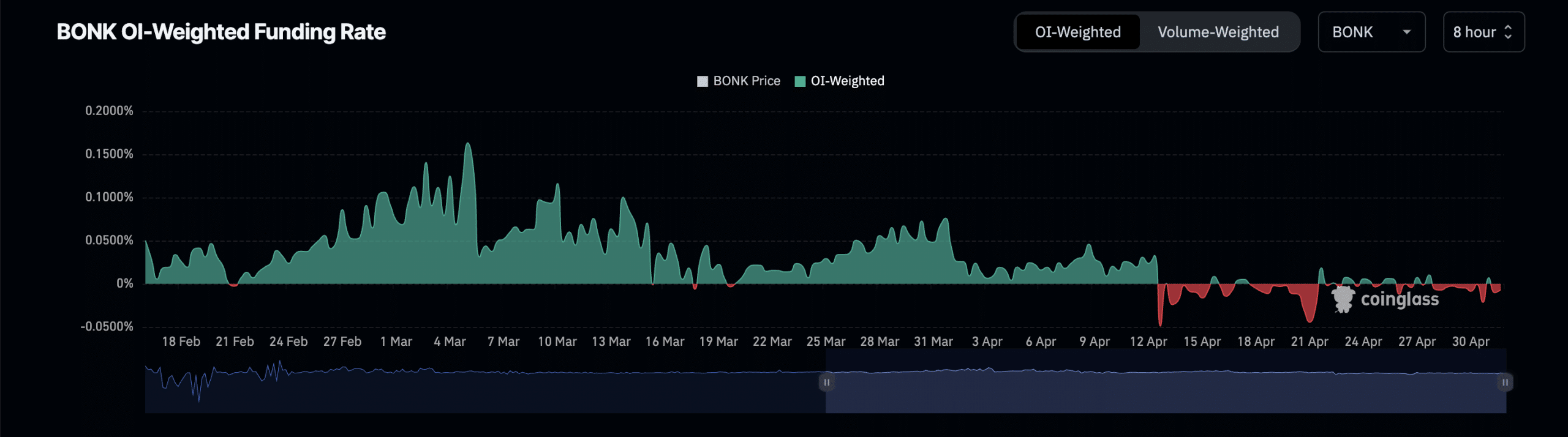

- BONK’s funding interest rate has been mostly negative since April 13th.

- If bearish momentum picks up, the price may fall further.

It is said that the recent decline in the value of Bonk (BONK) was accompanied by a negative funding rate in the meme coin futures market. coin glass.

The funding rate is a mechanism used in perpetual futures contracts to ensure that the contract price remains close to the spot price.

When the futures funding rate for an asset turns negative, it means there is strong demand for short positions. This is considered a bearish signal and a precursor to falling asset prices.

BONK’s funding ratio across cryptocurrency exchanges has been primarily negative since April 13, according to Coinglass data.

Source: Coinglass

At the time of this writing, it was -0.0068%. This value shows that in the BONK futures market, there are more traders who expect the price to fall than those who buy memecoin with the expectation that it will sell at a higher price.

Looking at futures open interest, we have seen a similar downward pattern since April 26th. At press time, Memcoin futures open interest was $6 million, down 33% in the past week.

An asset’s futures open interest refers to the total number of futures contracts that have not yet been settled or terminated. A decline in this way means that the number of market participants who are closing positions rather than opening them has increased.

This is also considered a bearish signal.

What can BONK do next?

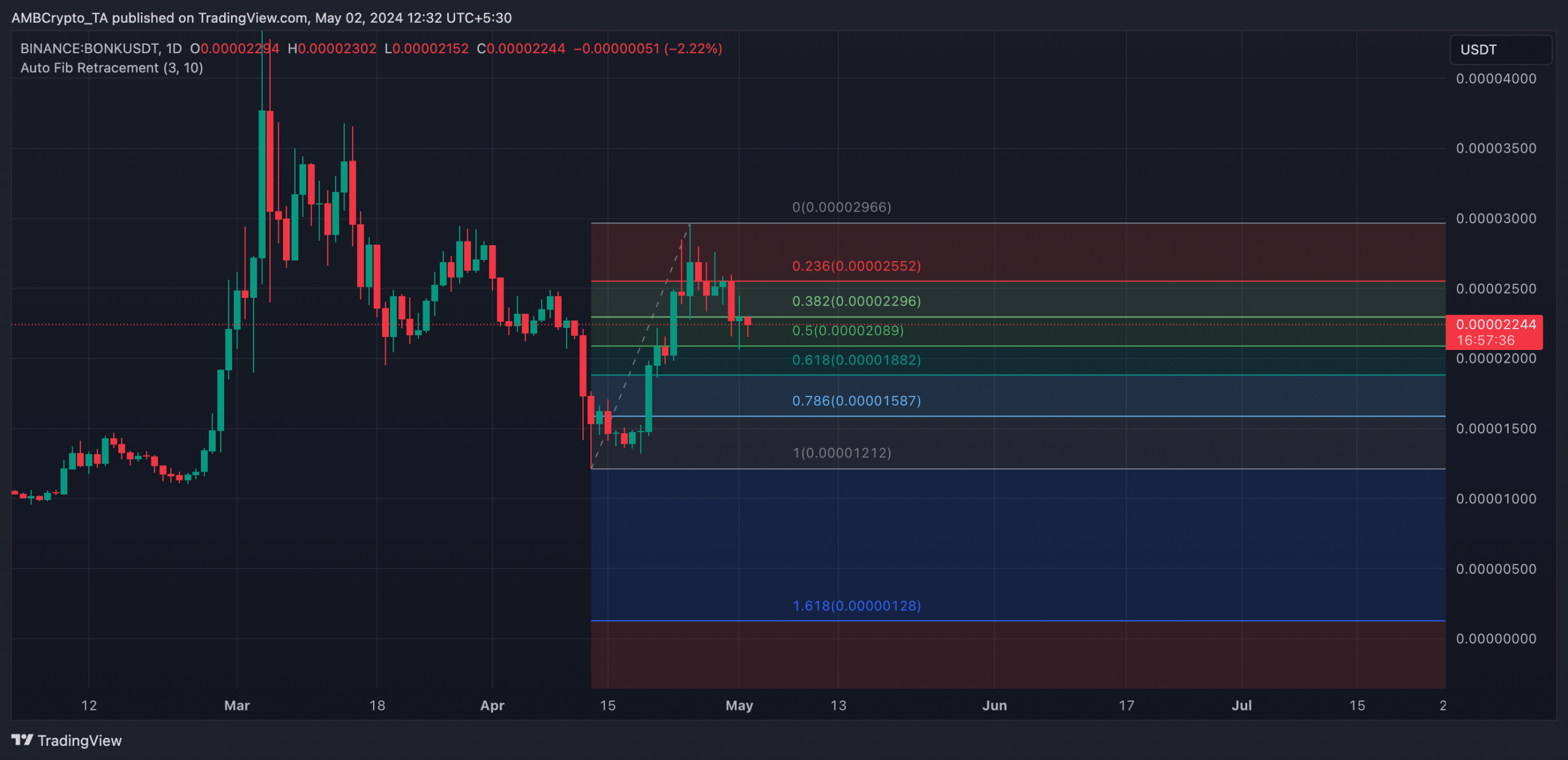

BONK witnessed a brief price rally between April 20th and 25th, which pushed the price above the support line.

By April 25th, Memcoin’s rally had hit a snag as it was unable to overcome the resistance level of $0.000029. It then trended downward toward a retest of support.

However, a surge in bearish momentum pushed BONK below support to close at $0.000018 on May 1.

Source: BONK/USDT on TradingView

If bear power continues to rise, Mim Coin could experience further declines to exchange hands at $0.000015. If the bulls fail to regain control at this point, the price of BONK could fall further, with memecoin trading at $0.000012.

However, if the bullish momentum surges, the coin could retest the support and bounce back to reclaim the resistance at $0.000029.