- ETH has corrected up to 17% over the week and could fall further below $2,400.

- As of this writing, market sentiment towards ETH is neutral.

Ethereum (ETH) fell below $3,000 over the past 24 hours after its price fell 3.24%, according to CoinMarketCap.

The second-largest cryptocurrency has corrected as much as 17% for the week as bulls struggle to overcome downward volatility in the broader market.

However, market participants appear to be reacting differently to the ongoing recession. Some want to profit from their investments, while others are looking to accumulate ETH at low prices.

Buy or Sell?

The whale, known for its dip-buys, purchased 3,279 ETH worth $9.75 million at current prices on Wednesday, according to Lookonchain, an on-chain tracking data platform.

The influential investor recently doubled his ETH investment, holding a whopping 86,457 ETH tokens as of April 17.

On the other hand, Whale, an active participant in the ICO in 2015, sold 2,000 ETH at a selling price of $2,997, Spot On Chain data showed.

Whale received 33,213 ETH as part of the ICO at a price of $0.31. So, recent sales have increased our profits several times.

How has the broader market reacted?

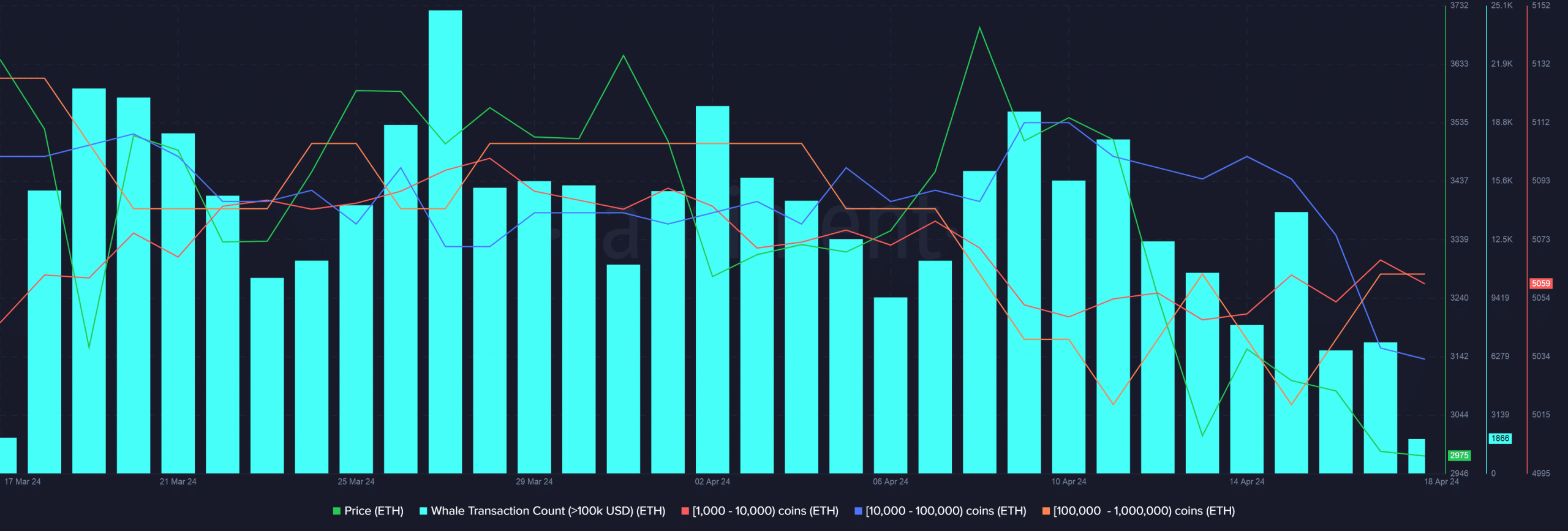

To better understand the market reaction to ETH’s slump, AMBCrypto examined Santiment’s whale indicator.

In particular, the numbers of two groups of whales (1,000 to 10,000 and 100,000 to 1 million) increased over the week, suggesting they were accumulating.

However, at the same time, wallets holding 10,000 to 100,000 ETH fell and showed a sell signal.

Source: Santiment

The aforementioned indicators reinforce the “mixed” response narrative described earlier in the article.

Is your portfolio green? Check out our ETH Profit Calculator

Measuring ETH’s next move

The Ethereum Fear and Greed Index somewhat hinted at the above-mentioned reasoning. According to the last update, market sentiment towards ETH was neutral and there was no clear bias towards buying or selling.

AMBCrypto previously reported that ETH is at risk of falling further to the $2,000-$2,400 level.