- LINK’s network activity increased along with its price.

- Most indicators indicated sustained price growth, but some did not.

Chainlink (LINK) It has attracted a lot of attention recently, with prices rising significantly over the past week.

Interestingly, the popularity of the token has increased. Bitcoin (BTC) There has been a slight decline in dominance recently. Let’s take a closer look at what’s actually happening.

Source: CoinStats

State decoding in Chainlink

IntoTheBlock recently posted: Twitter We highlight some interesting developments related to Chainlink.

The tweet first noted a significant increase in LINK search trends data, reflecting renewed interest in the token.

The rise in popularity had a positive impact on the blockchain’s network activity as the number of transactions began to surge.

To be precise, LINK recorded 5,82,000 transactions in the last day, which is close to its monthly high.

However, it was interesting to note that the increase in transactions did not help attract more users, as there were no significant changes in the new address graph.

However, as accumulation increased, things looked good in terms of investor interest. According to the tweet, net withdrawals occurred mostly on exchanges, suggesting hoarding activity.

Additionally, whales have been stockpiling LINK, with addresses holding more than 0.1% of the supply seeing a net accumulation of 25 million LINK over the past month.

LINK Is Earning Investors Profits

The increase in accumulation actually helped the token start a bull market. According to CoinMarketCapLINK is up more than 20% over the past seven days.

At the time of this writing, it was trading at $16.22, with a market capitalization of over $9.5 billion.

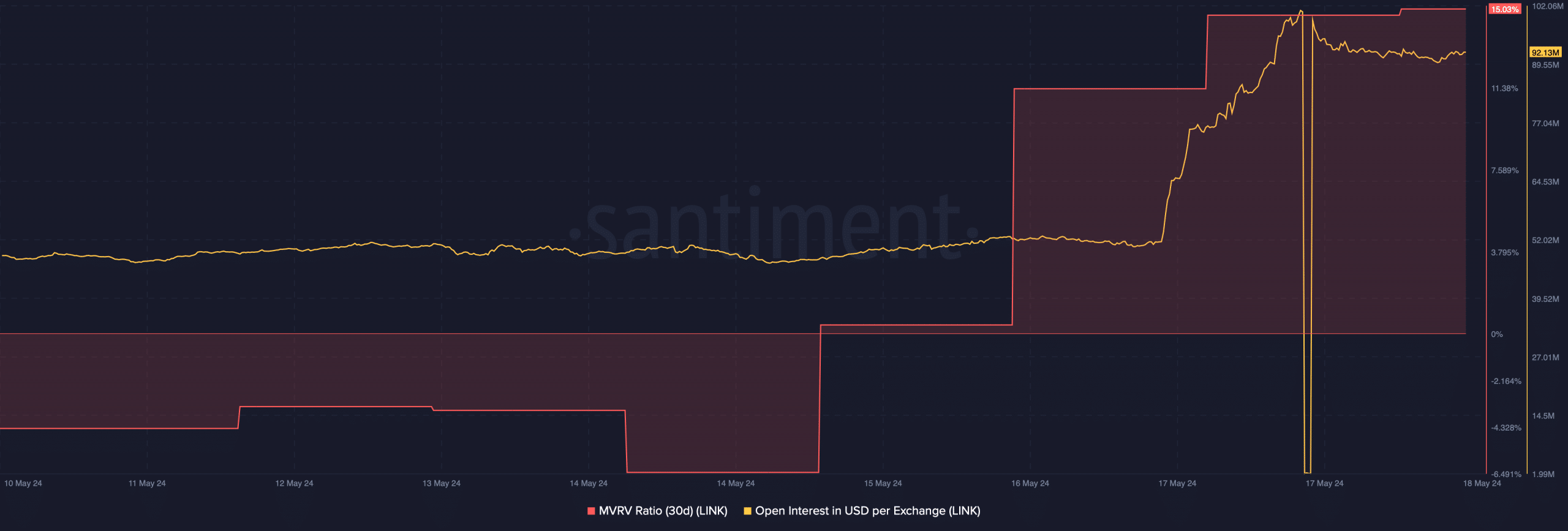

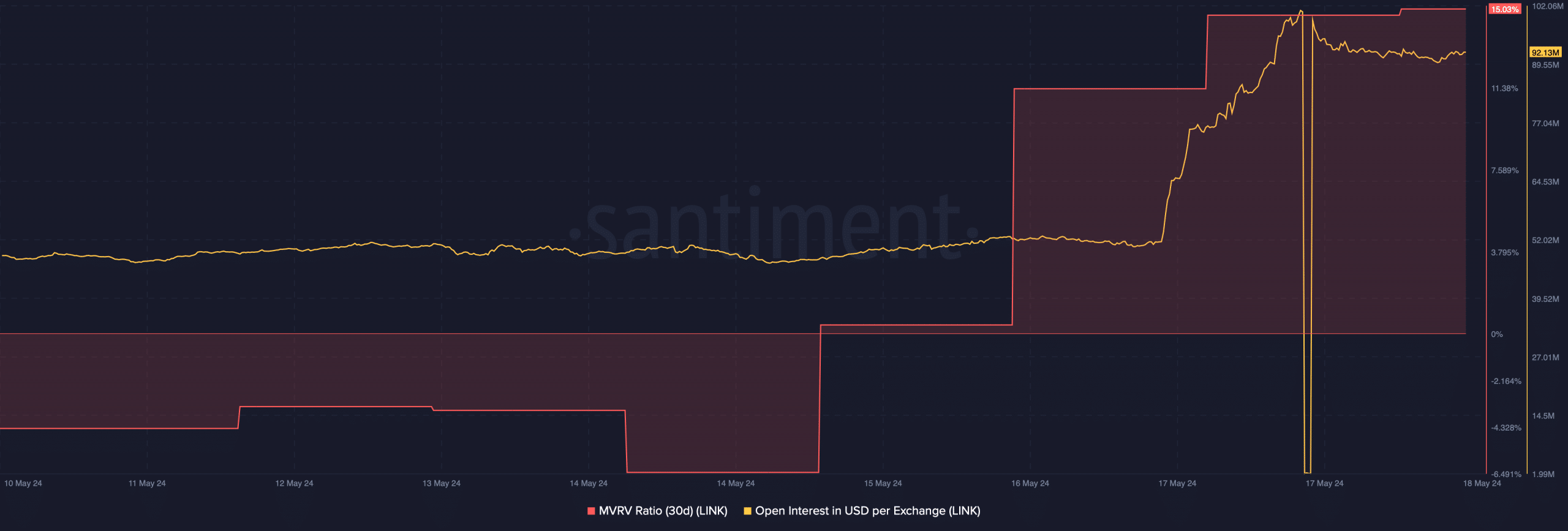

Thanks to this, LINK’s MVRV ratio has risen significantly, meaning that more investors are making profits. Open interest also increased along with the price, suggesting a continued price rise.

Source: Santiment

Interestingly, Santiment recently posted the following: Twitter It highlights the increase in bullish sentiment towards the token. In fact, Chainlink was witnessing some of the most bullish sentiments over the past year.

However, these positive metrics did not help LINK remain strong as the token price fell nearly 2% in the last 24 hours.

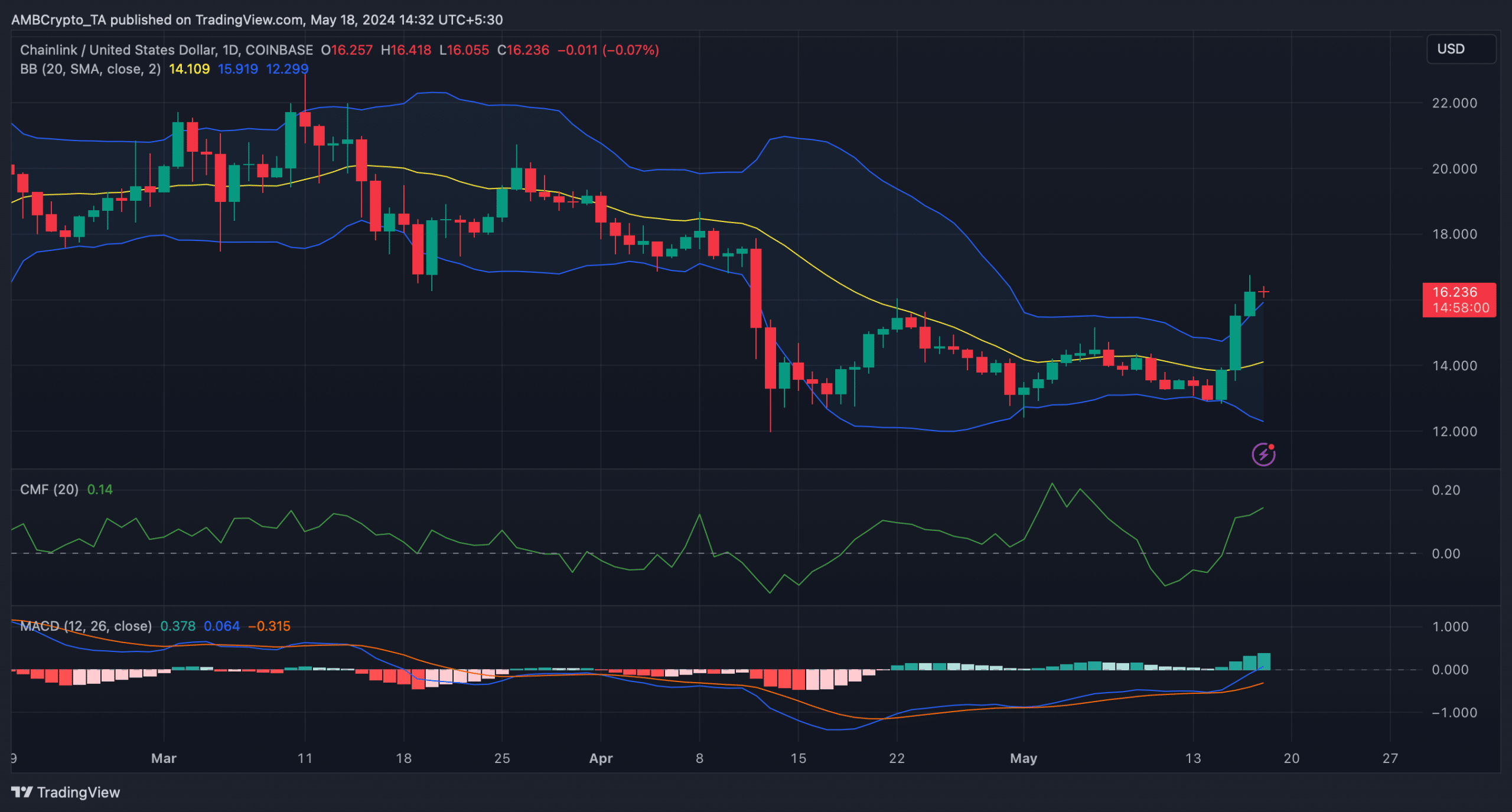

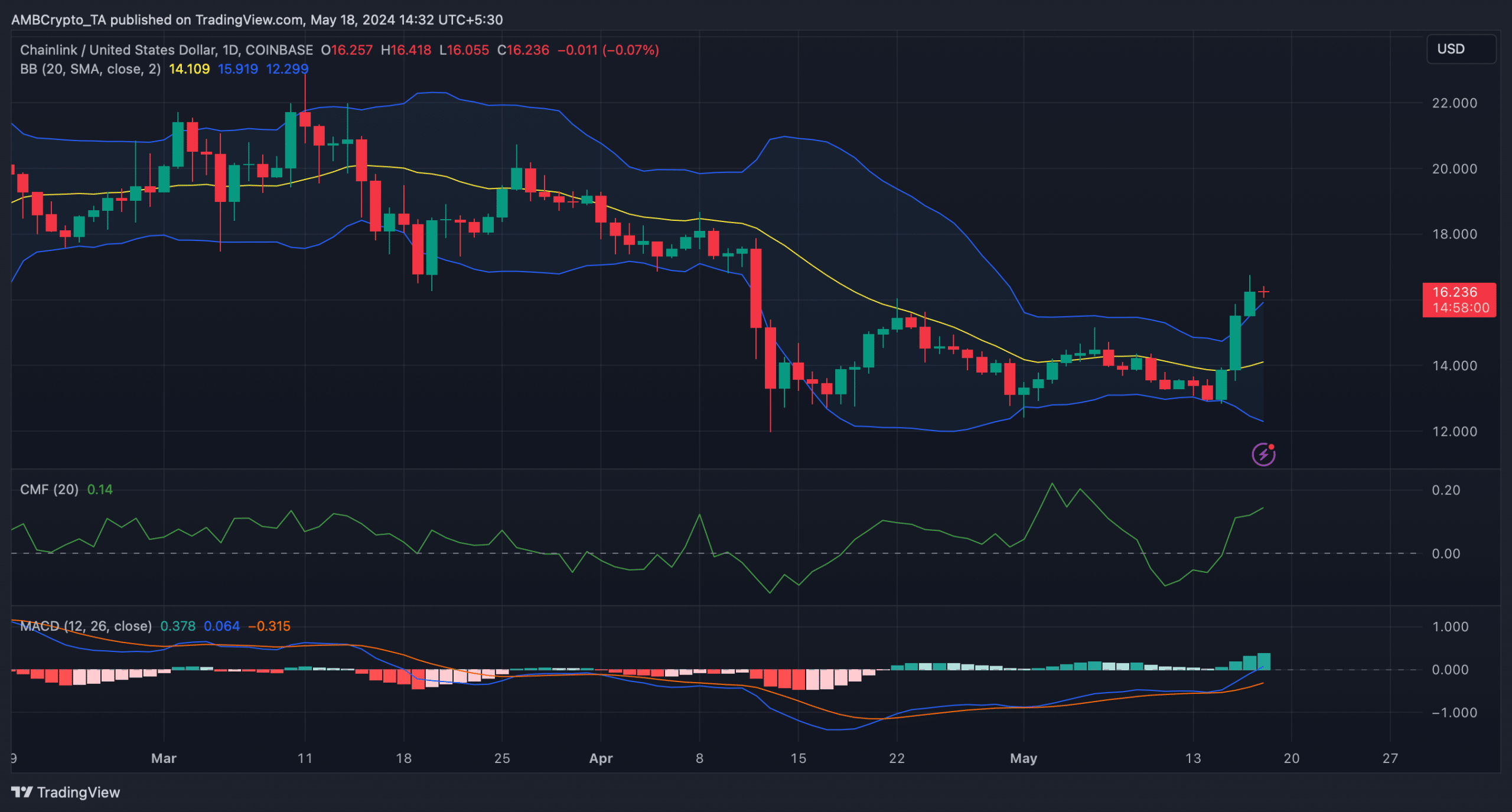

To determine if this is the end of LINK’s double-digit bull rally, AMBCrypto analyzed the daily charts. Our analysis shows that MACD still favors buyers.

Is your portfolio green? Please confirm LINK Profit Calculator

Additionally, Chaikin Money Flow (CMF) recorded a sharp rise. This indicates that the recent price correction may be short-lived and that LINK will soon resume its rally.

However, there were concerns as the token price reached the Bollinger Band upper limit.

Source: TradingView