- XRP holders rejoiced as the price rose towards the key resistance zone.

- On-chain indicators showed accumulation but also warned of potential selling pressure.

Ripple (XRP) saw a moderate price increase on May 20th. It rose 6.13% in 24 hours, and during the same period, Bitcoin (BTC) rose 6.9% but fell slightly from $71.3,000 to $70.9.

Despite the gains, XRP continued to trade within a long-term range and faced a strong supply zone of $0.57-$0.585.

Ethereum (ETH) ETF approval probability upgraded from 25% to 75% by Eric Balchunas, with token price soaring 20% within hours.

The ETF analyst added that this surprised everyone.

This could lead to spot ETFs being filed in other cryptocurrencies. As one of the largest tokens on the market, XRP could be one of the next cryptocurrencies for which ETF issuers submit applications.

However, the ongoing SEC-XRP case remains a hurdle for issuers.

Cryptocurrency market is unstable and investors should be cautious

In November 2023, XRP surged to $0.7503 due to fake reports that BlackRock had applied for a spot XRP ETF. A month before this event, false news about the approval of a Bitcoin spot ETF led to a 10% surge in the price of BTC.

In both cases, strong gains were quickly reversed. Therefore, while XRP may see a massive price increase due to such reports or speculation, it will do little to strengthen investor confidence.

Therefore, AMBCrypto analyzed social and network indicators to understand whether the token could see a real bounce in the coming months.

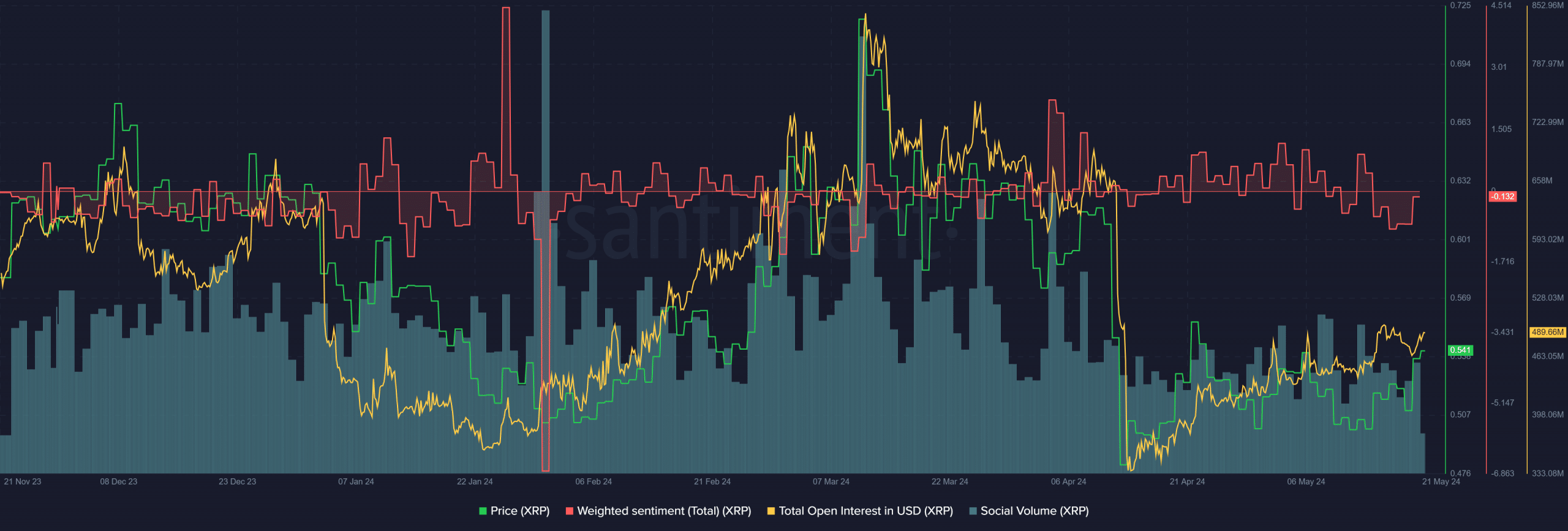

Source: Santiment

Daily Weighted Sentiment has been positive over the past month. During this period, XRP hit higher lows but still struggled to form a long-term uptrend.

Social volume has remained consistent over the past month, but has declined noticeably since March.

Open interest also rose, showing that speculators are gaining confidence in buying. However, the speed of recovery is slow compared to the decline in April.

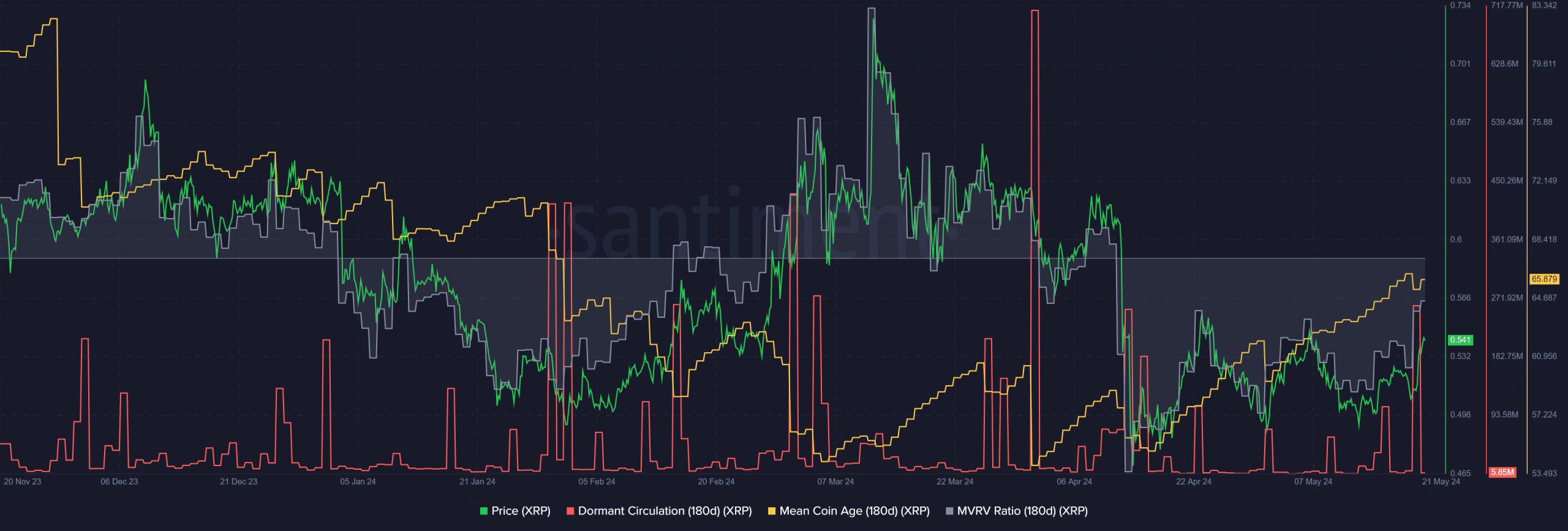

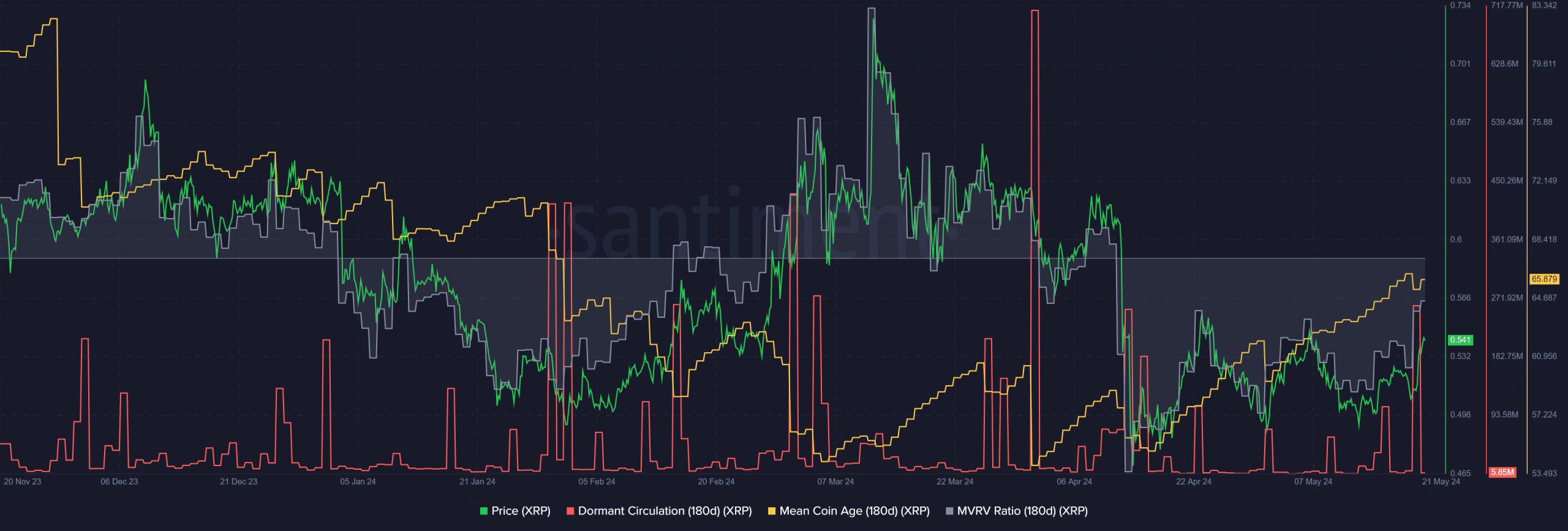

Source: Santiment

The MVRV ratio showed that investors suffered losses after the mid-March correction. It fell to -19% on April 14 and was -3.83% at press time.

Is your portfolio green? Check out our XRP Profit Calculator

Meanwhile, the average currency age continued to trend higher, signaling accumulation across the network. Together they announced a buying opportunity.

Worryingly, there has been a surge in dormant circulation during the recent rally. This suggested increased movement of tokens for sale. This could hinder the bulls’ recovery attempts and push prices lower.