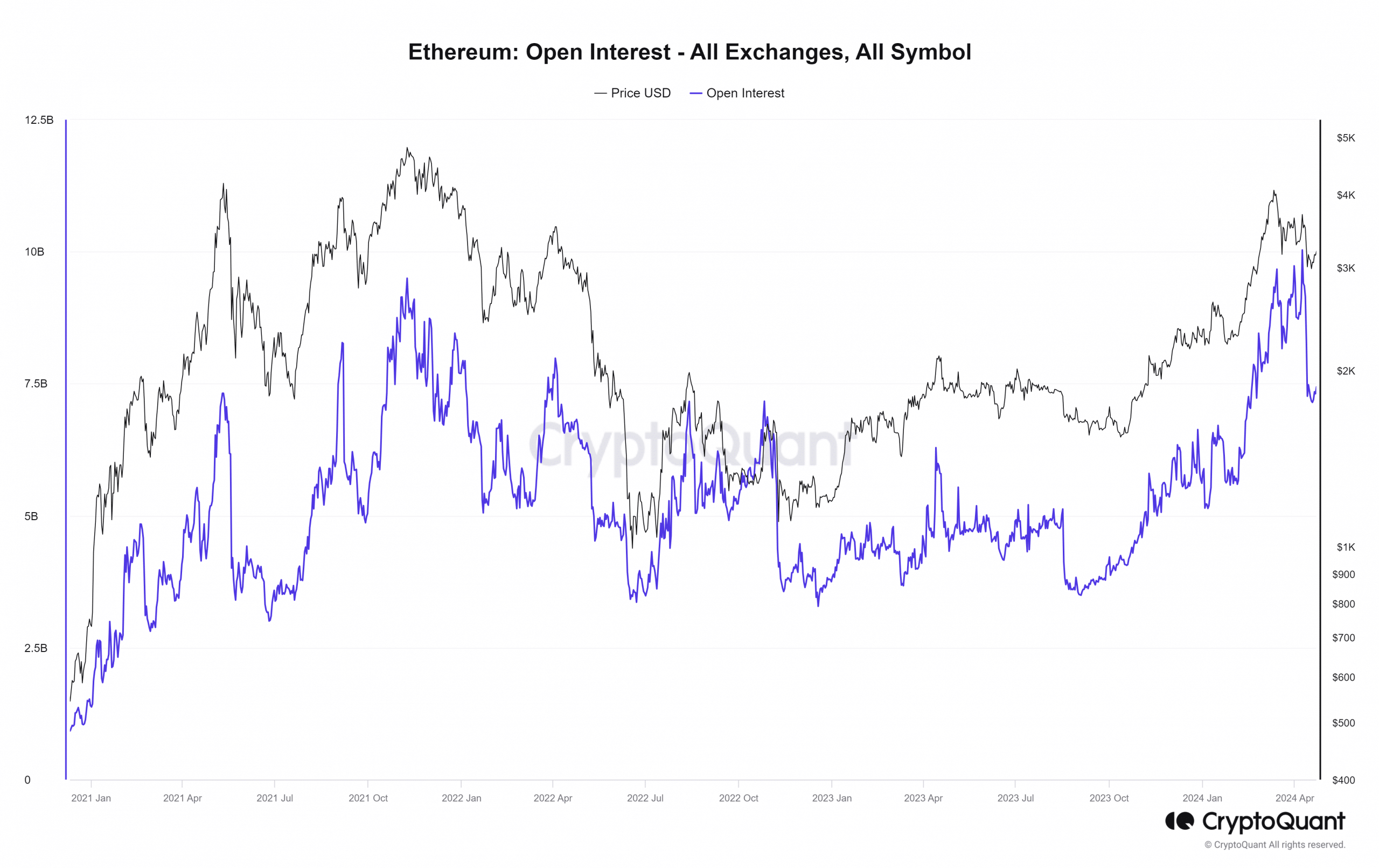

- Ethereum saw a significant drop in open interest in April after the $3.7,000 rejection.

- On-chain indicators remain good, suggesting a possible upward trend.

Ethereum (ETH) was trading at $3.2,000 at press time. The $4,000 psychological level has been violated several times in lower periods since April 13, and sentiment towards the altcoin king has weakened significantly.

This is evident from the sharp decline in open interest behind ETH. Looking at the price trajectory over the past few weeks, a downward trend seems possible.

However, there was also a possibility of a bull resurgence with $3,000 being defended on a higher period. AMBCrypto examined on-chain metrics to understand which path is more likely.

Similarities to February 2021

Source: CryptoQuant

During the previous bull market, in mid-February 2021, the Ethereum price corrected from $1.9,000 (then ATH) to $1.4,000. V-reversal followed, but it showed that the futures market is often overheated.

Impatient bulls want to make money quickly using leverage. This works, but after some point the lack of spot demand and the overwhelming buying in the futures market resets.

The decline in OI in April from $10 billion to $7.17 billion is likely to be one of those resets. Given the selling pressure on Bitcoin in recent weeks, it is unclear whether a similar V-reversal will begin.

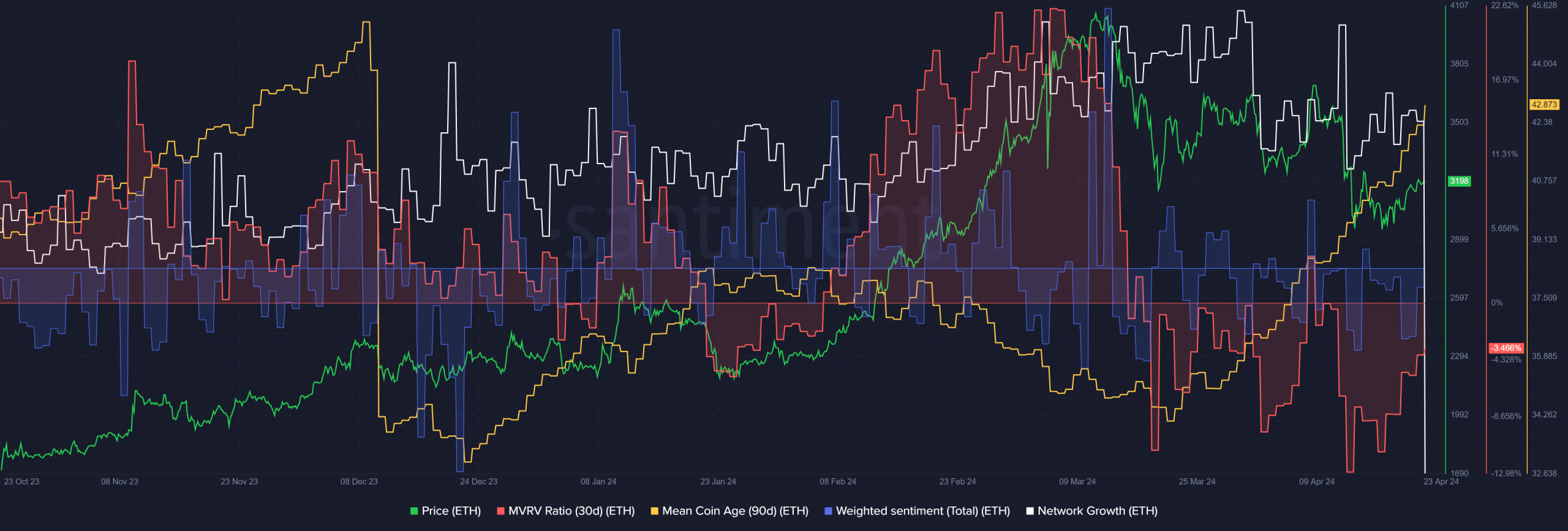

User adoption fell along with price and sentiment.

Source: Santiment

Weighted social sentiment was very positive for several days in February and mid-March. Afterwards, prices entered a correction and mostly fell. Sentiment prior to the price peak may also revolve around high gas prices on the network.

Network growth metrics have also slowed over the past three months. A rise is a sign of increased demand, but it is more likely to follow an upward trend than before.

Is your portfolio green? Check out our Ethereum Profit Calculator

The 90-day average age of currency usage has been steadily increasing since March 27. This shows the accumulation of ETH across the network. Meanwhile, the 30-day MVRV rate has been negative for almost a month, causing losses to holders.

It presented a good buying opportunity, but some uncertainty remained. If ETH can climb back above the $3.3,000 resistance, swing traders and investors will become more confident of a continued rise.