- The presence of MEV bots on the Solana network has increased significantly.

- While interest in NFTs has decreased, overall sentiment has decreased.

There has been a surge in activity on the Solana (SOL) network over the past few months. This surge in activity can be partially attributed to the overall interest in memecoin on the network.

MEV bot takes over

However, much of this activity was driven by MEV bots. Solana has surpassed Ethereum in MEV going to validators over the past two weeks, according to new data.

MEV bots are software programs that scan the blockchain for profitable opportunities related to trading orders. They can use things like arbitrage, buying at a low price and selling at a high price on another exchange.

They are also responsible for front-running, where these bots insert trades before other users in order to manipulate prices and take profits.

Source: X

High MEV bot activity is a sign that the ecosystem is growing, but there are some issues. High MEV activity can have a negative impact on the experience of all users, which may result in lower activity and sentiment towards the protocol over time.

Reducing this requires active efforts from the network to provide users with a better experience.

Another factor that could influence sentiment around the Solana network would be interest in the NFT sector. Solana NFT trading volume has decreased significantly over the past month.

At the same time, the total floor value of Solana NFTs has also decreased significantly.

Source: Solana Floor

Solana needs to attract more users to NFTs to improve the overall health of the ecosystem.

emotional decline

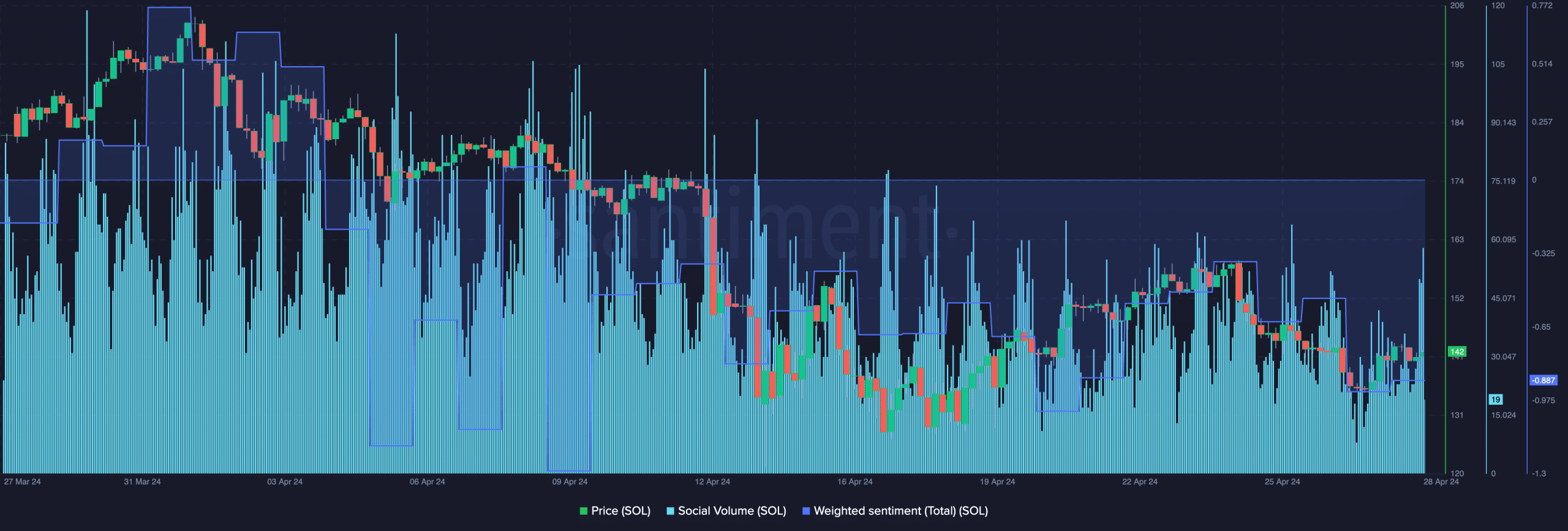

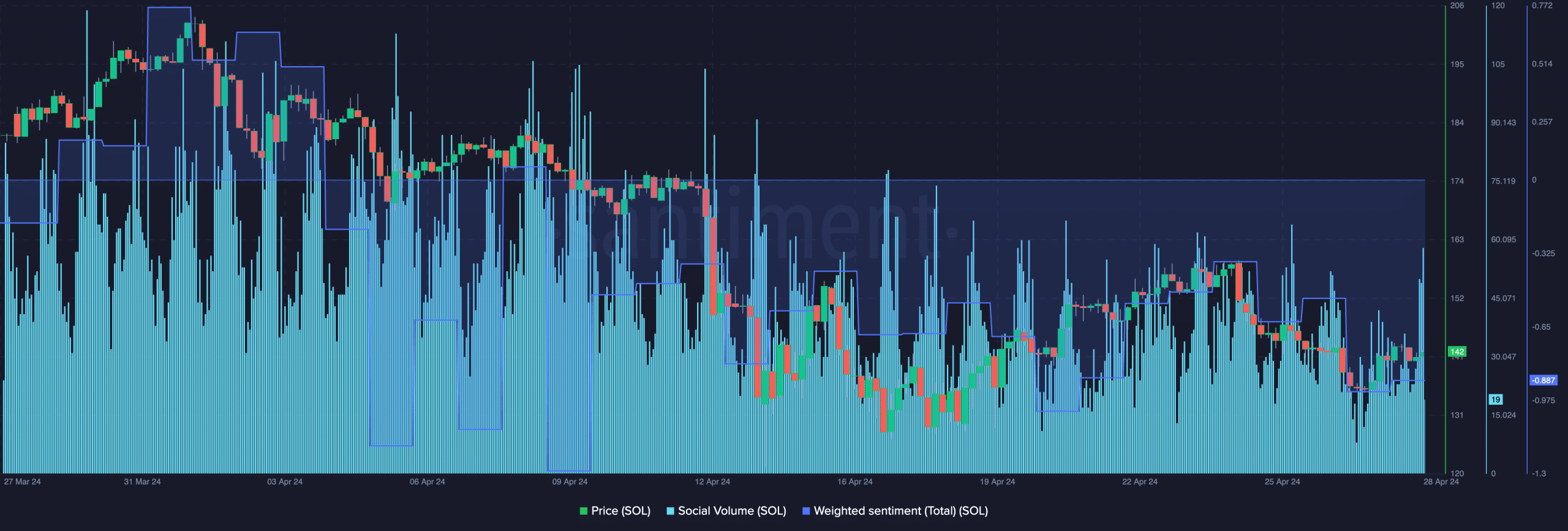

Looking at the tokens, we see that the price of SOL has decreased by 4.64% in the last 24 hours. Along with this, the social volume surrounding the SOL token has also decreased.

Declining social volume indicates a decline in the popularity of the SOL token over the past few weeks. Additionally, the weighted sentiment surrounding the token has also fallen.

Read Solana (SOL) price prediction for 2024-25

This suggests that at the time of writing, the number of negative comments on SOL outnumbered the positive comments.

Negative sentiment towards SOL could put downward pressure on the price of SOL in the future.

Source: Solana Floor