- One whale was spotted accumulating ETH despite high unrealized losses.

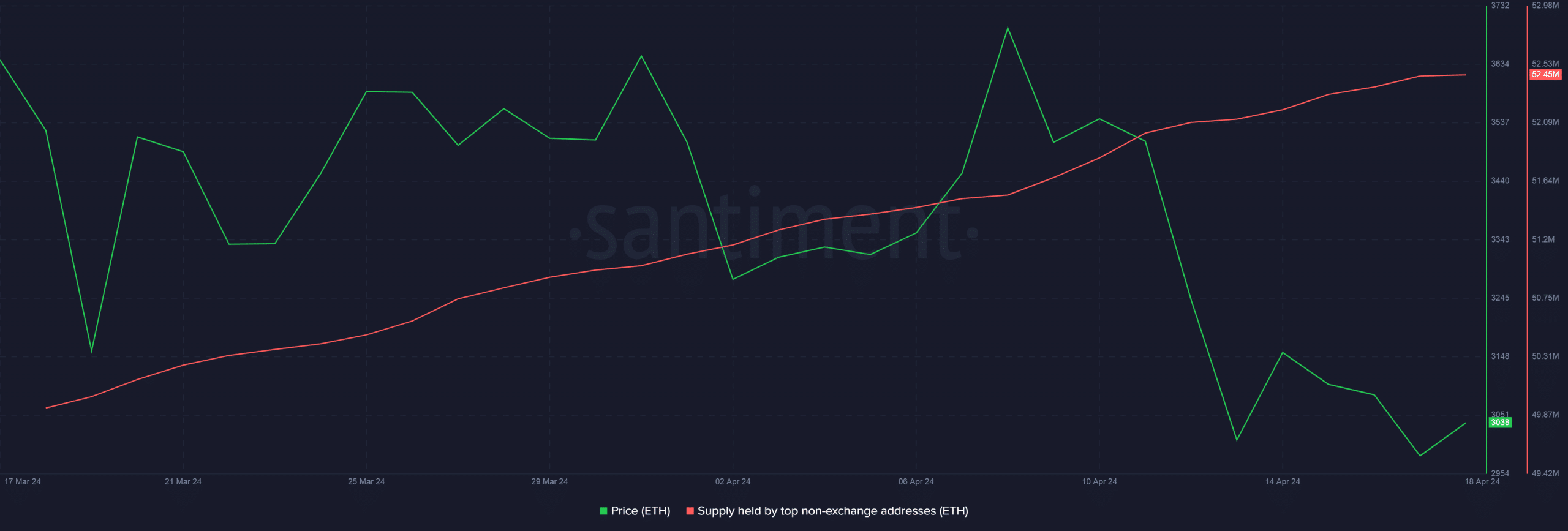

- In recent weeks, the supply of ETH held by addresses that are not part of exchanges has increased.

Ethereum (ETH) price corrected sharply in early Asian trading on Friday as tensions between Israel and Iran escalated. Although its value had recovered to over $3,000 at press time, the second-largest cryptocurrency has been largely in the red over the past week. In fact, it has lost more than 12% of its valuation, according to CoinMarketCap.

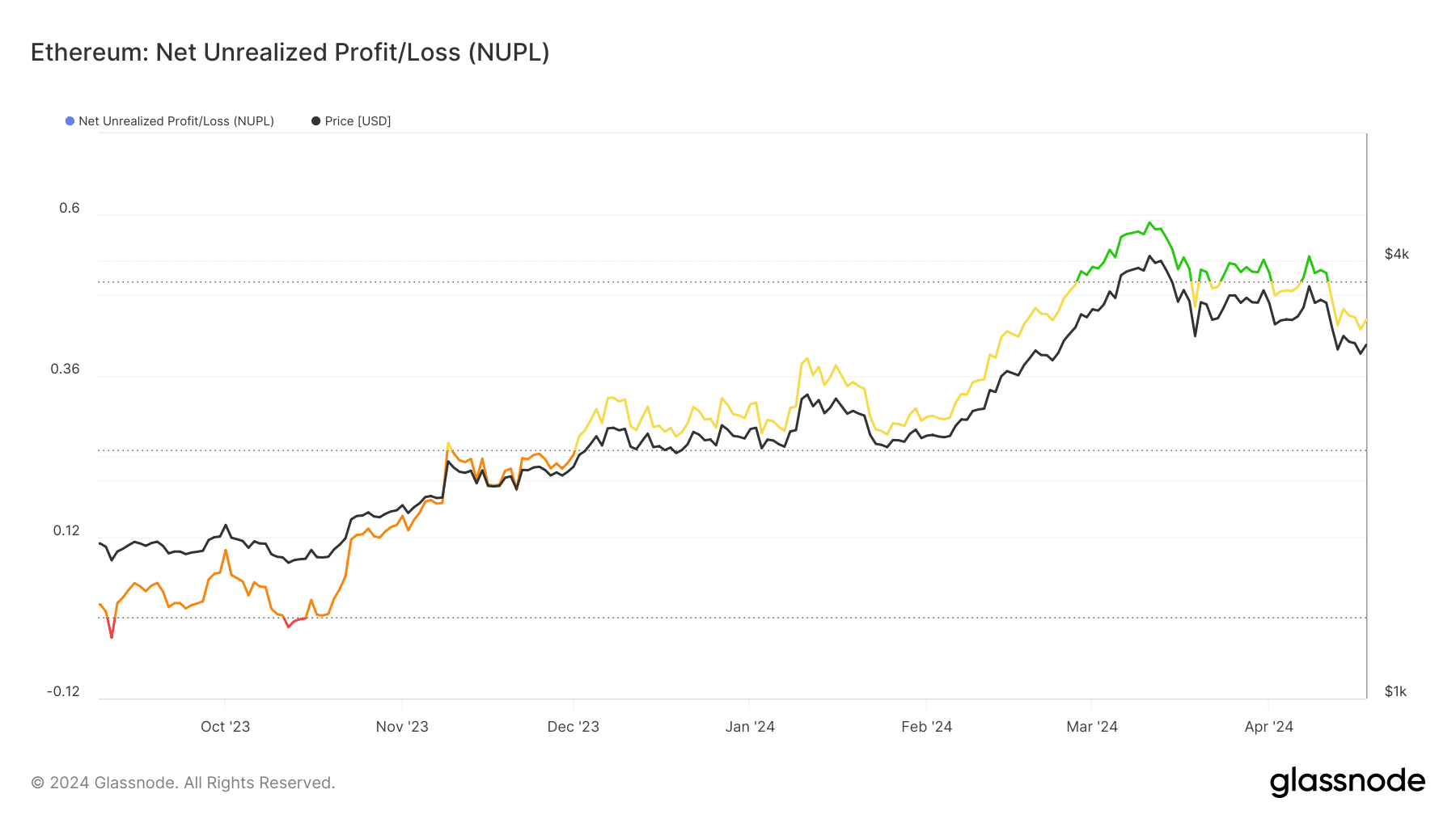

ETH profitability declines

The sluggish performance reduced the network’s unrealized net income. AMBCrypto examined the same using data from Glassnode and found that the number of profitable ETH holders has declined sharply.

Source: Glassnode

When their portfolios face this risk, many participants begin to capitulate and panic selling occurs. However, the actions of certain whale investors have piqued market interest.

Whales keep buying without panicking

According to Spot On Chain, an on-chain tracking platform, “huge” whales are accumulating ETH despite unrealized losses. Risk-taking investors have sold 41,358 ETH over the past five days, worth about $128 million at current prices.

In total, the whale currently holds a whopping 117,268 ETH coins, which would result in a loss of around $20 million if sold.

However, the accumulation pattern was not limited to the aforementioned whales. AMBCrypto looked deeper using Santiment data and discovered a steady increase in the supply of ETH held by addresses that are not part of exchanges.

This HODLing trend is a sign of confidence in the price of ETH over the long term. These addresses can expect ETH to bounce and bounce back.

Source: Santiment

Is your portfolio green? Check out our ETH Profit Calculator

What do you expect next?

As of this writing, the Ethereum market is neutral according to the latest figures from the Ethereum Fear and Greed Index. This means balanced market sentiment without a strong bias towards buying and selling.

The Bitcoin (BTC) halving is expected to have ripple effects across the broader market, including ETH. ETH’s trajectory following the last halving in 2020 mirrored that of BTC, with both major assets hitting new highs in the following year.