- Polygon’s NFT sales surged 9.6% in the last 24 hours.

- Whales have been busy collecting MATIC at discounted prices.

Despite how MATIC is doing on the pricing front, Polygon remains the leader in one very important respect. That said, there was non-fungible token (NFT) activity on the Ethereum Virtual Machine (EVM)-based blockchain in April.

Polygon’s NFT Market Tracking

According to AMBCrypto’s research on the Dune Analytics dashboard, Polygon processed approximately 3.4 million transactions on April 15, nearly 10% higher than the week before. Polygon’s dominance can be measured by the fact that the second-best BNB chain can only record 1.9 million transactions, almost half of Polygon’s.

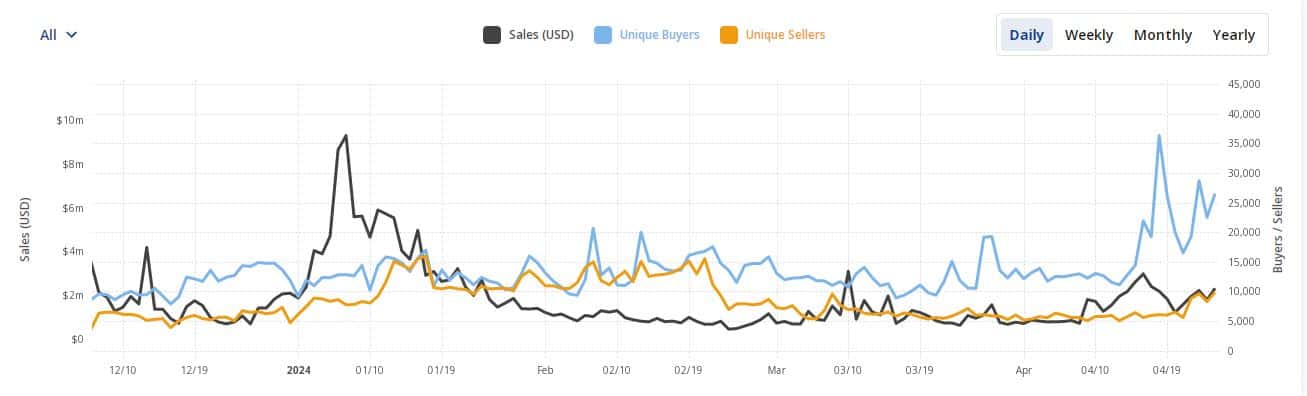

While Polygon clearly dominated the EVM rankings, its overall market performance was equally impressive. According to CryptoSlam data, Polygon was the fourth largest chain by NFT trading volume over the past 24 hours at press time, surging 9.6% to surpass $2.5 million in revenue.

In fact, the network has held the fourth position for over a month, behind top layer 1 (L1) chains such as Ethereum, Bitcoin, and Solana.

Source: CryptoSlam

Will higher NFT activity lead to higher burn rates?

Like many other cryptocurrencies, MATIC derives its value from the trading activity of its parent chain. A portion of the fees paid in MATIC is burned after each transaction, creating a deflationary effect on the coin.

According to burntracker.io, approximately 48,865 MATICs have gone up in smoke in the past 24 hours. It’s impossible to say with certainty, but according to CoinMarketCap, MATIC reacted marginally to this event, rising 1% in 24 hours.

But over a broader period, MATIC suffered, plummeting nearly 34% in one month.

Is your portfolio green? Check out the MATIC Profit Calculator

Whale Bag MATIC Discount

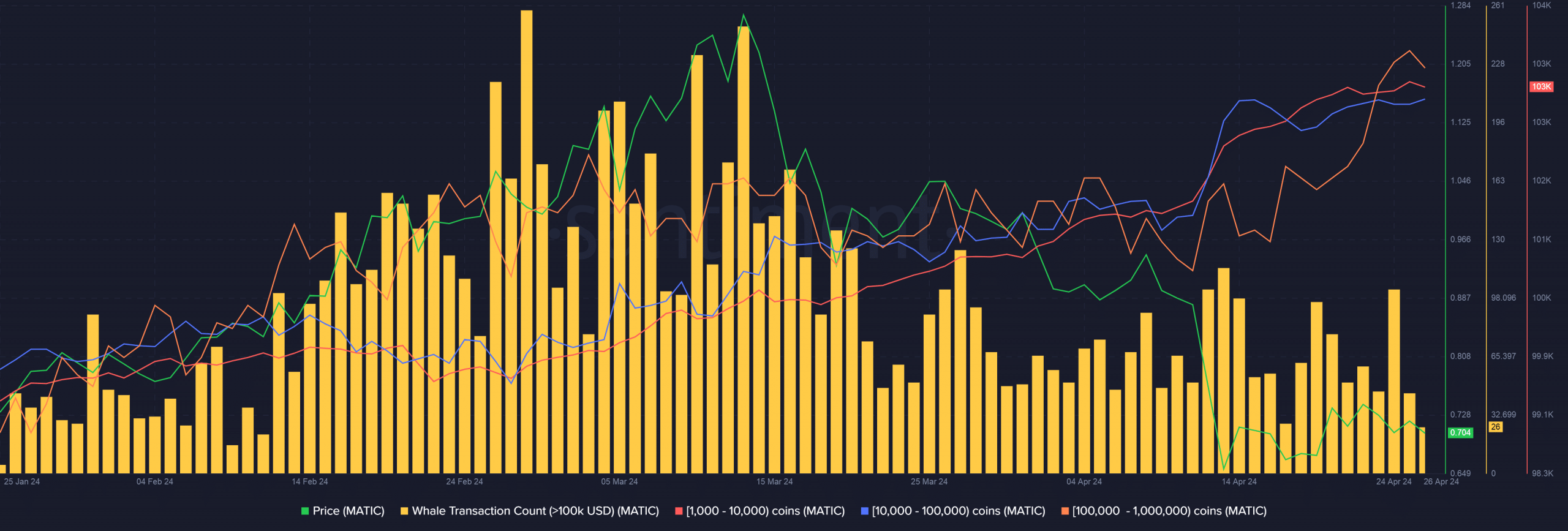

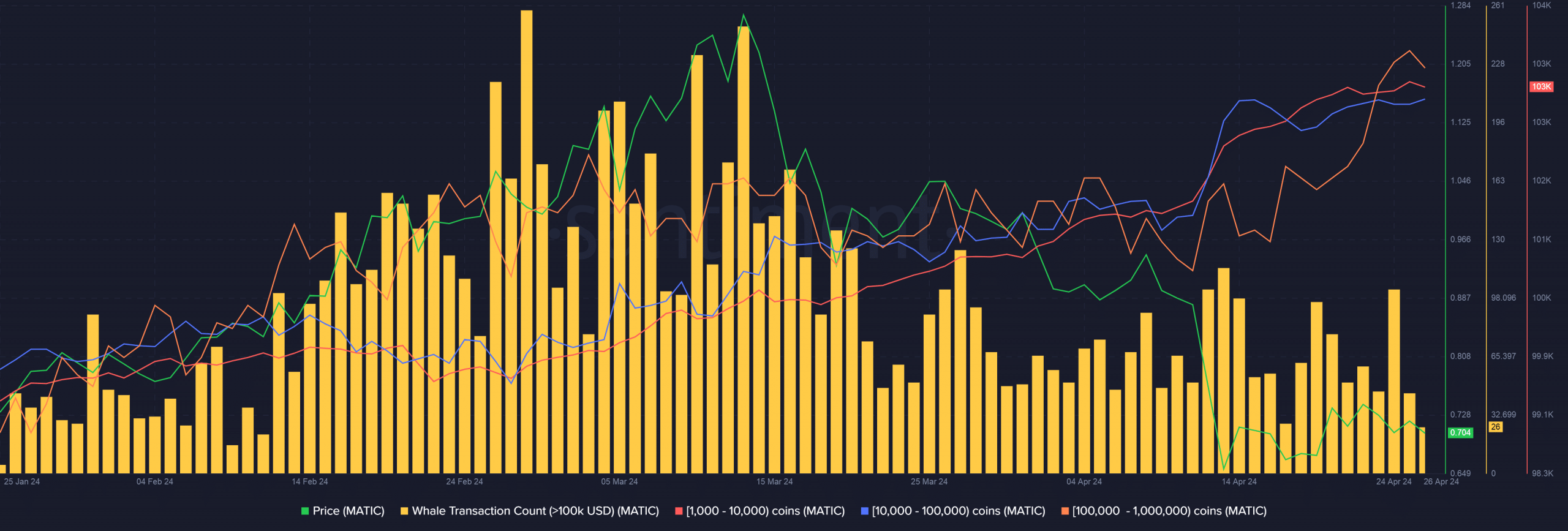

Meanwhile, MATIC whales took advantage of negative price action to add to their positions. Using Santiment data, AMBCrypto found that the number of user groups holding between 10 and 1 million coins was steadily increasing while the price was falling.

This indicates that wealthy investors are confident in MATIC’s medium-term prospects and are going on an asset accumulation spree accordingly.

Source: Santiment