- Bitcoin dominance remains above 50%.

- Despite recent market movements, altcoin season has not yet begun.

Bitcoin (BTC) has experienced impressive price trends since the beginning of the year, and Ethereum (ETH) has also seen significant gains recently.

The current trajectory of ETH and the surge in value of various other assets raises questions about whether altcoin season can get underway.

Altcoin season will not take place

Typically, when Ethereum starts rallying, it signals the start of altcoin season. But for the season to fully begin, other metrics will need to see significant movement as well.

Currently, the altcoin season index on Blockchaincenter.net is 35. For the index to indicate an ‘altcoin season’, 75% of the top 50 coins would have to outperform Bitcoin.

Source: Blockchain Center

Bitcoin dominance disrupts altcoin season

Bitcoin’s decline in dominance could contribute to the start of altcoin season as traders diversify their holdings. They invest in other cryptocurrencies, shifting the market capitalization away from BTC.

According to CoinMarketCap, the current cryptocurrency market cap is approximately $2.55 trillion. BTC’s dominance is over 52%, while altcoins’ market share is less than 50%. Of these, Ethereum holds 18.2%.

Additionally, BTC price tends to remain stable and stable even after significant price trends. This stability may encourage market participants to sell Bitcoin and move into altcoins in search of short-term profits.

Additionally, BTC’s high price could be a barrier for new traders who might choose altcoins instead. This shift in investment could contribute to a broader redistribution of market capitalization across altcoins.

Performance of Ethereum and other top altcoins

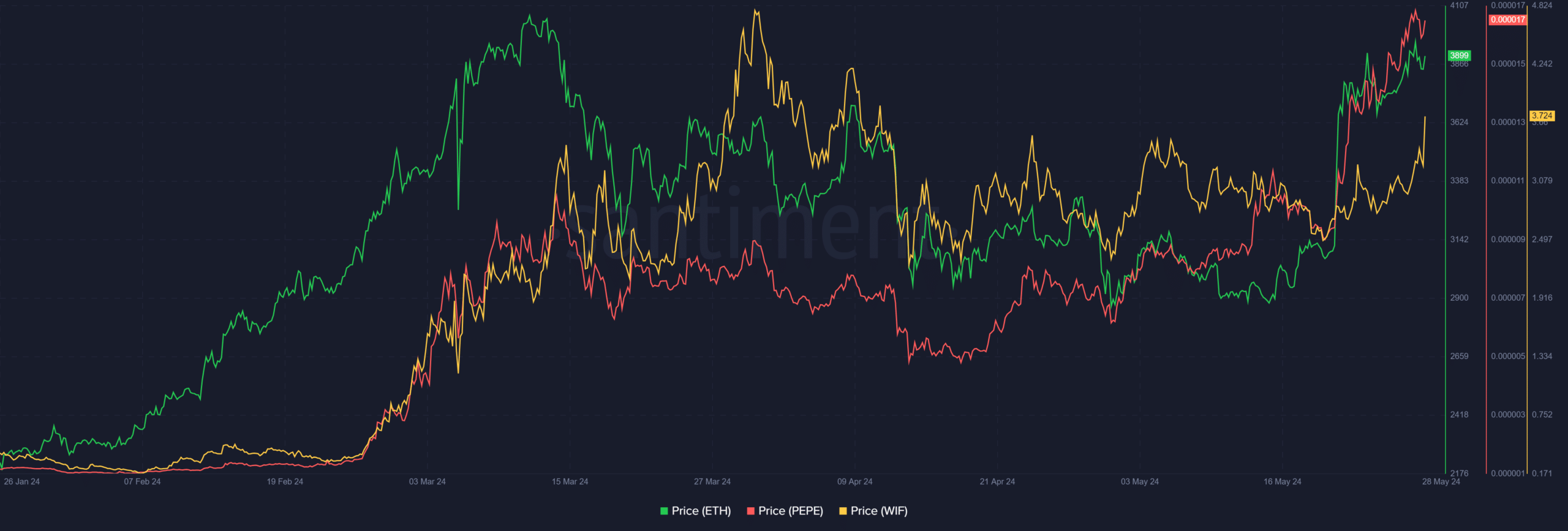

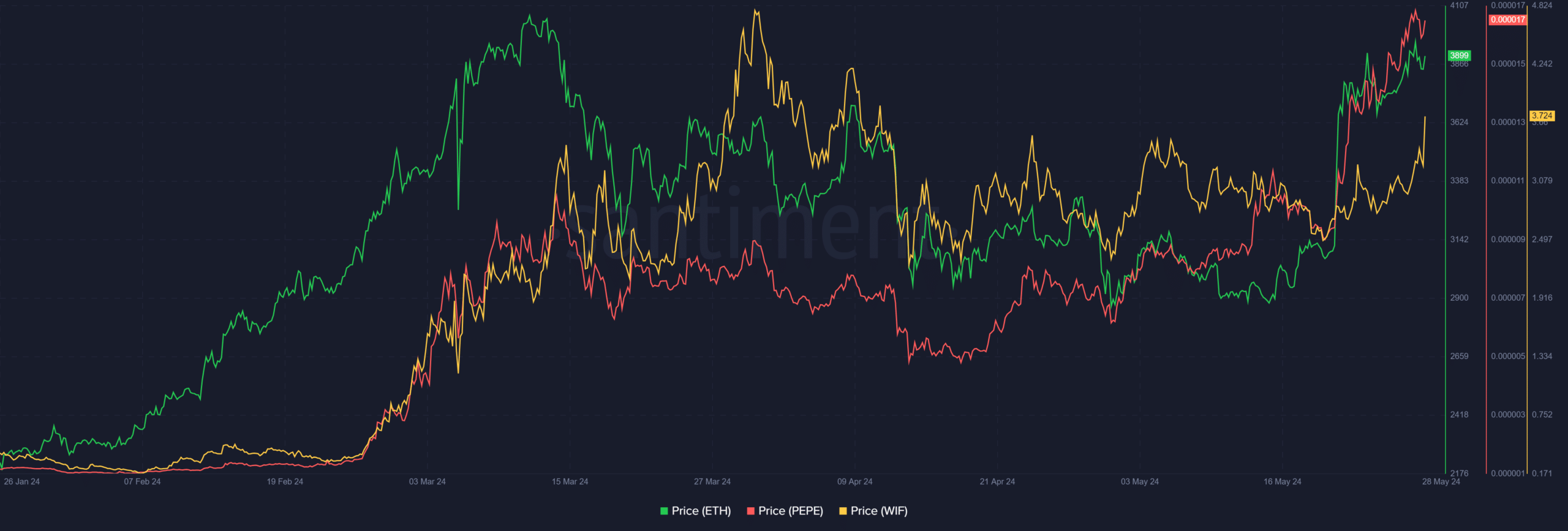

Bitcoin season is underway, but Ethereum and several altcoins such as Pepe (PEPE) and Dogwifhat (WIF) have seen significant gains recently. Analysis shows that PEPE has outperformed Bitcoin by more than 1,000% over the past three months.

The daily timeframe chart shows several recent all-time highs and a strong bullish trend, as confirmed by the Relative Strength Index (RSI).

Likewise, WIF maintained a strong bullish trend, increasing more than 800% during the same period. As of this writing, WIF is up about 9% and trading at around $3.70.

Source: Santiment

Is your portfolio green? Check out our ETH Profit Calculator

According to RSI, Ethereum is experiencing a strong bullish trend in oversold territory. It is trading at about $3,890, up slightly by less than 1%.

These moves suggest that significant momentum is building in the altcoin market while Bitcoin dominates.