- The Polygon network has consistently exceeded 1 million daily active addresses for 65 days.

- TVL and DEX trading volume decreased.

Polygon (MATIC) has continued to attract a lot of users over the past few months. The ecosystem was not only able to attract users but also retain them.

Increasing polygon activity

Recent data shows that the Polygon network has maintained a record of over 1 million daily active addresses for 65 consecutive days.

Source: X

Nonetheless, on the DeFi side, Polygon has struggled. Overall, decentralized volume (DEX) has decreased from $320 million to $50 million over the past few weeks.

Additionally, Polygon’s Total Value Locked (TVL) decreased significantly from $1.2 billion to $980 million.

Source: Artemis

These factors have had a significant impact on the revenue generated by the Polygon network. AMBCrypto’s analysis of token terminal data shows a 42% increase in revenue over the past month.

Similarly, development activity has also decreased by 14% over the past 30 days.

Source: Token Terminal

If the number of code commits on the network continues to decline, this could have a significant negative impact on the Polygon network.

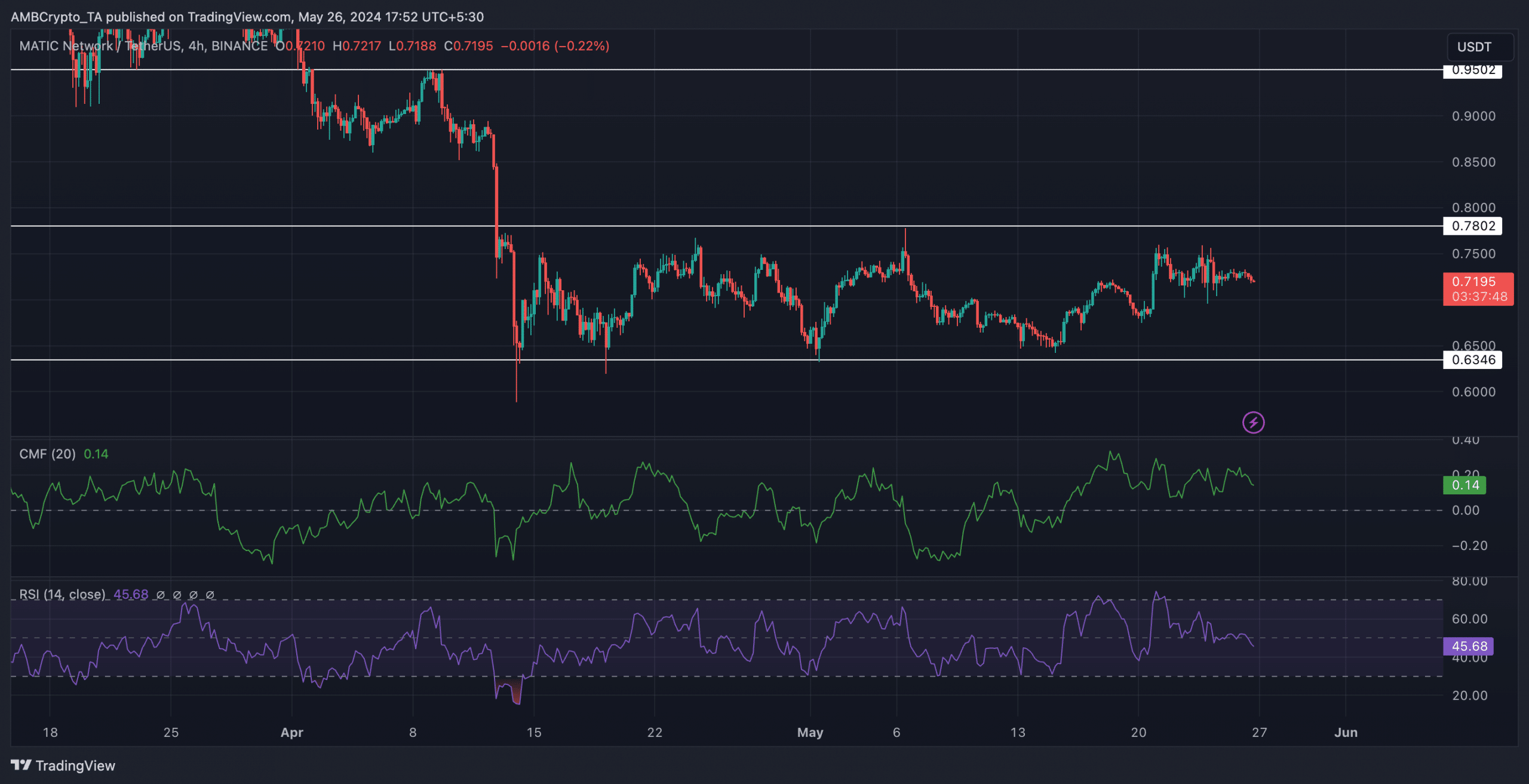

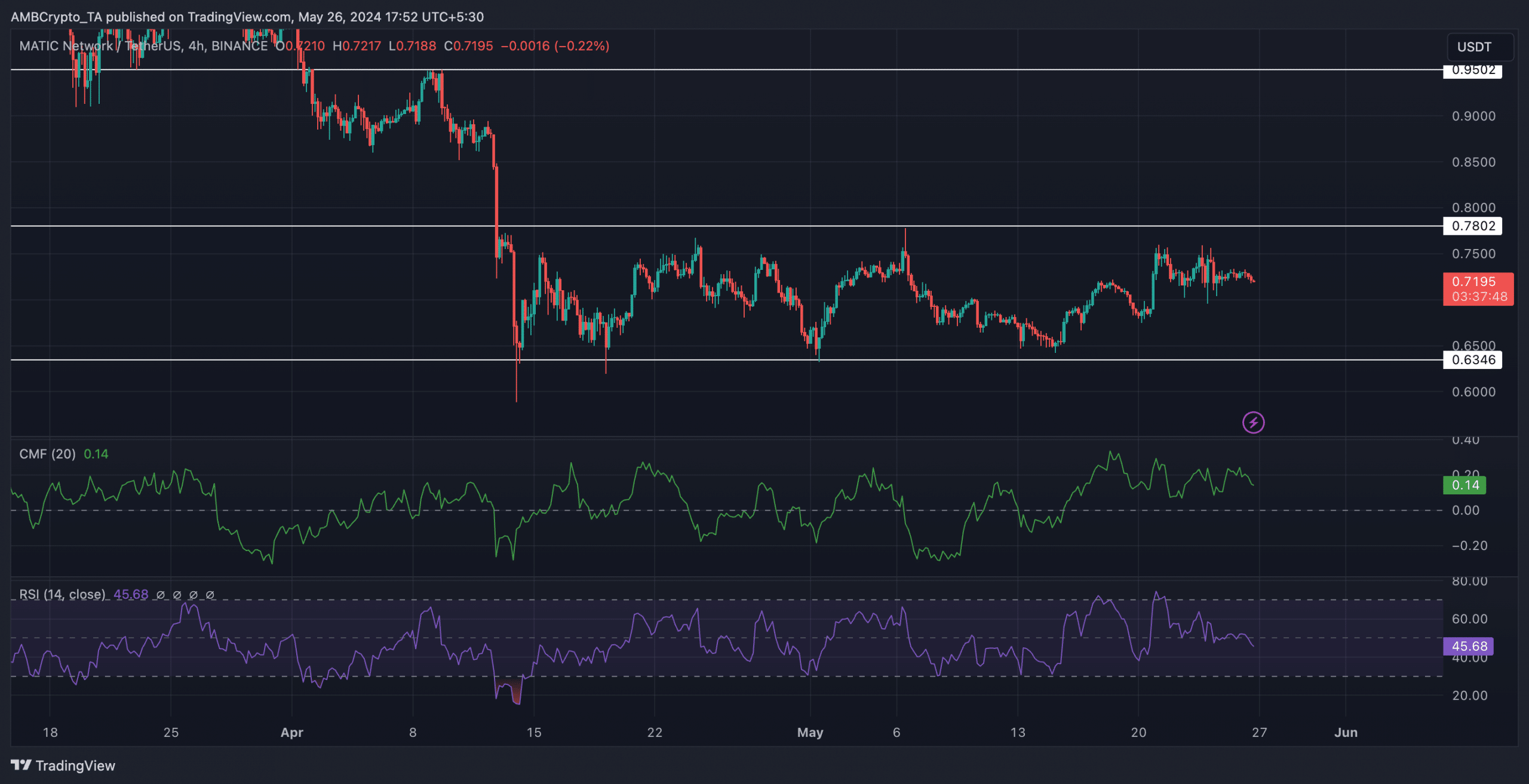

The token has not had a positive time in terms of price movements either. Since April 9, the price of MATIC has been falling, making several lower lows and lower highs.

This pattern suggests that a bearish trend has been established. Despite several attempts by MATIC to break the trend, the price remained consolidated between the $0.7802 and $0.6346 levels.

The price will need to retest and weaken the $0.7802 resistance level before a reversal appears.

The Relative Strength Index (RSI) has declined significantly during this period, meaning that the bullish momentum around MATIC has weakened.

On the positive side, Chaikin Money Flow (CMF) has grown, which means that funds flowing into MATIC have increased rapidly.

At press time, MATIC was trading at the following prices: $0.7191.

Source: Trading View

Realistic or not, the market cap of MATIC in ETH terms is:

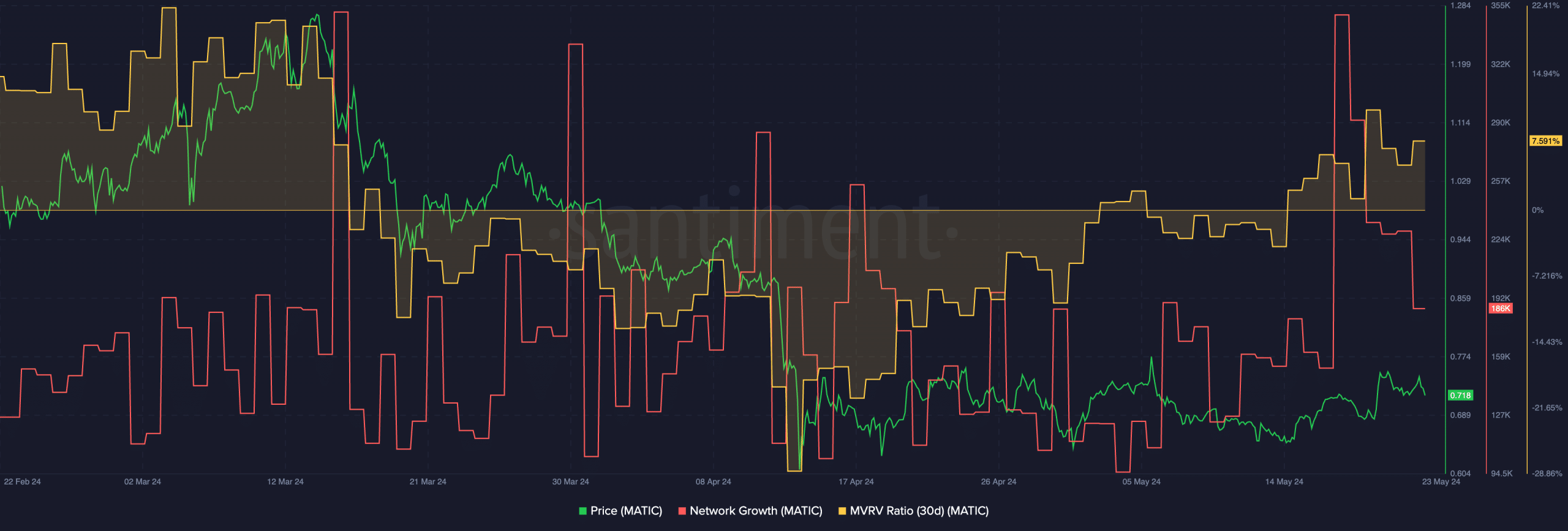

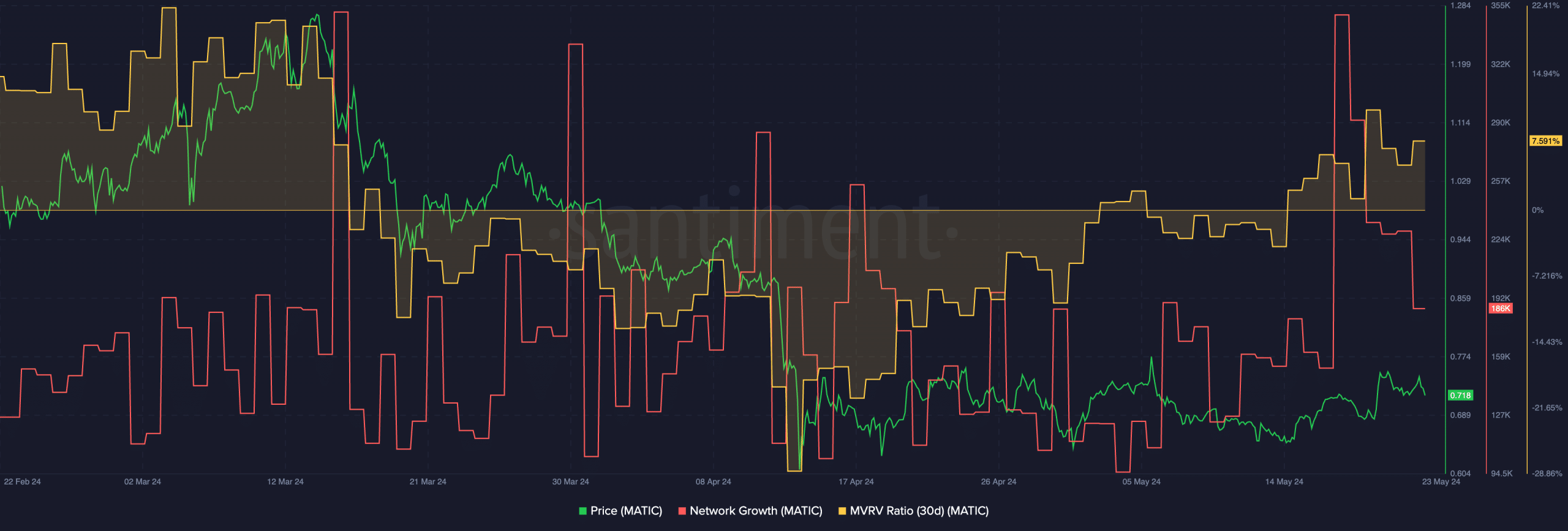

Holders are shown in green and tokens are shown in red.

MATIC’s network growth has also declined over the past few days, indicating a lack of interest in new addresses.

The MVRV ratio has also risen, suggesting that most holders are profitable and may have an incentive to sell their tokens in the future.

Source: Santiment