- The Arbitrum active address registration figure for consecutive days is 900,000.

- Although the market trend of ARB continues to decline,

Arbitrum is in the news today after solidifying its position and asserting itself in the layer 2 ecosystem. After maintaining the level of active addresses above a certain threshold, we set a new record for daily active addresses.

There has also been a noticeable increase in the number of recent transactions. However, despite these developments, the volume and price of the native token have remained relatively stable on the charts.

Arbitrum set a record for active addresses.

Active Address Analysis growth blood Arbitrum said it achieved a record number of active addresses on May 15. The chart shows that active addresses exceeded 972,000, setting a new record for L2 networks and all Layer 2 networks. Additionally, Arbitrum has maintained an average of over 900,000 active addresses over the past seven days. This is another record.

As of this writing, the network has registered over 786,000 active addresses in the last 24 hours. Base, the closest L2 competitor, highlighted Arbitrum’s significant reach by citing approximately 299,000 active addresses.

Additionally, transaction count analysis shows that Arbitrum leads other L2 networks with approximately 2.1 million transactions at the time of writing. This increase in active addresses is positively correlated with the increase in transaction count, demonstrating dominance in the L2 space.

The amount of crystals remains constant.

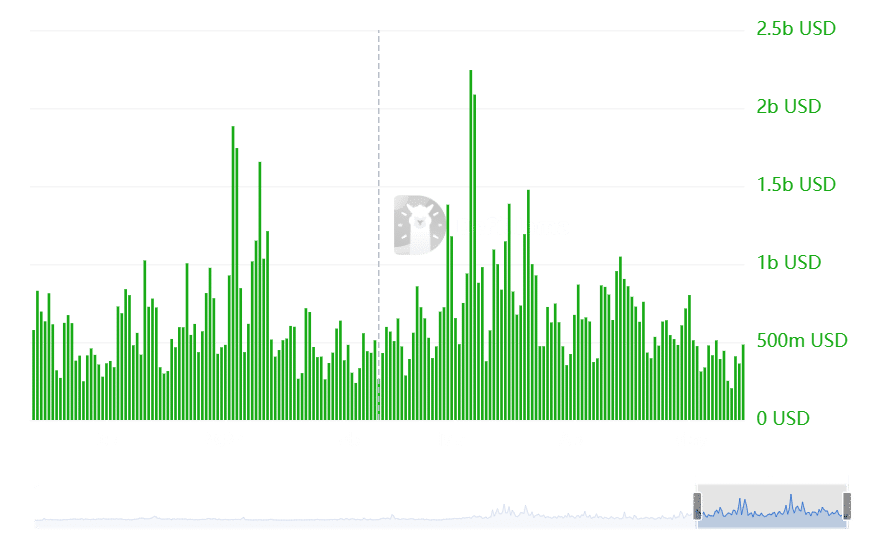

Arbitrum has seen record activity related to active addresses over the past few days. However, no significant movement was seen in the trading volume analysis. In fact, data from DefiLlama shows that there has been no noticeable change in L2 volume over the past seven days.

Nonetheless, the network recorded its highest trading volume in the past 24 hours, totaling $483 million during the period.

Source: DefiLlama

Additionally, Arbitrum’s Total Value Locked (TVL) has seen a slight increase of over 1% in the last 24 hours.

Arbitrum’s TVL surpassed $16 billion at the time of writing after rising more than 1.2%, according to data from L2 Beats.

ARB remains weak.

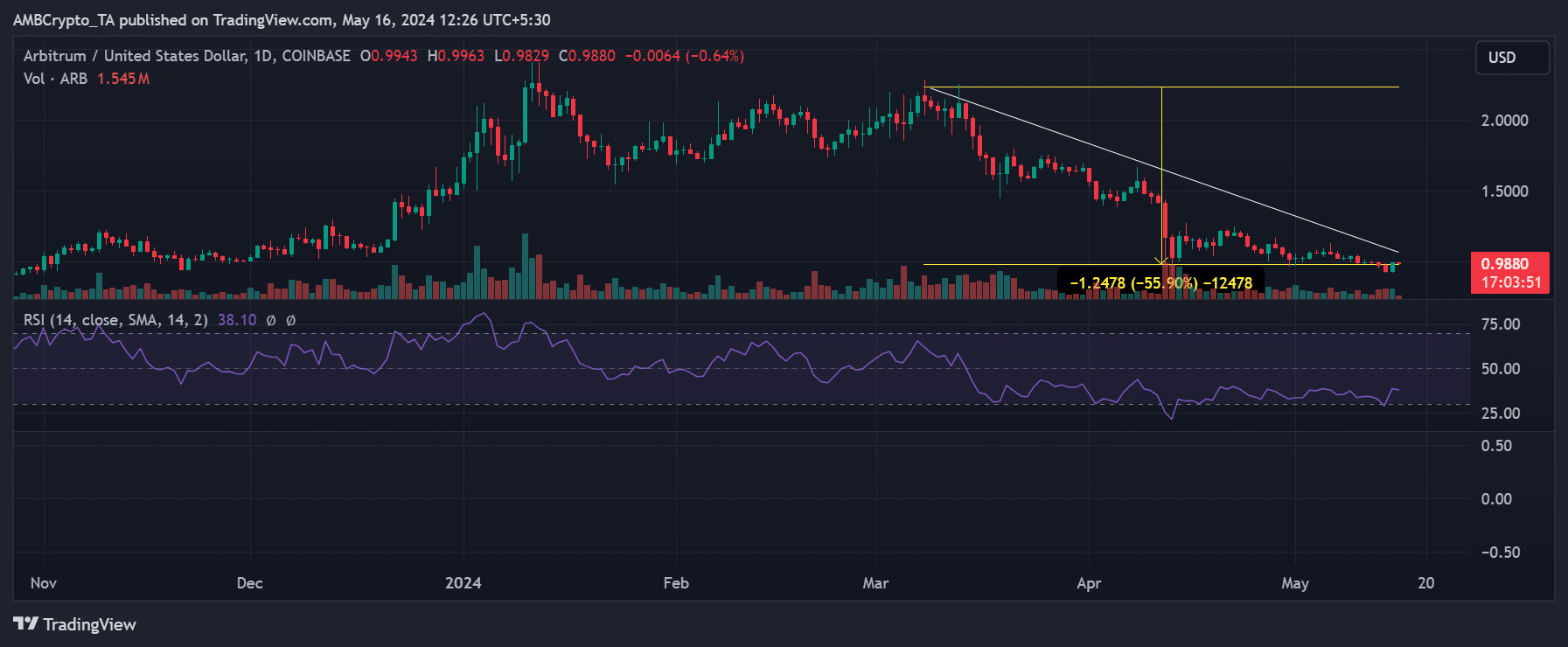

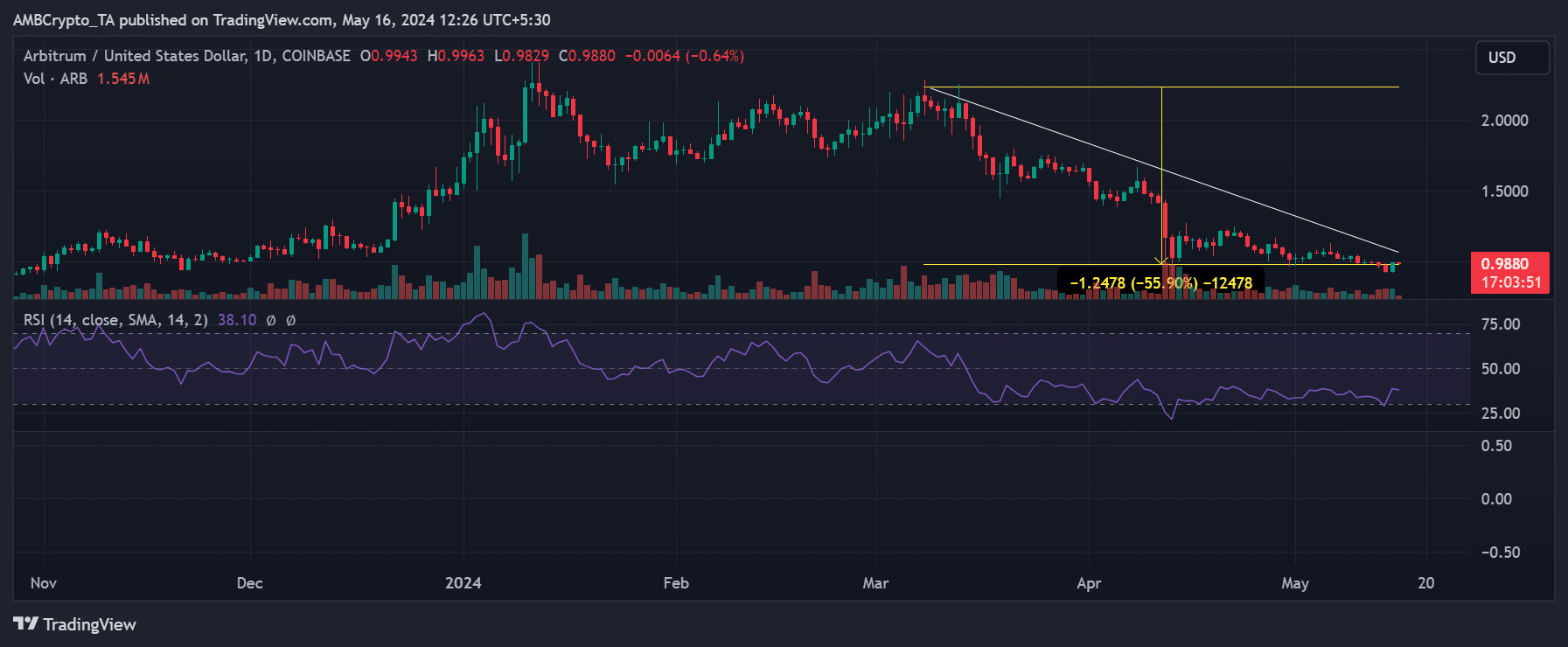

However, the momentum seen in Arbitrum’s active addresses and Total Value Locked (TVL) has not translated into its native token, ARB. In fact, analysis of ARB on the daily chart showed a downward trend since March.

Source: TradingView

– Realistic or not, ARB’s market capitalization in BTC terms is:

ARB is down about 55% since the downtrend began at the time, according to the Price Range Tool.