- Dogecoin’s long-term liquidation has been totaled April 12 $16 million

- Bearish sentiment continues to follow memecoin.

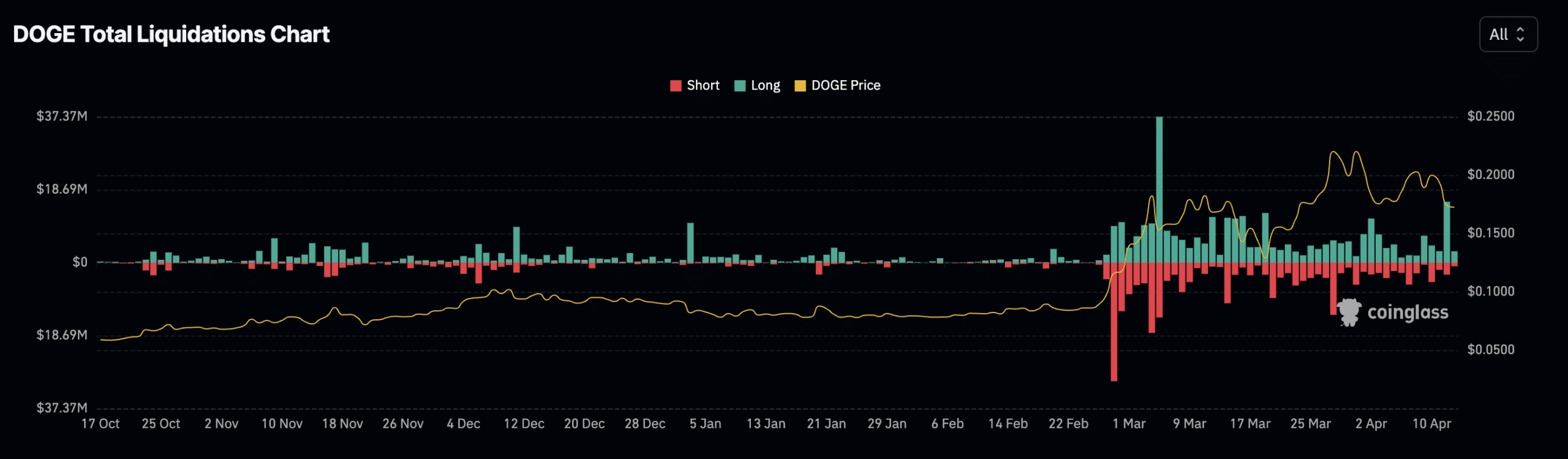

Long-term liquidation of Dogecoin (DOGE) hit a 30-day high in the last 24 hours, according to Coinglass. This follows the broader market falling due to the price of Bitcoin itself falling on the charts. In fact, across the entire cryptocurrency market, over $860 million worth of trading positions were liquidated among 270,993 traders.

According to on-chain data, long-term liquidation of DOGE totaled $16 million. The last time the cryptocurrency saw such a large amount of buy-clear in the futures market was on March 6th.

Source: Coinglass

Liquidation occurs in the futures market for an asset when a trader’s position is forced to close due to insufficient funds to maintain the position. Long liquidation occurs when the price of an asset falls unexpectedly, forcing traders with open positions to push the price higher.

By comparison, DOGE short liquidations on the day in question totaled $3.08 million, according to Coinglass data.

Prepare for further decline in value

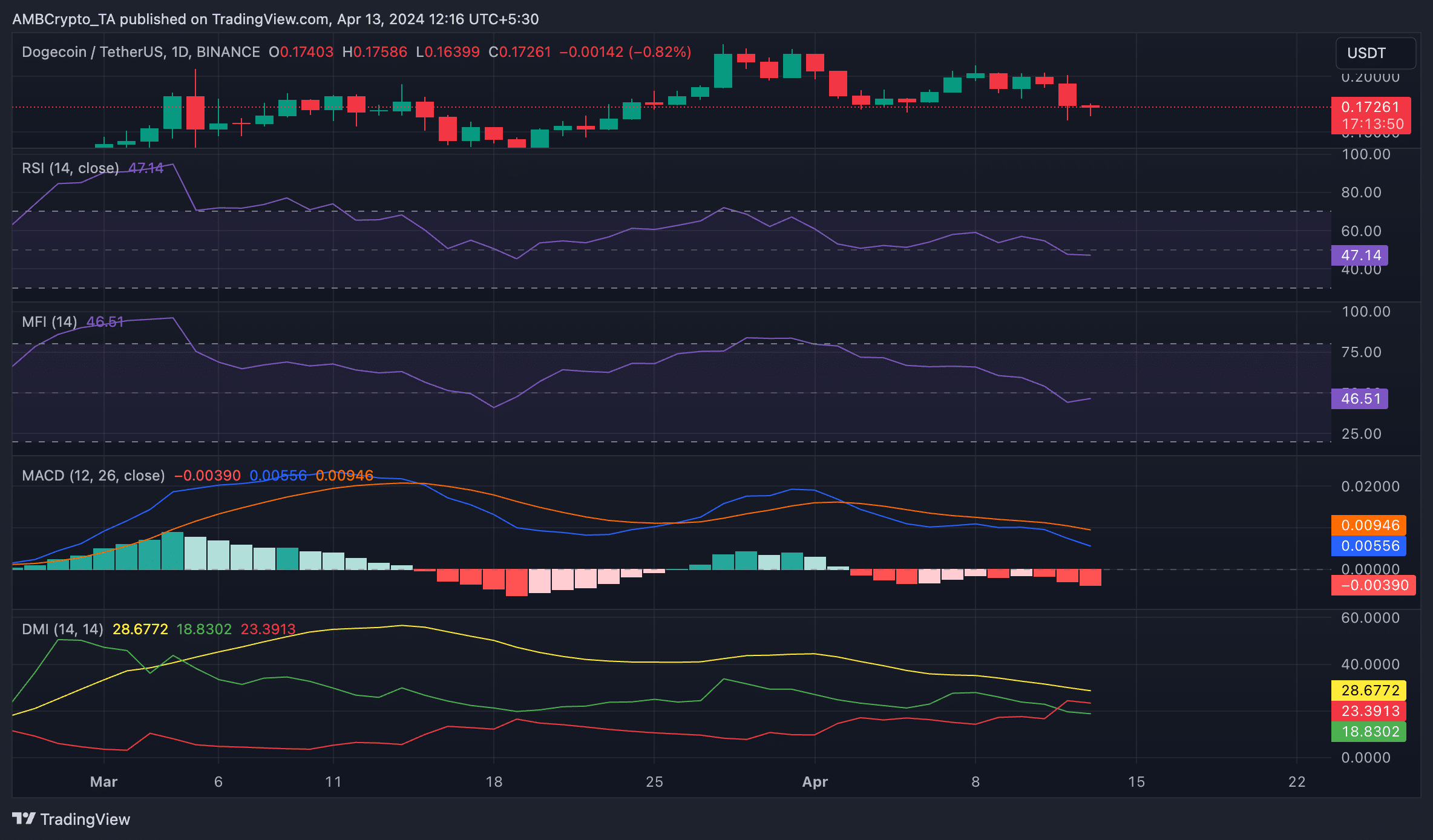

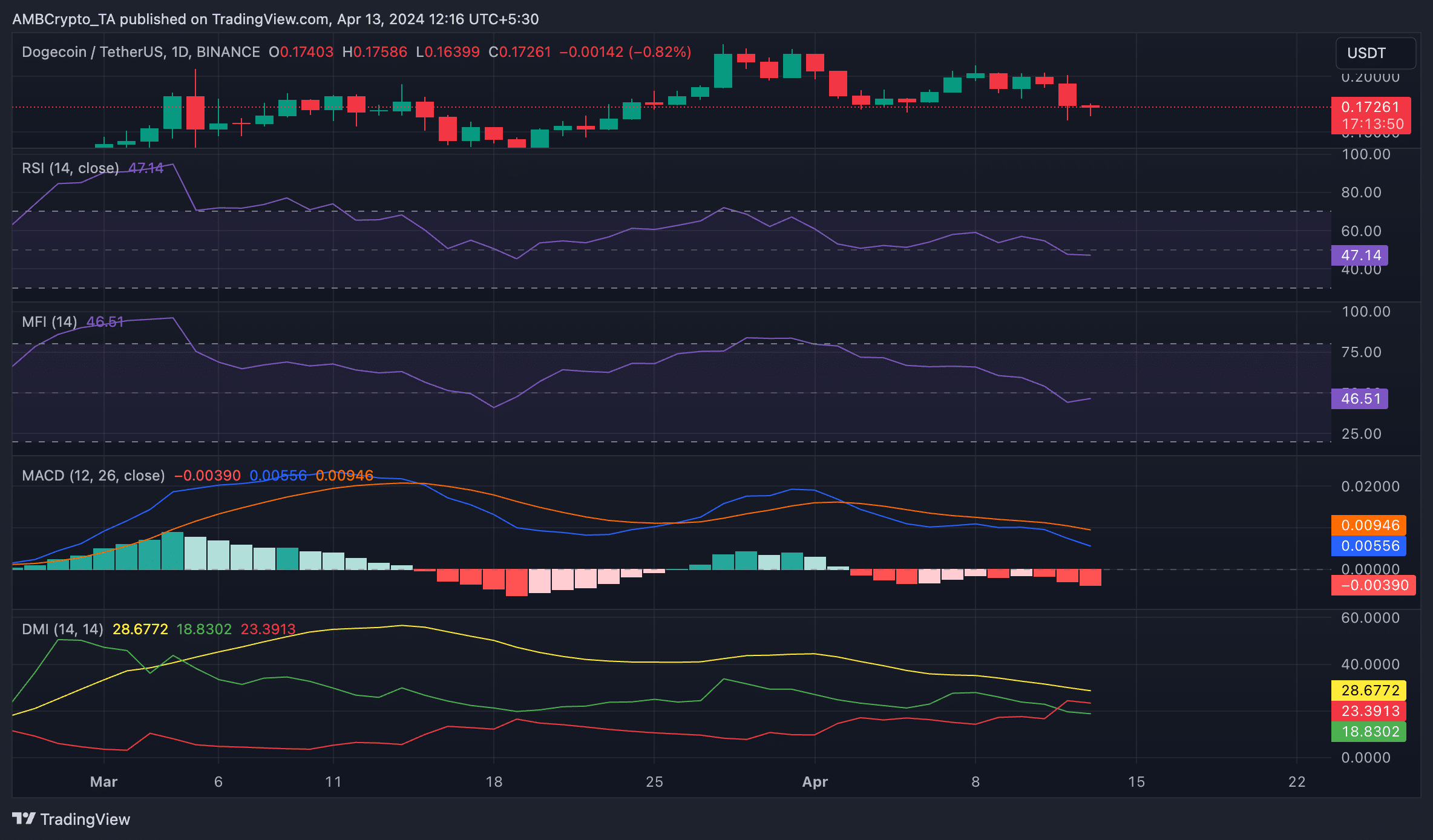

DOGE’s price has plummeted 13% in the past 24 hours, with weekly losses reaching 6%, according to CoinMarketCap. At press time, the value of the main memecoin was $0.1721 on the chart.

An assessment of the altcoin’s price action on the 1-day chart shows that it could see further upside this weekend. Key observed momentum indicators showed a steady decline in demand for DOGE.

For example, the values of Relative Strength Index (RSI) and Money Flow Index (MFI) were 46.85 and 46.53, respectively. These indicators indicate a decline in demand for altcoins and a surge in coin selling among market participants.

Realistic or not, DOGE’s market cap in BTC terms is:

Moreover, a reading of the coin’s Directional Movement Index (DMI) shows that the positive directional index (green) fell below the negative index (red) on April 12. If these lines trend in this direction, it signals a shift from bullish to bearish momentum. This signals a re-emergence of weakness and increased profit-taking activity.

Lastly, DOGE’s MACD line was above the signal line at press time, confirming this. This also indicates that DOGE’s short-term moving average is higher compared to its long-term moving average.

Source: TradingView

If these lines are arranged like this, it appears to be a sign that the coin selling trend will intensify. So, it’s going to be a tricky time to be a Dogecoin holder.