- Ethereum futures open interest shows that the coin will recover to all-time highs in the medium term.

- Key indicators also confirmed the rise in bullish sentiment in the coin spot market.

Leading coin Ethereum (ETH) could see another significant rally in the medium term, anonymous CryptoQuant analyst ShayanBTC noted in a new report. report.

The report assessed the coin’s futures market and found that despite overall market consolidation in March, ETH’s funding rates remain positive and open interest rates continue to rise.

Funding rates are used in perpetual futures contracts to ensure that the contract price remains close to the spot price.

If the contract price of an asset is higher than the spot price, traders holding a long position pay a fee to traders selling that asset. In this case, the funding rate returns a positive value.

Conversely, if the contract price is lower than the spot price, short traders will have to pay fees to traders holding long positions, resulting in a negative funding ratio.

According to the analyst, there has been a “corresponding surge in funding rate metrics” as ETH attempts to regain the $4,000 price mark.

The report added:

“This indicates aggressive execution of long positions by participants.”

coin glass According to the data, the coin’s funding rate was positive at 0.024% at press time. When an asset’s funding ratio is positive and increasing, more traders hold long positions. This means that there are more market participants who expect asset prices to rise in the short/medium term than those who expect them to fall.

Regarding the coin’s futures open interest, this has also increased due to the double-digit price rise last week. As of this writing, ETH futures open interest was $15 billion, according to Coinglass data. Over the past seven days, this figure has increased by 7%.

according to the report:

“Given these indicators, the market appears poised for another significant move in the medium term, with the possibility of a restoration of long positions in the perpetual market. “This suggests a favorable outlook for Ethereum’s price trajectory, potentially heading towards all-time highs.”

Are the bulls regaining their strength?

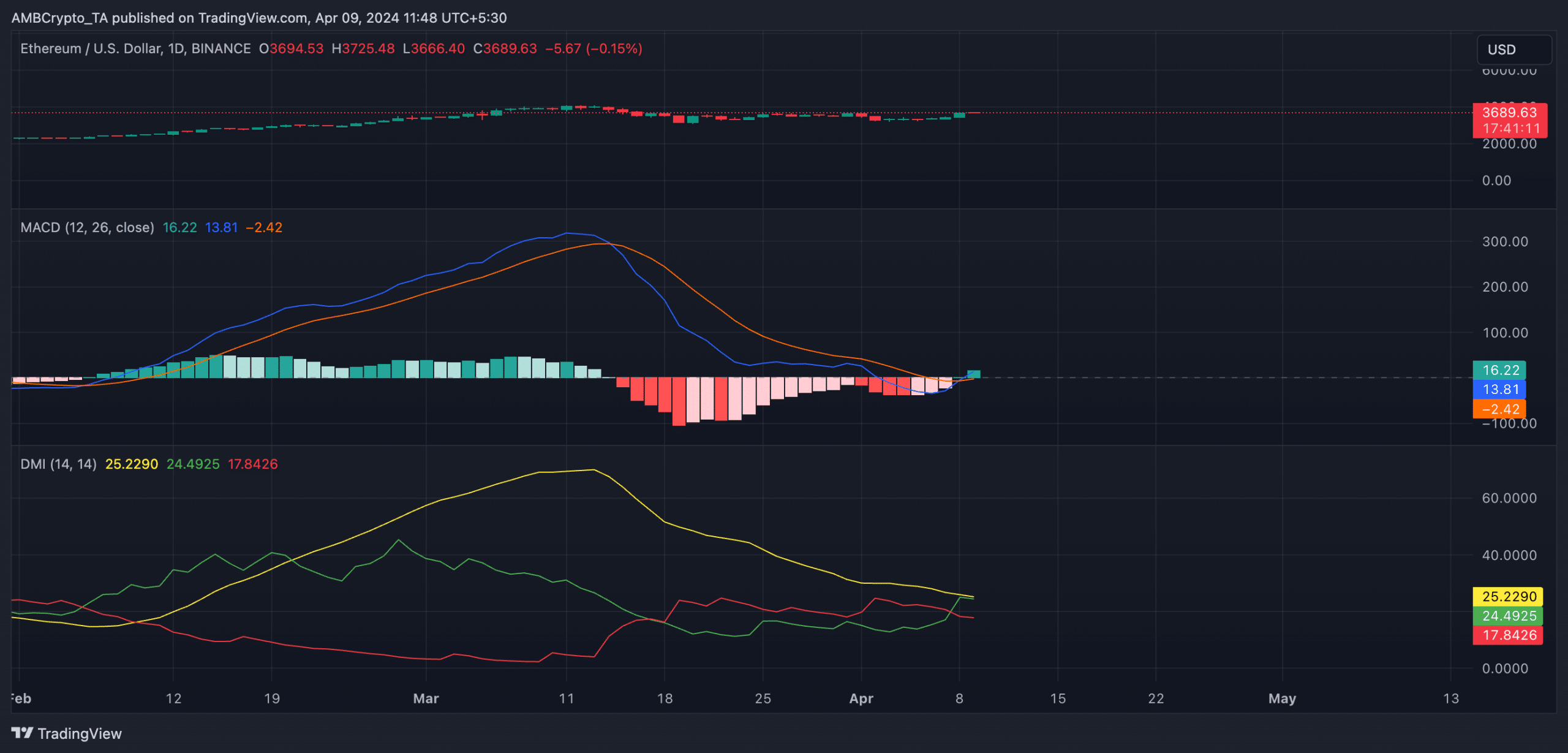

March saw the ETH price consolidate within a narrow range due to bearish sentiment.

However, the rally in the price of the coin last week confirmed that the bulls are now trying to re-enter the market, according to the readings of some indicators observed on the 1-day charts.

For example, for the first time since March 15, ETH’s MACD line remained above its signal line.

When an asset’s MACD line crosses its signal line, it means that the short-term moving average is starting to rise faster than the long-term moving average. This indicates an increase in bullish momentum in the near term.

Read Ethereum (ETH) price prediction for 2024-25

Additionally, ETH’s Directional Movement Index (DMI) showed that on April 7, the positive directional index (green) exceeded the negative index (red).

This confirmed the change in sentiment from a downtrend to an uptrend.

Source: ETH/USDT on TradingView