The average daily trading volume on the Uniswap decentralized exchange has reached $3 billion over the past week.

From April 10 to April 15, Uniswap’s average daily trading volume was $3.08 billion, according to DefiLlama.

Surpassing $3 billion means that the DEX did not record any declines despite news of a possible legal showdown with the US SEC.

Available statistics show that users have not been deterred by the increased risk of legal confrontation with the SEC. Trading volume did not decrease significantly. This figure has remained steady from $2.6 billion to $3.9 billion over the past five days.

As of April 16, total value locked (TVL) was $6.62 billion, and the platform’s market capitalization was $5.65 billion.

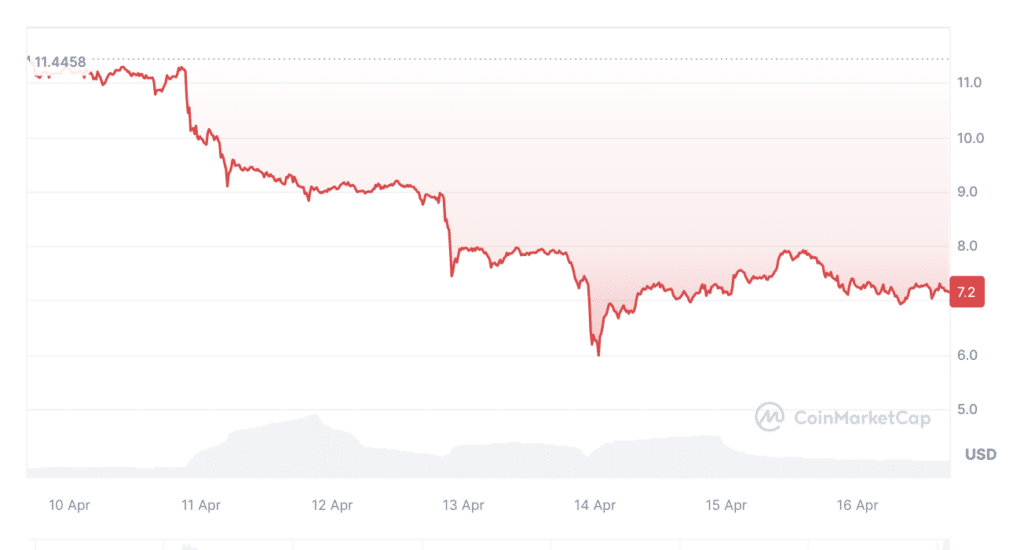

However, the Uniswap token (UNI) exchange rate did not boast positive dynamics. According to CoinMarketCap, the value of the token fell 37.5% last week. On April 10, the price of UNI was $11, but three days later it fell below $6. As of this writing, UNI is trading at $7.15, down 8% in price over the last 24 hours.

On April 10, Uniswap CEO Hayden Adams said the agency had provided his team with the Wells notice. Typically, these letters are sent before a formal lawsuit is filed or to give you a final opportunity to refute any allegations.

The exchange also increased its fees from 0.15% to 0.25% following news of a possible SEC lawsuit.