In recent weeks, Ethereum has shown subtle signs of recovery, with altcoins mimicking Bitcoin’s gradual upward trend amid a generally bearish cryptocurrency market.

Despite the price of Ethereum rising slightly by 0.2% over the past 24 hours, a parallel trend is unfolding beneath the surface that could have a major impact on Ethereum’s economic model.

Reduced ETH consumption due to reduced network activity

In April, Ethereum’s ETH burn rate hit a yearly low, largely due to a significant decrease in network transaction fees.

These fees have typically fluctuated just below 10gwei this year, but in recent weeks the fees have fallen to their lowest levels, directly impacting the rate of ETH burns.

This reduced burn rate is evidenced by a sharp decrease in ETH burned per day. It reached a low of 671 ETH last day, which is a notable decrease from the daily figure of 2,500-3,000 ETH earlier this year.

This decrease in burn rate is not simply a statistical anomaly, but reflects broader changes within the Ethereum network.

An important factor contributing to lower gas rates is migrating network activity to Layer 2 solutions. This improves transaction speeds while lowering costs.

Moreover, innovations such as Blob transactions introduced in Ethereum’s recent Dencun upgrade have further optimized the cost of these secondary layers.

In particular, Blob is a feature introduced to improve Ethereum’s compatibility with layer 2 solutions such as zkSync, Optimism, and Arbitrum by efficiently managing data storage requirements. This feature is part of the Dencun upgrade that incorporates proto-danksharding via EIP-4844.

These technological advances help reduce transaction fees, but they also pose challenges to Ethereum’s deflation mechanism.

This upgrade introduces a new fee structure where the base fee, which is a portion of every transaction fee, is burned, potentially reducing the overall ETH supply. However, the reduction in transaction fees will alleviate the expected deflationary pressure through burning, suggesting a shift toward a more intensified inflation trend in the short term.

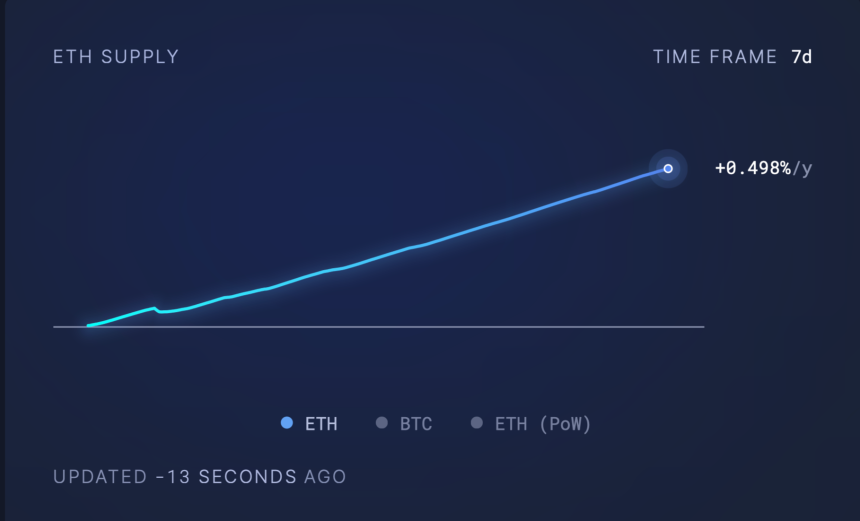

According to Ultrasoundmoney, Ethereum’s supply dynamics have shifted into a mildly inflationary mode with a growth rate of 0.498%. As network activity intensifies, these changes may be rebalanced, leading to increased transaction fees and ultimately higher burn rates.

Ethereum market reaction

Despite these underlying network dynamics, Ethereum’s market price has struggled to recover its previous highs above $3,500. The asset trades at around $3,085, reflecting a slight decline in recent weeks.

These price trends highlight the broader market’s response to internal network changes and external economic factors, including regulatory struggles at the U.S. Securities and Exchange Commission (SEC) and macroeconomic uncertainty.

Going forward, the trajectory of Ethereum’s gas fees and resulting ETH burn rate will be important in determining the sustainability of its economic model.

Featured image by Unsplash, chart by TradingView