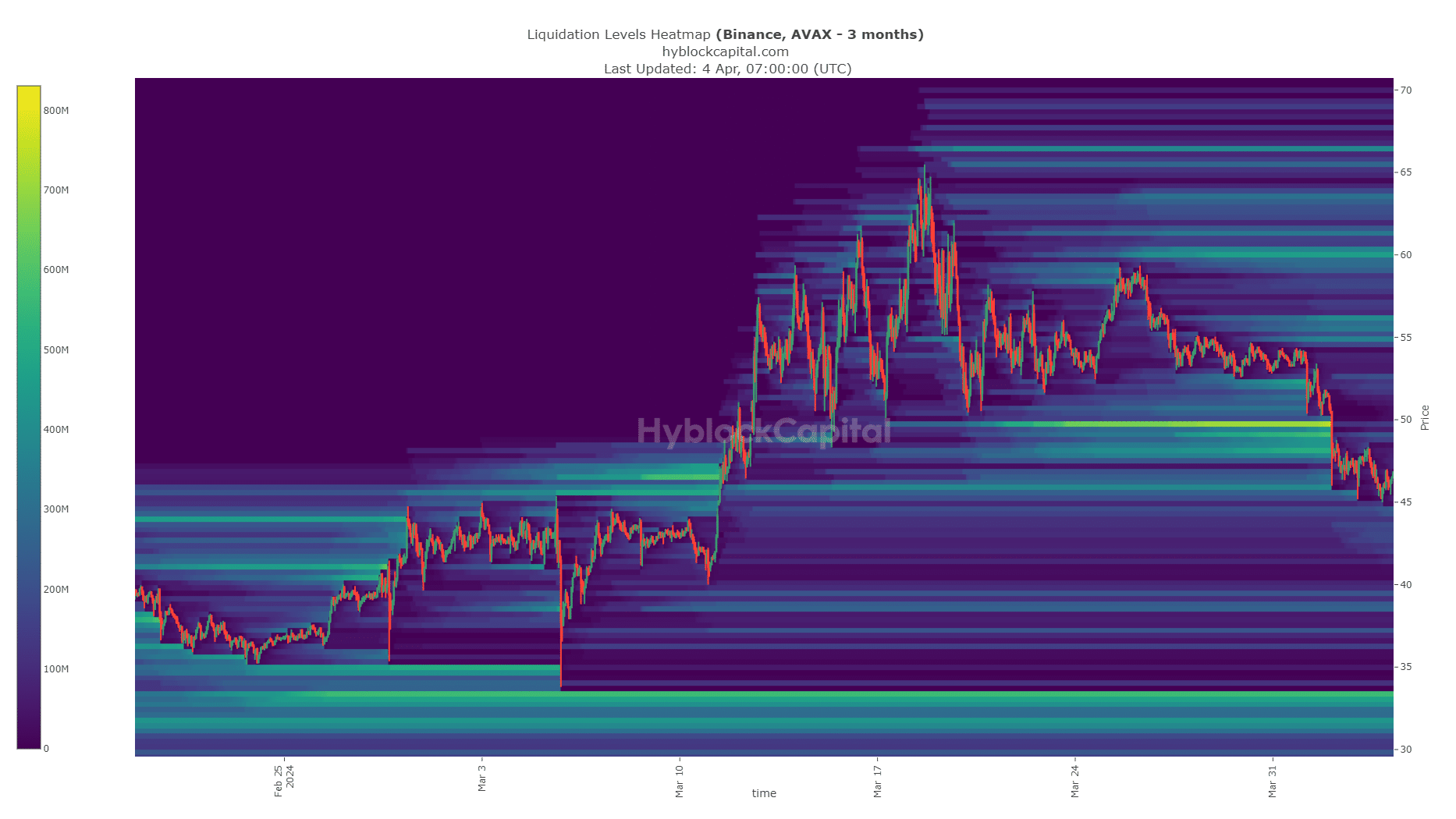

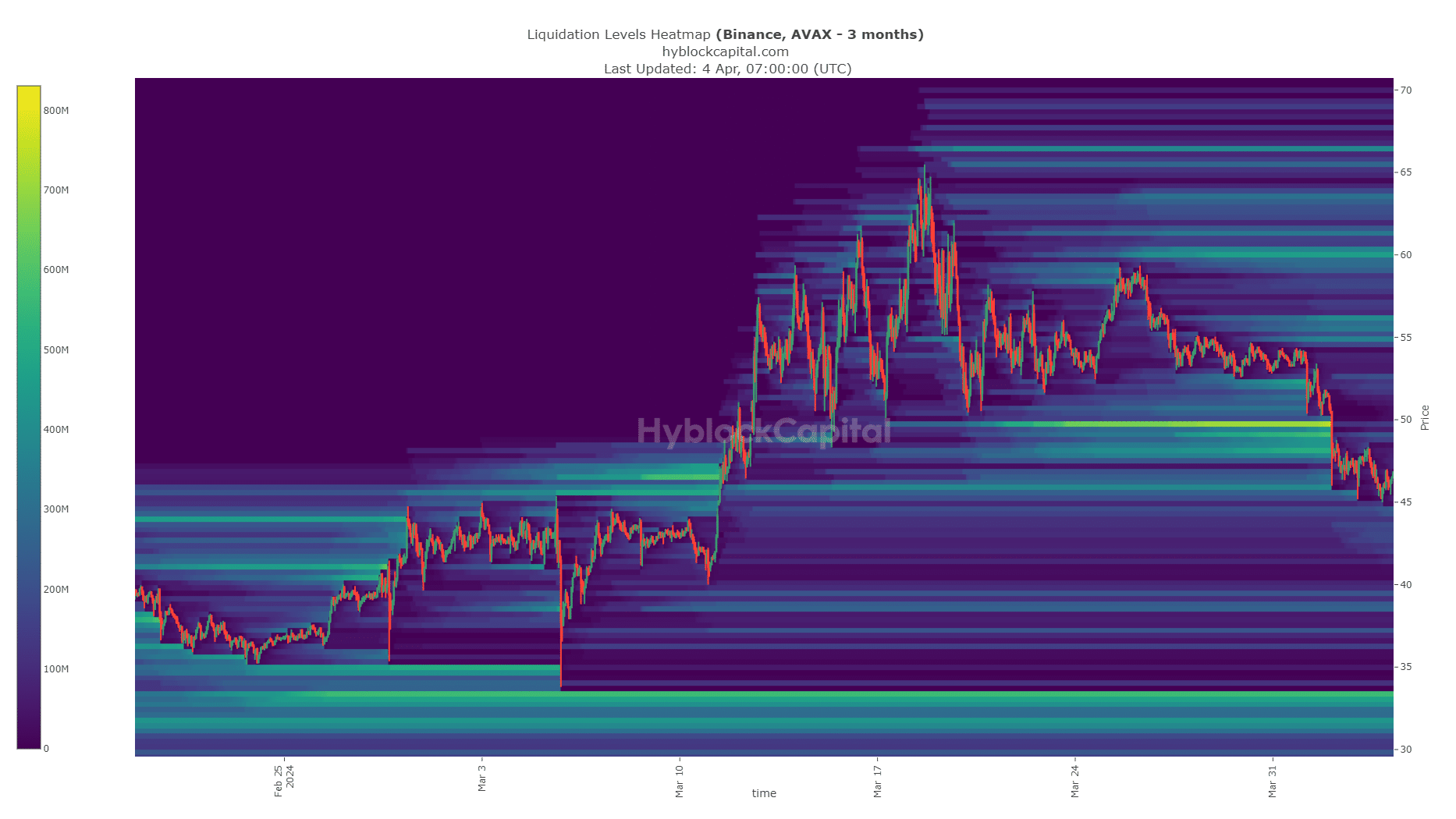

Source: Hiblock

Liquidation heatmaps over the past three months highlight the $50 region as a pivotal space for liquidity. When the price fell below that, a liquidation cascade followed, causing the price to fall further.

Read Avalanche (AVAX) Price Prediction for 2023-24

At press time, the $42.6 and $38.6 levels were the next pockets of liquidity that could attract AVAX price.

There was also a high clearing concentration of $33-$33.3. An avalanche could lead to a plunge to these levels and such a move would change the market structure to bearish.

Disclaimer: The information presented does not constitute financial, investment, trading, or any other type of advice and is solely the opinion of the author.