- Jupiter recorded the most daily users in the first quarter.

- Demand decreases due to SOL price decline

Solana-based decentralized exchange (DEX) Jupiter (JUP) ended the first quarter as the DeFi protocol with the highest number of daily unique active wallets over a 90-day period. According to DappRadar’s latest report, this is:

The newly released “State of the Dapp Industry, Q1 2024” report shows that the number of daily unique active wallets on DEXs totals 179,000. This was due to the memecoin craze, which saw the value of some Solana-based assets such as dogwifhat (WIF) and Book of Meme (BOME) surge by triple digits.

Solana benefited from a surge in transaction fees and revenue due to increased user activity on Jupiter.

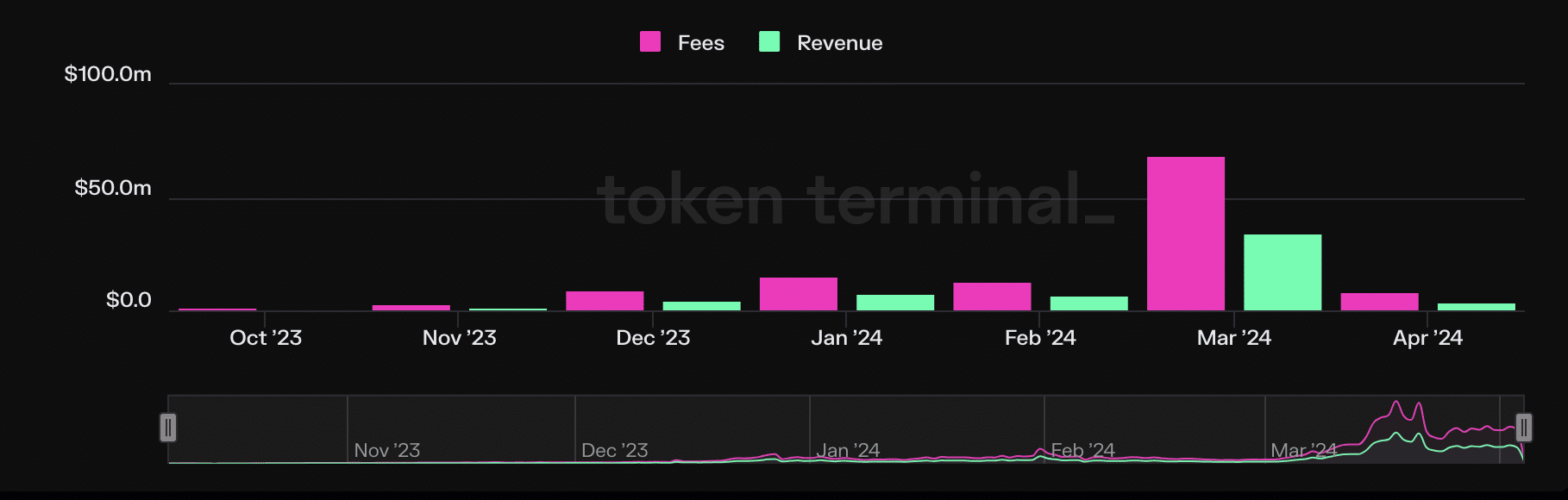

Solana’s monthly trading fees hit a record high of $69 million in March, according to data from Token Terminal. This means that the network’s monthly transaction fees increased by 360% in the first quarter of this year.

Likewise, Solana’s protocol revenue from these fees has also skyrocketed. By the end of March, the total amount was $34 million. This represents a 389% jump in Solana’s monthly revenue compared to $7 million in January.

Source: Token Terminal

show of force

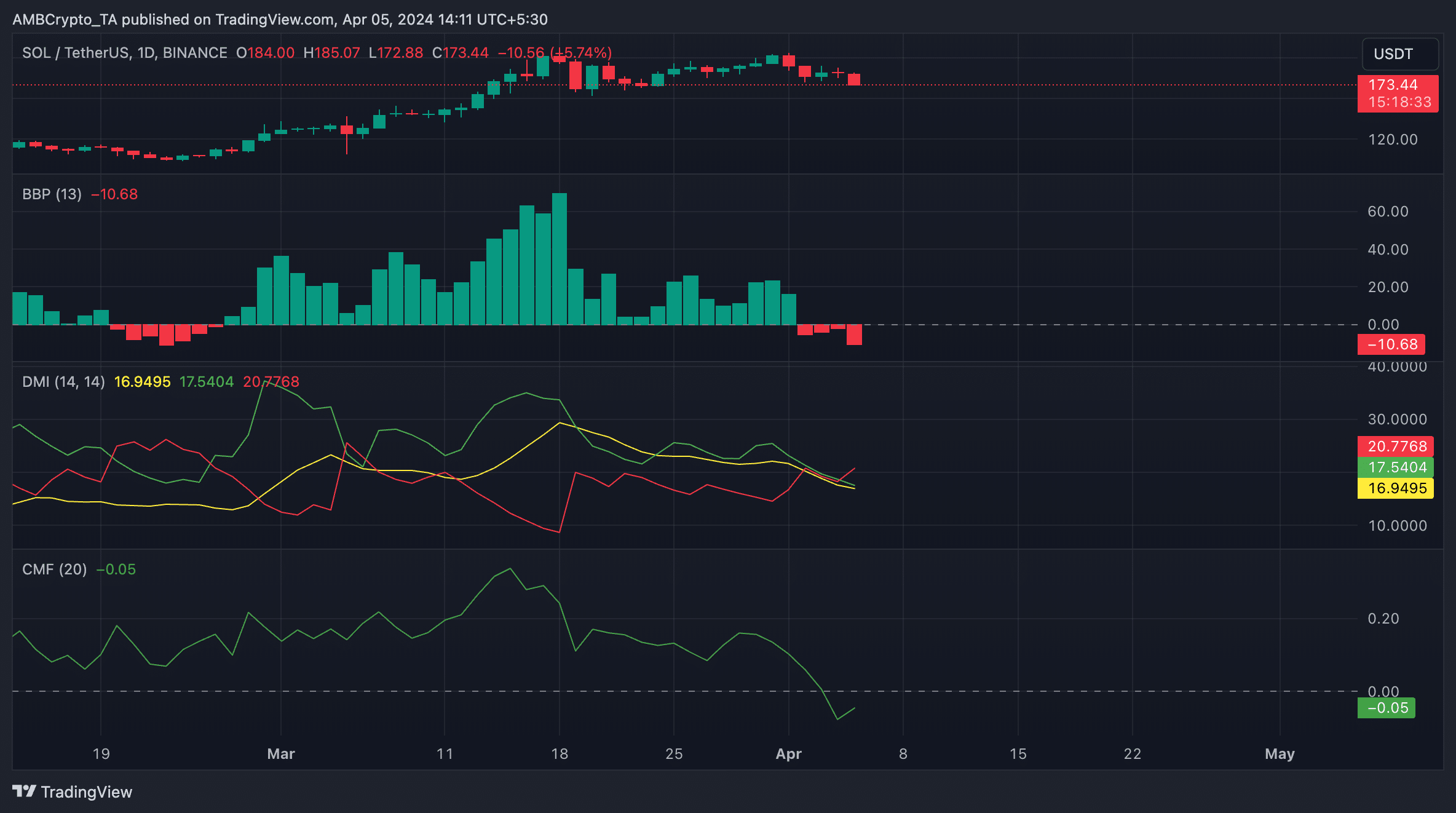

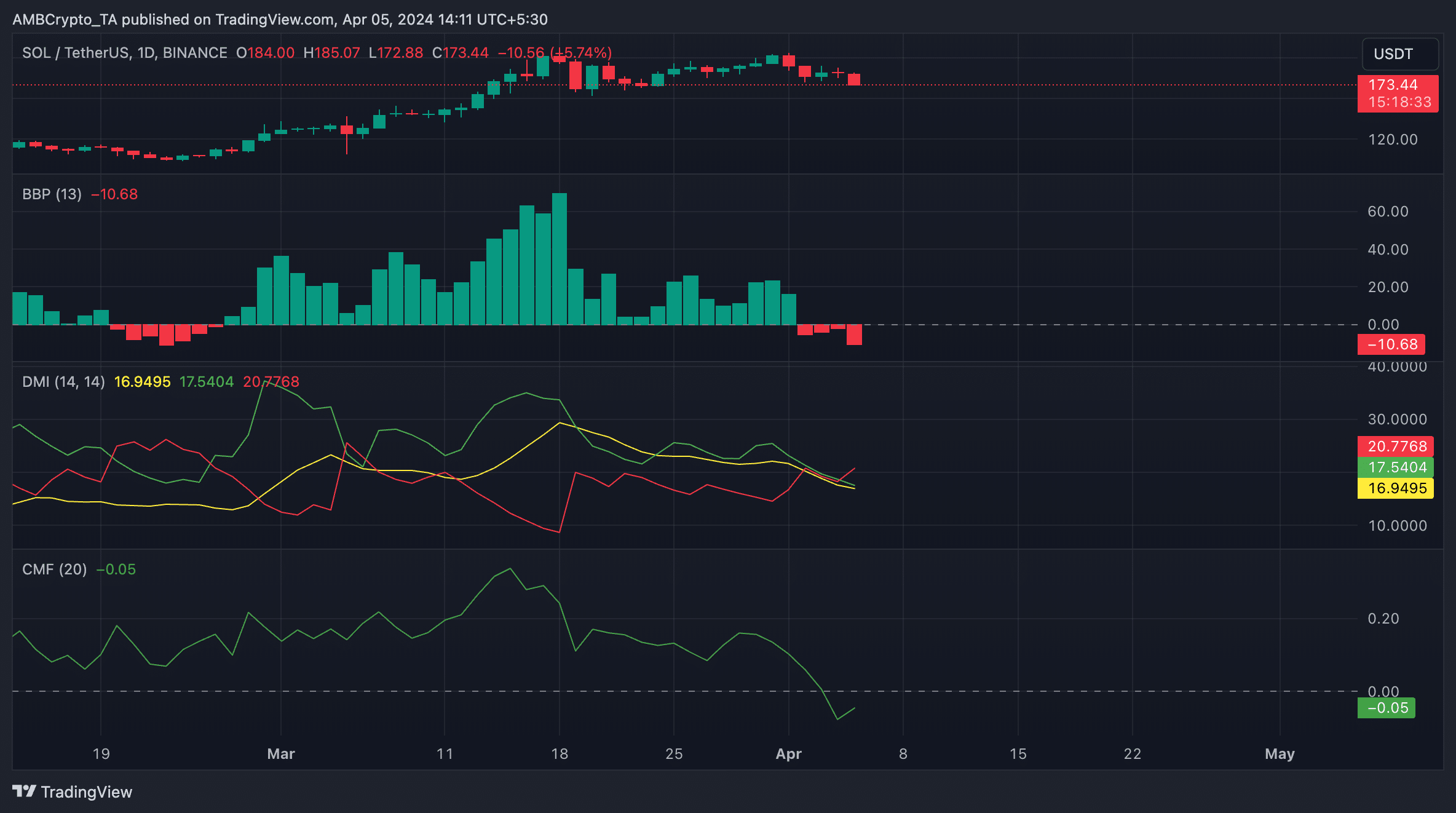

After giving up control to the bulls for an extended period of time, the SOL bears re-emerged and started the altcoin price decline. Trading at $175 at press time, SOL’s price has fallen 5% in the past week alone.

Realistic or not, the market cap of SOL in BTC terms is:

Signaling a surge in bearish sentiment, SOL’s Elder-Ray index returned negative readings at press time. This indicator estimates the relationship between the strengths of buyers and sellers in the market. If the value is negative, it means that the selling pressure in the market is stronger than the buying pressure.

Similarly, AMBCrypto’s reading of the coin’s directional movement index (DMI) shows that the positive directional index (green) is below the negative index (red). When these lines are positioned this way, it means that the bearish forces in the market are exceeding the bullish forces. This indicates that selling pressure is high and the price of the asset may fall further.

Lastly, SOL’s Chaikin Money Flow (CMF) at -0.04 showed low demand for the altcoin on the chart. This indicator measures the flow of funds into and out of an asset. If the value is negative, it indicates that the market is weak.

Source: SOL/USDT on TradingView