Bitcoin (BTC) price has seen a significant decline over the past three days, which has pushed BTC below $58,000. Many people think this is the beginning of a bear market, but it is simply a cooling off period.

The medium- to long-term outlook for digital assets remains optimistic, and Bitcoin looks set to validate this in the coming weeks.

Bitcoin investors are still focused on HODLing.

Bitcoin price has fallen significantly over the past 48 hours after being flat for the past few weeks. The decline in the cryptocurrency market shocked investors, with nearly $600 million lost in two days.

However, looking at BTC on-chain indicators, it appears that this decline was expected and was just a brief pause in the long-term rally. Coin Days Destroyed (CDD) for 90 days shows that long-term holders (LTHs) are heavily anticipating further increases in the price of Bitcoin.

The lower recorded CDD levels mean that investors are likely to be less motivated to accumulate or spend their holdings as Bitcoin prices fall. This strengthens optimism about the recovery and confirms that the recent correction is just a market cooling and not the start of a bear market.

Read more: Bitcoin Halving History: Everything you need to know

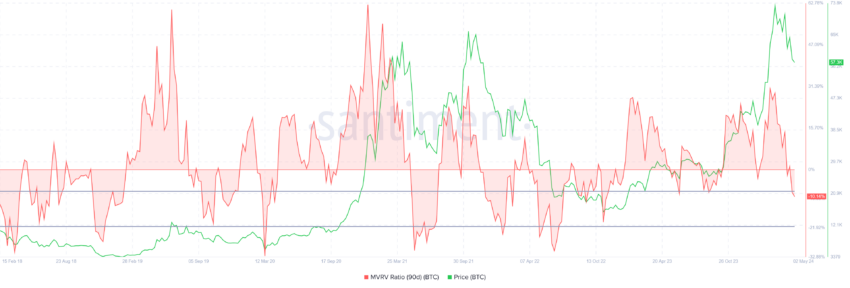

What further proves this is the Market Value to Realized Value (MVRV) ratio. The MVRV ratio measures profit or loss for an investor. With Bitcoin’s 90-day MVRV at -9.5%, implying a loss, investors are likely to hold off on selling or move towards accumulating BTC.

Historically, recoveries occur within a range of -8% to -21% MVRV, which often precedes rallies. Therefore, these zones are called accumulation opportunity zones.

If BTC holders act accordingly, the Bitcoin price could recover soon.

BTC Price Prediction: Bullish Flag Continues

Bitcoin price trading at $57,444 is reeling from a downtrend that has dragged BTC below $60,000. However, the digital asset is still above the lower trend line of the flag where BTC has been moving for the past two months.

The flag pattern is characterized by a sharp price movement followed by a period of consolidation in the shape of a rectangular flag. A breakout of the flag pattern indicates a continuation of the uptrend.

The Bitcoin price target based on the pattern remains at $92,505, which would represent a 45% increase above the breakout point. However, a more practical goal would be a rally above $73,700 to push BTC to new all-time highs.

Read more: What happened at the last Bitcoin halving? Forecast for 2024

For this to happen, Bitcoin price would first need to break the $68,500 barrier, turning the $71,800 resistance into a support bottom.

However, as BTC holders move to offset losses and sell their holdings, the cryptocurrency may cross the lower trend line. This would cause the Bitcoin price to fall below $52,000, effectively invalidating the bullish outlook.

disclaimer

In accordance with Trust Project guidelines, this price analysis article is provided for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate and unbiased reporting, but market conditions may change without notice. Always do your own research and consult with a professional before making any financial decisions. Our Terms of Use, Privacy Policy and Disclaimer have been updated.