- Solana (SOL) is down 16.56% in 7 days.

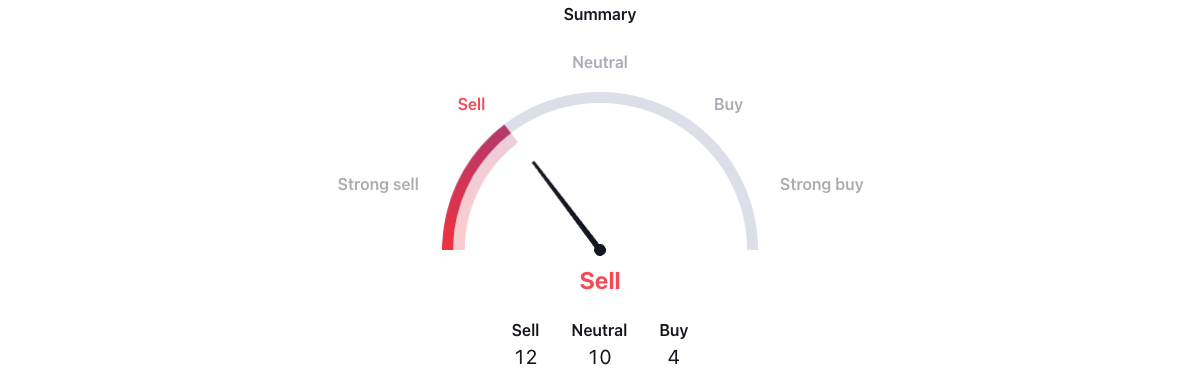

- Technical indicators provide sell signals.

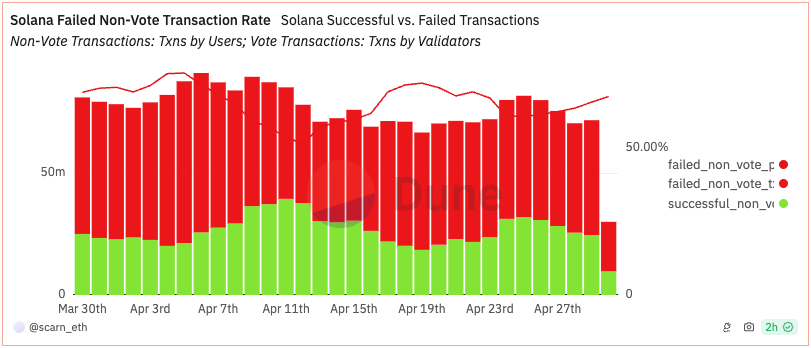

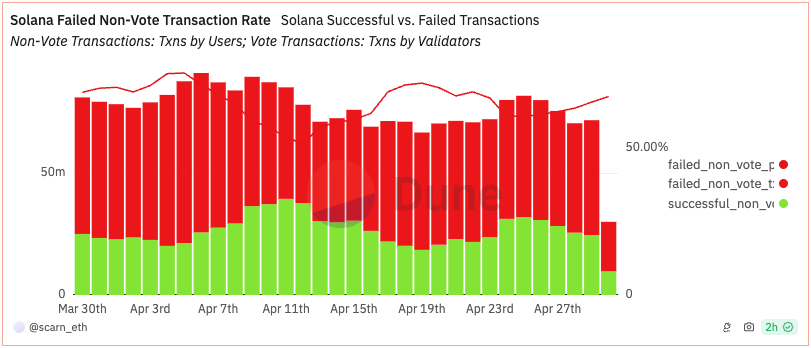

- Despite update attempts, the Solana network is still facing congestion.

The recent downturn in the cryptocurrency market is affecting most tokens, including Solana. High-performance blockchains are showing a noticeable decline after months of strong performance.

Coupled with the decline are worsening technical issues and ongoing congestion issues that still plague the network despite recent updates.

Solana’s tech decline, time to sell

Solana’s recent decline reflects the overall downturn in the cryptocurrency market. On Tuesday, April 30, Solana was trading at $128.41, with a daily decline of 4.74%. The token is also down 16.45% for the week compared to $154.5 last Tuesday. This decline has caused most of Solana’s technical indicators to turn bearish.

Most oscillators, including Relative Strength Index (RSI), Stochastic %K, and Awesome Oscillator, indicate a neutral position or sell action. RSI is 35.58, indicating a neutral stance, and Stochastic %K is also 25.91, indicating a neutral stance. The Awesome Oscillator registered at -22.48, reflecting a neutral mood.

Solana’s moving averages further confirm the bearish trend, while most indicators indicate selling action. Exponential moving averages (EMA) and simple moving averages (SMA) for various time periods such as 10, 20, 30, and 50 days indicate sell positions. In particular, the 200-day EMA and SMA are 112.09 and 103.08, respectively, suggesting a long-term buy signal.

The worsening technology has also been accompanied by ongoing congestion issues due to high DeFi and Memecoin traffic. Solana’s recent attempts to alleviate network congestion through updates have not fully resolved the ongoing problem.

Solana faces persistent network congestion.

Despite significant updates to fix “implementation bugs” related to the QUIC protocol, the network still faces issues. Even on Monday, April 29th, the transaction failure rate was still quite high at 65.75%.

This update was critical to improving network performance by prioritizing transactions from more invested network participants and adjusting the handling of staked and non-staked packets. However, the success of these updates will largely depend on widespread adoption by network validators, and continued high transaction failure rates suggest challenges remain.

This continued congestion will impact Solana’s reputation and could impact its long-term adoption by developers and investors. This is especially true in the DeFi and NFT sectors, where transaction efficiency is critical. Solana was particularly popular.

On the flip side

- Solana’s performance has closely followed that of the entire cryptocurrency market. For example, Bitcoin 9% loss Its value over the past seven days is currently trading at $60,800.

- So far, Solana investors have not reacted negatively to the congestion issues. Instead, the token largely followed the larger trends of the market.

Why This Matters

Solana’s recent struggles with network congestion and falling technical indicators could have a significant impact on its market position. As a high-performing blockchain that previously enjoyed strong performance, ongoing issues may deter developers and investors alike.

Learn more about the latest Solana updates:

Will the Solana update solve congestion? Here’s what it depends on:

Learn more about North Korea’s Lazarus hackers:

Lazarus Evading the Authorities: Blockchain and $200 Million Laundering