- Interest in Liquid Stake on the Avalanche network has been declining over the past few days.

- As AVAX fell, network activity continued to increase.

According to recent data, the total Avalanche (AVAX) staking amount has exceeded 8 million. Despite the surge in overall AVAX staking, a worrying trend has been observed over the past few days.

AMBCrypto looked at data from Flipside and found that the net flow of staked Avalanche has decreased significantly over the past few days.

Source: Flipside

A significant decrease in net flow of staked Avalanche over the past few days could potentially have a negative impact on the Avalanche network.

What’s going on with the avalanche?

A decrease in net flow of staked tokens means a decrease in the overall amount of AVAX staked or locked in validator nodes on the network.

This decline could signal a lack of trust among token holders in AVAX staking and could potentially signal concerns or uncertainty about network performance, security, or future prospects.

Despite the decline in floating staking, activity on the Avalanche network continued to surge.

AMBCrypto’s analysis of token terminal data shows that the number of daily active users on the network has increased by 29% over the past month.

Likewise, revenue generated from the network increased by 10.5% over the same period.

Source: Token Terminal

Status of AVAX

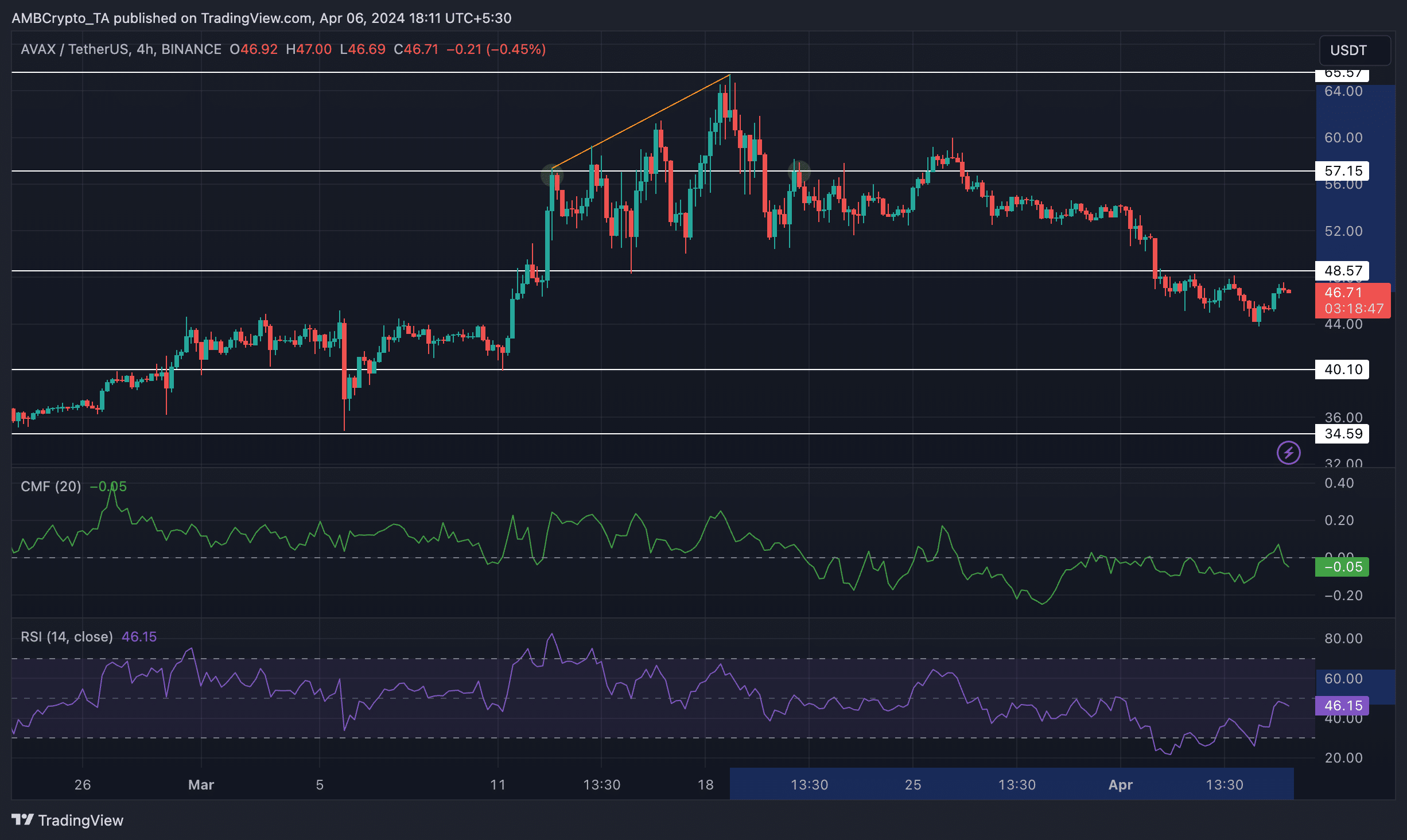

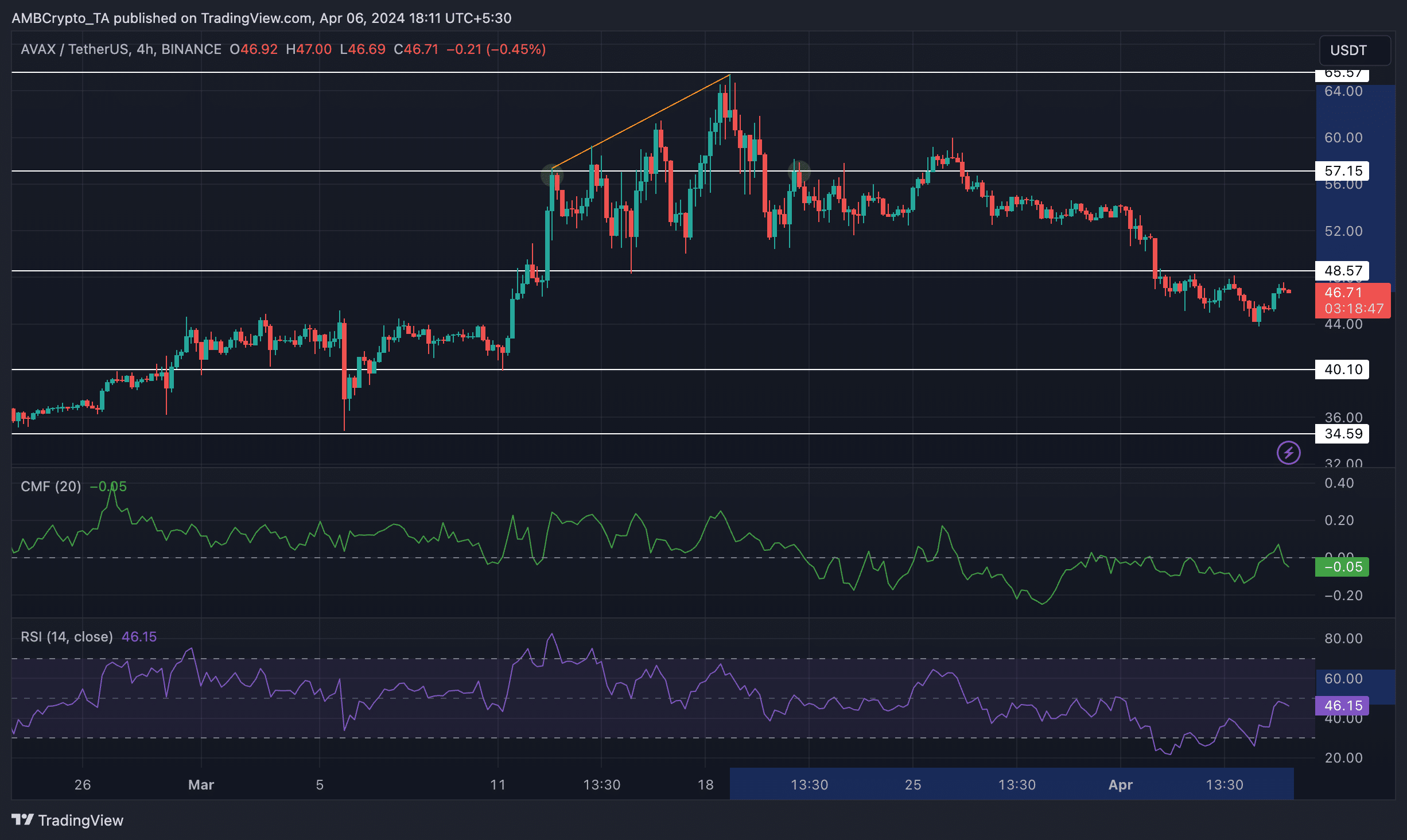

Looking at the price of the AVAX token, we see that the price has fallen 27.61% since hitting the $65 level on March 18th.

During this period, AVAX’s price showed lower lows and lower highs, showing a bearish trend. Chaikin Money Flow (CMF) and Relative Strength Index (RSI) were relatively neutral.

This could mean that AVAX could see some sideways movement ahead before making a bigger move.

Source: Trading View

Source: Trading View

Realistic or not, the AVAX market cap in BTC is:

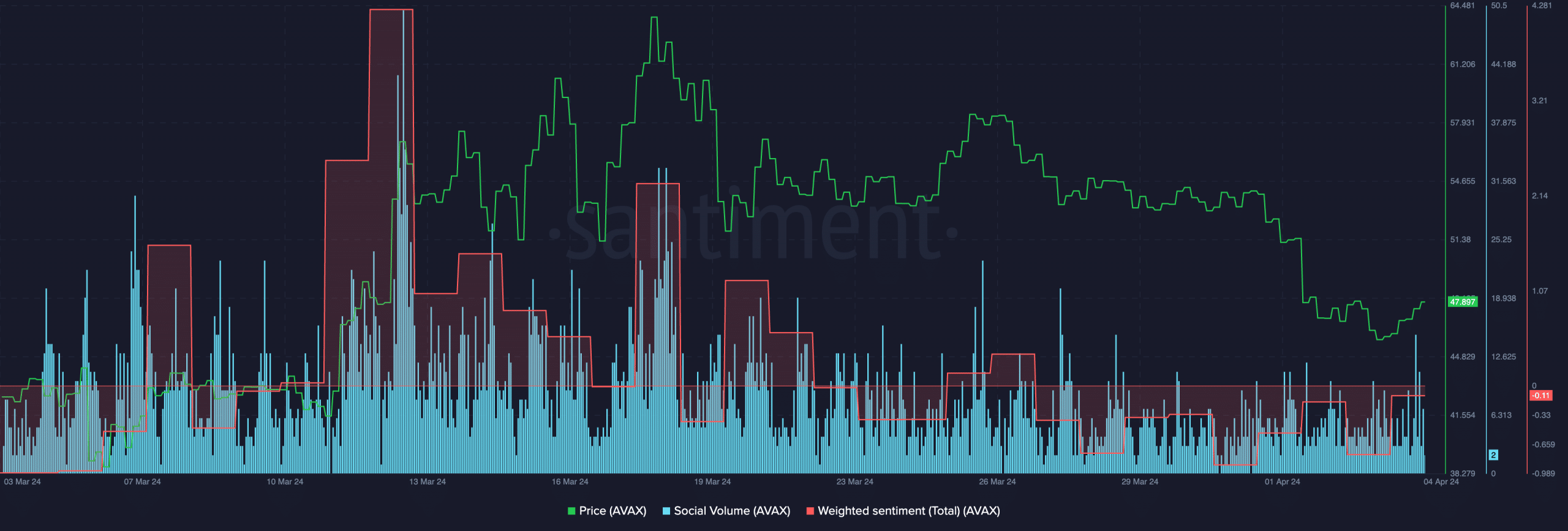

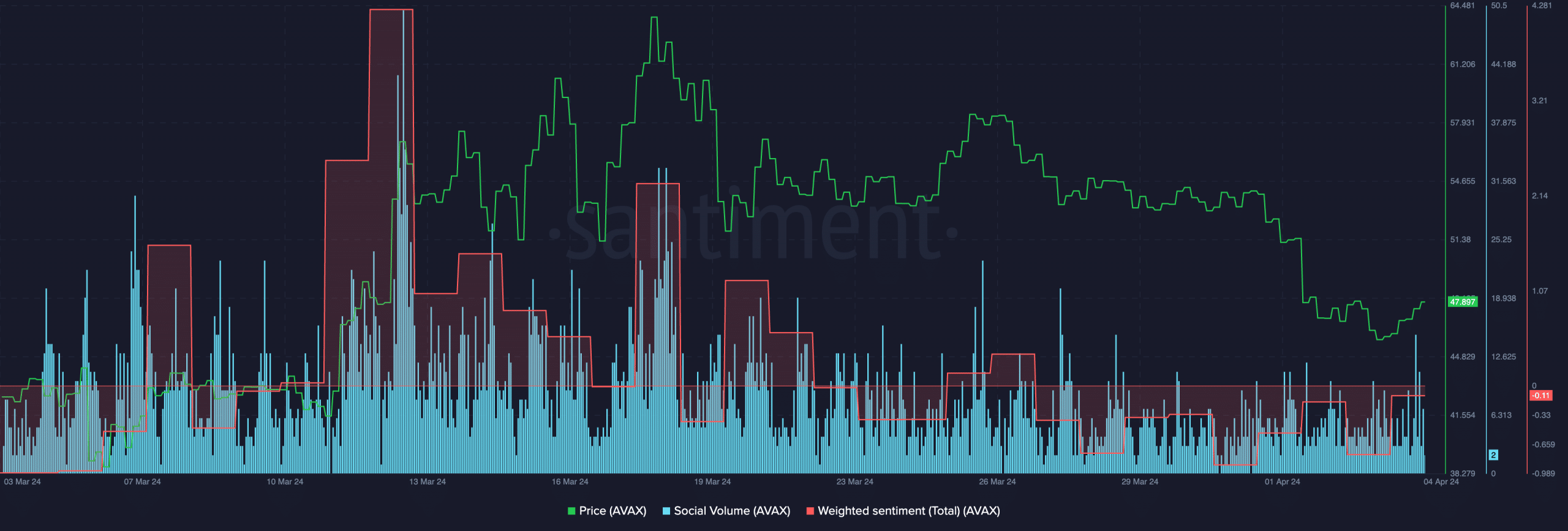

Much of AVAX’s price movements may be determined by how it is perceived in social circles. Data from Santiment shows a significant decline in social volume around AVAX.

Moreover, Weighted Sentiment for AVAX has also fallen, meaning that negative comments about the token have increased.

Source: Santiment