About freedom of speech

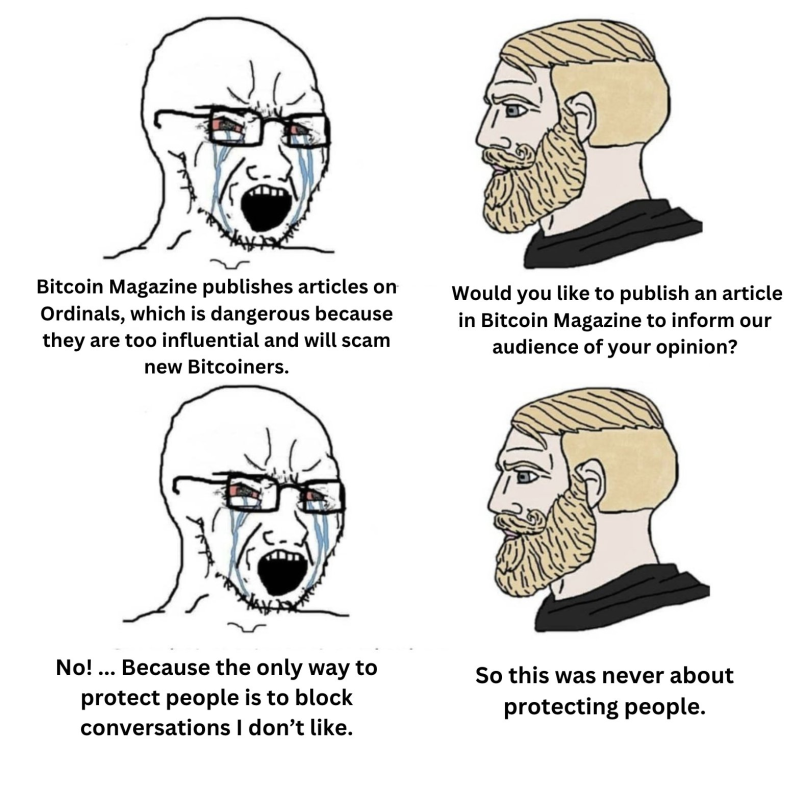

Mike Germano, President of Bitcoin Magazine, dared to post this rant with the following meme:

To all the haters out there, yes. Free discussion can also flourish in Bitcoin Magazine. Thank you for the opportunity to submit your objection to Ordinals. No permission is given to the author’s contributions, directed by technical editor Shinobi!

About technical achievements

I appreciate Bitcoin Magazine editor Pete Rizzo’s post detailing the entire history of Bitcoin, but he is just as morally wrong on Ordinals as he was on the Ethereum Merge.

While the merge was a great technological feat for Ethereum, the transition to proof-of-stake further weakened Ethereum’s decentralization. and Casey’s A technical feat by the Ordinals, he also harms Bitcoin by making it less fungible.

On Peter McCormack’s What Bitcoin Did podcast, Pete Rizzo argued that “at worst, people who own ordinal numbers will at least own Bitcoin.”

no. The worst case scenario is that people realize they have been scammed and never want to access their Bitcoin again.

to make money

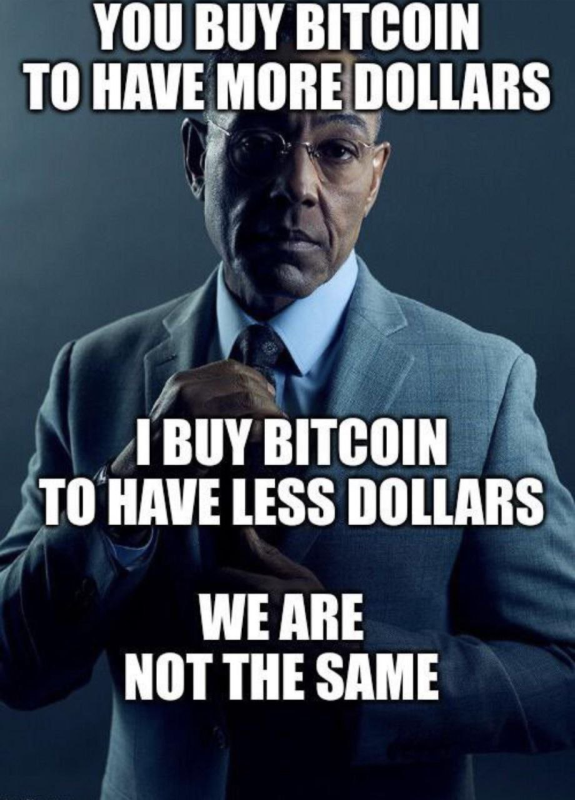

Some people try to defend that flipping ordinal numbers for profit isn’t a scam, it’s just people willing to gamble on guesses. Likewise, many people bought Bitcoin at the 2021 cycle high without doing any research and haven’t touched it since realizing the losses. Speculators buy Ordinals for the same reason they buy Bitcoin: to make money.

However, Bitcoin Maxis’ position on this issue is clear.

Bitcoin, like ordinal numbers, is not an intangible asset that suffers from the Greater Fool Theory. Two meaningful ways to save Bitcoin compared to gambling on the Ordinals are network effects and actual limited supply. Many copycat altcoins have been issued, but none have the network effect of OG. Additionally, most altcoins are taken out of the air through Proof-of-Stake, and there is virtually no physical cost for larger issuances. Bitcoin is issued only through Proof-of-Work, which gives it real weight and power behind its value.

Bitcoin Maxis, here to fix money, knows that we don’t buy Bitcoin to make money, we buy Bitcoin to fix the world.

About rare collections

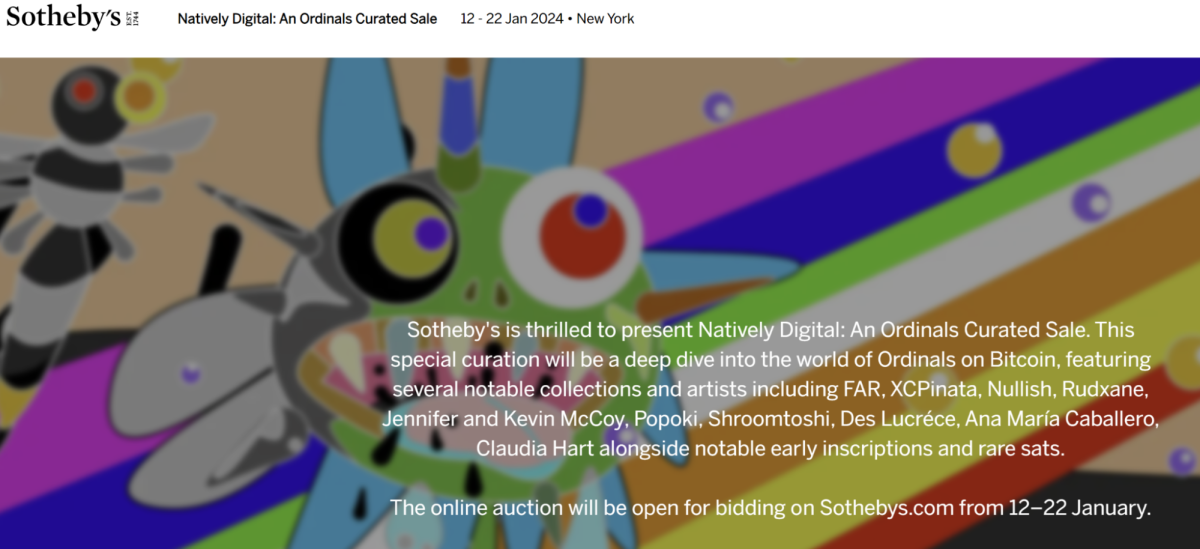

As for what Bitcoin has done, McCormack argues that no one is actually buying Ordinals to collect them. Some Ordinals supporters have fooled themselves to the point where they think some are actually collecting while most are trying to flip. Respected art auction house Sotheby’s has held an ordinal auction in January 2024, but putting its brand behind this ‘collection’ doesn’t mean it will.

Whether I morally disagree or not, I acknowledge that there are people who find value in collecting worthless things. Some might argue that Sotheby’s is not scamming any willing buyer of digital art. However, this is a scam because you are not purchasing digital art because you do not actually own anything. You can add the same digital art to every transaction. It’s just their shared delusion that by using the same common protocols as their peers, the digital art they own in the transaction is more valuable than my digital art.

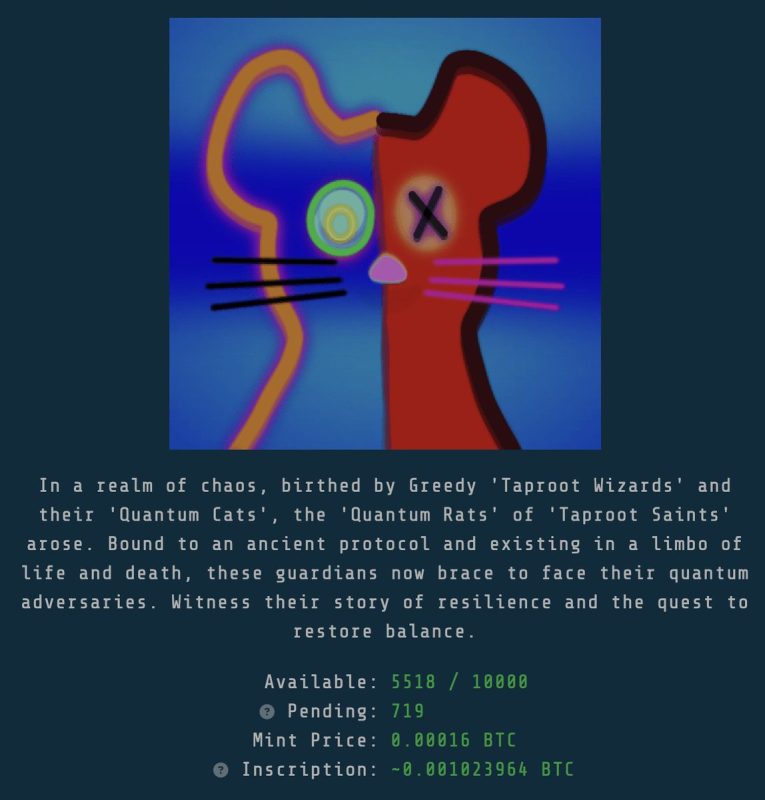

What I will not accept is the notion that ordinal numbers and NFTs are arbitrary. I can take a jpeg of every Quantum Cat and re-release the same collection of 3000 cats and tell people that mine are only worth 0.0001 Bitcoin each, not 0.1 Bitcoin. It’s so cheap. A much better deal!! There is nothing rare or special about it. Do people want to pay 0.1 Bitcoin to Udi or Sotheby’s to own Sat’s address to a cat in their collection, or do they want to pay the same cat in My Cats? In fact, an imitation collection called Quantum Rats has already been created for this purpose.

Of course, adding another collection isn’t as direct as diluting the supply of an existing collection, but it’s close enough. If a collection starts small and becomes so expensive that the creator creates a separate, similar collection to make it available to more people, this is actually just to scam more people. It is a moral judgment, but the Ordinals do not advocate Bitcoin Maximalist values. Although the supply of Bitcoin is limited to 21 million, there is no limit to the number of Ordinal collections that can be created. Next, Udi could release a “mutant” quantum cat or a “boring” quantum cat, which could become more popular and render the original obsolete altogether.

That’s a scam. That’s rug pull.

The rug pull formula is simple. You launch a “rare” collection, build hype through wash trading with yourself and influencers, and then leave it to the idiot holding the bag.

Then do it again, do it again, and do it again.

Bitcoin could also succumb to the “greater fool theory,” but the difference is the network effect that has made Bitcoin survive unlike other pump-and-dump cryptocurrencies.

About digital art ownership

Conversely, owning digital art exists. In other words, intellectual property exists. I own the art for Bitcoin Girl: Save the World because I can afford to pay for the cover art design. I own the files and create the products. If anyone tries to sell a physical product using digital art I own, it is copyright infringement.

Think of every digital file or character art from every video game or Pixar animated film. Digital art rights exist, are real, and can be used to create new films or products.

About filtering and censorship

I’m not trying to filter ordinal numbers or censor transactions, but I think supporting ordinal numbers is wrong. For Bitcoin to succeed, it has to be money for the enemy. However, Bitcoin Maxis still needs to advocate for people to do their own research.

Scammers scam all the time. But I won’t support it. Still, I’ll allow it. Fortunately, ordinal numbers don’t need my permission.

We are not trying to destroy Bitcoin by adding filtering or censorship, but we can still oppose it.

Hodlonaut explained my position on ordinal numbers succinctly.

Thanks to Bitcoin Magazine for letting me complain about ordinal numbers!

This is a guest post by Will Schelkoff. The opinions expressed are solely personal and do not necessarily reflect the opinions of BTC Inc or Bitcoin Magazine.