- Wormholes show promise with high development activity.

- The price action chart reveals a short-term downward trend.

all st tly According to a post by X (formerly Twitter), Wormhole (W) had the highest development activity among projects in the Solana (SOL) ecosystem last month.

It comfortably surpassed the development efforts of Solana and Jupiter (JUP).

Solana has been suffering for the past few days. On April 6 and 7, the network collapsed with a transaction failure rate of 75%.

Over the past month, demand for meme coins has led to a surge in on-chain traffic, leading to a decline in the number of daily active users.

Wormhole’s high development activity has been an encouraging development. Demand has also increased in the spot market.

Wormholes compared to Solana and Jupiter

Source: Santiment on X

Wormhole’s 30-day development activity stands at 189. Meanwhile, Solana recorded 108.2 and Jupiter recorded 83.07.

In a Medium post, Santiment explained why event tracking provides a better understanding of development activity than GitHub commits.

The term events include code push counts, pull request interactions, GitHub wiki edits, etc. The upshot is that more activity usually equates to greater belief in the ultimate success of the project.

This is a metric that can go a long way in convincing investors that your project offers more features and reduces the likelihood that your project is a scam.

Technical analysis emphasizes two key levels, but there are pitfalls:

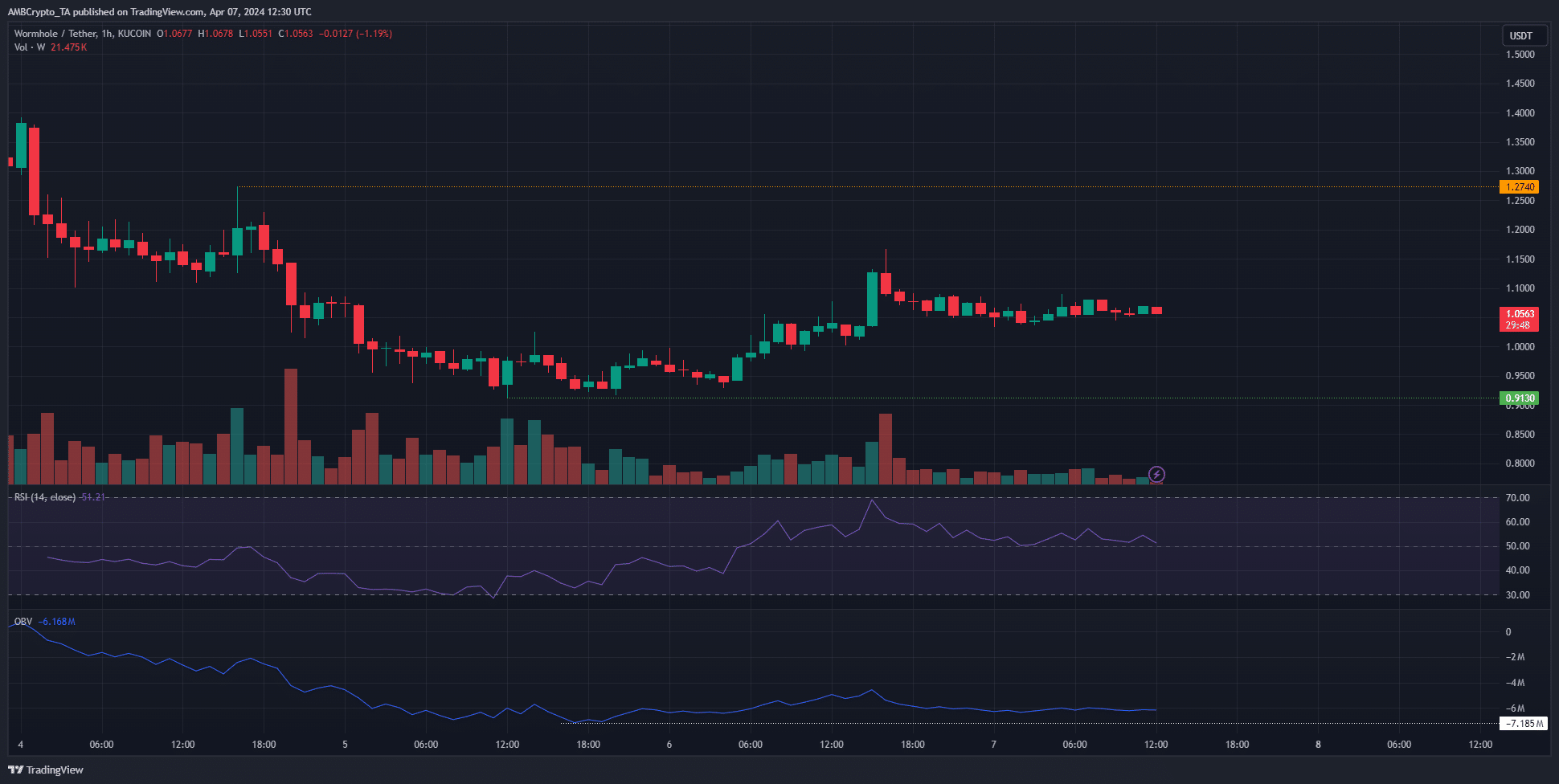

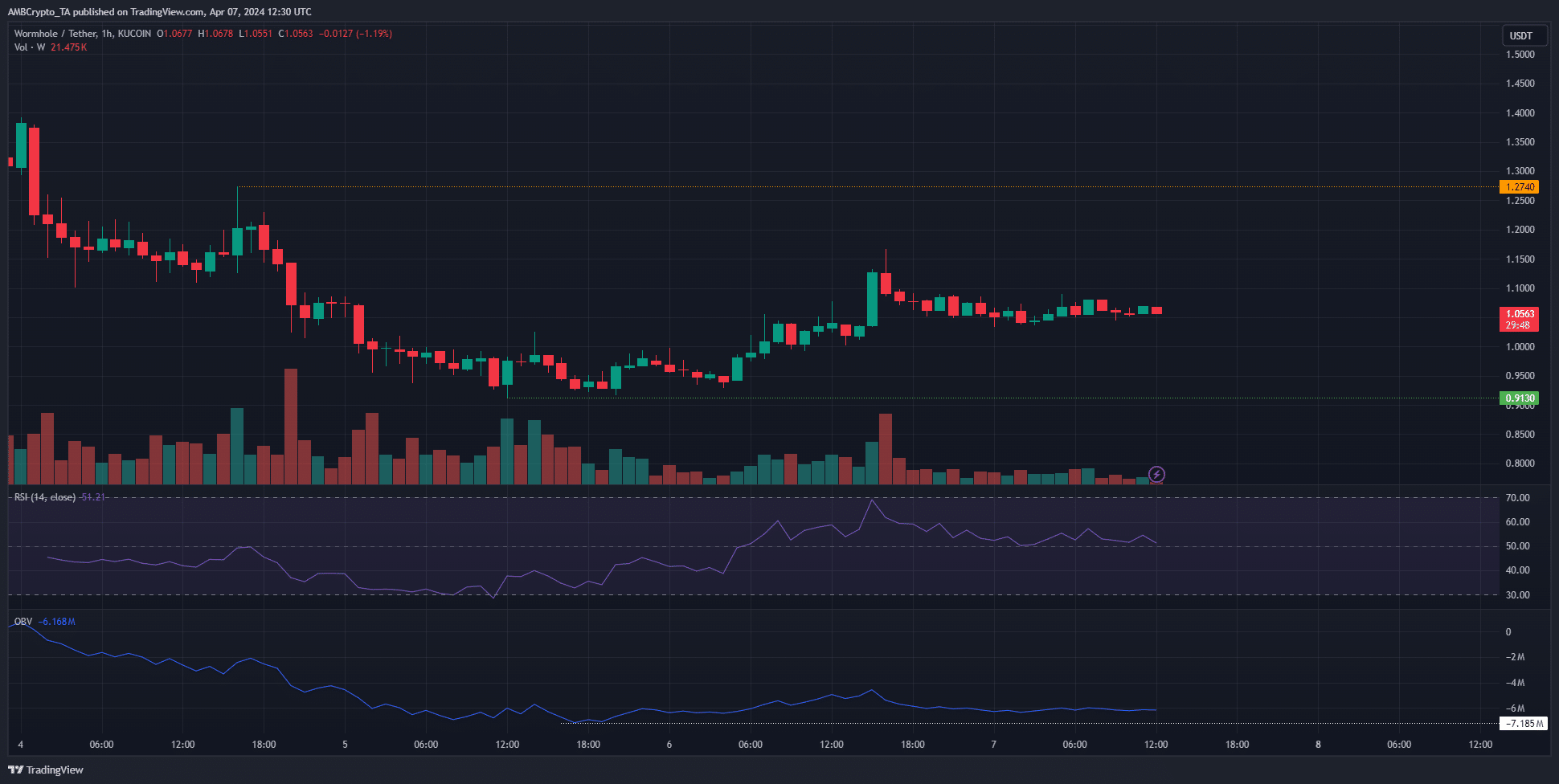

Source: W/USDT on TradingView

The 1-hour chart of W reveals a bearish market structure. A violation of the $0.913 low would mean continued weakness and further losses for the token.

The price has bounced from $0.913 to $1.05 over the past two days. At the same time, OBV also increased slightly. However, starting March 5, transaction volume showed a downward trend.

The RSI on the H1 chart is 51, showing that neither bulls nor bears have the upper hand in the short term.

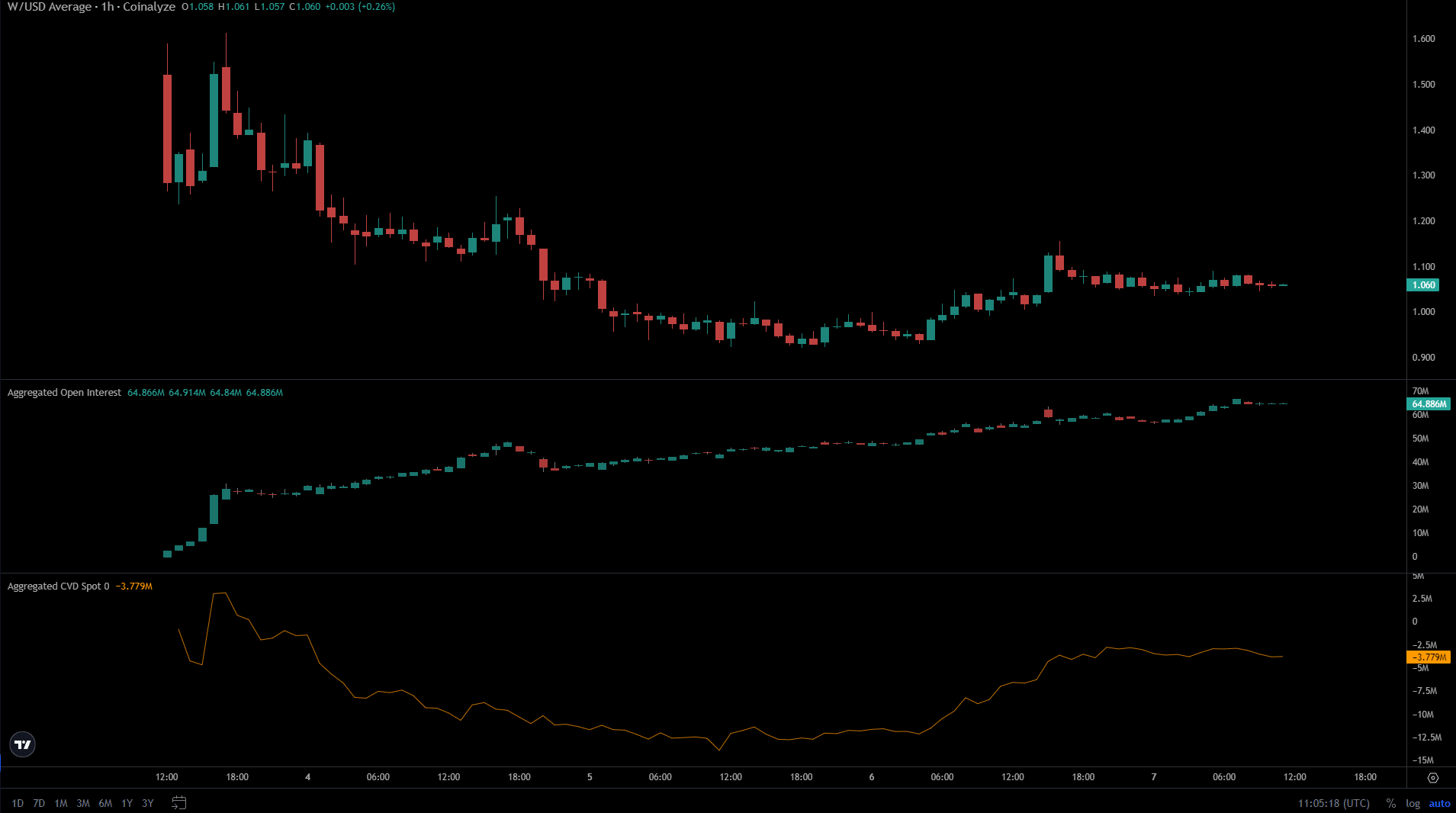

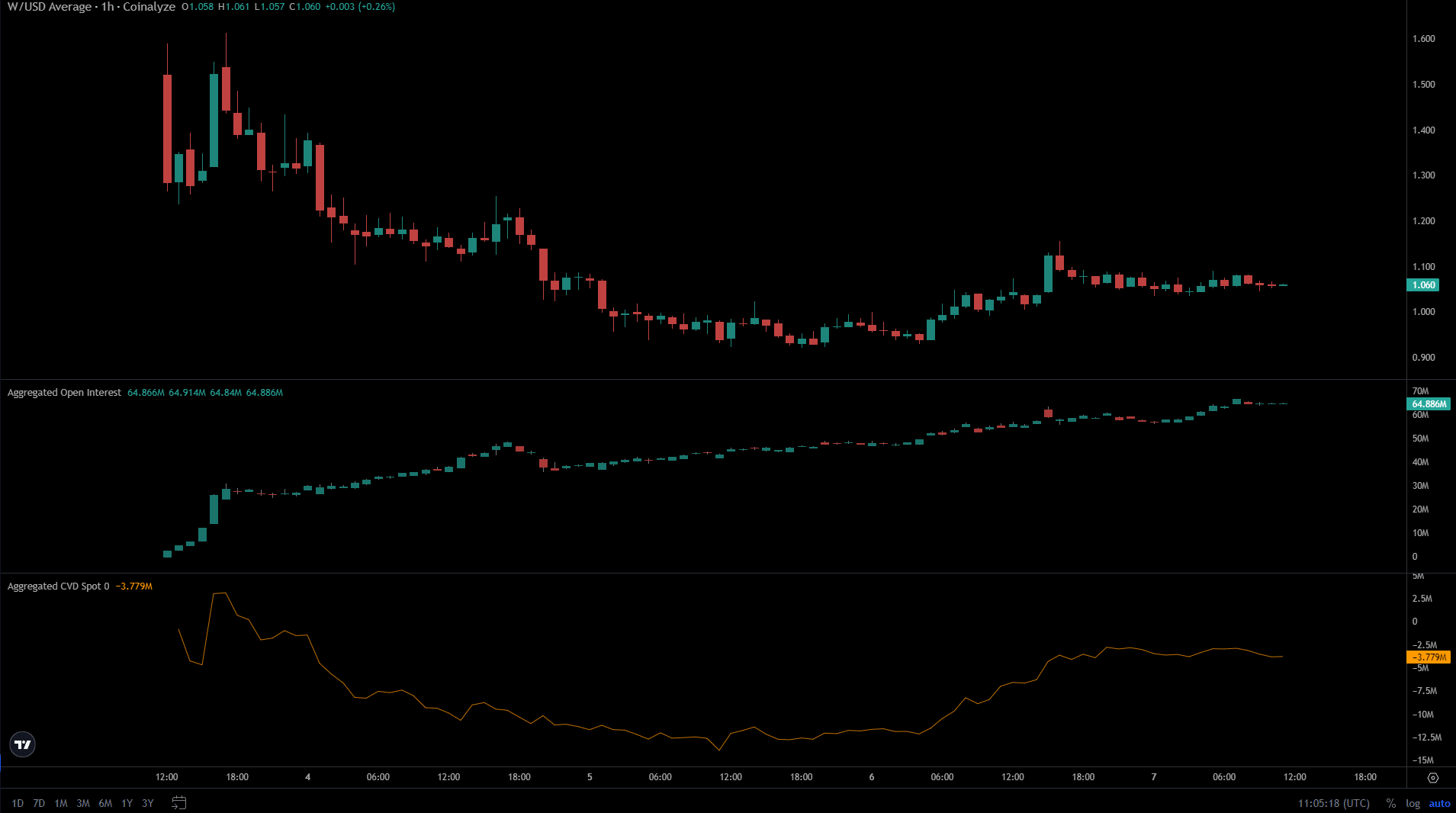

Source: Coin Analysis

Conversely, W’s spot CVD has seen a significant uptick over the past 24 hours. This meant increased demand in the spot market.

While prices struggled to stem the decline, open interest also showed an upward trend.

Is your portfolio green? Check out the W Profit Calculator

The important thing here is that the price action is very young. With only a few days of transaction data available, it’s difficult to figure out where W could move next.

As things stand, a break below the $1.27 level could lead to a rally in the Wormhole.