- Helius Labs executives raise concerns about large corporations becoming Solana’s top validators.

- However, one of Solana’s primary validators is in a very small minority.

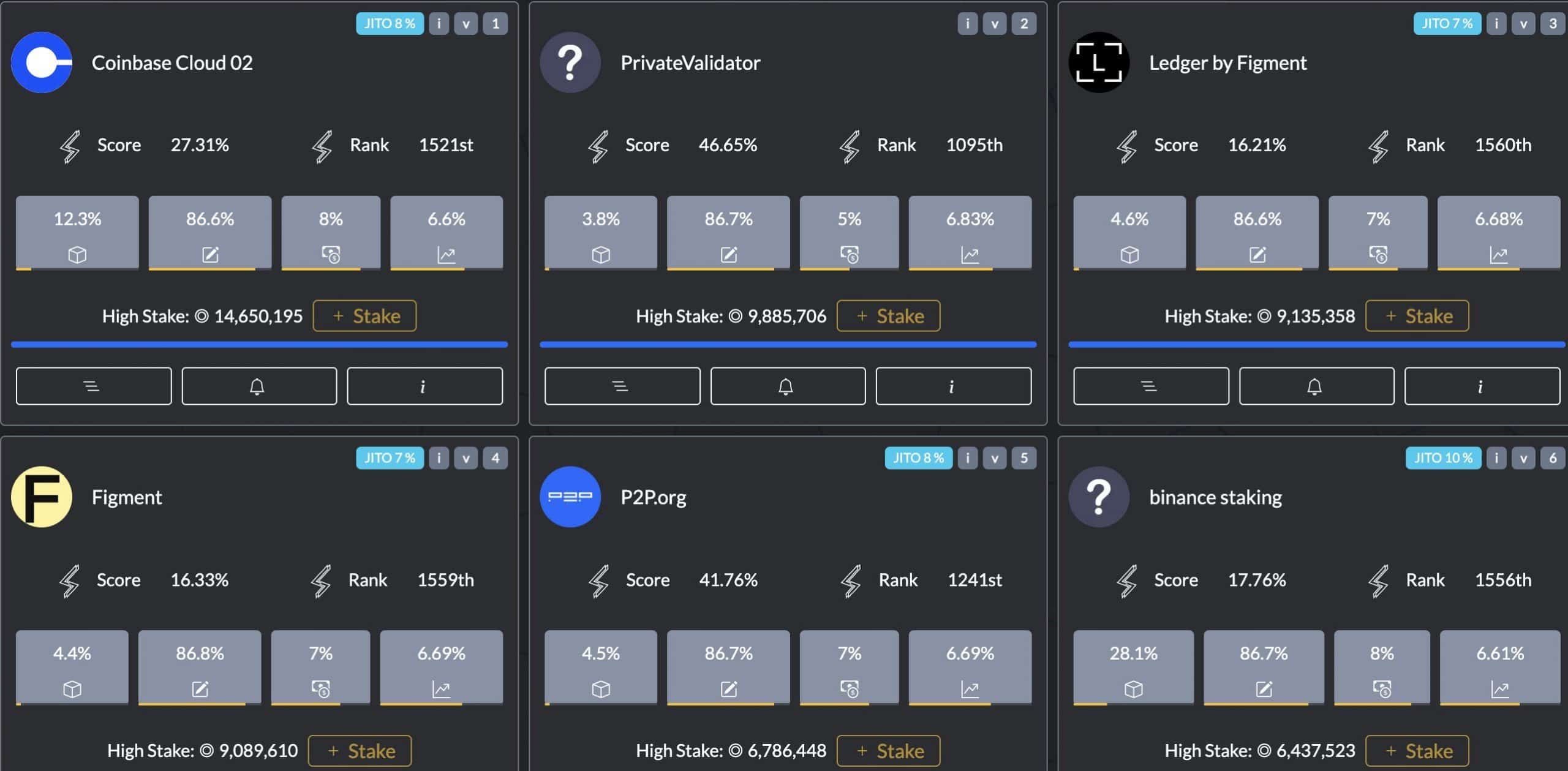

Large companies such as Coinbase Binance (BNB) dominate greatly Solana (SUN) Validator ecosystem. it’s over 1700 Solana validators22 control over 33% of the total staked SOL (super minority).

Mert Mumtaz, co-founder and CEO of Helius Labs, the Solana developer platform for cryptocurrency investors, raised concerns about this dominance.

Helius Research Institute executives were criticized for the false ‘trust’ and ‘security’ of large corporations and the high fees. called Allow users and investors to consider staking with the Solana Native team.

“Large corporations generally create a false sense of trust and security. Trust me when I tell you that Solana is complex enough that its team can navigate uncertainty much better than any large company.”

The problem of being the best Solana validator

According to Mert Mumtaz, the top six largest companies running Solana validators charge a fee of 8%. According to Mumtaz, this is a high fee when there are alternatives.

“I really don’t like that Solana’s top 6 validators are giant corporations and not Solana based teams. This needs to change. And they charge up to 8% commission. Our relationship with the native team, we are paying too much in fees.”

Source: X/OxMert

The executive provided information to Solana primary team validators such as Cogent, Laine, and Overlock. that Added that,

“Most Solana-based teams can achieve much higher returns, literally making them safer, better investments in the network and better returns at the same time.”

Interestingly, according to Solana Beach: dataOne of the teams that Mumtaz tipped, Laine (LaineStakeWiz.com), is one of the top 22 validators.

This means that, in theory, the network is part of a super-minority group that can censor it if it colludes. This is a significant centralization risk. This seems counterintuitive to what Mumtaz is trying to achieve, especially in terms of “security”.

In the meantime, SOL canceled the network post-upgrade. rally At press time, it was trading at $133.

On the higher timeframe charts, $130 was an important support level for the bulls. So a drop below that could give the bears more leverage.