Data shows that the hype around new Bitcoin coins has declined sharply, which is not a good sign for miner profits.

The Bitcoin halving effect settles into miners’ profits as rune interest falls.

The much-anticipated Bitcoin halving took place a few days ago. Halving is a periodic event coded into the blockchain where the BTC block reward is exactly halved. It is held every four years, and the most recent event was the fourth.

Block rewards, which are heavily influenced by halving, are one of the two main ways miners generate revenue. Miners receive these rewards as compensation for solving blocks, which has historically been their main source of revenue.

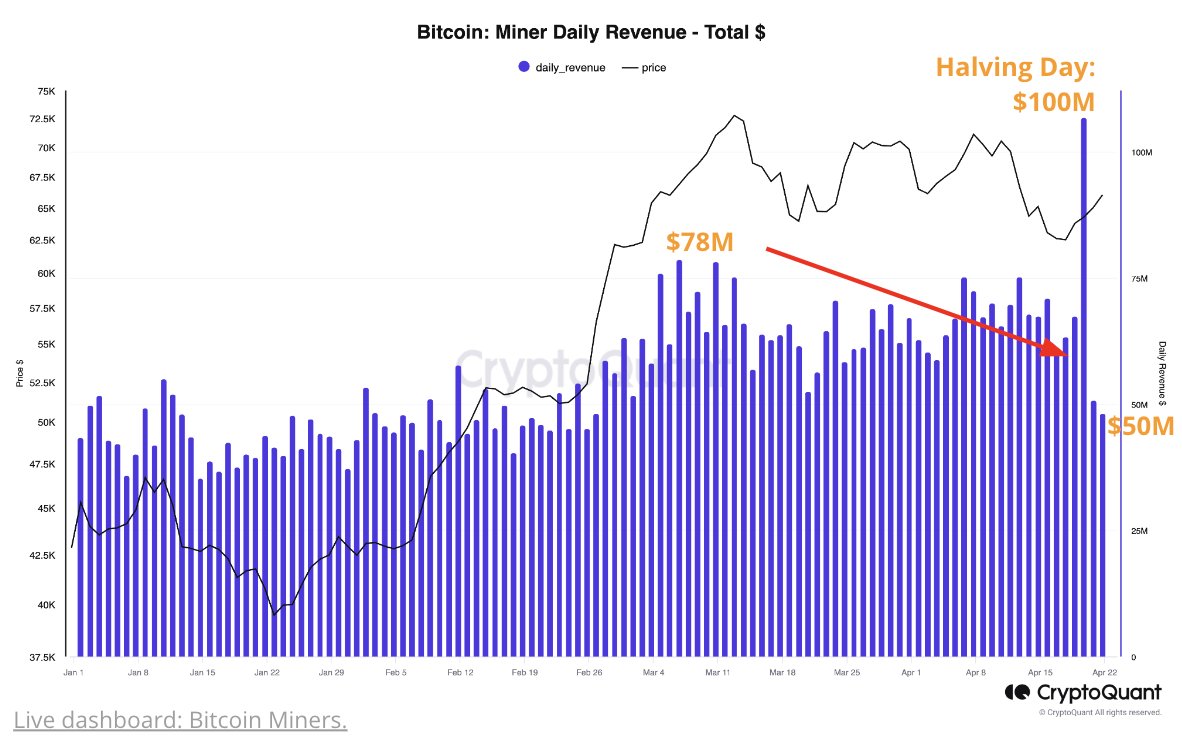

Therefore, the halving could be problematic for the group’s finances as it would significantly reduce its profits. However, shortly after the recent halving, miner profits soared to a record $100 million.

The event cut block rewards in half, but at the same time caused a second source of revenue, transaction fees, to explode, helping total revenue increase rather than decrease as would normally be expected.

This surge in fees is due to the launch of the Loon Protocol, another major development for the network on the day of the halving. This protocol provides a way to issue fungible tokens on the Bitcoin blockchain.

Fungible tokens are indistinguishable from one another, just as individual BTC satoshis are usually completely identical. On the other hand, unique tokens are known as non-fungible tokens (NFTs).

Runes immediately became popular among users and network usage grew rapidly. Transaction fees are typically tied to network activity, so when this new protocol was discontinued, fees also increased.

This is natural, because during periods of high traffic, transmissions can be queued due to limited throughput on the network. Therefore, users have no choice but to pay high fees if they want to move faster.

According to data shared by on-chain analytics firm CryptoQuant, the high interest Runes received upon its launch led to an explosion in total transaction fees.

The value of the metric seems to have been quite high in recent days | Source: CryptoQuant on X

The chart also shows that the indicator has cooled since this massive peak. So while runes were quite popular at launch, interest in them has already waned.

Accordingly, Bitcoin mining profits, which were extremely high after the halving, also decreased.

Looks like the miner revenue has taken a deep hit in the past few days | Source: CryptoQuant on X

Bitcoin miner revenue is now down to $50 million, half of its previous high of $100 million. So while Loon temporarily put miners in a comfortable position, that support line is now gone and these chain validators are starting to come under pressure.

BTC price

As of this writing, Bitcoin is trading at around $63,900, down more than 1% over the past seven days.

The price of the asset appears to have plunged over the past couple of days | Source: BTCUSD on TradingView

Featured image from iStock.com, CryptoQuant.com, chart from TradingView.com