- SOL’s market capitalization increased by more than 130% in the first quarter.

- Sentiment surrounding the token has turned bearish over the past week.

Like most cryptocurrencies, the first quarter of 2024 ended on a positive note. Solana (SUN), This is because it achieved good results in many ways. So, let’s take a closer look at SOL’s first quarter performance and what we can expect in the second quarter.

Solana’s first quarter statistics

Data analysis platform Coin98 Analytics recently launched Twitter We highlight Solana’s network statistics for the first quarter. According to the tweet, SOL has shown remarkable performance in terms of value captured.

SOL’s fees and profits increased 7 times compared to the previous quarter and 27 times compared to the same period last year.

However, despite the huge revenue surge, it was surprising to see Blockchain’s total revenue decline by 131% last quarter. That’s because Solana’s costs increased 141% in the first quarter.

Despite this, network activity on the blockchain remained robust. This was the case when daily active addresses surged 214% to exceed 591,000.

AMBCrypto confirmed Artemis. data Find out what happened in the second quarter. We’ve seen both feed and revenue decline over the past week.

A similar downward trend was seen in terms of daily active addresses. Nonetheless, SOL’s daily trading volume increased last week, reflecting increased usage.

Source: Artemis

Solana investors benefited

Coin98’s tweet also mentioned how the price of SOL rose during the first quarter due to optimistic market conditions. According to the report, SOL’s circulating market capitalization surged more than 130% in the first quarter, exceeding $53 billion.

However, growth momentum slowed in the second quarter as the decline took hold.

According to CoinMarketCap, the price of SOL has fallen by more than 5% over the past 7 days. At the time of this writing, SOL was trading at $173.25, with a market capitalization of over $77 billion. To see how token price drops affect market sentiment, AMBCrypto looked at data from Santiment.

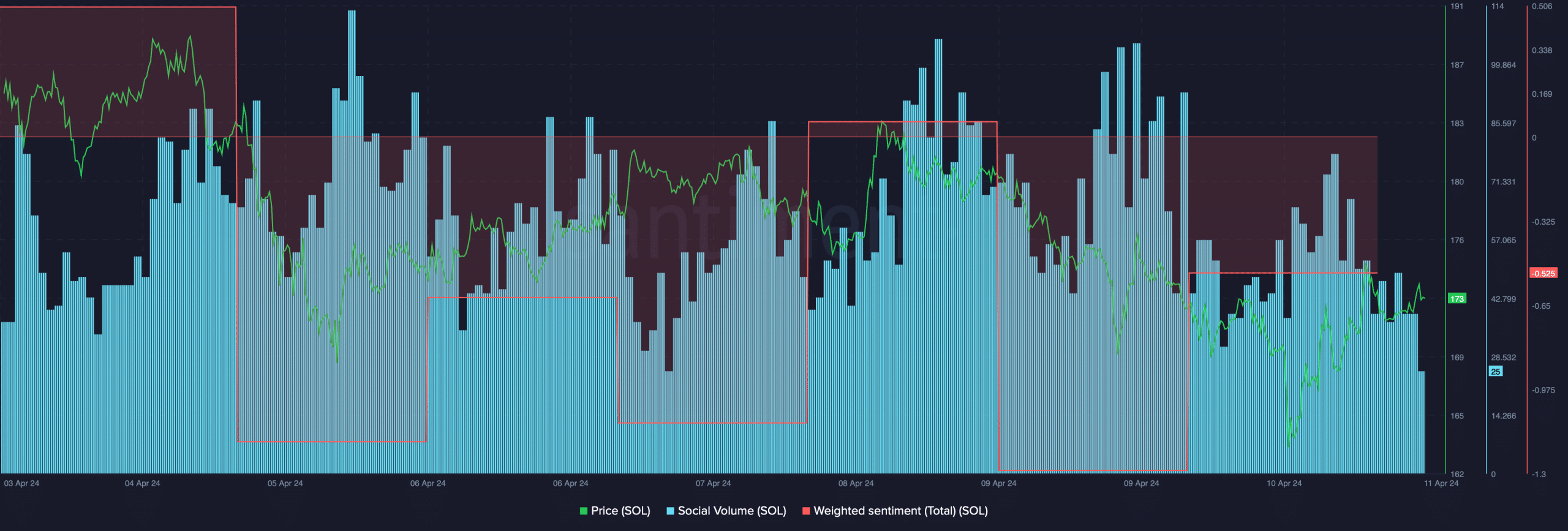

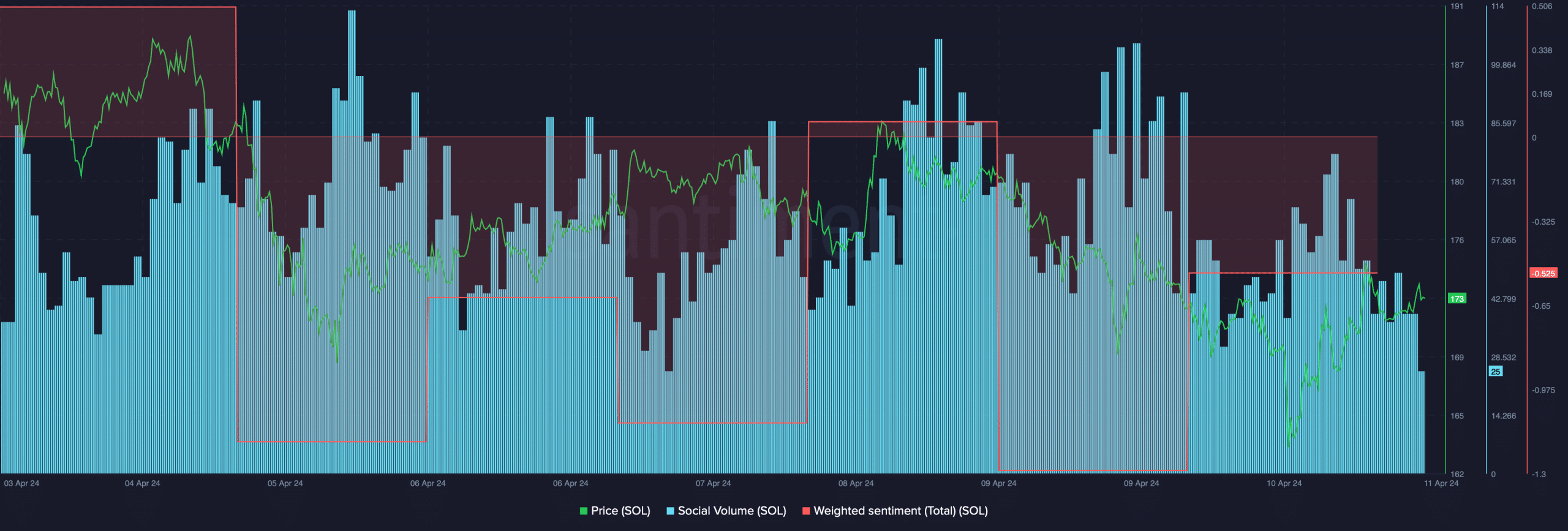

Our analysis shows that Solana’s social volume remained high over the past week, reflecting its popularity in the cryptocurrency space. However, price fluctuations have reduced investor confidence in SOL.

The token’s weighted sentiment remained in negative territory. This means that bearish sentiment surrounding SOL is dominant in the market.

Source: Santiment

Realistic or not, the following is Market capitalization of SOL in BTC terms

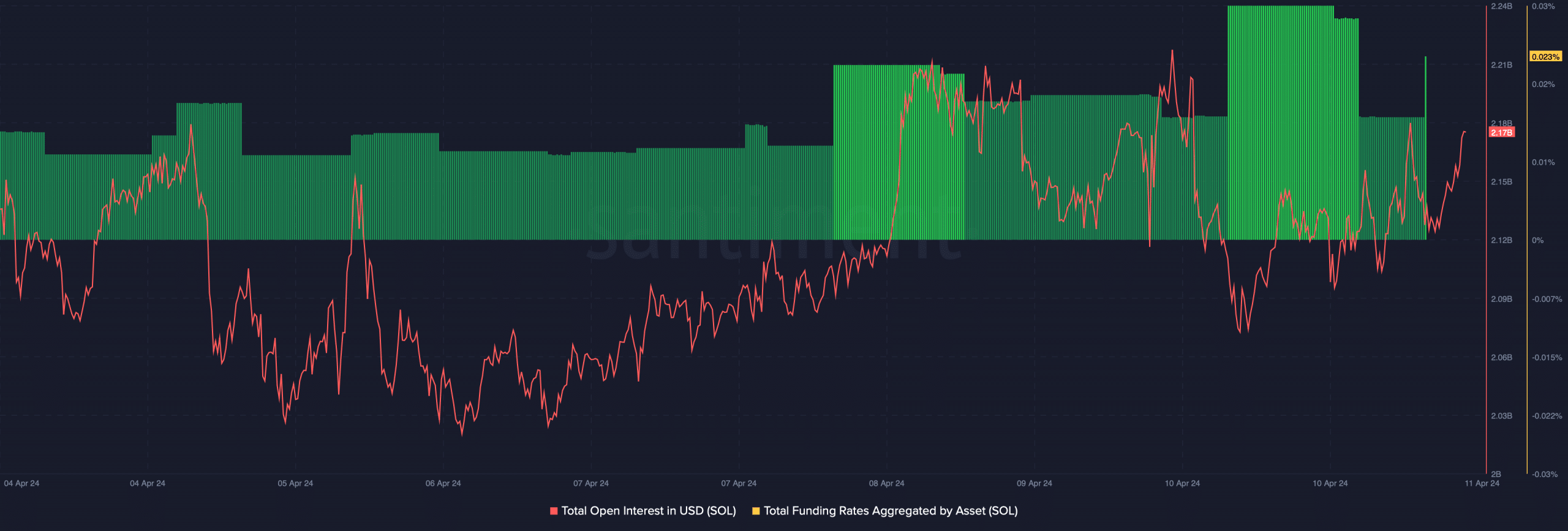

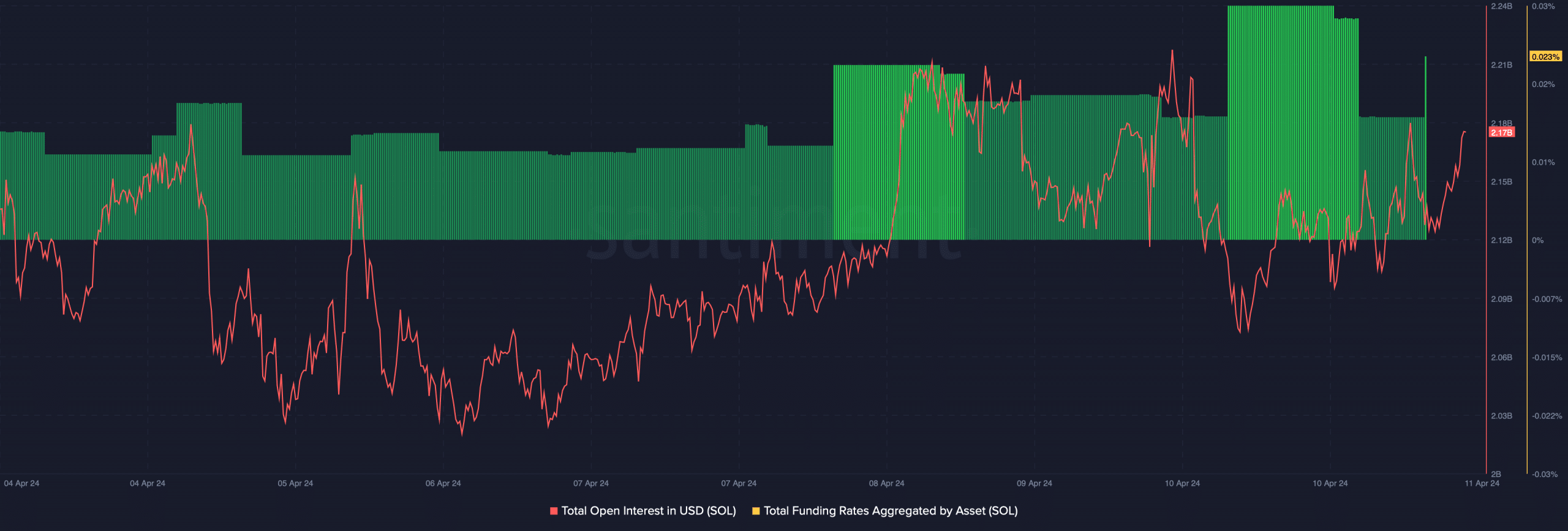

Conditions in the derivatives market were also quite weak in SOL. Open interest increases while the price is falling, indicating that the downward price trend may continue further.

Additionally, the funding rate was high. This suggested that futures investors were buying SOL activity at low prices.

Source: Santiment