Bitcoin Cash (BCH) price is heading toward recovery with only one barrier standing in its way.

This resistance can be nullified with the help of investors who can return to BCH.

Bitcoin Cash Is Ideal for Accumulation

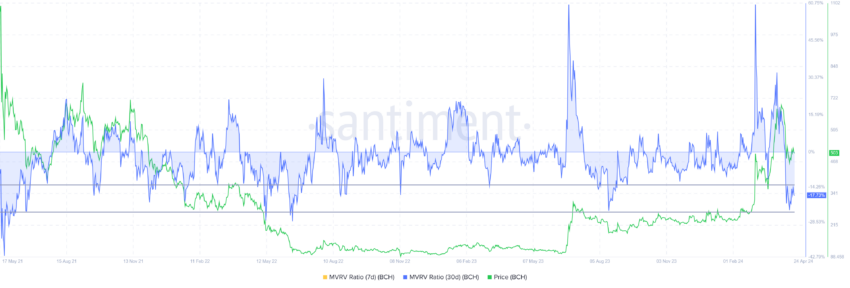

Bitcoin Cash is trading above $500, but has failed to break $513 in the past few days. This may now change as the market value to market value (MVRV) ratios of altcoins are in the opportunity zone.

MVRV ratio monitors investors’ profits and losses. Accumulation may occur as Bitcoin Cash’s 30-day MVRV is -17%, implying a loss. Historically, BCH has witnessed recoveries from MVRV levels of -14% to -24%, marking this as an area of accumulation opportunities.

This accumulation will attract new investors to the asset, allowing BCH to witness further rise in price.

BCH has been observing investors moving away from the token. The total number of addresses holding BCH has decreased by more than 390,000 since the beginning of the month.

Read more: How to Buy Bitcoin Cash (BCH) and Everything You Need to Know

This is because altcoins were scheduled to undergo adjustment as the market cooled after the rally last March. As a result, investors refuse to invest in the asset, risking losses. This reduced the total addresses from 25.16 million to 24.77 million.

Now that cryptocurrencies are showing potential profits and exist in accumulation zones, these investors can profit. This will effectively help Bitcoin Cash price recover.

BCH Price Prediction: Key Resistance

Bitcoin Cash is trading at $504 and is currently struggling to break the resistance level marked at $513. This level is important because it joins the 23.6% Fibonacci retracement of $709-$452.

Turning this into support would help BCH potentially record its upcoming recovery over the past 10 days. The Bitcoin hard fork token could subsequently attempt to breach the 38.2% Fib line at $550.

Read More: Bitcoin Cash (BCH) Price Prediction for 2024/2025/2030

However, failure to breach the 23.6% Fib could cause Bitcoin Cash’s price to fall through the $501 support. This could cause BCH to potentially test $452 as support, invalidating the optimism.

disclaimer

In accordance with Trust Project guidelines, this price analysis article is provided for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate and unbiased reporting, but market conditions may change without notice. Always do your own research and consult with a professional before making any financial decisions. Our Terms of Use, Privacy Policy and Disclaimer have been updated.