Context of the article

The world economy is emerging from saturation, and major world indices are booming. Although inflation has eased in most countries, policymakers warn that meeting the central bank’s target of around 2% will be quite difficult. World Bank Group Senior Vice President and Chief Economist Indermit S. Gill predicts that developed and developing countries will grow more slowly in 2024 and 2025 than in the decade before COVID-19.

So the relevant question is: Cryptocurrency boom in 2024? Is this a sign of recovery or is a bubble forming?

Let’s explore

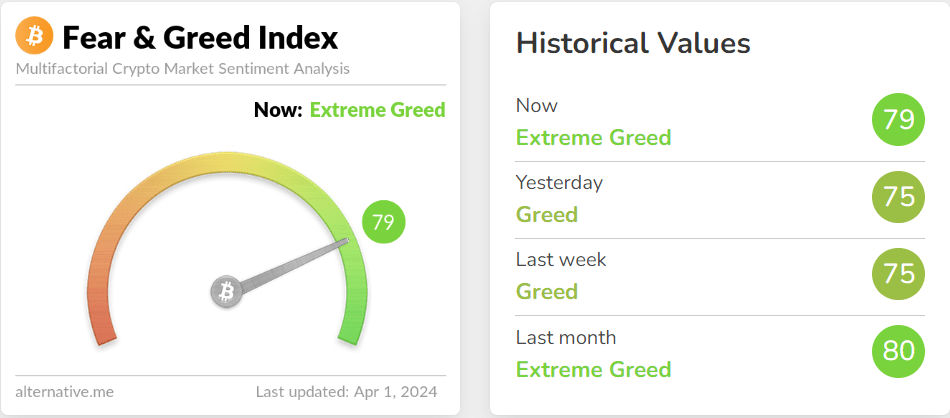

The cryptocurrency fear and greed index has been above 70 for over three weeks now. The index ranges from 0 (extreme fear) to 100 (extreme greed), with higher values warning of a potential market correction. The past two months have seen unprecedented levels of demand. This is something the entire cryptocurrency market has never seen before.

Source: alternative.me

AMBCrypto’s March 2024 Research Report It turns out that American billionaires are selling stocks. Among all sales, the one that made headlines was JPMorgan Chase & Co., which sold $150 million worth of bank stock for the first time in 18 years. It was a sale by CEO Jamie Dimon. Each billionaire has their own reasons, but it may have something to do with the growing interest in cryptocurrencies among big-money players.

Which coins were the market leaders in March?

bitcoin

- King Coin broke its all-time high (ATH) at $73,797.35 on March 14, and its market capitalization surpassed silver. Analysts are predicting $100,000 as the next ATH, but the AMBCrypto report claims: Bitcoin has not yet reached the ATH figure. And investors are trading it with a false sense of accomplishment.

- Interestingly, as soon as the coin crossed the $72,000 level, a group of long-term holders increased the overall distribution pressure. As a result, The market recorded realized profits of more than $2.6 billion per day..

- Now, if BTC turns the $70,000 level into strong support, New Yorkers will benefit the most from price surge. It is important to note that the psychological level of $70,000 is an area of good liquidity. It has already been tested for resistance several times. Thus strengthening the argument for bulls.

- Meanwhile, the emergence of Bitcoin spot ETFs has been a huge boost to the cryptocurrency. $12.1 billion by the end of the first quarter.

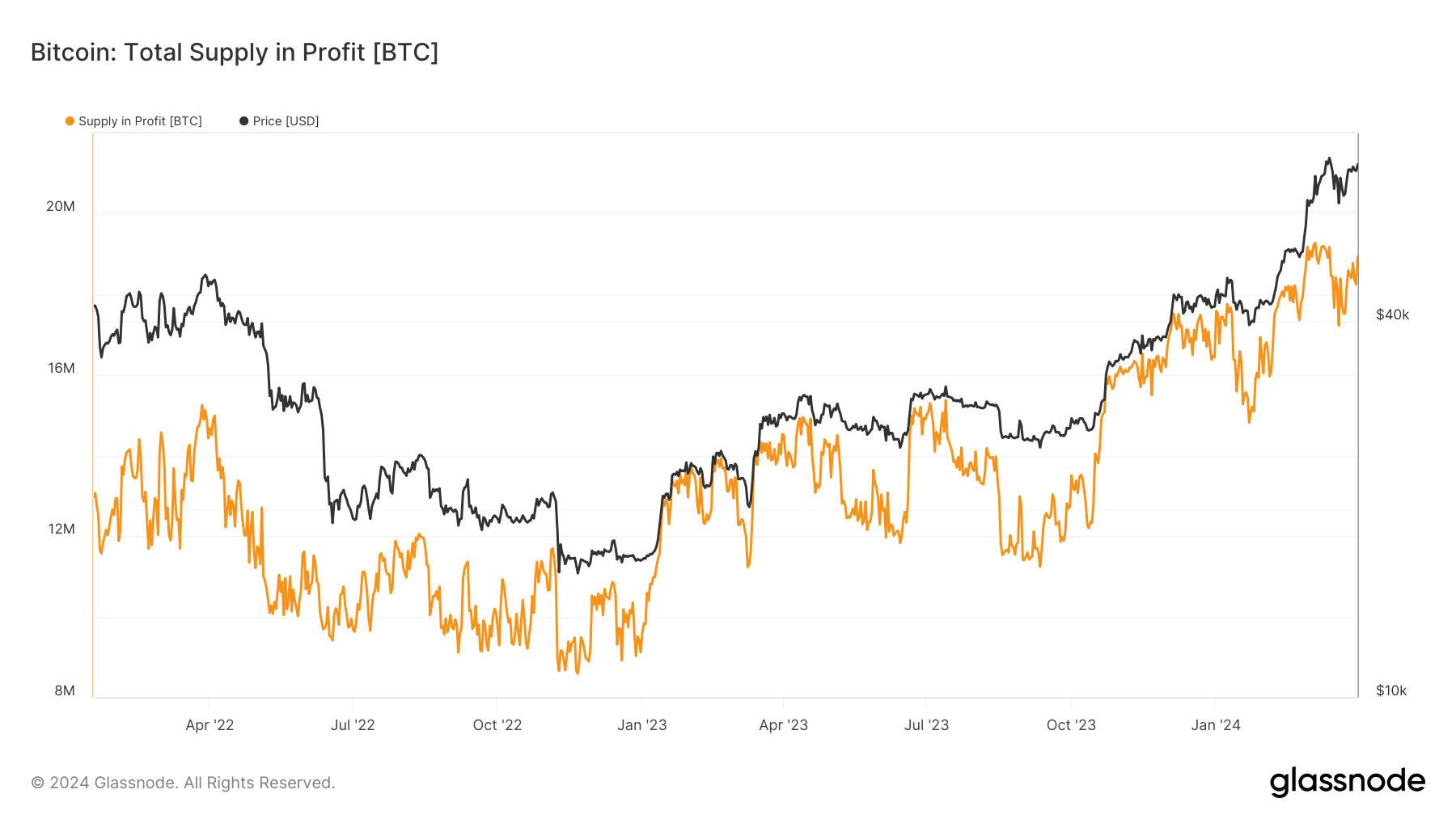

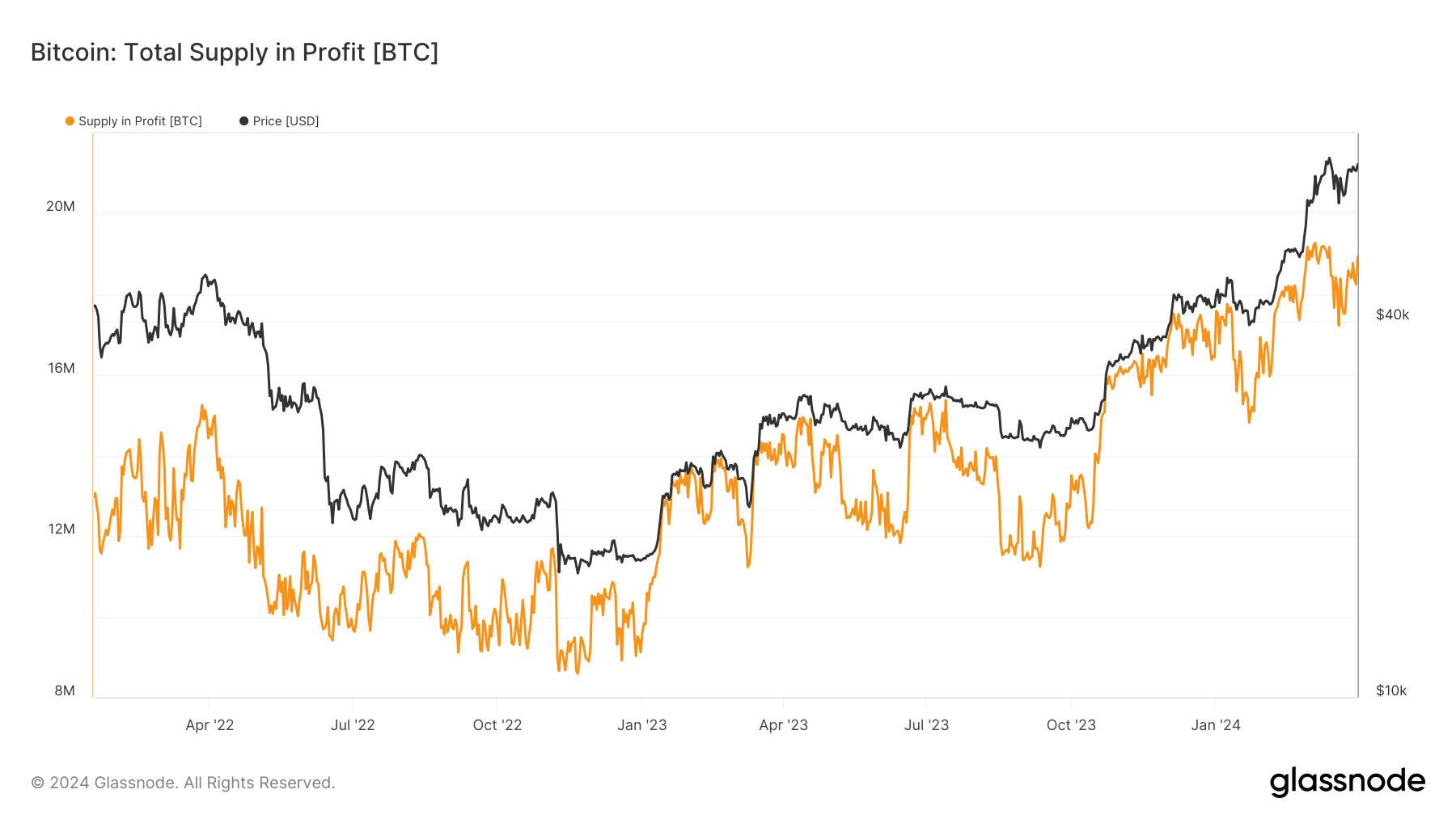

- The good news is that most investors who currently hold BTC in their portfolios are profitable. According to the Profit Supply Index, 18 million addresses made a profit on April 1st. This is an increase of 3 million from the lowest cycle of 15 million.

Source: glassnode

Ethereum

- with Dencun upgrade coming in MarchEthereum opens up new levels for developer growth as scalability concerns and gas fee issues are resolved.

- Ethereum’s price successfully maintained the $3500 support. It recently reached $4,000, its highest in nearly two years. This may be due to a variety of factors, including: Expectations for increased DeFi activity and Dencun upgrade.

- According to AMBCrypto’s research report, Ethereum’s future prospects are positive and Spot ETH ETF Could Build a Rally in the Future.

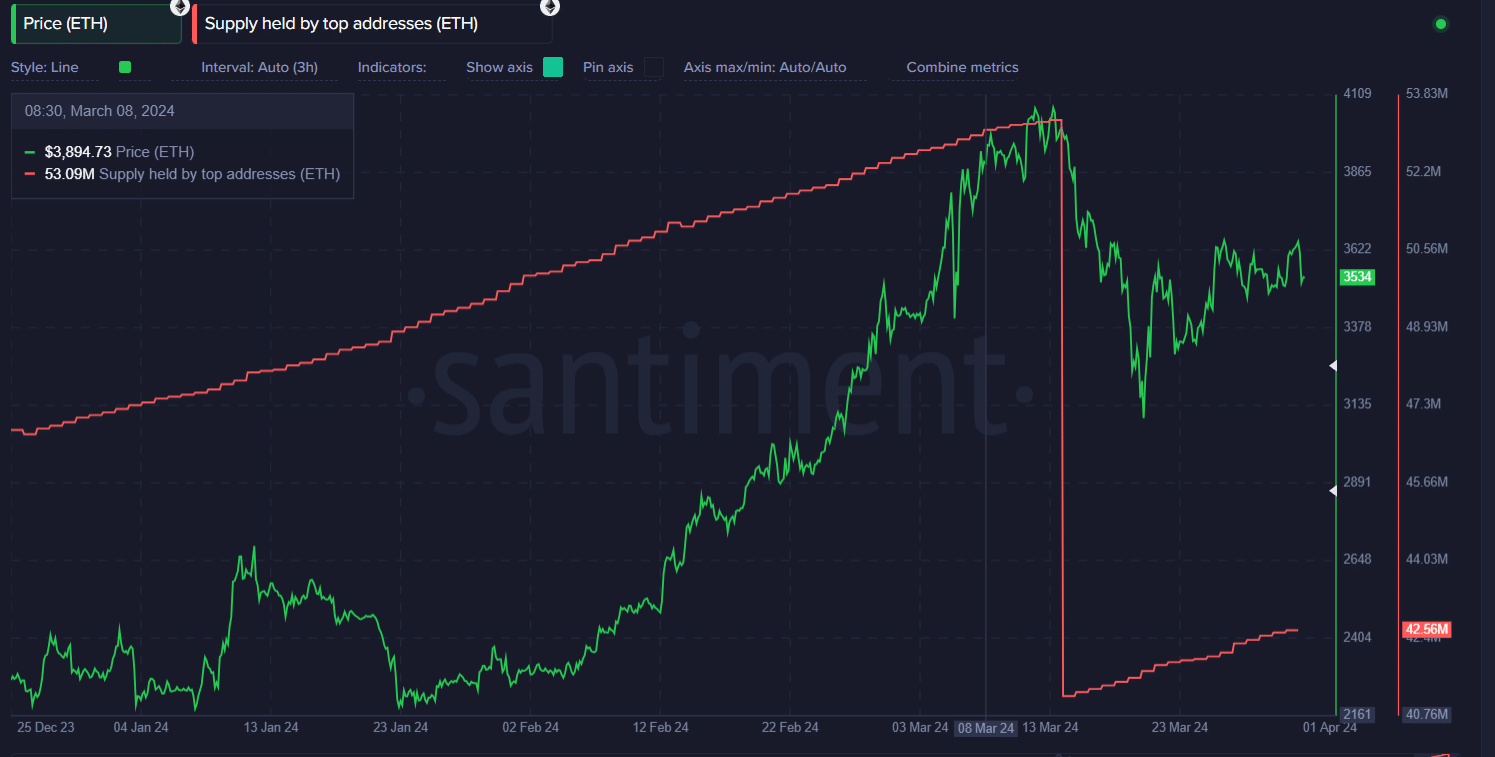

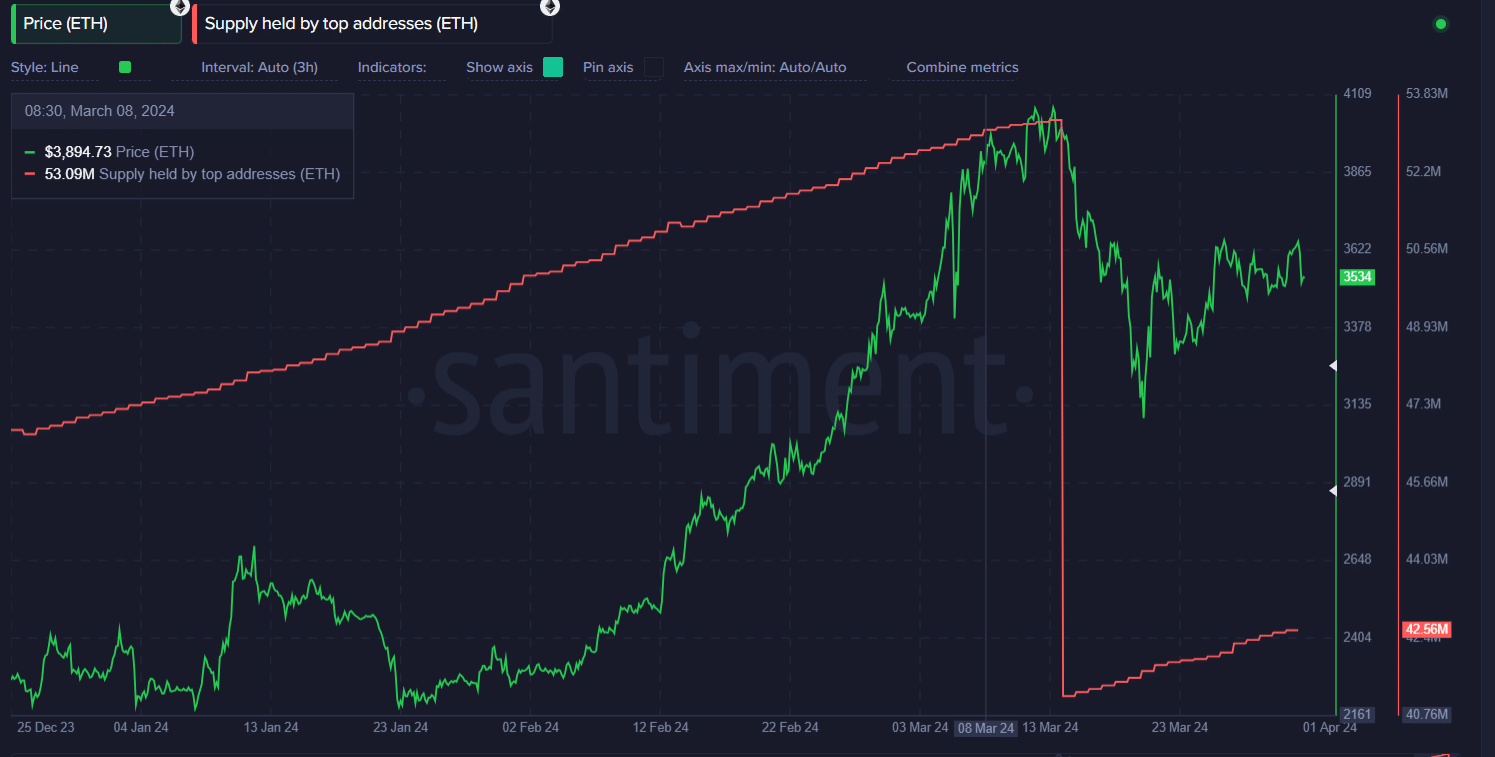

- Notably, after the massive sell-off on March 14, the top 10,000 richest wallets purchased 42.56 million ETH. I hope this purchase will help you Ethereum is off to a good start in April 2024 for two main reasons.. First, these large investors have a lot of power over the price of Ethereum and can even influence how regular people invest. Second, these wallets typically plan to hold their holdings for a long period of time, so there may not be much selling pressure in April.

Source: Santiment

Memecoins and DePIN sector

- Here are the meme coins for the past month: WIF, PEPE, and FLOKI surged significantly. For its price, it is performing much better than popular products like DOGE and SHIB. Many traders have seen their investments skyrocket by triple digits. As a result, trading activity last peaked in November 2021. According to a report by AMBCrypto, many of these traders were hoping to make enough money with the meme coins to later buy Bitcoin.

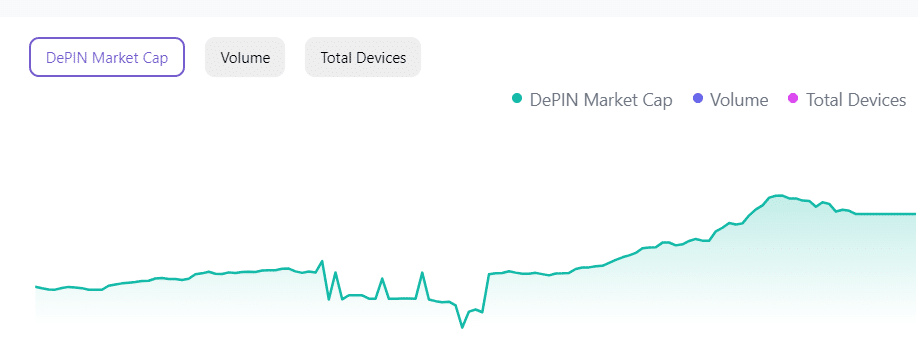

- Whenever the cryptocurrency market surges, there is a popular story that catches everyone’s attention. For example, in 2017, people were crazy about ICO coins and privacy coins. Then in 2021, DeFi, NFTs, and Layer 1 became the big thing. Now analysts say that for 2024-25 DePIN will become the most important trend in the cryptocurrency world.

- From January 1, 2024 DePIN market cap increased by $353,708.26 million.. Solana has seen the largest increase in trading volume among major DePIN projects, with a notable increase of 52% over the past 30 days.

Source: DePINscan

biggest loser

According to Alex Casassovici, founder of Web3 streaming project Azarus, we are witnessing the first real bear market for NFTs. In fact, over the past 30 days, NFT sales volume has decreased by 8.50%, while NFT trading volume has decreased by 45.79%. On the other hand, NFT sellers increased by 45.25%. So it paints a very bleak picture of the overall market.

Interestingly, AMBCrypto’s report shows the surprising performance of Bitcoin NFTs compared to Ethereum NFTs.

Read Bitcoin (BTC) Price Prediction for 2024-25

About Cryptocurrency Market Report – March 2024

AMBCrypto’s latest report is a comprehensive analysis of March market trends and provides valuable insights for predicting April market trends.

The report covers the following key topics:

- Bitcoin vs Inflation

- BTC’s Next ATH Projection

- Bitcoin conversion to Ethereum

- ETH Price Potential

- NFT Market Dynamics

- April market outlook

You can download the full report here.