- As the token price rose significantly, ADA trading volume surged.

- Despite the price surge, most holders failed to make a profit.

Over the past few days, there has been a resurgence of interest in ADA, the Cardano (ADA) token. According to recent data, ADA’s 24-hour trading volume exceeds $550 million.

Source: X

There’s a long way to go

Along with the increase in trading volume, we have also seen growth in terms of price movements. In the last 24 hours, the price of ADA has surged 4.43% and is trading at $0.4498 at the time of writing.

Despite the recent price surge, the overall picture for Cardano remained good.

Beginning March 15, the price of ADA began a downward trajectory, showing several lower lows and lower highs.

This indicates a bearish trend that ADA has been unable to reverse over the past few months.

To reverse this trend, ADA may need to test and surpass the $0.5761 level. However, at the time of this writing, the ADA has not reached this level.

Even though ADA has a long way to go, ADA indicators have shown a positive picture.

Chaikin Money Flow (CMF) for ADA soared to 0.6, showing a sharp increase in funds flowing into ADA.

Additionally, ADA’s Relative Strength Index (RSI) has also increased, indicating a surge in the token’s bullish momentum.

Although these factors may give ADA holders a somewhat optimistic outlook, it is important to consider that a huge price increase would be needed before a trend reversal could occur.

Source: Trading View

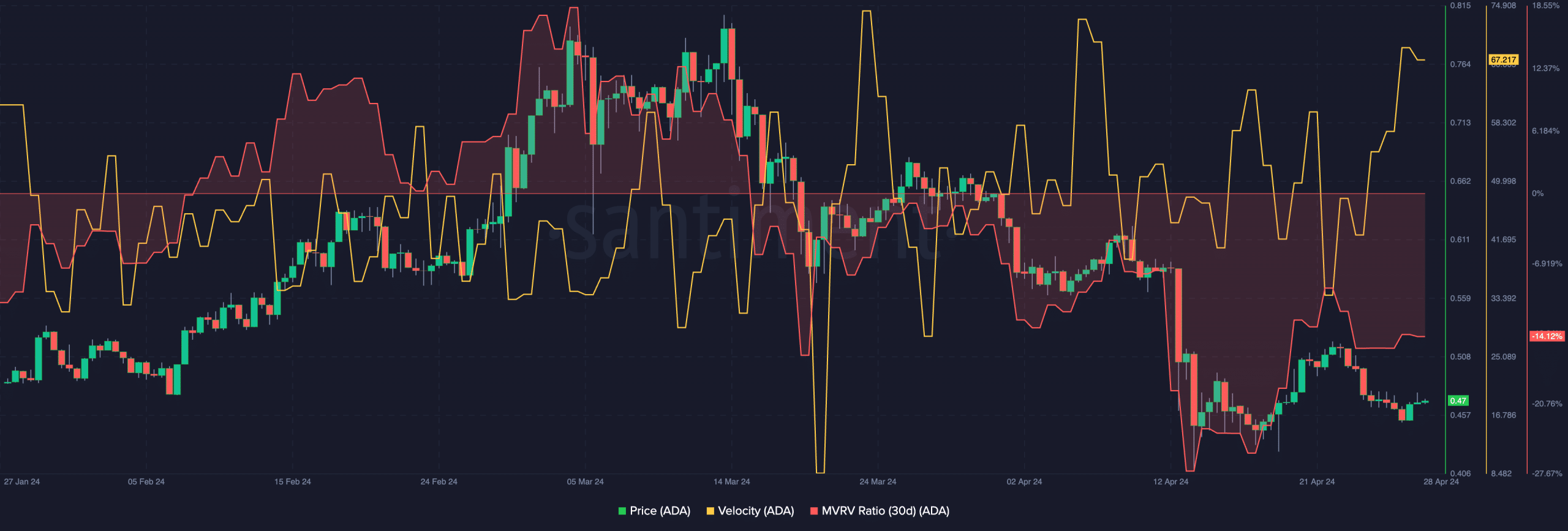

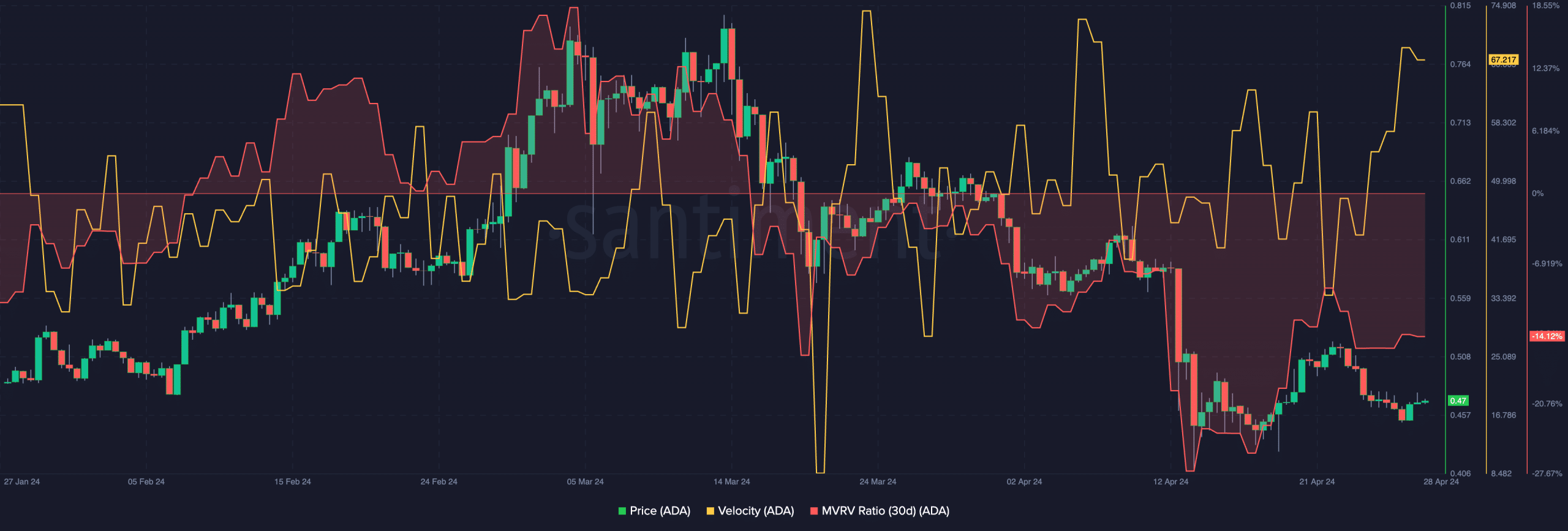

On-chain activity

On-chain data shows a significant increase in transaction speeds for ADA.

This means that ADA’s trading frequency has spiked, which could be a positive sign for the altcoin. Moreover, despite the price surge, the MVRV ratio remained negative.

Read Cardano (ADA) Price Prediction for 2024-25

A negative MVRV ratio indicates that most holders are not making a profit at the time of this writing. This gives holders no incentive to sell and reduces selling pressure on ADA tokens.

The price of ADA may continue to rise until holders reach profitability. A correction may be expected once the holder reaches a stage where he or she can sell his or her holdings for some profit.

Source: Santiment