- Dogecoin fell 3.2% during Tuesday’s overall market decline.

- On-chain indicators provide mixed signals as DOGE hits monthly lows.

- After trading below $0.20 for three weeks, DOGE has seen its volume increase.

After a month of intense cryptocurrency market corrections, cryptocurrency bears have suffered heavy losses in Dogecoin (DOGE), resulting in a 33% monthly deficit. With the general cryptocurrency market losing 2% of its market cap this Tuesday, DOGE fell below the $0.14 support level for the first time since March 20, 2024.

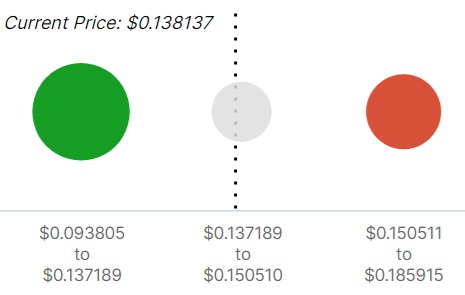

The support cluster shown in the center at the time helped DOGE hit a new yearly high of $0.22 a week later. This support bubble, which holds 6.44 billion DOGE across 232.28K addresses according to on-chain data from IntoTheBlock, is significantly smaller than the green colored bubble, representing a price range of $0.09 – $0.137.

DOGE’s price performance is consistent with that of Bitcoin (BTC), the leading cryptocurrency asset. Due to their high price correlation of 0.92, both assets fell below key support levels on Tuesday. Shiba Inu (SHIB) is also perfectly correlated with Dogecoin, as both assets are down 12.9% over the past seven days.

Bears & Bulls go head to head for DOGE.

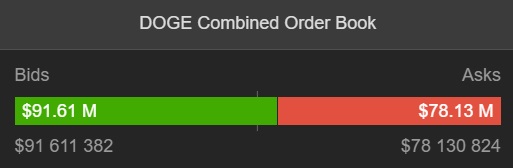

Despite the continued bearish trend, DOGE trading volume doubled in both spot and derivative cryptocurrency markets. For example, the top dog cryptocurrency saw a 15.26% increase in trading volume over the last 24 hours, totaling $1,789,809,872. According to real-time data from cryptocurrency research platform CoinPaprika, buyers have a $91 million to $78 million advantage over sellers according to the consolidated liquidity ledger.

Consolidated spot market liquidity statistics are favorable to the bulls, but key on-chain indicators include: ‘In the Money’ It suggests that the bear and the bull have not yet fought. For example, 18% of currently active addresses are profitable, while 21% of active DOGE custodians are in the red.

Two key on-chain signals favoring the Bears

According to Spot’s 7-day chart, the bears won 126 to 123, with a somewhat even double win in the derivatives markets. The overall long to short ratio is now 0.9387, meaning there are more short positions than long positions in DOGE. However, traders on major exchanges such as Binance and OKX appear to be very bullish on DOGE, sporting a long to short ratio of 4.13 and 4.45 respectively.

As of press time, DOGE, the largest proof-of-work (PoW) blockchain outside of BTC, is trading at $0.1369, according to CoinGecko. Down 3.2% in the last 24 hours, Dogecoin needs to stay above $0.145 at the daily close to reach the $0.20 price target, creating a symmetrical ascending triangle. Otherwise, a close below $0.14 could send DOGE to retest the green support cluster below $0.12.

On the flip side

- DOGE has not recovered the $0.20 price target since April 12, 2024.

- The previous two surges above $0.20 in March lasted no longer than three days.

Why This Matters

Dogecoin’s status as a long-term top 10 contender by market capitalization is supported by a large and active community and popular cryptocurrency figures.

Check out the latest cryptocurrency news on DailyCoin:

Has Ethereum’s Vitalik Buterin created a new form of mathematics?

Altcoin Season: Tips and Tactics for Market Research