- The Shiba Inu regained its support area where it had been since mid-March.

- As buying pressure increases, the token may begin to recover.

Shiba Inu (SHIB) has been trending downward on the sub-period chart for the past month.

However, as Bitcoin (BTC) trades within a range and shows signs of consolidation after the halving, altcoins could become more volatile.

Declining correlation between Shiba Inu and Bitcoin could help bulls strengthen their recovery.

Retesting previous support can help set the next direction.

Source: SHIB/USDT on TradingView

Although the market structure on the 12-hour chart appears strong, the internal structure remains weak due to the decline last month.

SHIB failed to recover, encountering resistance at the 50% Fibonacci retracement level.

A short-term bearish bias is justified as long as there is no rise above $0.0000275 and $0.0000295. In the meantime, the attempt at recovery appears to have some legs.

CMF exceeded +0.05, indicating massive capital inflows and buying pressure. RSI on the 12-hour chart was at 47 at press time, but has briefly moved above the neutral 50 level in recent days.

This could be a harbinger for a further rise.

The buildup across the network has been a huge positive.

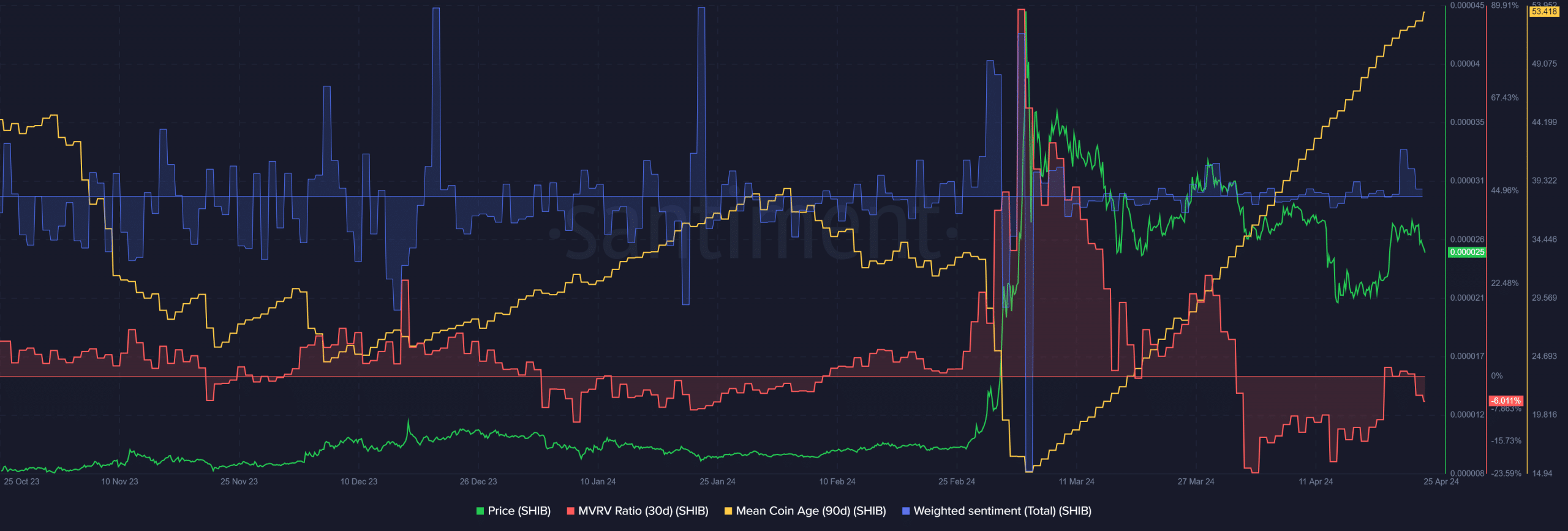

Source: Santiment

The 30-day MVRV rate was negative for most of April. This showed that the holders felt lost and lacked confidence. Additionally, the average age of money usage has clearly trended upward over the past six weeks.

It signaled a good buying opportunity with MVRV. Weighted Sentiment has also been positive over the past few days, highlighting a shift in sentiment in favor of the bulls.

Realistic or not, SHIB’s market cap in BTC terms is:

At the time of reporting, SHIB $0.00002486. The near-term technical outlook remains bearish, but traders should brace for a further upside.

A wave of selling in the Bitcoin market could still push Shiba Inu and other altcoins lower.

Disclaimer: The information presented does not constitute financial, investment, trading, or any other type of advice and is solely the opinion of the author.