- If TON holders fail to exit the market at $6.39, it could rise to $7.50.

- Network activity is down but likely to increase by double digits due to external developments

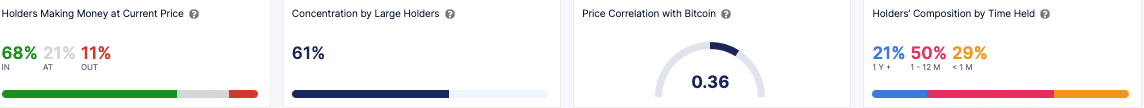

21% of Toncoin (TON) holders are sitting at the same price they purchased the token at, indicating that they are currently at a formation point. Additionally, further evaluation of IntoTheBlock’s data shows that 29% of all holders have accumulated TON in the last 30 days.

This percentage was higher than those who purchased cryptocurrencies a year ago. Over the past 30 days, the price of TON has increased by 22.09%, meaning that some addresses that recently purchased the token are currently making profits.

However, Toncoin has not been on my mind for the past 7 days. This is because the price fell by 1.91%. Considering the token’s performance this year, holders who are at the break-even point may decide not to sell.

This is because some of them may be among the 29% who purchased tokens in the past month. The price of TON has been trending well this year, especially after valuable reporting by AMBCrypto.

Source: IntoTheBlock

Things are working in TON’s favor.

Accordingly, the price on the chart is expected to rise further. Due to these predictions, it is possible that the $6.39 level, which is Toncoin’s price at press time, could act as support for the token.

In this case, if the bears fail to neutralize the defense, TON could rise to $7.50. However, AMBCrypto is not the only party looking forward to this move.

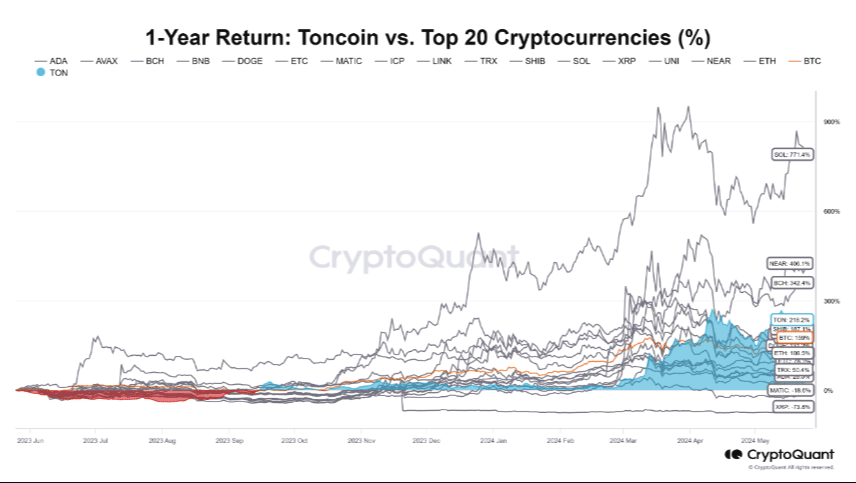

Shiveen Moodley, a token economics researcher, also shared this prediction. For Moodley, the focus was on the long-term prospects of the project using TON’s performance against other top cryptocurrencies.

Source: CryptoQuant

His comments and the aforementioned are consistent with AMBCrypto’s report on Toncoin’s correlation with Bitcoin (BTC) and Ethereum (ETH).

Will the price reach $10?

According to him, Toncoin’s supply, active user base, and link with Telegram could help the token rise further. He noted in his analysis via CryptoQuant:

“With a current supply of 5 billion coins and a 2% inflation rate, approximately 10 billion coins are expected to be created over 35 years, allowing for steady price growth over the long term.”

On May 23, Telegram said it would launch a digital currency for payments on its platform. Given Toncoin’s connection to social media platforms, there is speculation that the token may be involved.

If so, network activity and token demand could surge. In this case, it may take a short time for TON to reach $10.

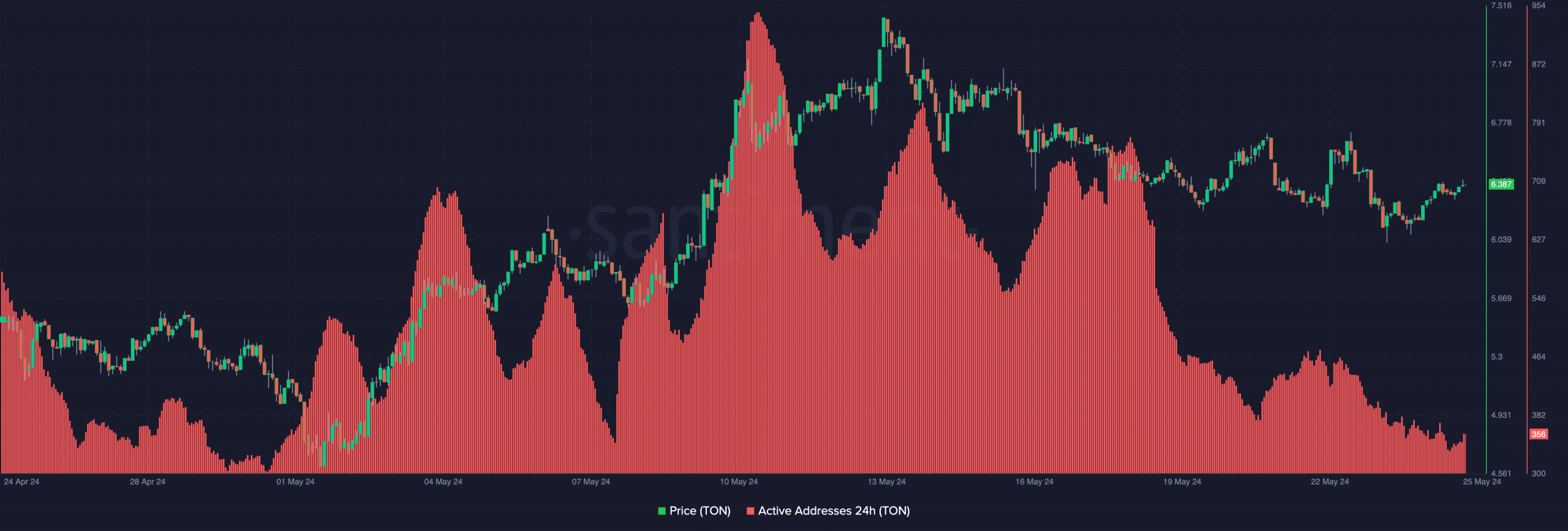

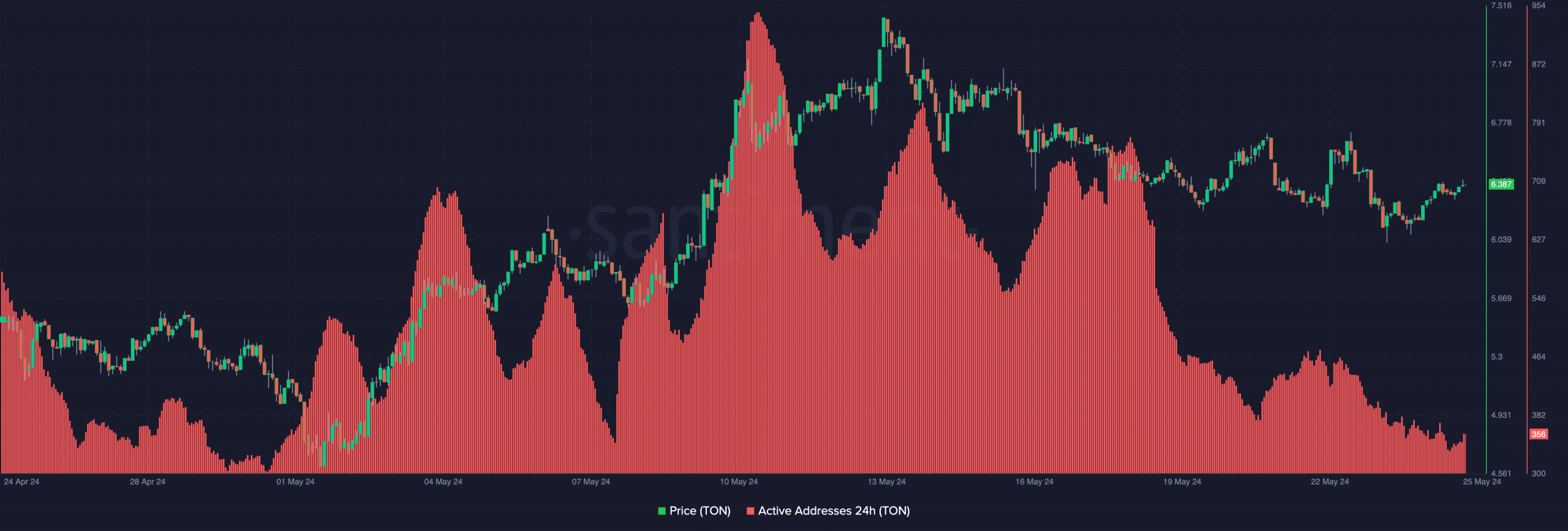

However, data from Santiment shows a decline in activity on the Toncoin network. At press time, the number of addresses active 24 hours a day had also dropped to 356.

Source: Santiment

Is your portfolio green? Check out our Toncoin Profit Calculator

This was roughly the same point as the metric before the price reached $7.45 in May. While the token may not be able to replicate the same movement, an increase in network activity could set the stage for a rally for TON.

But before that, the price may fluctuate between $5.90 and $6.40 on the chart.