- Solana is currently one of the best performing cryptocurrencies among the top 15.

- Strong optimistic sentiment within the community may also help the price of SOL

It’s no secret that Solana (SOL) has been making waves in the cryptocurrency market for quite some time. The entire cryptocurrency community loves SOL, and Memecoin has delivered incredible returns for investors and traders alike. The summer of 2024 has been dubbed ‘Solana Summer’ as the community anticipates that altcoins will trigger a highly anticipated alt season.

Solana’s network is healthier than ever.

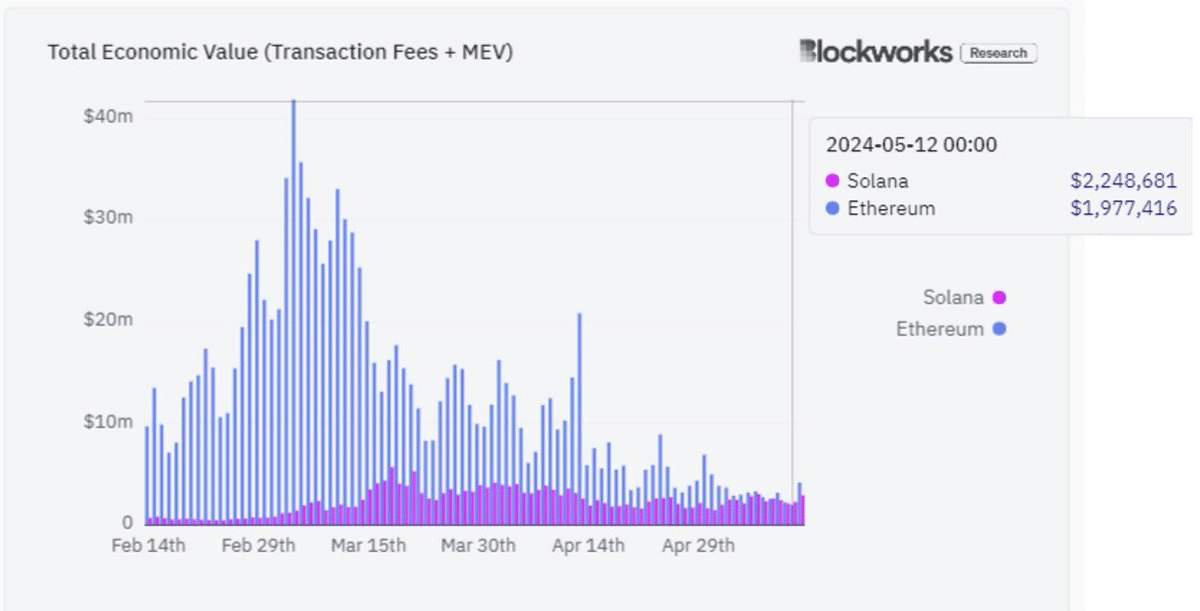

Currently, Solana’s network is known to boast the best performance in the industry. According to Onchain analyze Solana’s total economic value, including Leon Waidmann’s transaction fees and MEV, has surpassed the value of the Ethereum mainchain.

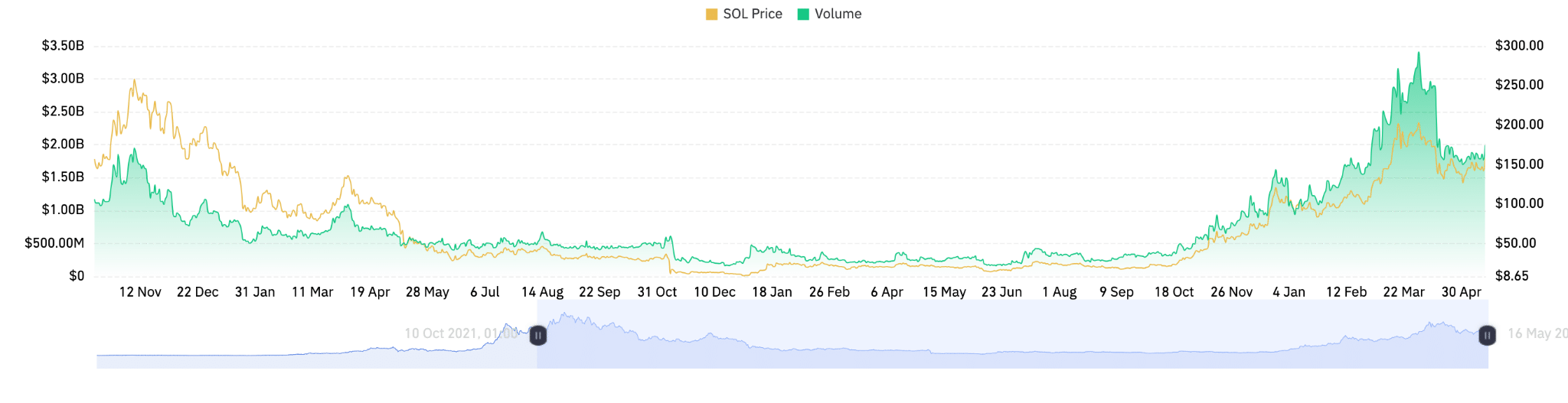

Additionally, dat ata coin glass It said open interest on Solana increased more than 1% in the past 24 hours, reaching approximately $2.1 billion. Trading volume also increased by about 41%, adding nearly $8 billion to the market capitalization.

Source: Coinglass

Trading activity has also shown that buying interest is generally strong when prices are low. Looking at the end of the chart, there are very strong signs of a return to the Solana uptrend, clearly confirming that Solana is indeed at the top now.

SOL price/performance review

AMBCrypto analyzed TradingView data for Solana performance since the beginning of the year. Data shows that SOL has been on a strong upward trajectory since the beginning of 2024, peaking in mid-February when the general market was strong.

After the peak, the price of the coin weakened for several weeks in a row, with a notable decline.

Initial resistance was around $220, with the price reaching a high before falling. After the peak, the price stabilized and found support around the $160 level, as evidenced by the latest green candlestick, which indicates a bounce or consolidation around this price.

The recent recovery near the $160 support level could suggest that the price may begin to stabilize or potentially move higher if additional buyer momentum enters the market.

Next week will determine whether the rebound continues or the downward trend resumes. Watch for a potential resistance retest around $180-$190 as a sign of continued resilience in the near term.

The general consensus based on data and community sentiment as to whether SOL could trigger a bull market is – it could.