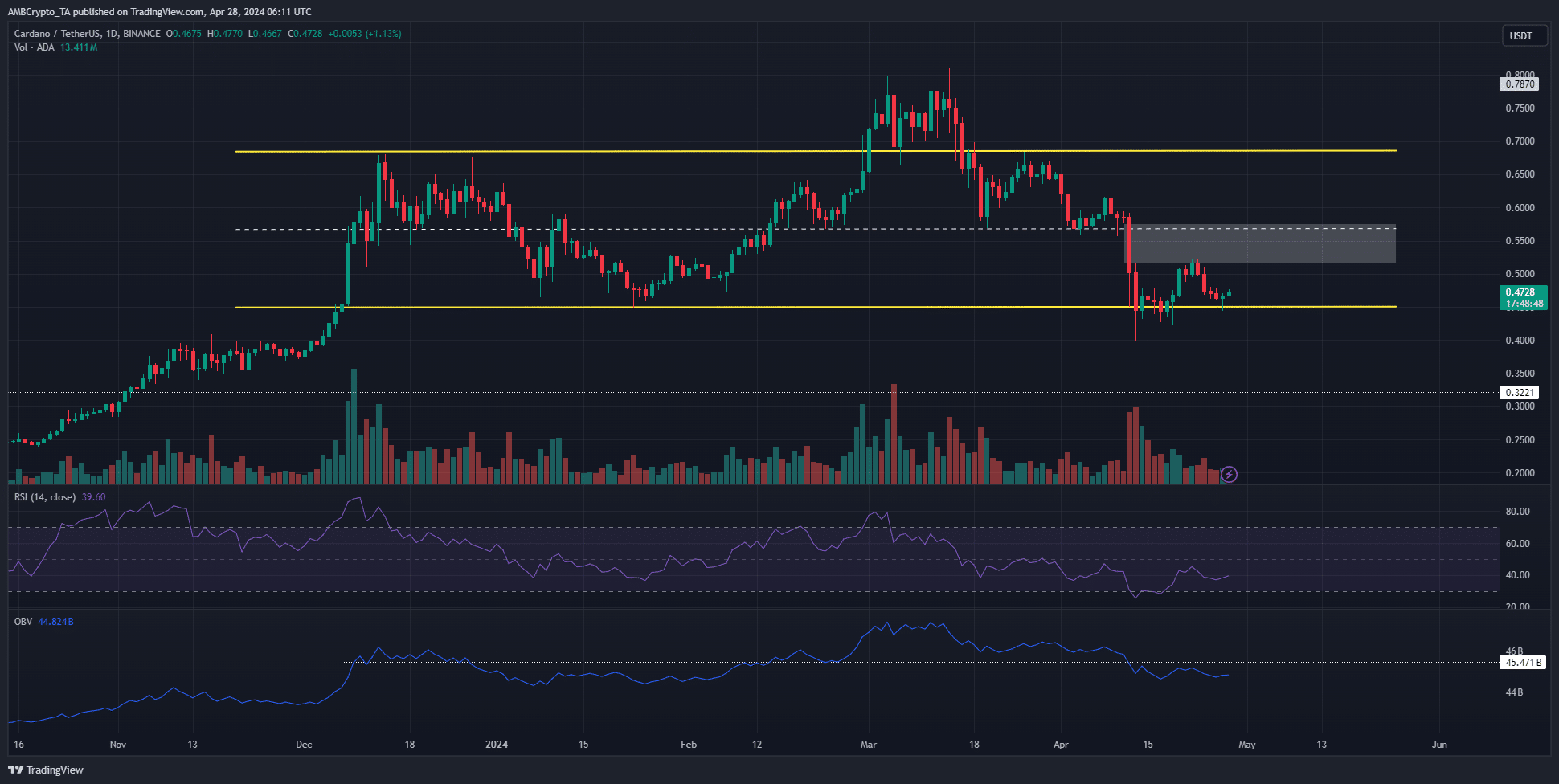

- Cardano has a bearish market structure after recently falling below $0.45.

- An immediate imbalance may result in the buyer’s recovery attempts being rejected.

Cardano (ADA) has fallen in value over the past month amid the DeFi and NFT sectors. User activity also declined along with ADA prices. The token formed a range between $0.45 and $0.685 levels.

AMBCrypto’s Cardano price prediction is bearishly biased. A short-term range is likely to form around the $0.5 level over the next week or two.

Bulls have little power in the market until $0.568 turns into support.

The combination of the fair value gap and the mid-range has created tremendous resistance.

Source: ADA/USDT on TradingView

The formation of a trading range over the past five months is clearly visible on the 1-day chart. The chances of ADA trending higher in Q2 2024 have been drastically reduced as the price falls below the important $0.568 support level.

This is equivalent to displaying mid-range values. At press time, prices were once again near the lows after being rejected from the imbalance (white zone).

RSI has been below neutral 50 for almost six weeks now.

This indicated solid downward momentum. OBV also fell below key support (white dotted line), indicating strong selling pressure.

Taking these factors together, Cardano price predictions point to a further downward trend, with $0.4 likely to be the primary demand area.

Likelihood of $0.5 being tested next

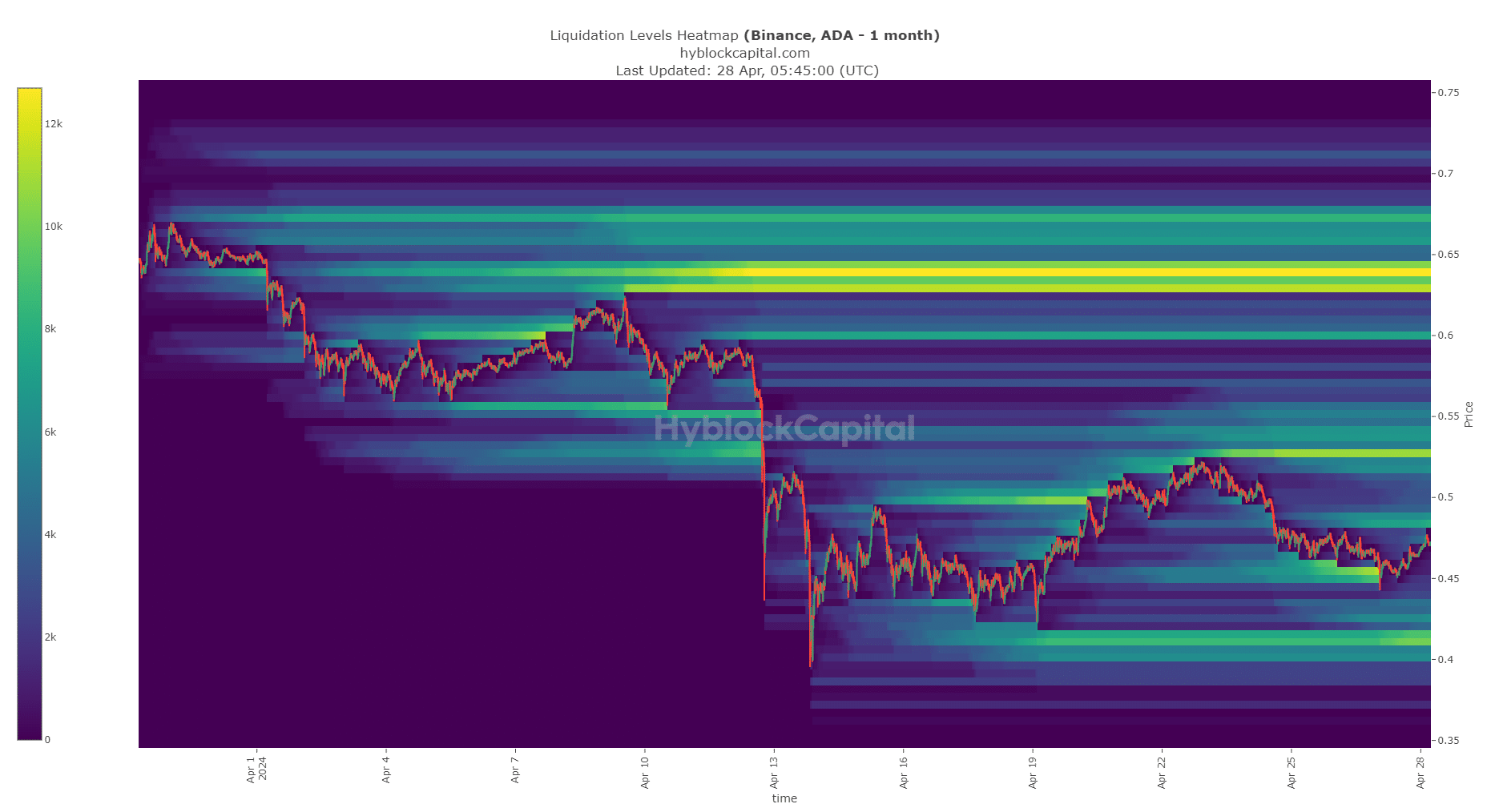

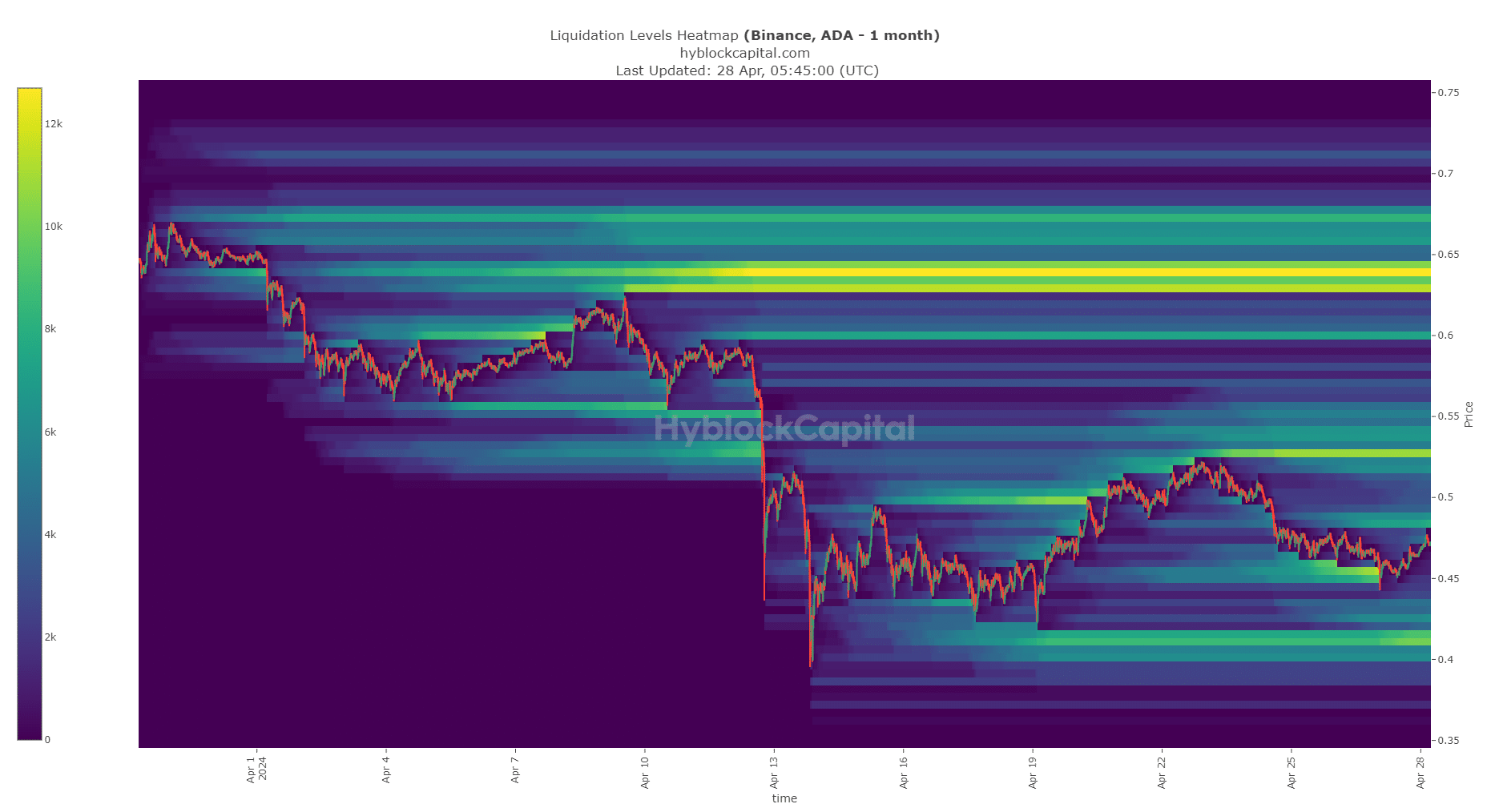

Source: Hiblock

Is your portfolio green? Check out our ADA Benefits Calculator

According to the liquidation heatmap, $0.483 and $0.527 appear to be the next areas of interest. Now that there was liquidity at $0.45, a move into the $0.5-$0.52 area seemed likely.

To the south, significant liquidation levels were also concentrated around the $0.41 level. Therefore, the $0.41-$0.51 level is likely to be the level at which Cardano is likely to trade this week.

Disclaimer: The information presented does not constitute financial, investment, trading, or any other type of advice and is solely the opinion of the author.