- Ethereum has shown a bearish market structure and could be heading to $2.5k.

- As selling pressure increased, OBV fell below key levels.

Ethereum (ETH) has been in a bearish trend on the daily time frame after falling below $3,000 six weeks ago.

Reports that applications for a spot Ethereum exchange-traded fund (ETF) in the US are likely to be rejected will strengthen bearish sentiment in the market.

Analysts predicted that if rejected, the price of Ethereum would fall much lower in the coming months. This is consistent with technical analysis, but it is unclear how long the downtrend will last.

Bear market structure continues to falter

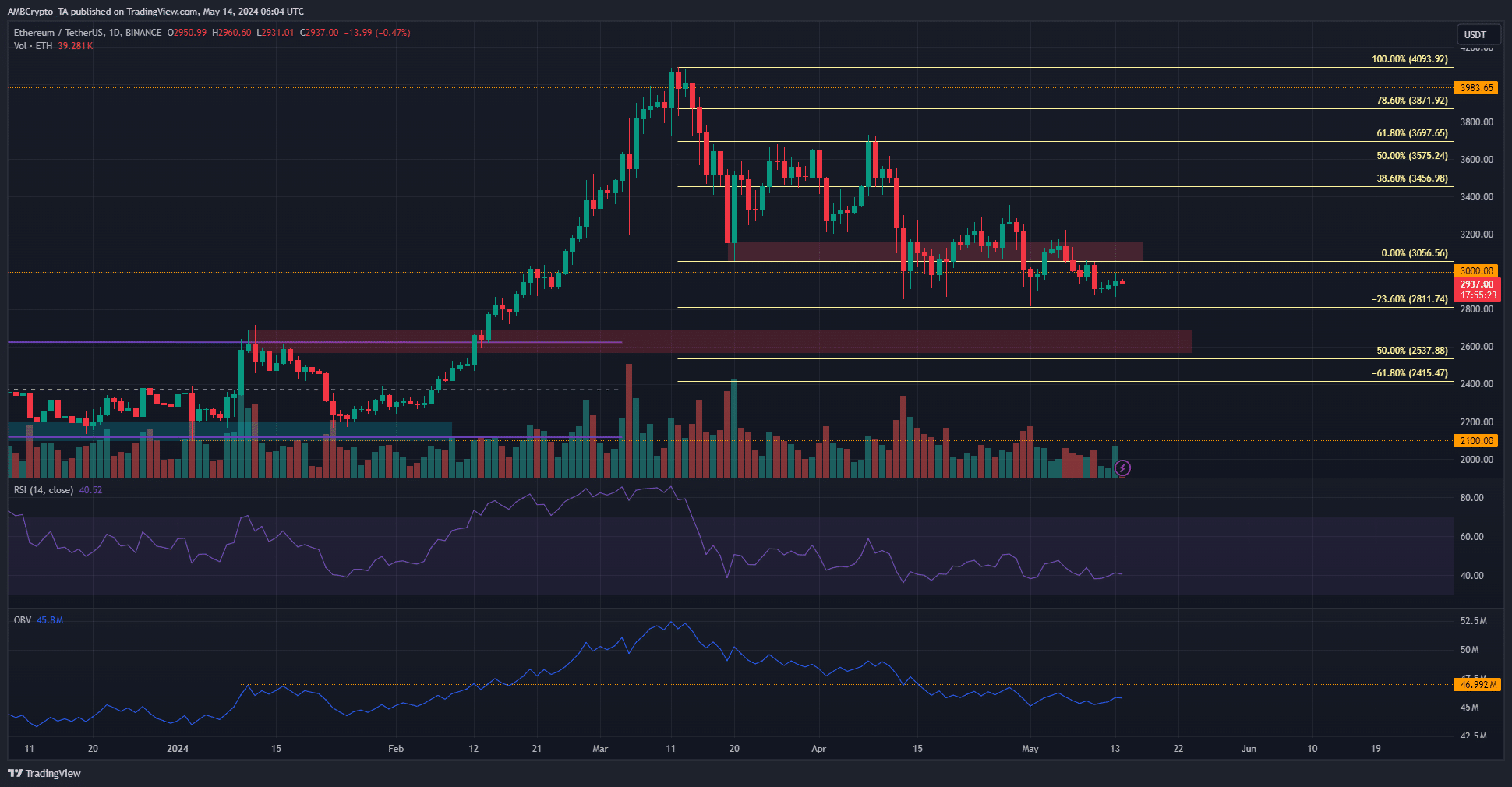

Source: ETH/USDT on TradingView

A series of Fibonacci retracement levels were marked based on ETH’s decline from $4093 to $3056.

ETH fell below the $3,000 level in mid-April, although this move did not change the market structure of higher periods to bearish.

This caused the structure to waver bearishly and OBV to fall below significant levels. At press time, the $3,000 resistance zone was strong and the RSI reading was weak at 40.5.

Ethereum price prediction shows a fall below $2.8,000 is likely, given Fibonacci extension levels.

The 50% and 61.8% expansion levels could be tested, but it is unclear whether Ethereum will have a V-reversal or consolidate at those levels.

The liquidity chart shows that the short-term rebound is over.

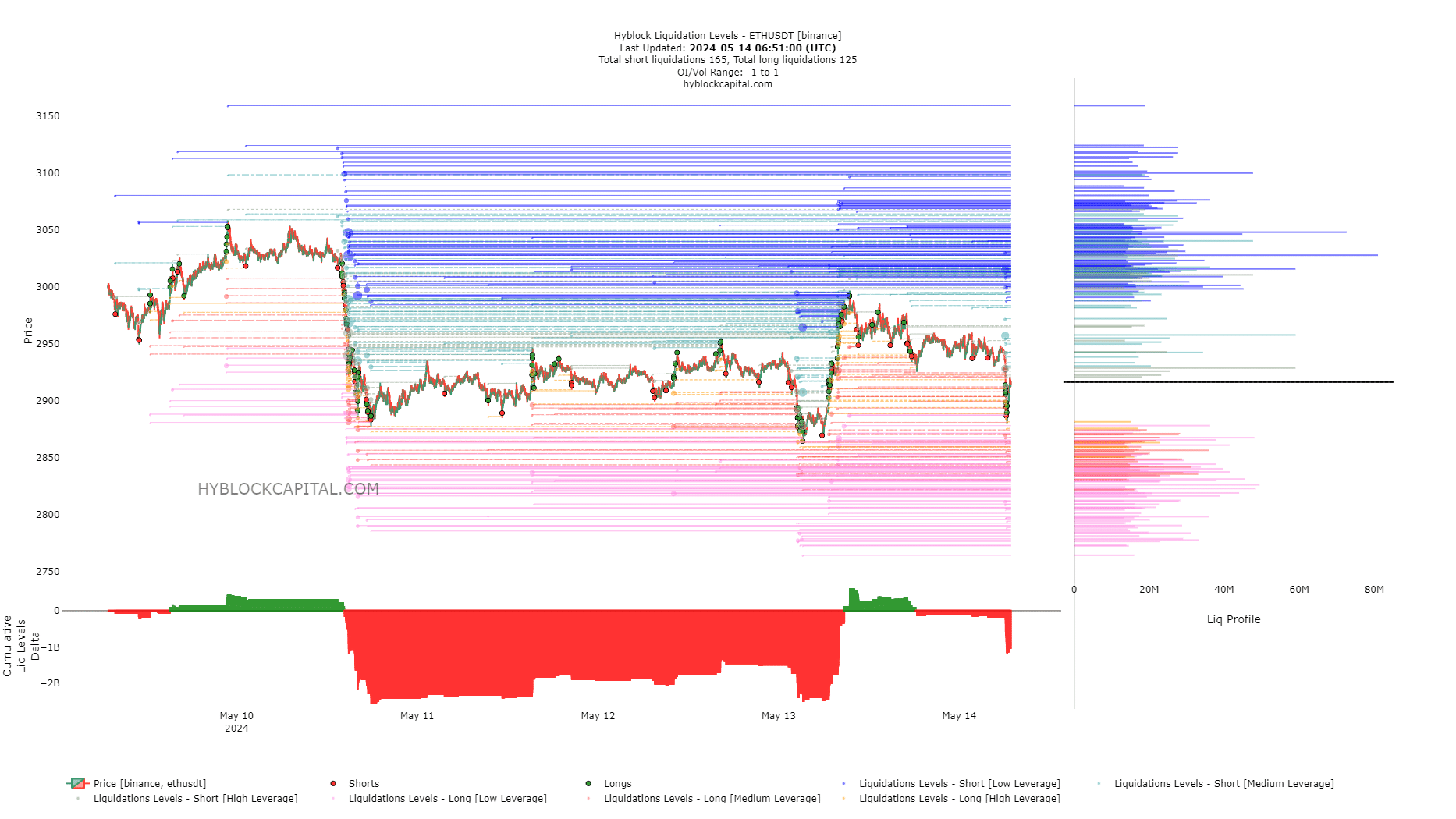

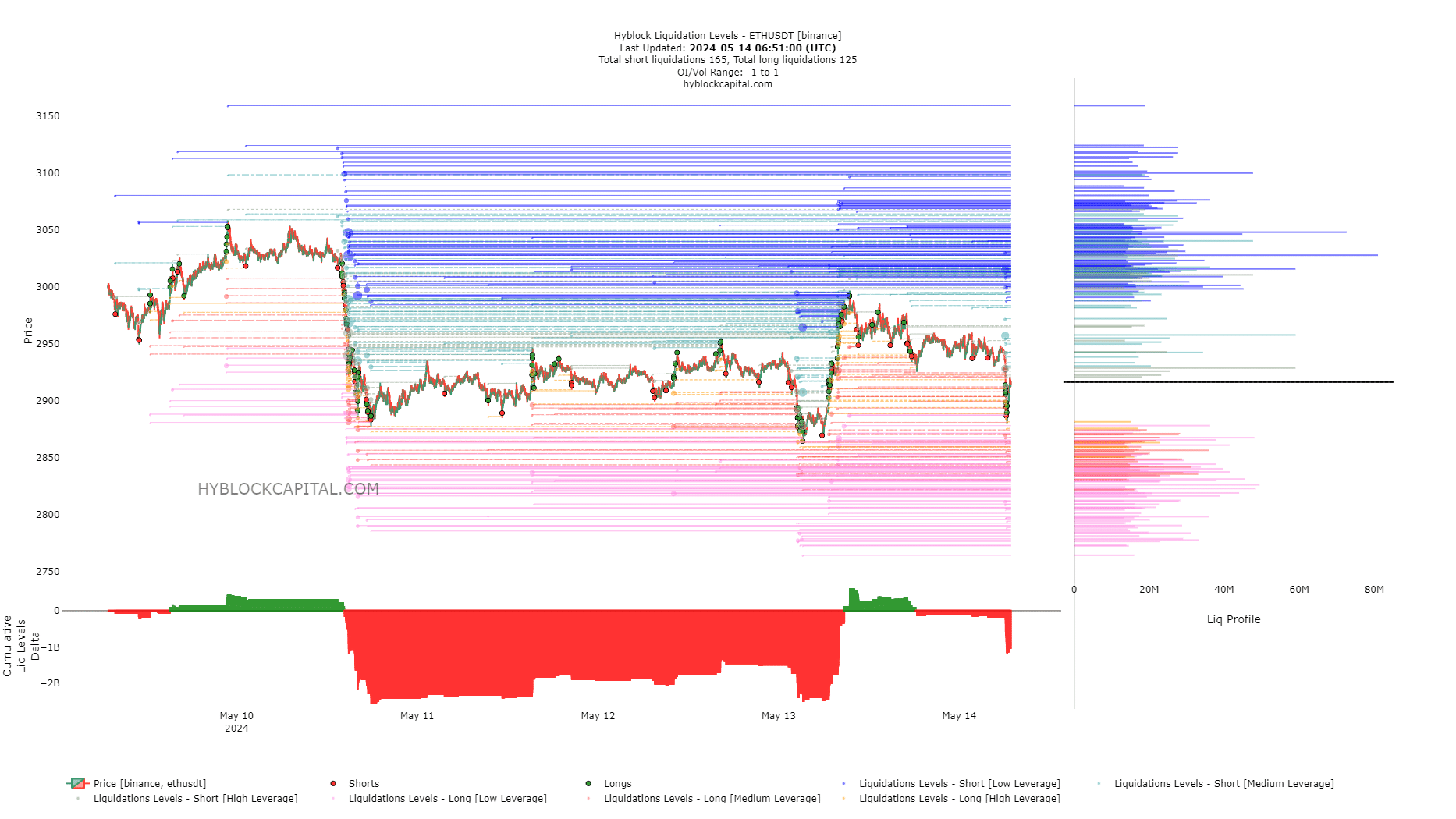

Source: Highblock

Just over 24 hours before writing, cumulative Liq levels were very negative. This indicates that sell liquidations outnumbered buy liquidations.

Read Ethereum (ETH) Price Prediction for 2024-25

A few hours later, the price rebounded from $2,870 to $2,990, crowding out late short sellers.

At press time, cumulative liquid levels were negative but less extreme. So there is room for prices to move further south. The $2840 region is the short-term Ethereum price prediction target.

Disclaimer: The information presented does not constitute financial, investment, trading or any other type of advice and is solely the opinion of the author.