- Amid strong buying pressure, the price of Ethereum soared 20%, surpassing Mastercard in market capitalization.

- The SEC’s move to approve the ETH ETF sparked a market rally.

So far, Ethereum (ETH) has experienced an incredible surge, rising nearly 20% in the past day alone. This impressive increase pushed the price of Ethereum past $3,600, its highest level since April 19th.

Asset size is also trending upward, indicating strong buying pressure in the market. These developments come as Ethereum’s influence and adoption grows and highlights its position as the second-largest cryptocurrency by market capitalization.

Leon Waidmaqnn, a renowned on-chain analyst, said: pointed out Ethereum’s market capitalization has now surpassed that of global payments giant Mastercard, reaching $440 billion compared to Mastercard’s $427 billion.

This change not only reflects Ethereum’s growing prominence, but also signals the broader acceptance and integration of cryptocurrencies into mainstream finance.

Regulatory changes and market dynamics

The recent rise in Ethereum market value follows significant developments in the regulatory environment. The U.S. Securities and Exchange Commission (SEC) showed signs of positive change regarding its approval of applications for a spot Ethereum exchange-traded fund (ETF).

Bloomberg analysts specifically Modified approval probability for Ethereum ETF from 25% to 75%.. The change is based on signs that the SEC is rapidly changing its position, with exchanges being asked to update their 19b-4 filings in preparation for potential approval as early as May 22.

The regulatory pivot appears to be a key driver behind the current bullish momentum in the Ethereum market.

Meanwhile, Ethereum’s circulating supply increased from 119.6 million ETH in mid-April to 119.73 million ETH at press time. data Glassnode suggests that more tokens can be used for trading and transactions.

While this would generally mean increased selling pressure, current market dynamics show that demand remains solid, fueled by current expectations for the approval of an ETH spot ETF.

Source: Glassnode

Market reaction and future outlook

Amid these developments, Ethereum not only surged in price but also saw significant movement in other market indicators.

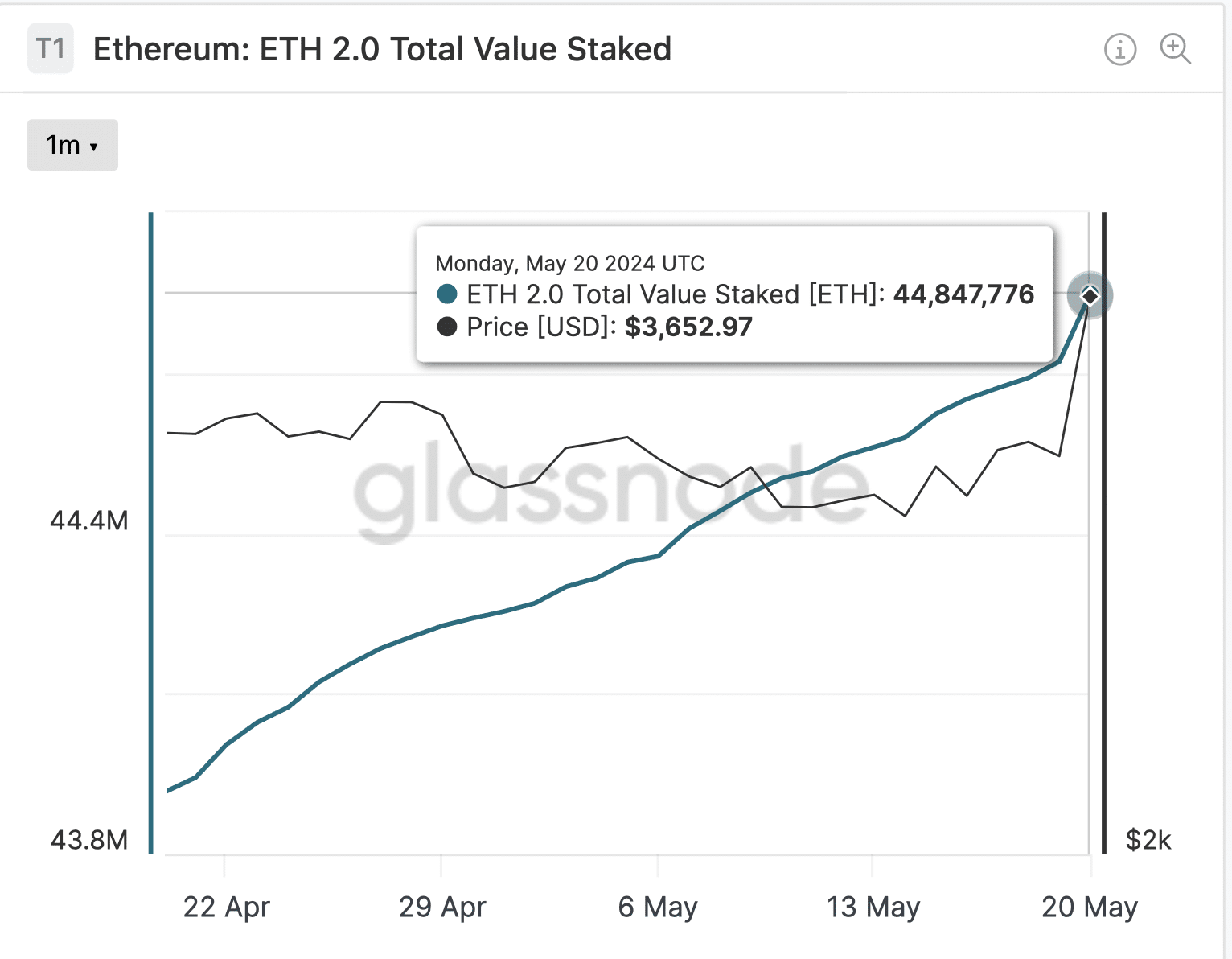

For example, according to Glassnode, the total value staked in Ethereum increased from 43 million ETH to over 44 million ETH last month.

This increase in staked ETH highlights investor confidence in the long-term value and utility of Ethereum.

Source: Glassnode

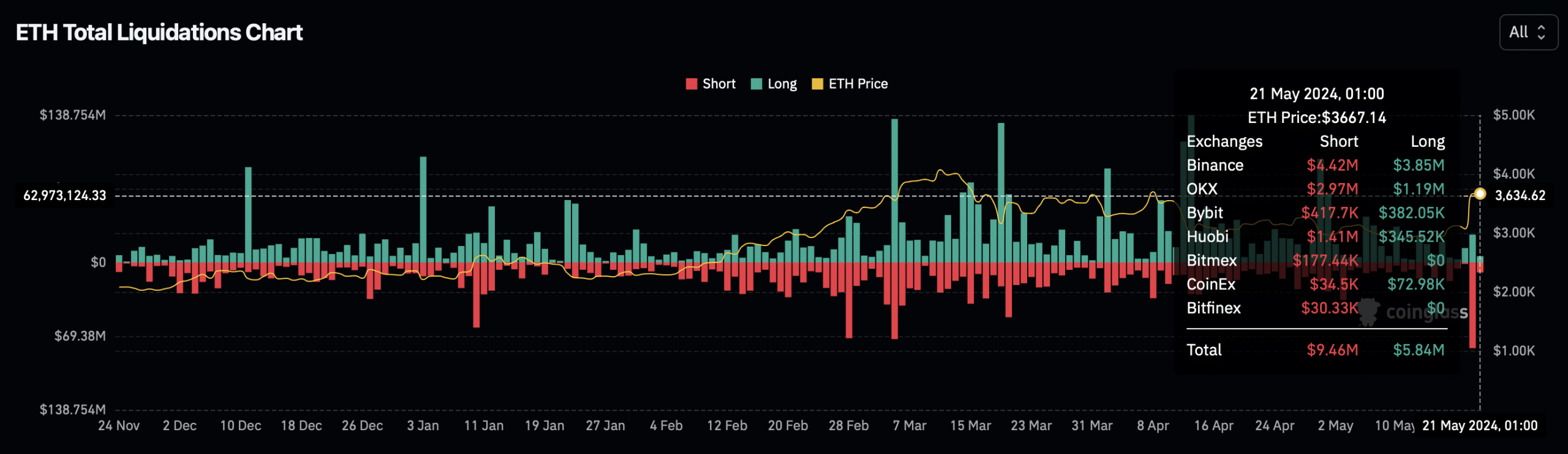

However, not all market participants benefit from this rise. coin glass data Over the past 24 hours, more than $10 million has been liquidated from the Ethereum market, with short sellers bearing the brunt of these losses.

This follows the trend of liquidation of short positions of more than $80 million the previous day, indicating that many who had bet on Ethereum were caught off guard by the rapid rise of Ethereum.

Source: Coinglass

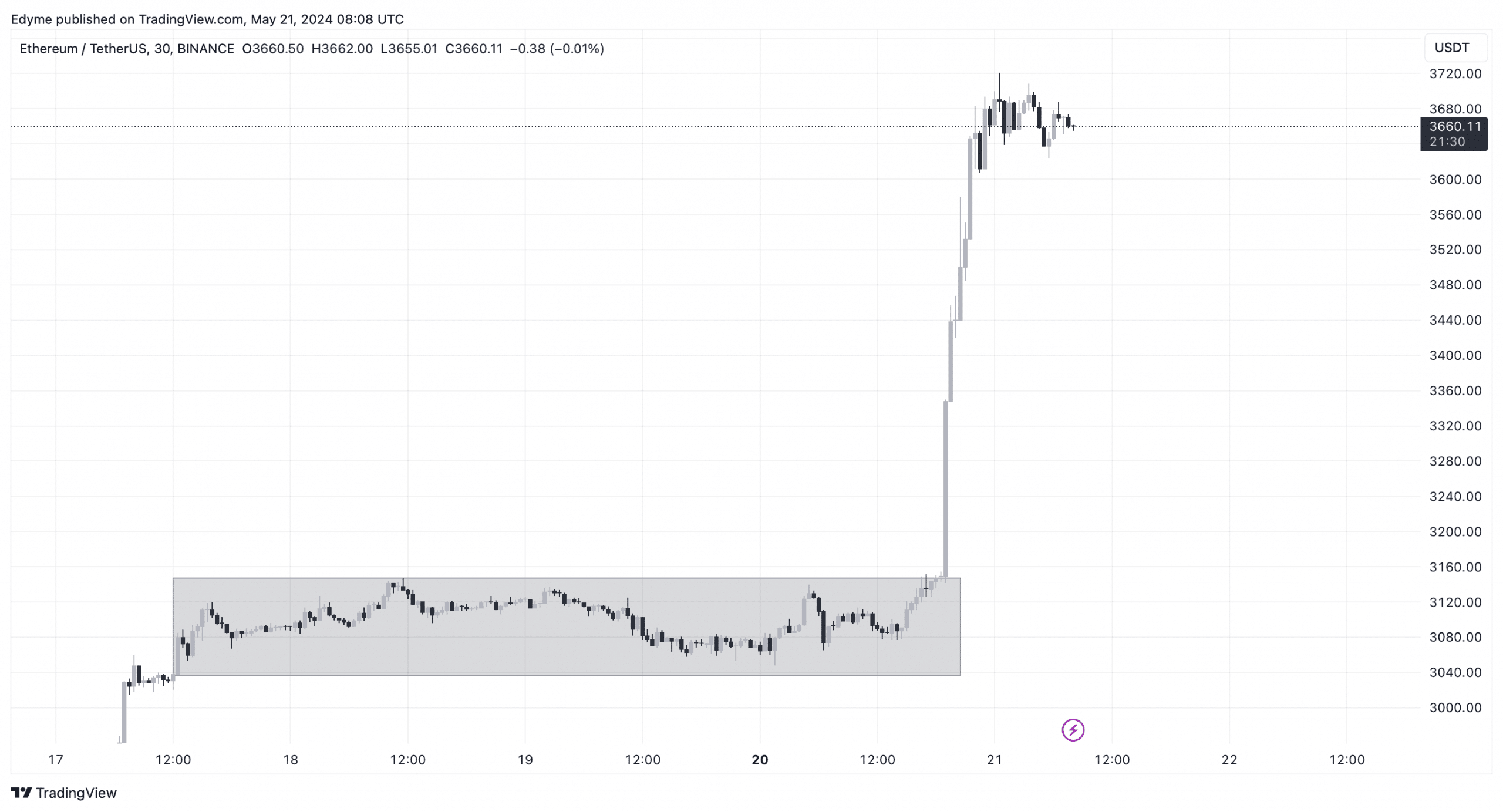

Looking at the price chart of Ethereum, it appears that the asset is poised for further gains.

Is your portfolio green? Check out our Ethereum Profit Calculator

It recently broke through a consolidation area and is on the rise, a technical pattern that suggests buyers are firmly in control.

Source: TradingView

This breakthrough, combined with positive regulatory developments and strong market metrics, sets the stage for a likely sustained upward move in the ETH price.