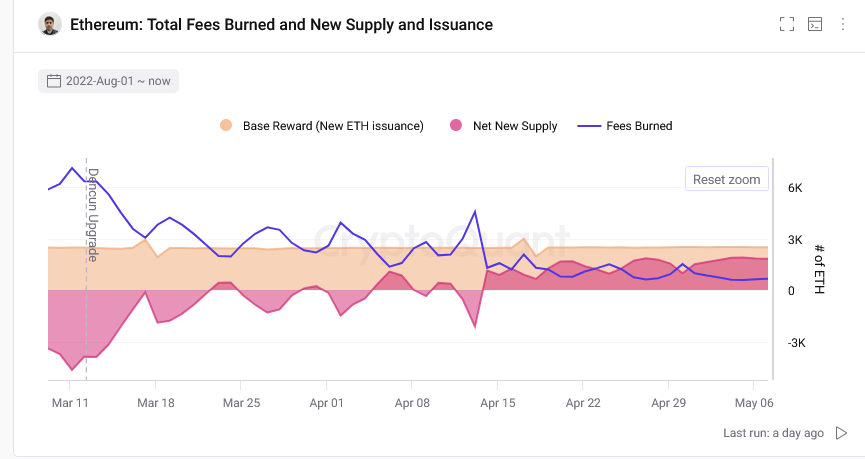

Researchers at CryptoQuant, a cryptocurrency analysis platform, have now disprove It occurred to me that Ethereum was a “supersonic currency,” especially after activating the highly anticipated Dencun upgrade in mid-March.

Analysts have observed that hard forks have slowed down the number of coins moving into the “melting pot.” So, considering the increase in daily supply over the past few weeks, ETH is now in a more deflationary state.

How Dencun Affects Your Gas Bill

Analysts say the Dencun upgrade is one of the major updates after The Merge. With Dencun, Ethereum developers introduced proto-danksharding for more efficient and cheaper transaction processing, especially on layer 2 platforms like Arbitrum.

This update not only helps reduce gas fees for layer 2 solutions, but also improves mainnet scalability. This allows the base layer to process more transactions without congestion or spikes in gas bills.

Layer 2 gas rates have fallen sharply, but more activity has been recorded for Arbitrum, Optimism, and Base. However, the issue of lower gas fees for Layer 2 transactions, the bundled and confirmed mainnet, means that Ethereum is now increasing fewer coins.

Therefore, ETH will gradually become inflationary after months of declining supply, reflecting the adoption of mainnet and off-chain solutions.

The rate at which ETH became deflationary before Dencun meant that the “ultrasonic money” story was valid. A sharp decline in supply could cause ETH to become a store of value like BTC or gold.

Ethereum Is Inflationary: Study

But CryptoQuant data now paints a worrying picture. According to the report, lower gas fees on layer 2 platforms result in lower ETH being pulled from supply.

These “structural changes” discovered by the researchers mean that ETH supply is no longer declining as quickly as before. In their evaluation famous In recent days, ETH supply has been growing at the fastest daily rate since the merger.

If ETH burn rates continue to drop at this rate, Ethereum may no longer fall into a state of deflation. This is especially true if activity shifts to cheaper, more scalable competing networks like Solana and Avalanche, as has happened in the past.

Falling Ethereum and Bitcoin prices will further worsen burn rates. Whenever prices fall, on-chain activity tends to decline dramatically over time.

Featured image from Canva, chart from TradingView