- dApps in the BNB ecosystem have shown growth in terms of development activity.

- Overall activity and trading decreased and prices moved sideways.

Binance Smart Chain (BSC) has one of the most active ecosystems in the cryptocurrency space. The popularity of dApps in the ecosystem has enabled the network to attract a large number of users.

Developers go to work

One of the reasons these networks have become popular is because dApps have improved their protocols.

Data from Santiment indicates that development activity is increasing on the BSC network at the time of this writing.

High development activity shows the speed at which new updates and upgrades are happening on the BNB network.

These updates not only help you attract new users, but also help you retain users and improve the overall user experience.

Source: Santiment

Despite the popularity and development of these dApps, overall activity on the BNB network has been declining over the past few weeks.

Since early April, daily transactions on the network have fallen from 4.5 million to 3.5 million.

Additionally, the network’s daily active addresses decreased from 1.4 million to 1 million.

Source: Artemis

Problems have also been observed in the DeFi sector. The BNB network’s decentralized exchange (DEX) trading volume has decreased significantly compared to BNB over the past few days.

However, the Total Value Locked (TVL) of the BNB network remained consistent during this period.

Source: Artemis

Looking at the price

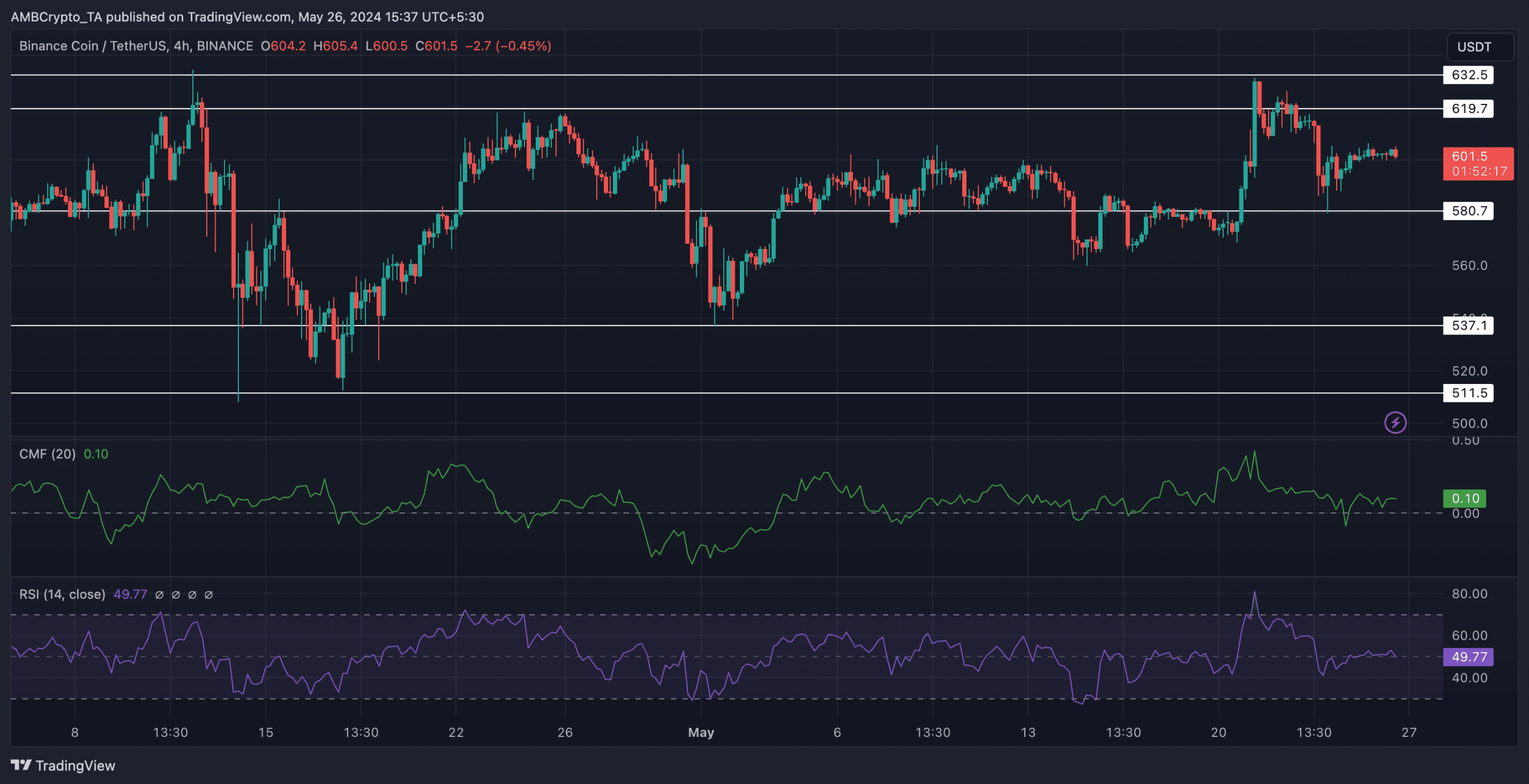

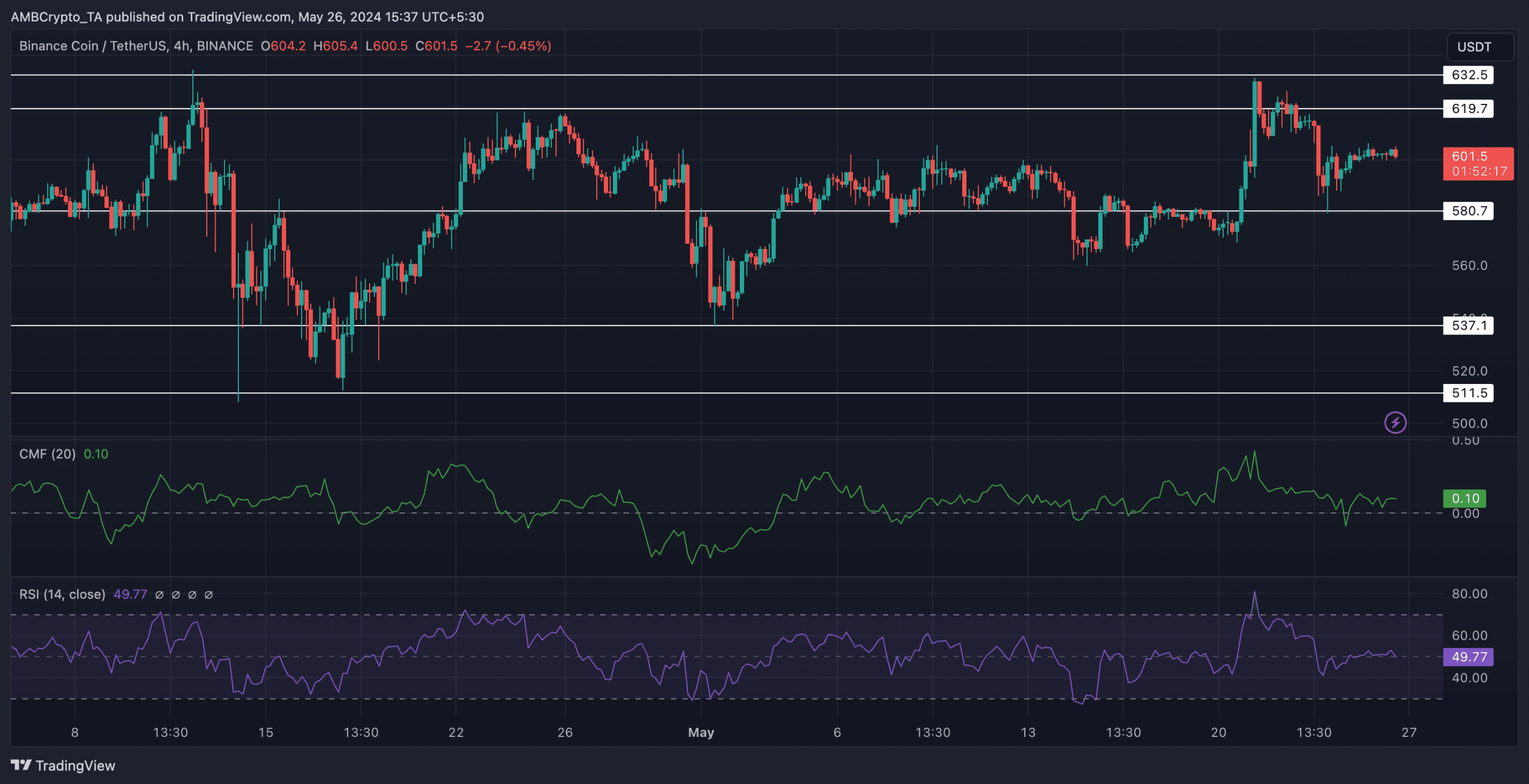

Looking at the status of the token, we see that at the time of press, BNB was trading at $601.34 and the price is down 0.71% in the last 24 hours.

The price has been fluctuating between $619.7 and $537.1 levels over the past few weeks. No significant trends have been established for BNB during this period.

Despite the $632 resistance level being tested several times in the past, there have been no signs of BNB breaking above that level anytime soon.

BNB will likely need a significant amount of bullish momentum to surpass that level in the future.

Is your portfolio green? Check out our BNB Profit Calculator

The Relative Strength Index (RSI) showed that the bullish momentum around the token has declined over the past few days.

However, Chaikin Money Flow (CMF) remained high, suggesting that funds were flowing into BNB.

Source: Trading View