Following the successful launch of its Bitcoin ETF, BlackRock, the world’s largest asset manager, is now setting its sights on Saudi Arabia.

The company aims to expand its presence in the Kingdom’s financial sector.

Why BlackRock aims to expand in Saudi Arabia

BlackRock CEO Larry Fink frequently visits Riyadh and interacts directly with Crown Prince Mohammed bin Salman, according to Bloomberg. The firm was the first major global investment manager to open an office in Riyadh, underscoring its commitment to the Saudi market.

This strategic move puts BlackRock in a prime position to access the state-owned Public Investment Fund (PIF), which manages approximately $925 billion.

“The Middle East is an important market for BlackRock in terms of investment opportunities for our clients and the continued growth of our international business. We have long-standing client relationships in Kuwait, Qatar, Saudi Arabia and the UAE,” a BlackRock spokesperson said.

Read more: Cryptocurrency Hedge Funds: What are hedge funds and how do they work?

Saudi Arabia presents a complex mix of opportunities and challenges. The kingdom is actively diversifying its economy beyond its traditional oil base. The changes are part of Crown Prince Mohammed’s vision to modernize the economy and make Saudi Arabia an attractive market for foreign investors.

However, investing in Saudi Arabia comes with a series of controversies. The kingdom’s human rights issues and dependence on oil raise concerns among investors focused on ethical and environmental factors.

Nonetheless, Fink advocates “corporate engagement” to promote economic and social change within the country.

Saudi Arabia’s investment appeal is further complicated by the geopolitical situation. Known for its volatility, this region poses risks to market stability and investment returns. Despite these challenges, BlackRock’s strategy to connect directly with regional leaders and build a local presence aims to mitigate those risks.

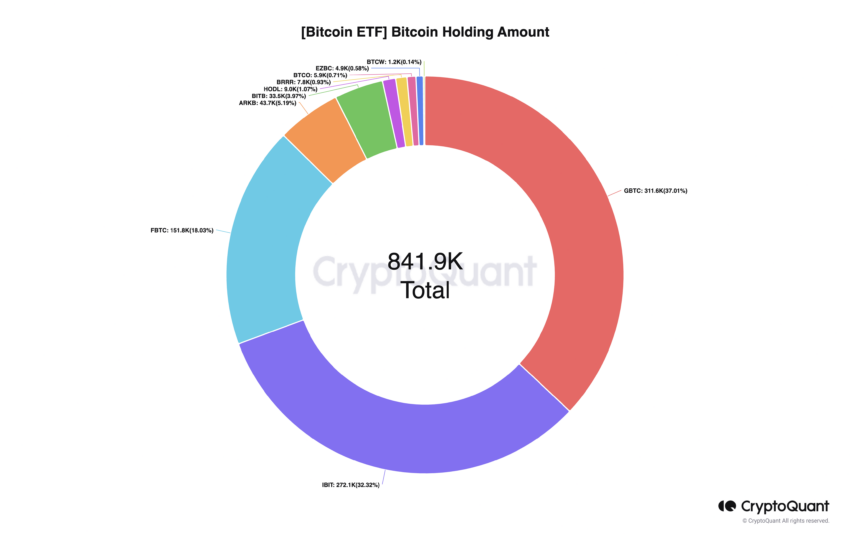

Globally, BlackRock continues to innovate, as evidenced by the launch of the iShares Bitcoin Trust. This development marks a strategic diversification for the company.

Launched in January, IBIT quickly attracted $15.3 billion in inflows. This move also demonstrates BlackRock’s agility in spotting market opportunities at the right time.

Read more: How to Trade Bitcoin ETFs: A Step-by-Step Approach

Despite the enthusiasm for Bitcoin ETFs, the market has experienced volatility. For example, overall net inflows into spot Bitcoin ETFs have faced difficulties recently, with BlackRock recording inflows of less than $100 million this week.

This is consistent with the broader cryptocurrency market struggles, as the price of Bitcoin is down nearly 15% from its all-time high.

disclaimer

In compliance with Trust Project guidelines, BeInCrypto is committed to unbiased and transparent reporting. These news articles aim to provide accurate and timely information. However, before making any decisions based on this content, readers are encouraged to check the facts and consult with experts. Our Terms of Use, Privacy Policy and Disclaimer have been updated.