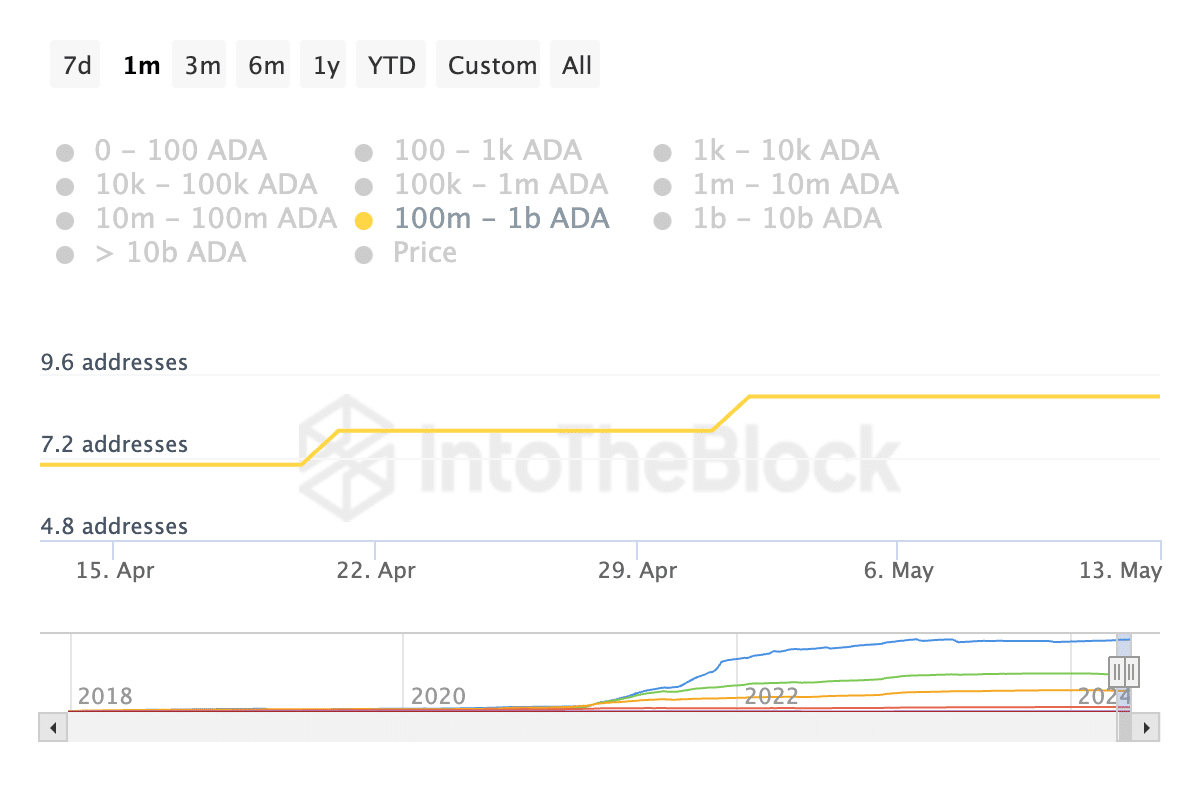

- The number of ADA whales holding between 100 and 1 billion coins has increased in the last month.

- However, the price of ADA is still suffering due to bearish sentiment.

Whale activity in Cardano (ADA) has seen a significant resurgence in the past month. Into the Block.

Information from on-chain data providers shows that the number of ADA whales holding between 100 million and 1 billion ADA coins has increased by 29% over the past 30 days.

Source: IntoTheBlock

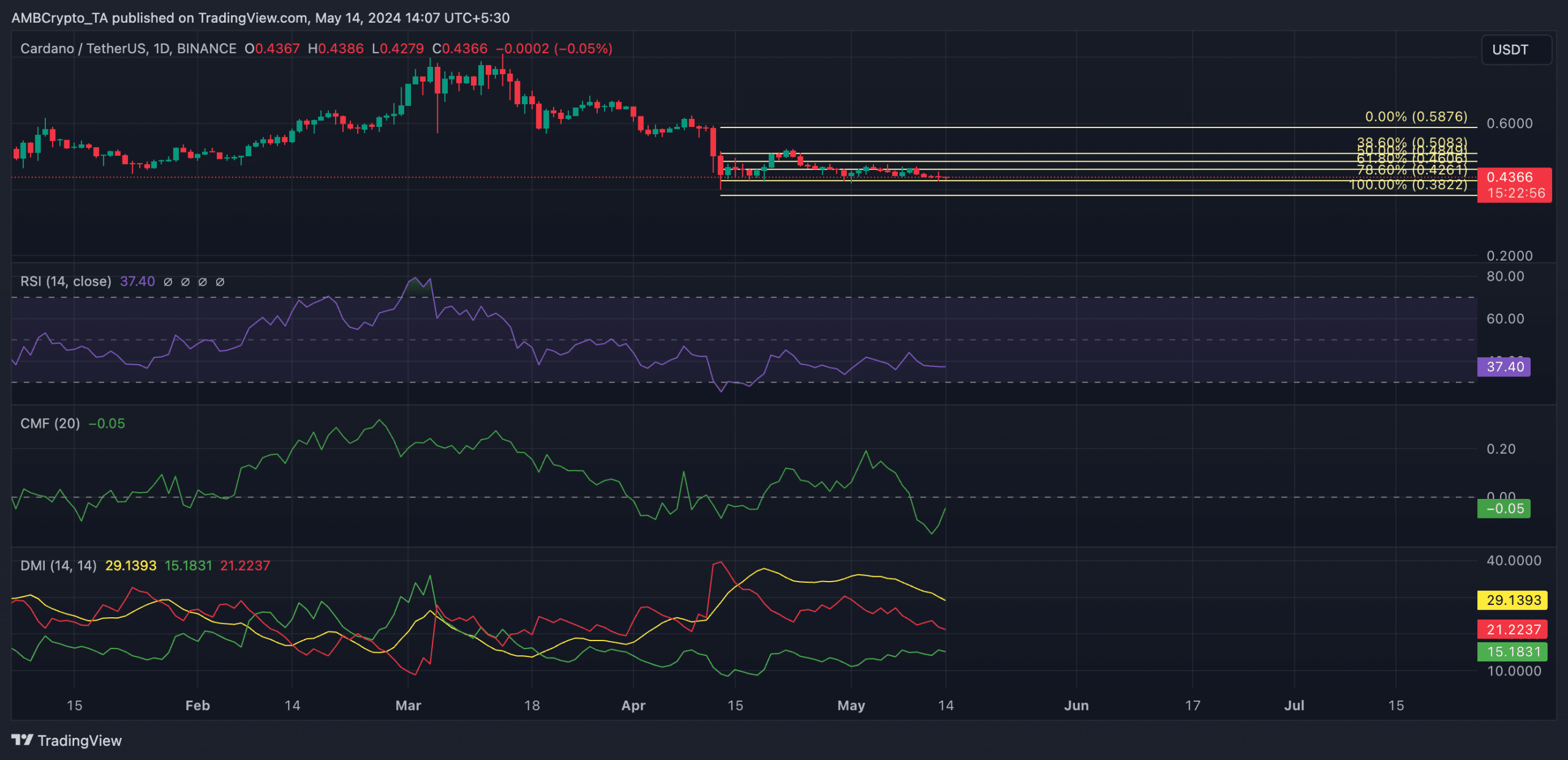

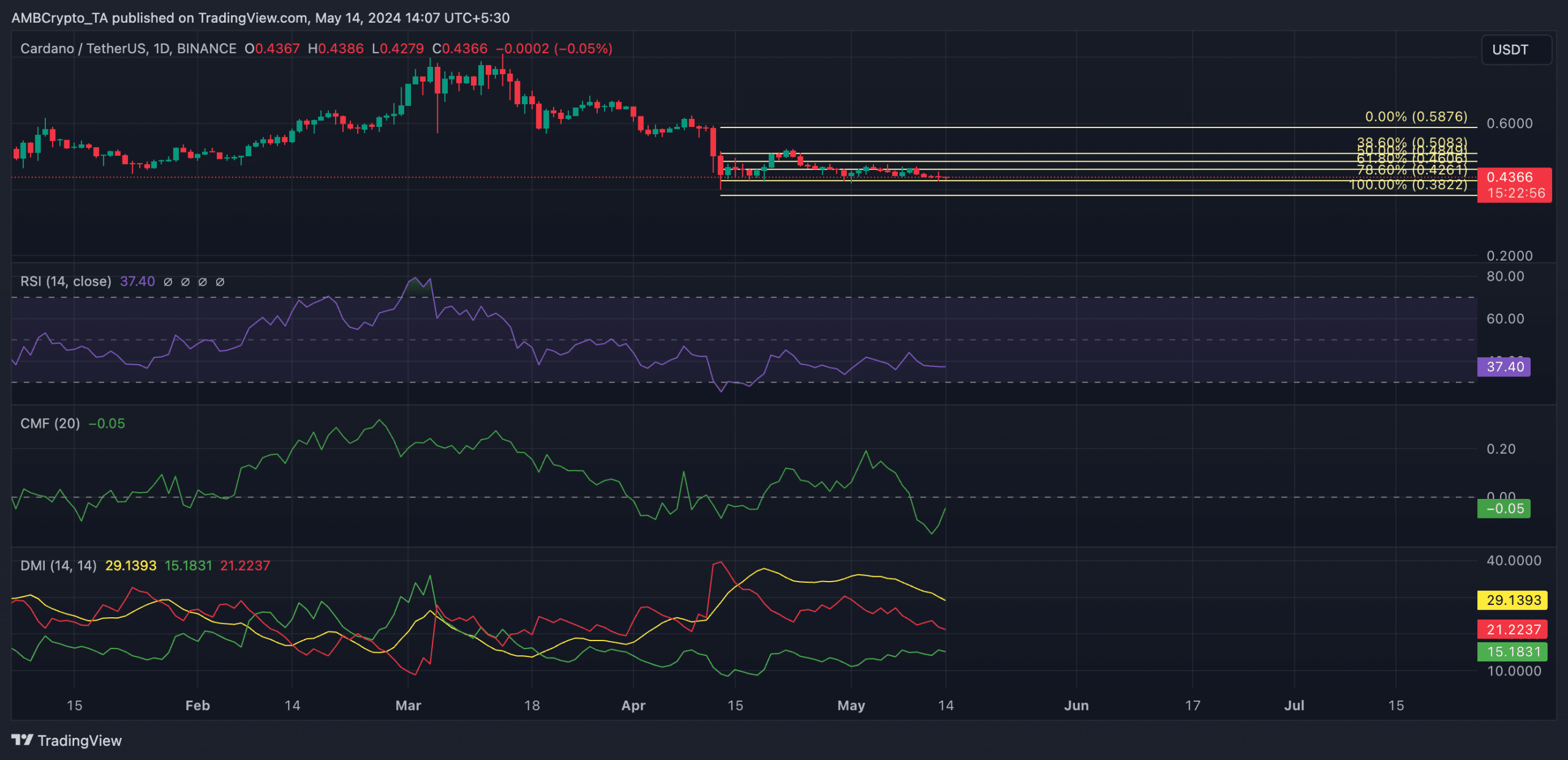

However, due to the overall market decline last month, ADA’s surge in whale activity has not had an impact on prices. At press time, the altcoin was trading at $0.43.

Its value has fallen 7% over the past 30 days, according to data from CoinMarketCap.

Where is the ADA headed?

Although the number of large investors in ADA has increased in the past month, demand for altcoins has decreased overall.

The readings of the key momentum indicators observed on the 1-day chart confirm this.

At the time of writing, ADA’s relative strength index (RSI) was 37.42. This indicator indicates high momentum in coin distribution among market participants.

Additionally, this coin’s Chaikin Money Flow (CMF) is below the 0 line at the time of this writing. This indicator measures the flow of funds into and out of an asset.

A value lower than 0 means more liquidity is leaving the market. This is known to precede a continued decline in asset values.

At press time, ADA’s CMF was -0.04.

Confirming the strength of the ADA bears, the coin’s positive directional index (green) is positioned below the negative index (red).

When an asset’s Directional Movement Index (DMI) line is set up in this way, the downward trend is strong.

With an average directional index (ADX) value of 29, ADA’s downtrend was strong at press time.

At press time prices, ADA bulls are holding on to important support levels. However, if bearish momentum picks up, ADA may breach support to change hands at $0.38.

Conversely, if this bearish outlook is invalidated, the coin price could begin a rebound towards the $0.46 level.

Source: ADA/USDT on TradingView

Read Cardano (ADA) Price Prediction for 2023-24

This is possible because activity in the coin futures market has been steadily increasing, suggesting that market participants remain optimistic despite continued price declines.

According to ‘Coin Glass’ According to the data, the coin’s funding rate across cryptocurrency exchanges remains positive. This is a sign that futures traders continue to open long positions.