ApeCoin (APE), the ERC-20 token governing the ApeCoin Decentralized Autonomous Organization (DAO), saw notable growth in the first quarter of 2024 (Q1).

Key metrics showed significant progress, driving APE’s market capitalization, token price, and trading volume quarter-over-quarter (QoQ), showing consecutive quarters of growth.

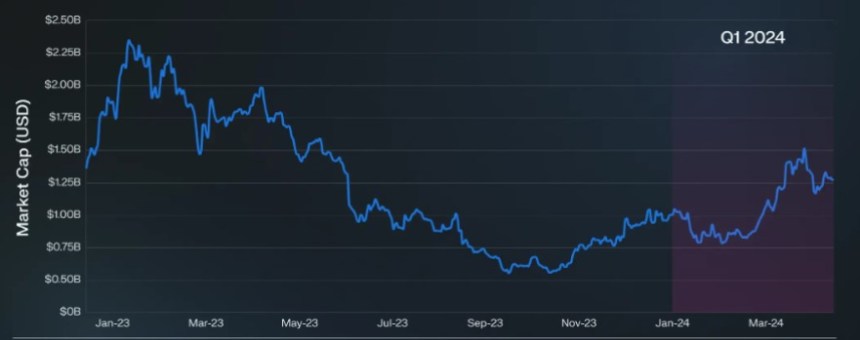

ApeCoin regains unicorn status

As recently noted report According to Messari, APE’s rebound was particularly notable when compared to the broader cryptocurrency market, which grew 53% quarter-over-quarter, and the Bitcoin market cap, which grew 63% quarter-over-quarter.

APE’s market cap briefly fell below $1 billion in the second quarter of 2023 before regaining unicorn status, and closed the first quarter of 2024 at $1.3 billion, representing 31% growth. According to the report, this increase in market value was driven in part by: APE token price rose 21% compared to the previous quarter.

The report also highlighted that 46.8 million APE tokens were unlocked from circulating supply, contributing to the increase in market capitalization. However, this resulted in $16.5 million unlocked and allocated for governance spending, potentially creating selling pressure on the asset throughout the quarter.

Another 46.8 million people APE token Unlocked in Q1 2024, 22 million APE will be delivered to the DAO Treasury and 24.8 million APE will be distributed to non-DAO entities. The DAO plans to issue or sell APE to fund approved proposals, and non-DAO entities will be free to sell the funds once they are unlocked.

Despite additional selling pressure from 8.3 million APE tokens unlocked and committed, APE price is still up 21% QoQ. These price spikes indicate a high volume of buy orders, putting upward pressure on the asset.

The report also analyzed trading activity, highlighting the dominance of large traders (whales and sharks), which accounted for 63% of trading volume in the first quarter. average Decentralized Exchange (DEX) swap volume increased 28% QoQ, reflecting increased activity from large traders.

Additionally, transfer volume of APE tokens increased by 12% QoQ, likely due to significant transaction volume following the approval of various governance proposals throughout the quarter.

APE’s future journey

In the future, APE’s utilities will expand by implementing recently passed governance proposals. AIP-381 aims to build a gaming-focused DAO and Vault accessible only to APE holders, allowing APE holders to participate in governance and access specific ecosystem assets.

Additionally, the ApeChain proposal chose Horizen Labs to blockchain Utilizing and potentially supporting APE as a gas token Other asset-related applications.

But while APE continues to attract new holders, the growth rate of new APE holders has not accelerated despite two consecutive quarters of price increases, according to Messari.

To solve this problem, ApeCoin DAO has formed a branding partnership with a Formula One racing team to attract new holders in the future.

Meanwhile, the ApeCoin DAO has been actively voting on new governance proposals, including approving the deployment of ApeChain on the Arbitrum technology stack and extending the utility of APE tokens to GameFi DAO and Vault.

The average number of votes per proposal increased by 19% QoQ, indicating increased community engagement. ApeCoin DAO plans to move the voting process more on-chain. Dispersion and governance participation.

Despite the overall growth APE witnessed in the first quarter, the token has recently experienced significant declines, in line with the downward trend of the overall market. APE has fallen noticeably by over 41% over the past month, reaching a current trading price of $1.148.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: This article is provided for educational purposes only. This does not represent NewsBTC’s opinion on whether to buy, sell or hold any investment, and of course investing carries risks. We recommend that you do your own research before making any investment decisions. Your use of the information provided on this website is entirely at your own risk.

Source: NewsBTC.com