- Solana has a bullish structure after a deep retracement.

- A retest and rally is expected in the coming weeks, marking the previous resistance level as a “buy” zone.

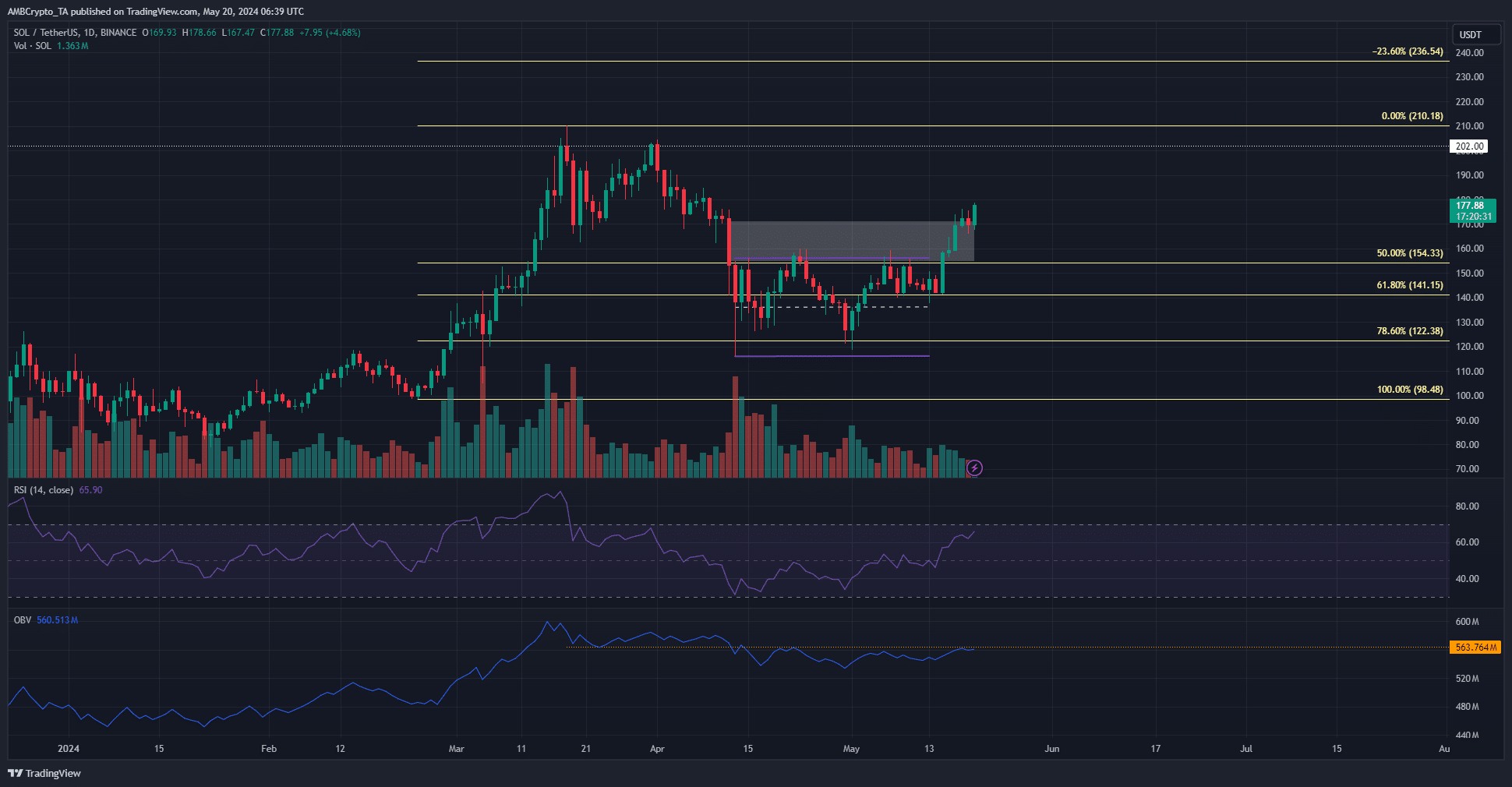

Solana (SOL) broke the $160 resistance zone and cleared the imbalance above its monthly range. In doing so, it asserted the previous higher period uptrend.

The $160 region is likely to act as support going forward.

A recent AMBCrypto report highlighted that social metrics are disappointing. The network also surpassed Bitcoin (BTC) in terms of revenue generated over a 24-hour period.

Is the bull market strong enough to sustain the rally?

Source: SOL/USDT on TradingView

The daily market structure remained strong despite the April retracement to $122, but the internal structure was bearish. There was also a bullish reversal when the price closed above $160.

RSI on the daily chart is also clearly above the neutral 50, highlighting upward momentum.

However, OBV was unable to expand local resistance levels. Trading volume also decreased, which was particularly surprising since the $160 level was an important local resistance level.

Volume indicators raised some concerns for buyers. Support is expected to retest the $160-$165 region. This should be a buying opportunity.

The Fibonacci extension levels of $210 and $236 are the next targets.

Optimistic speculation drives SOL growth

Source: Coin Analysis

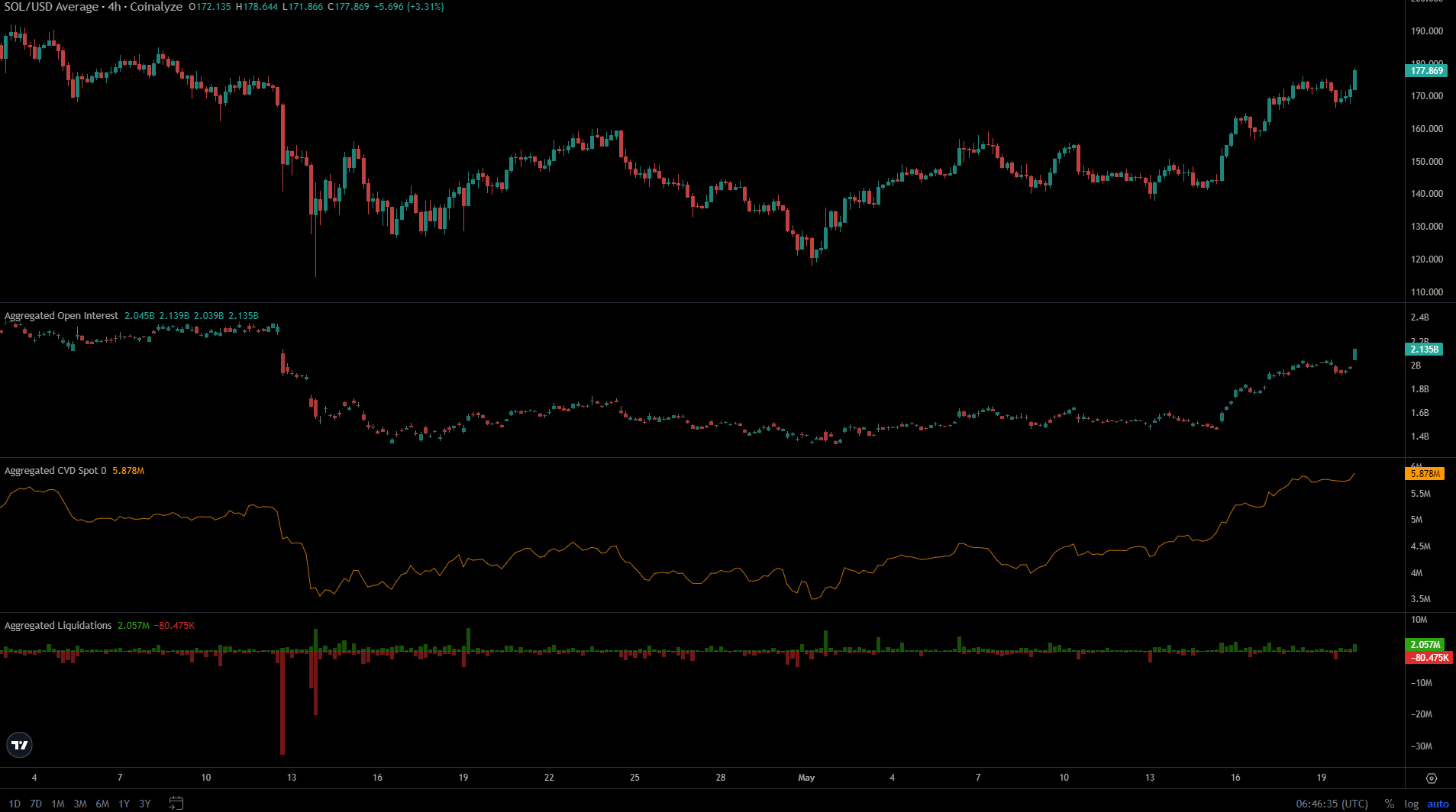

The open interest chart rose by more than $400 million last week. This was accompanied by a bullish price breakout, highlighting the enthusiastic strength of the futures market.

Read Solana (SOL) price prediction for 2024-25

Spot CVD has also seen strong gains over the past two weeks.

Therefore, despite the disruption to OBV, spot market demand was strong and the current rally was maintained. Short-term liquidations have been small but consistent in recent days, further fueling price increases.

Disclaimer: The information presented does not constitute financial, investment, trading or any other type of advice and is solely the opinion of the author.