- Exchange outflows hit a yearly high, signaling optimistic confidence.

- The price of ETH may struggle to break above $3,255 in the near term.

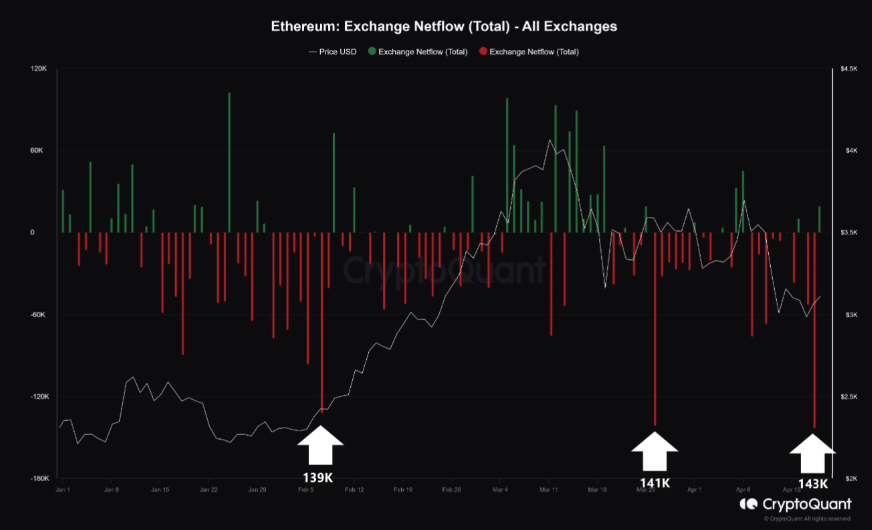

Unknown to many, Ethereum (ETH) recorded its highest exchange outflow of 2024 on April 18th. On this day, market participants withdrew 143,000 ETH from the platform, per CryptoQuant.

Exchange outflows signal a lack of selling appetite, suggesting that the altcoin may not experience a significant capitulation. The last time ETH saw this happen was on February 7th and March 26th.

When the accumulation occurred last February, the price of ETH was $2,372, and the value of the cryptocurrency at the end of the month was $3,386.

However, the March outflow did not have the same result as prices later fell. But AMBCrypto discovered that there may be a reason for the surge in breaches.

Source: CryptoQuant

Persistent owners keep the faith

One of them is the growing enthusiasm that the US SEC will approve an Ethereum ETF by May. While some participants were confident that approval would occur, some skeptics thought otherwise.

CryptoQuant author Burakkesmeci seemed to agree with this view.

“We saw significant amounts of BTC leaving exchanges prior to the approval of the Bitcoin spot ETF. “We can’t say the same thing is happening, but we have to keep this possibility in mind.”

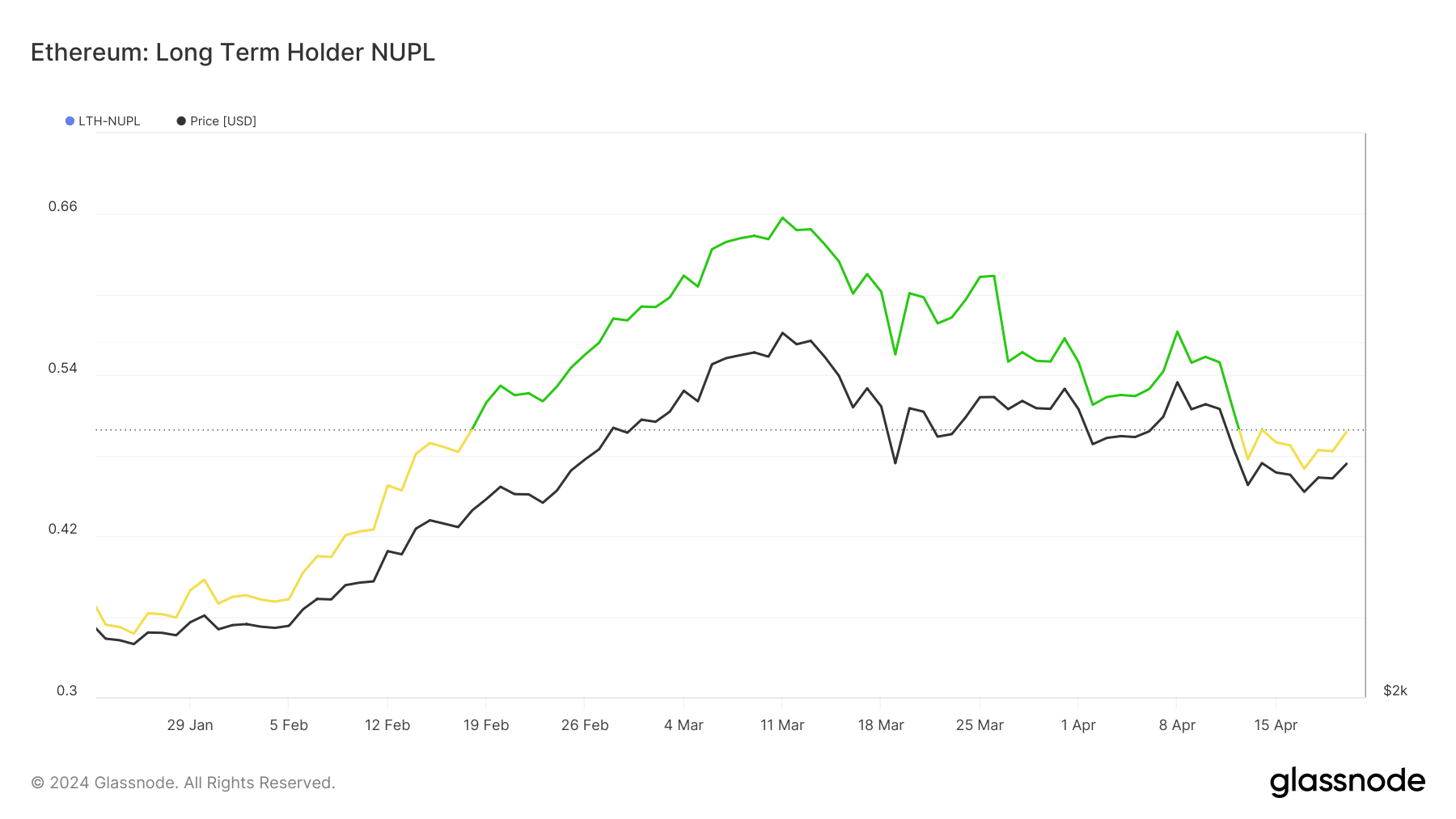

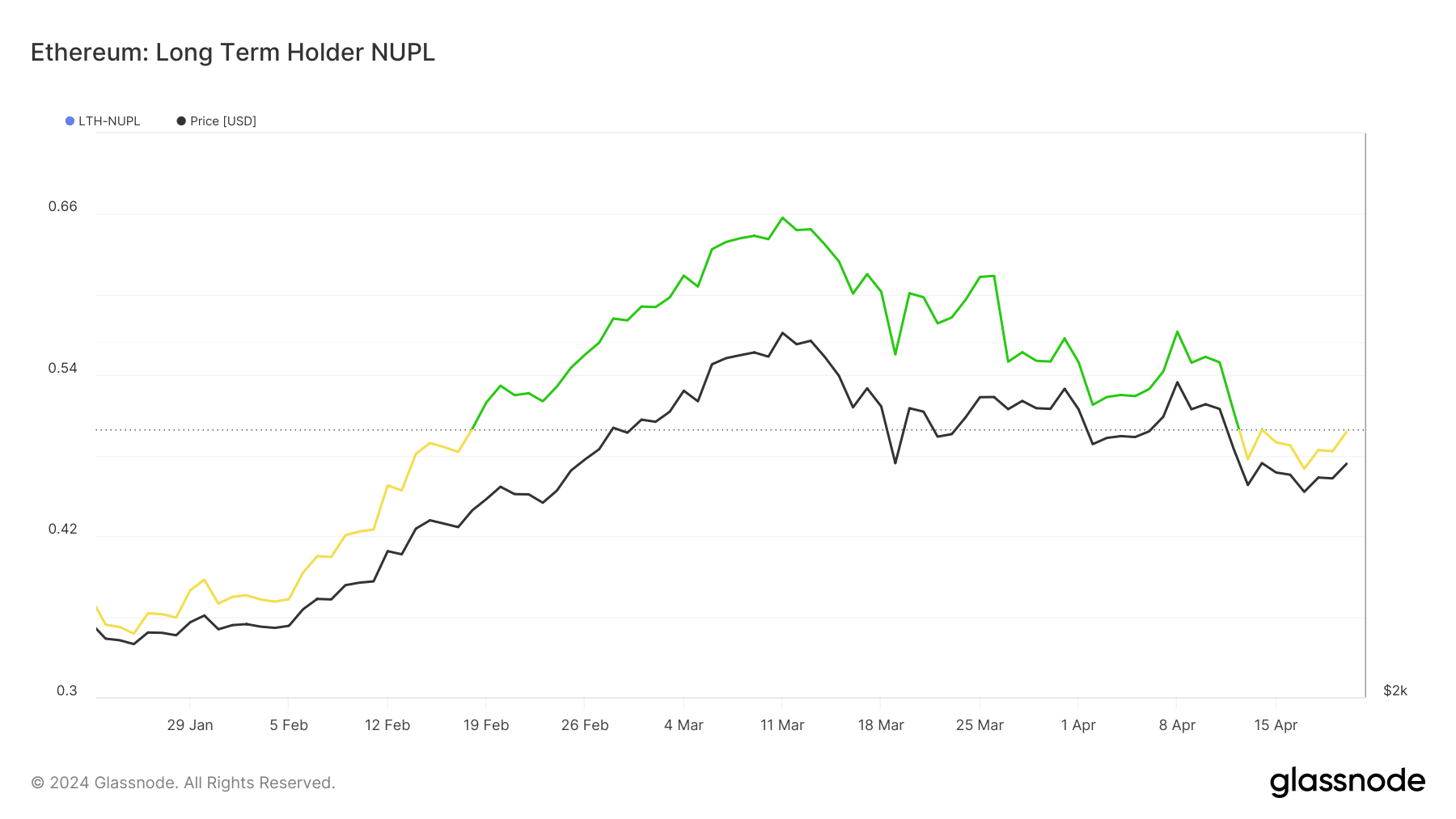

Another reason for the rise can be linked to the belief that the price of ETH will outperform Bitcoin (BTC) this cycle. Although this line of thinking remains unfounded, AMBCrypto has confirmed LTH-NUPL.

LTH-NUPL stands for Long Term Holder — Net Unrealized Gain/Loss. This indicator shows the behavior of holders who have held their cryptocurrency for at least 155 days.

At the time of this writing, LTH-NUPL is in bullish (yellow) territory, despite previously being closer to the euphoric side. However, this did not significantly affect the value.

Source: Glassnode

ETH is targeting lower lows.

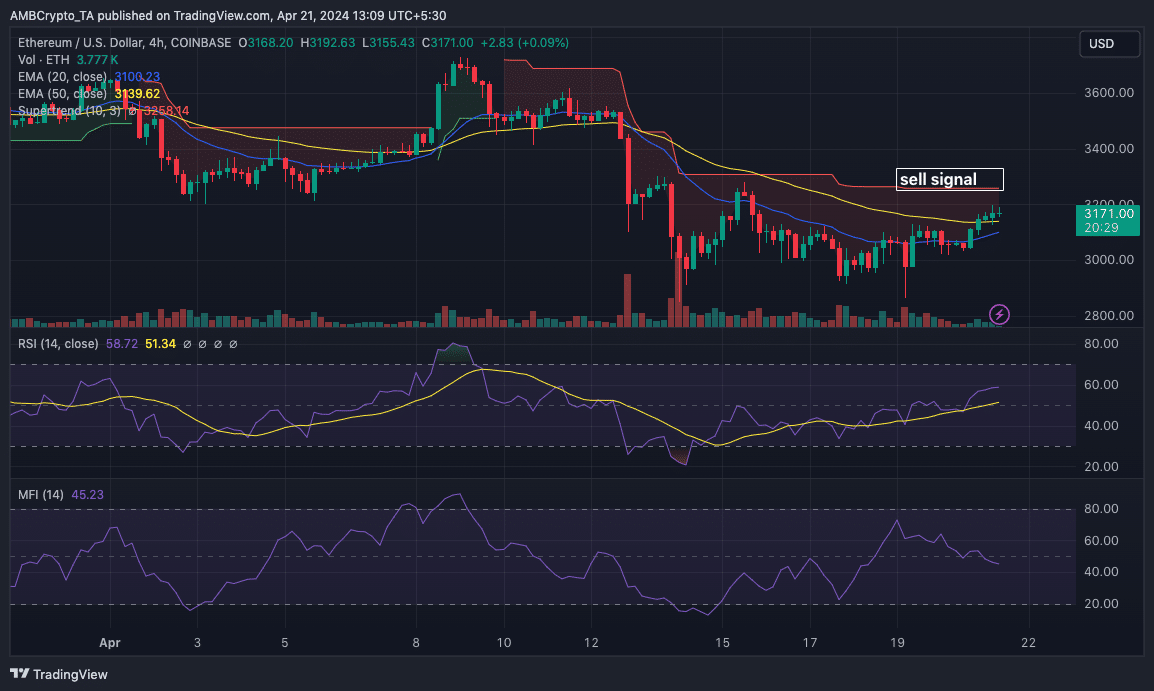

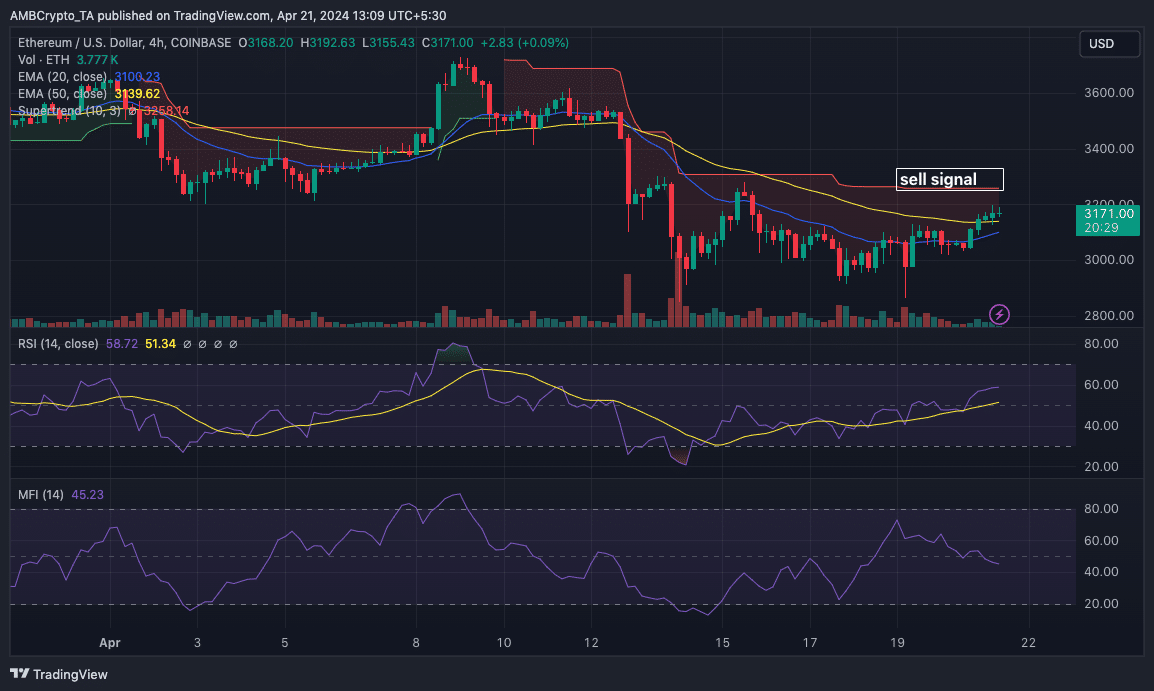

At press time, EHT was trading at $3,175, up 3.67% over the last 24 hours. From a technical perspective, momentum around the token has increased.

This came out to 58.64 in the Relative Strength Index (RSI). Generally, this is expected to result in a further increase in price action.

However, the exponential moving average (EMA) showed a different signal. At the time of writing, the 20 EMA (blue) is above the 50 EMA (yellow), indicating a bearish trend.

Supertrend also sent a sell signal at $3,255. Therefore, if the price of the cryptocurrency continues to rise, it may be rejected at the aforementioned price.

Source: TradingView

Read Ethereum (ETH) price prediction for 2024-2025

Like the super trend, the money flow index (MFI) also showed a downward trend. MFI said capital was flowing out of the ETH market due to the decline.

Therefore, the price may not break the $3,500 resistance.