- The price of RNDR has risen slightly over the past 24 hours.

- Selling pressure on AI tokens has increased recently.

After a large weekly meeting, Render (RNDR) The overall cryptocurrency market suffered a setback as it turned somewhat bearish. However, in the last few hours, investors’ attention has been focused on the token’s chart turning green.

Does this mean RNDR will soon resume its upward rally?

RNDR hits the brakes

According to CoinMarketCapRNDR investors had a good time last week as the price of the AI token surged nearly 20%, leading to a correction on May 11.

The downward price trend was short-lived as the daily chart of the token turned green again. At the time of this writing, Render has a market capitalization of over $4.2 billion and is trading at $10.90.

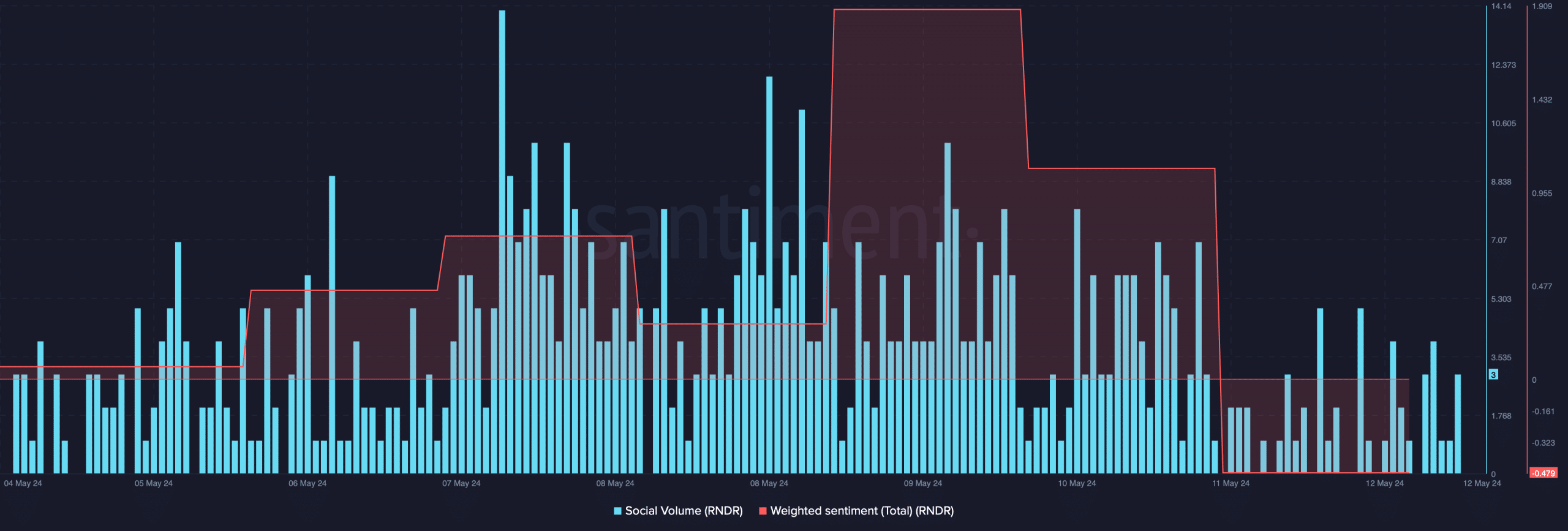

To see if this is a sign that RNDR is resuming its rally, AMBCrypto analyzed the metrics. It’s surprising that RNDR’s social volume declined last week, despite the massive weekly rally.

Weighted Sentiment on May 11 was also negative, indicating that bearish sentiment is dominating the market.

Source: Santiment

In fact, while the token price remained strong, investors may have thought the token was at the top of the market as they began selling.

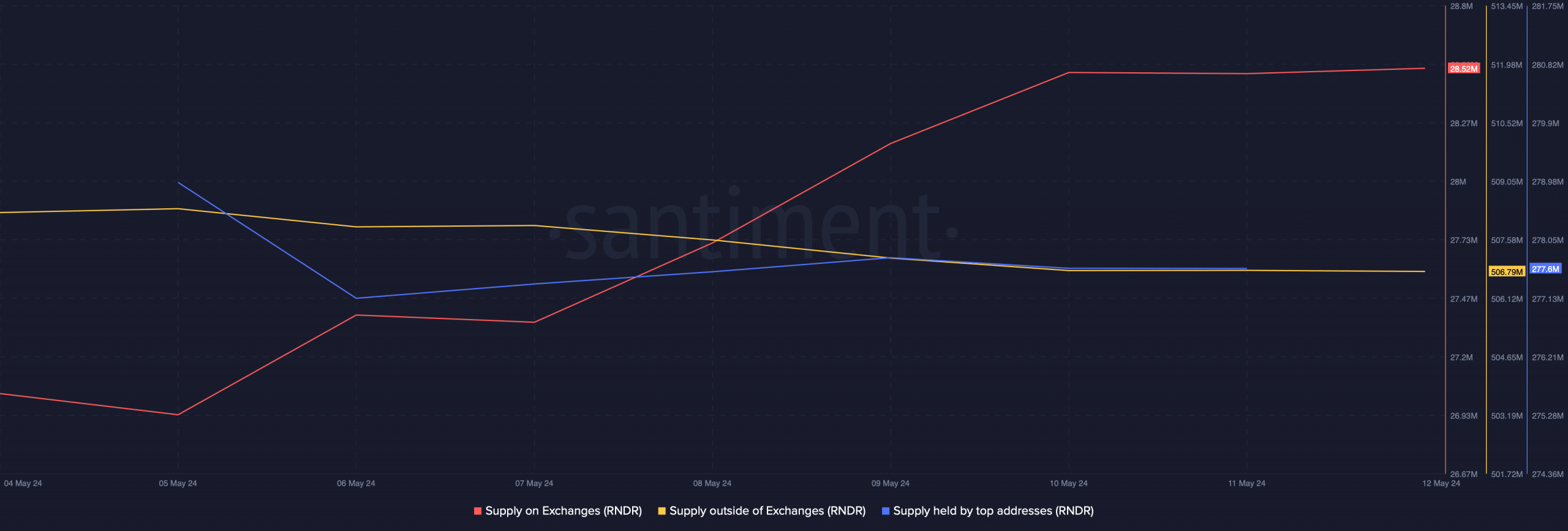

AMBCrypto’s analysis of Santiment’s data shows that exchange supply of RNDR increased significantly last week.

Meanwhile, supply outside of exchanges has declined, further proving that selling pressure has been high.

Additionally, the supply of Render held by top addresses has decreased slightly, suggesting that top players in the cryptocurrency market are selling.

Source: Santiment

The render bull market is over

The aforementioned indicators showed a downward trend, but things could change. Crypto Tony, a popular cryptocurrency analyst, recently posted the following: Twitter He mentioned how he expects AI token season to arrive.

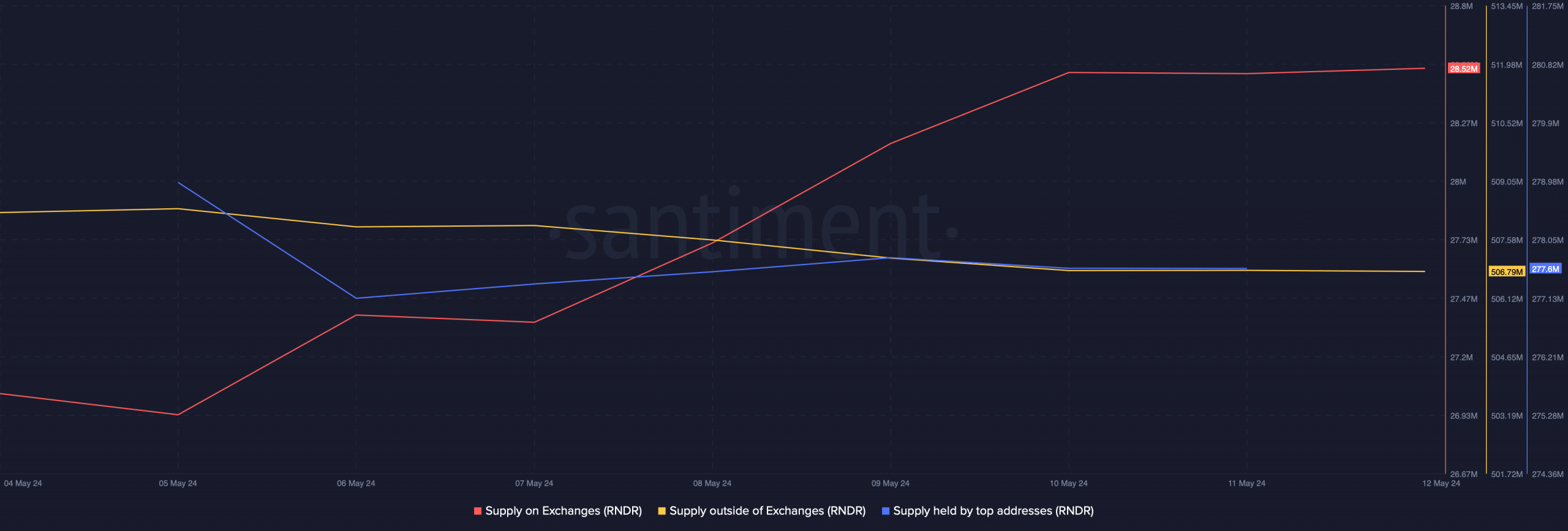

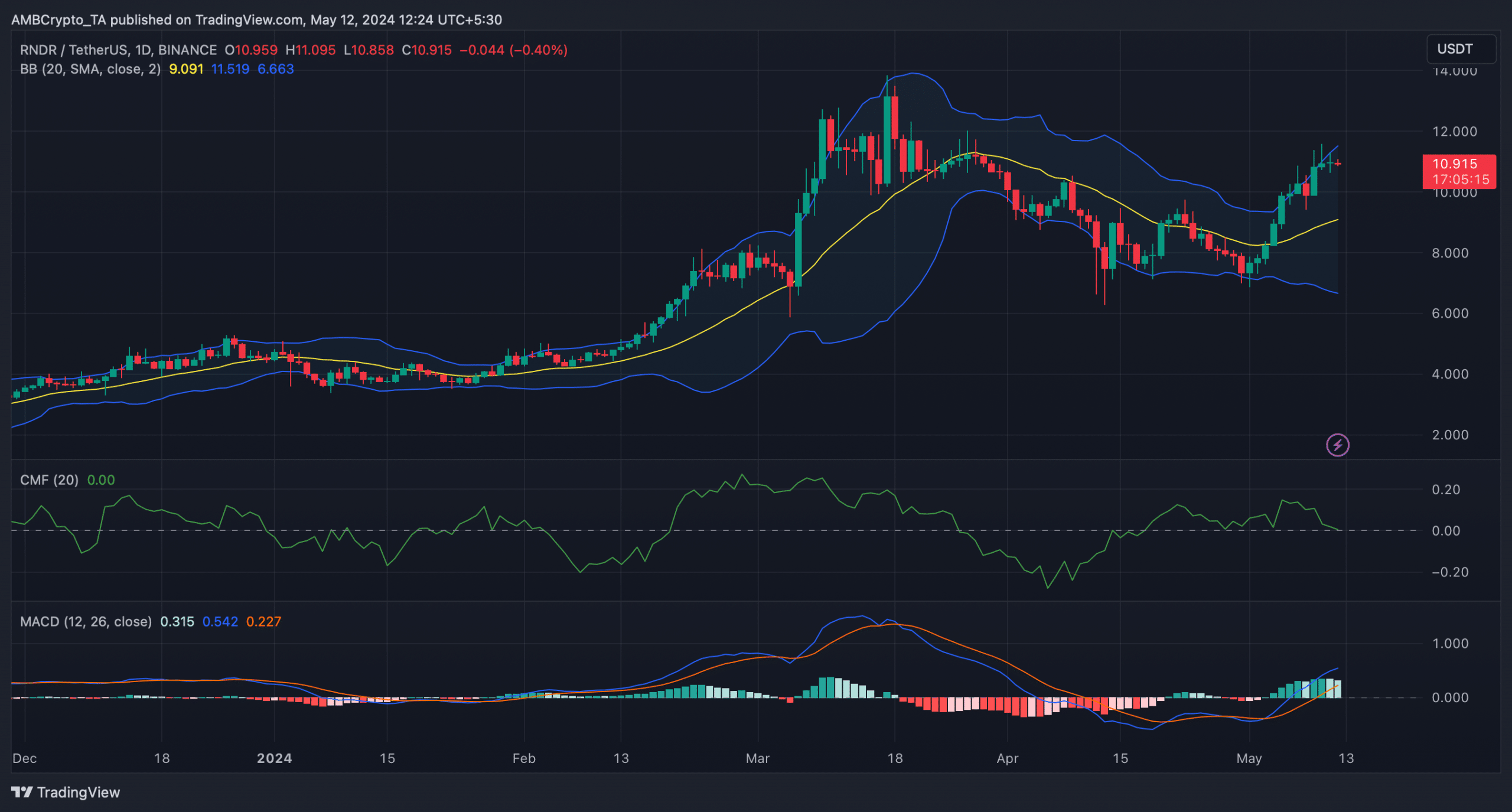

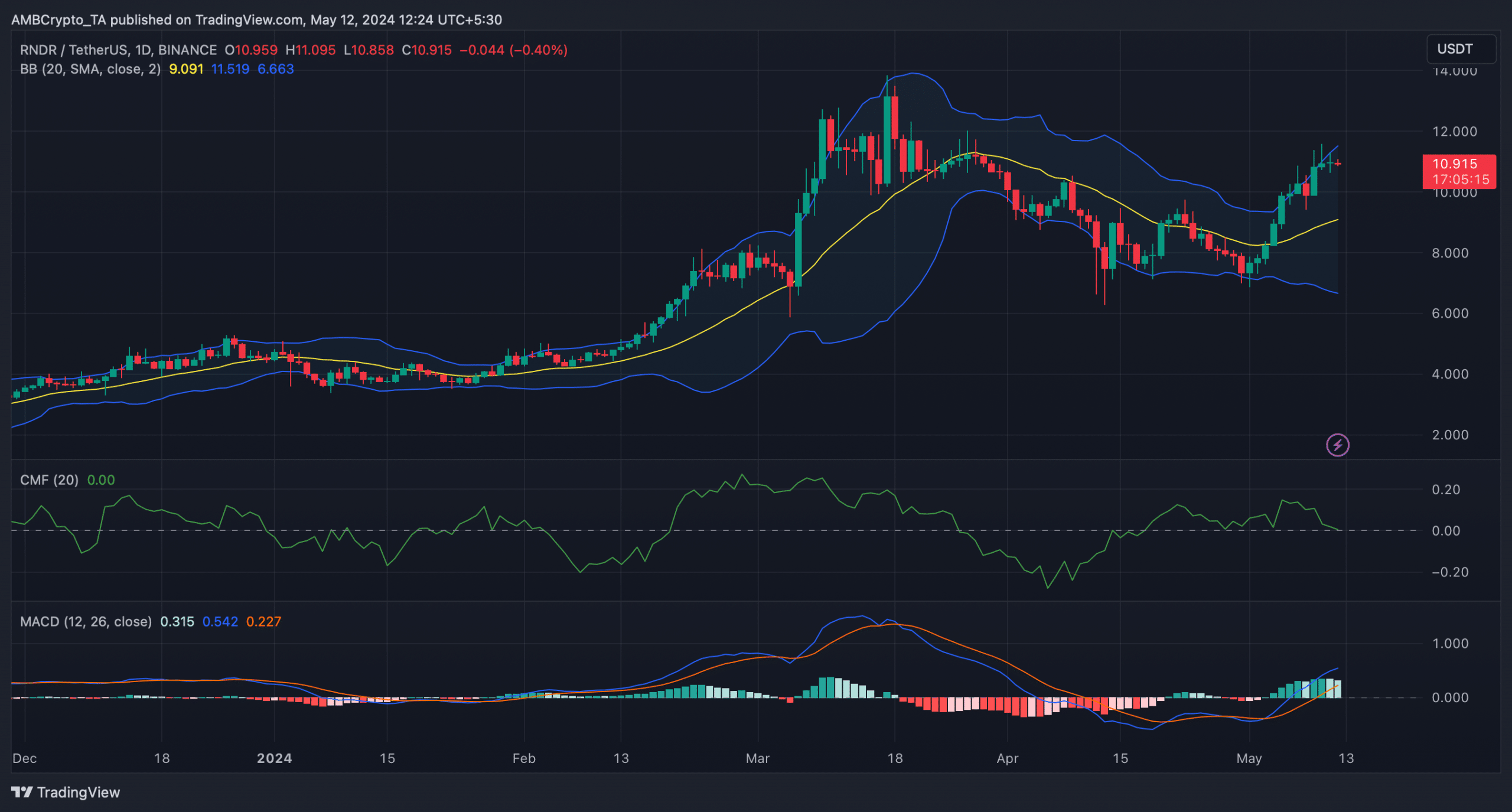

To determine whether such a possibility is likely to occur in the near term, AMBCrypto took a look at RNDR’s daily chart. Analysis shows that MACD has a clear bullish lead over the market.

The price also remained well above the 20-day simple moving average (SMA), which can be inferred as a bullish signal.

Source: TradingView

Nonetheless, the rest of the indicators showed otherwise. For example, token prices often hit the upper limit of Bollinger Bands, resulting in price corrections.

read Render (RNDR) Price Prediction From 2024 to 2025

Chaikin Money Flow (CMF) also recorded a sharp decline and was heading below the neutral line at press time.

These two indicators hinted that Render Bear is taking things a step further and could push the price of the token lower in the near term.