- Solana recorded the highest stablecoin transfers compared to all other networks.

- However, interest in Solana’s DeFi sector and NFTs has declined.

Despite the Solana (SOL) ecosystem experiencing significant growth over the past few months, interest in the network has not waned one bit.

Solana maintains dominance

Solana has recorded significantly more stablecoin transactions than any other blockchain, surpassing both Ethereum and other popular networks, according to the new VISA dashboard. In March 2024, Solana held a whopping 42.3% market share, compared to 1.9% a year ago. Solana’s fast transaction speeds and low fees make it ideal for high-frequency trading, which contributes significantly to stablecoin trading volume.

But while Solana is the frontrunner, the nature of the deal remains unclear. A significant portion of these transactions may originate from bots and may not reflect actual users of the Solana network. Additionally, Solana’s interest in the memecoin sector has driven much of the network’s activity.

Source: X

However, despite high stablecoin trading volume, the network has not seen growth in the DeFi sector.

In fact, AMBCrypto’s examination of Artemis’ data shows that Solana’s Total Value Locked (TVL) has decreased. This means that users are losing interest in Solana’s DeFi services, which could impact the network’s overall revenue.

Source: Artemis

I think there will be some problems in the future.

Solana’s NFT division also took a hit during this period.

For example, over the past month, the Solana Floor NFT Blue Chip Index has fallen significantly. This indicates a substantial decline in interest in popular Solana NFTs such as Mad Lads and Solana Monkey Business.

Source: Solana Floor

Additionally, interest in SOL staking has decreased. Over the past week, the amount of SOL staked on the network has decreased significantly. A significant decrease in staking could result in fewer validators, potentially making the network more vulnerable to attacks.

The number of validators can also affect transaction processing speed and fees. Fewer validators can reduce throughput, which can result in slower transaction times or higher fees.

Source: Staking Rewards

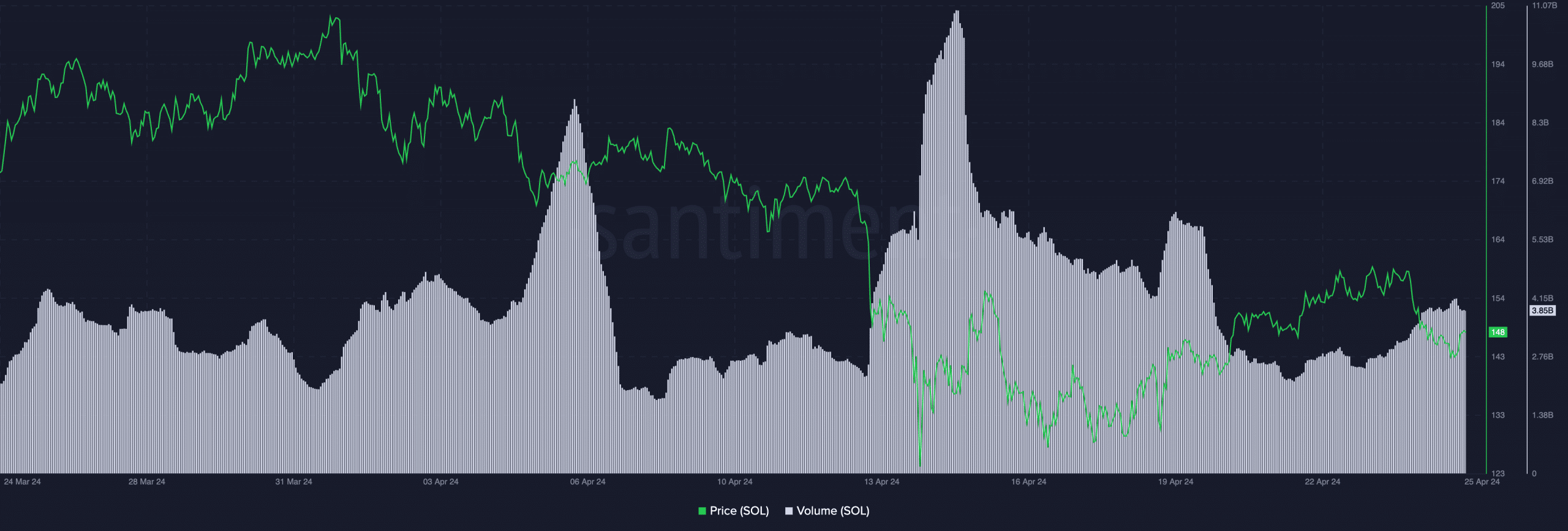

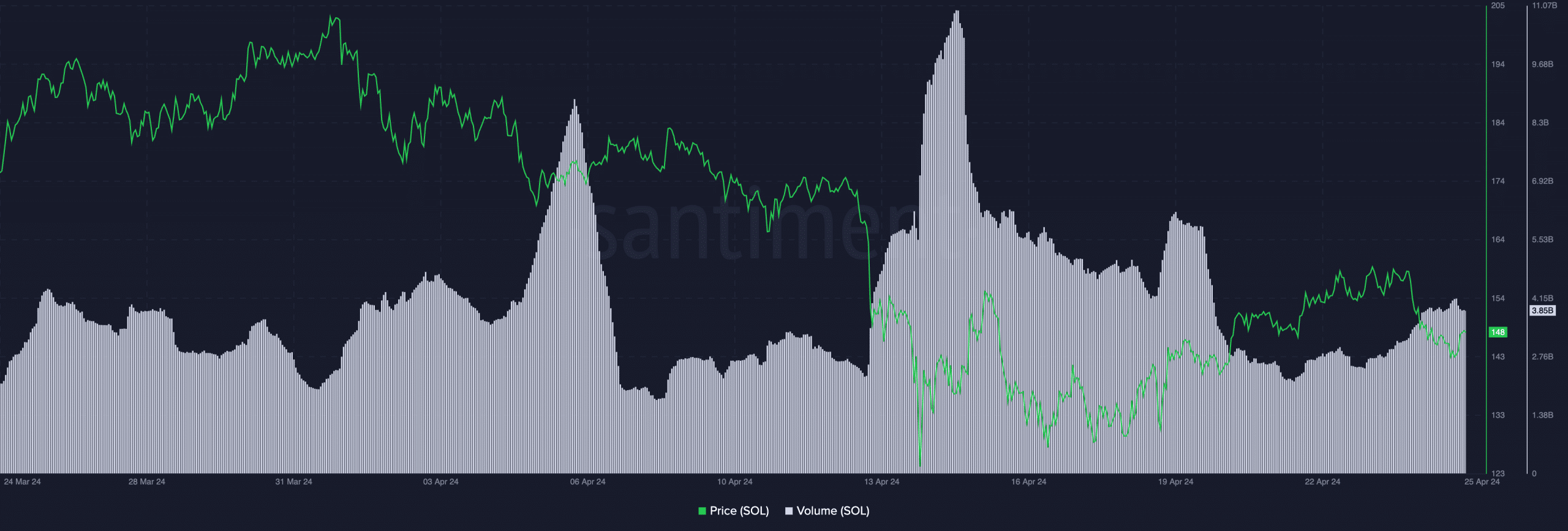

At press time, Solana was trading at $135.59, down 5%. Additionally, SOL’s volume also decreased by 25.49% on the chart.

Read Solana (SOL) price prediction for 2024-25

Source: Santiment